Rising interest rates and closed debt markets mean slow deal flow and volatile macroeconomic conditions. Consequently, the deals coming through your doors require extra scrutiny, and your criteria for due diligence needs to shift to take into account market changes.

While the industry is plagued by economic uncertainty, investing in the right deals during a downturn is proven to generate higher returns. However, conducting poor due diligence can lead to costly mistakes. In an unpredictable market, C-Suite leaders are starting to question what information should be reviewed before purchasing a portfolio.

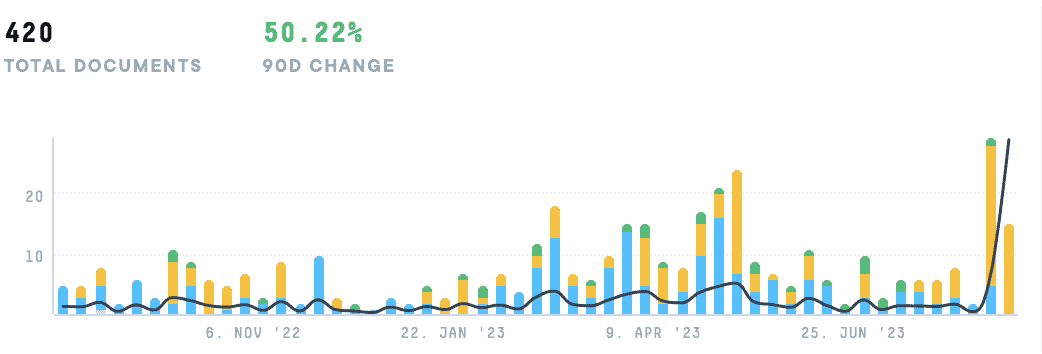

In the AlphaSense platform, this reality rings true as we noticed an over 50% increase in documents mentioning “due diligence” over the past year.

Below, we share why due diligence has become crucial in today’s shifting market, as well as highlight the information any financial investor should require and review—that spells out the red flags—before spending capital.

Due Diligence in Today’s Market

Periods of high risk renew attention brought to due diligence and what should concern r decision-making. The market landscape is dramatically different now than it was in 2022 as macroeconomic hardships (i.e., rising inflation, supply chains disrupted by COVID-19, etc.) and growing global tensions (i.e., Russian-Ukraine war, China-Taiwan conflict, etc.) have muddied waters. Consequently, deal flow and opportunities have never been more scarce.

Historically, M&A tends to slow down during times of economic volatility or uncertainty, but often these are the times when valuations become more attractive and new opportunities begin to emerge. 2023 so far has revealed ideal conditions for dealmaking due to valuation resets, lessened competition for deals, and new assets coming to market.

Ultimately, your due diligence needs to evolve to fit the current economic climate, meaning it is necessary to add enhanced scrutiny to your process. The stakes have never been higher for paying closer attention to a company’s historical financials and management changes, conducting more robust scenario analysis, and incorporating different sources, like an expert transcript library (ETL).

Historical Performance

When reviewing any sort of company documents relating to fiscal performance, make sure you’re able to answer these questions: has the company gone through a market downturn? If so, how did they fare in comparison to their peers? And what did they do to persevere in tough economic times? Did they make job cuts, hoard cash, increase spending on their revolver (increase debt), have a change in management, decrease spending (labor or capital expenditure), sell parts of a company, or become acquisitive? These questions will enable you to understand the full picture of the company’s historical performance and ensure there are no surprises later on in a deal.

Robust Modeling

When the market is good, investors tend to be more lenient in scenario analysis. However, modeling with a more conservative downside case is important to your analysis. Think: what is a worst-case scenario for this deal that would normally be considered too extreme? Would it be an inability to find synergies in an acquisition, the need to downsize the team or share leadership, or negative cashflow for part of the business? Of course, it’s important to back up these assumptions with good reasoning and sources.

Management Analysis and Noisy Financials

When diving into leadership dynamics, make sure to question: how experienced is management at handling downturns and volatility? What was their approach at different companies?

This becomes especially important in times of economic downturn. Make sure to take a close look at a company’s financials and see if there are restatements, one-off write-offs, or manipulating financials to distract from the lackluster performance. Be able to answer: is this company historically more aggressive or conservative during a downturn? Do they keep liquidity for emergencies or take advantage of discounted businesses? These are the questions you need answered before taking the reigns of a company.

Cash Conversion Cycle Analysis

Potentially most important is understanding a company’s relationship with its suppliers and vendors. Are they pushing off paying their suppliers (pushing Accounts Payable days) or having trouble collecting on their invoices? These are major red flags. Especially within the context of a disruptive market, know whether said company holds inventory, and if so, how does economic downturn impact its inventory turnover? Is it a necessity or a luxury good? And how will the market respond? The answers to these questions will reveal the financial health of the company.

Asking the Right Questions with Due Diligence

Even if you come to acquire an extensive collection of company documents and correspondence from a prospective seller, there’s still room for red flags that can mislead the value of a potential deal. You must ask questions about the sale or the business, as you need answers to the questions You might also need answers the documents don’t offer.

- Why are you selling the business?

This is a required, if not the first, question to ask before entertaining a deal because if the seller lacks a reasonable answer, that’s a red flag. More often than not, a business is being sold to raise funds for another business venture, divorce, estate tax, or retirement. However, some businesses are sold because of poor business practices or operating at a loss.

- Is this your first attempt to sell the business?

Again, understanding how dire the seller is to make a transaction or how reluctant they are to discuss failed sales, can shed light on the company’s underperformance or mismanagings.

- What is your business plan?

Without a business plan, you might first struggle to understand how to properly operate your purchase and ultimately make more work for you, the buyer, to develop one after a deal has been reached.

- How difficult is it for competitors to enter or leave the market?

Understanding the seller’s market means having an understanding of its competitors and how easily it is for new ones to enter and established ones to exit. This information also provides context into how saturated (over- or under-) the industry is and, therefore, how challenging it will be to reach your target audience.

- How complex is the business model?

While every business has many moving parts., too many subsidiaries or a super complex model can mean difficulties in managing after purchase.

- Do you have an organizational chart?

With an organizational chart, you’ll quickly learn the departments of a company and the responsibilities of specific managers. Further, a legal organizational chart helps you see subsidiaries, incorporations, and minority and majority investors associated with a company.

- What is your geographic structure?

This question is only relevant if the business operates in various regions. Learning how the regions are carved up, and if there are enough sales, marketing, and distribution to support each one, can show where performance needs to improve from within.

- Have there been any other acquisitions?

Knowing if there have been any other sales of companies in the industry lets you see trends (i.e., periods of consolidation) that could affect the price of your purchase.

- What is on your disclosure schedule?

Your due diligence checklist should uncover all of the information you need to make a decision, but anything potentially overlooked should be included on a disclosure schedule. If something isn’t, you can add it to your list of demands.

The Essential Info for a Due Diligence Checklist

When assembling your due diligence checklist, you need the right information to fully ensure that your decision to purchase is a financially beneficial one. Below, we outline the areas of concern and their corresponding documents, that should flesh out your knowledge of the seller’s company.

This information should include:

- Antitrust and Regulatory Issues: Antitrust issues as a result of the purchase, any prior regulatory or antitrust issues, any Exon-Florio issues for national security and foreign investment, a list of Department of Commerce filings

- Information Technology Concerns: A list of the software used by the company, software licenses bought to analyze other companies, the current system usage and age of equipment, outsourcing agreements with IT companies, and a plan that outlines a disaster recovery plan should systems crash or become damaged

- Publicity: Articles and press releases about the company within the last three years

- Outsourced Professionals: A list of all independent or contract professionals that have worked with the company within the past five years

- Insurance Coverage: A copy of insurance claims over the past three years as well as a schedule and copy of the company’s insurance coverage

- Litigation: A list of all pending litigation, descriptions of threatened litigation, unsatisfied judgments, documents about injunctions or settlements, copies of insurance policies that protect against litigation, a written history of problems with regulatory bodies such as the SEC or IRS, along with a review of all board minutes, shareholder minutes, and audit minutes

- Product and Services: Lists of products and services offered and in development, correspondence and documents related to regulatory approval of product line and a summary of complaints and warranty claims, a list of major customers and product applications, as well as current market share values.

- Customer Information: A list and description of competitors, including strengths, weaknesses, market position, and basis of competition, current ad programs, marketing budgets, and printed marketing materials, research on ways to get new business, a list of distribution channels, marketing opportunities, and marketing risks, surveys and market research on company products, comparative analysis, a list of coordination protocols between the sales and marketing departments, issues about keeping customers after the sale, a description of the company’s credit policies and purchasing policies, supply and service agreements, a schedule of unfilled orders.

- Tax Information: Federal, state, local, and foreign tax returns for the past three years, including net loss or profit, a list of any tax liens, IRS Form 5500 for 401(k) plans, state sales tax returns for the last three years, excise tax filings for three years, audit reports, employment tax filings for past three years, tax settlement documents over the past three years, detailed explanations of general accounting principles, a schedule of financing for debt and equity and a list of undisclosed tax liabilities.

- Materials Contracts: Monthly manufacturing yields, agreements and relationships with any subsidiaries, partnerships, or joint ventures, copies of contracts between the company and directors, officers, affiliates, and minimum 5% shareholders, loan agreements including promissory notes, financing details, and lines of credit, all nondisclosure and noncompete agreements, a list of mortgages, collateral pledges, indentures, and security agreements, installment sales agreements, guarantees involving the company on any level, copies of quotes, invoices, purchases, and warranty forms, options and stock purchase agreements affecting company operations. off-balance sheet liabilities, explanation of supply chain and supply restrictions, and power of attorney agreements.

- Licenses and Permits: Copies of federal, state, and local licenses, permits, and consent forms, and any documents about proceedings with a regulatory agency.

- Environmental Issues: A list describing or identifying any environmental liabilities or contingencies, hazardous materials used in production, any superfund exposure, environmental investigations and pending litigation, copies of notices and filings with the Environmental Protection Agency (EPA), environmental audits for each company property, a description of company disposal methods for hazardous materials, recyclables, costs for environmental compliance

- Real Estate: Listings of all owned or leased property and locations, copies of deeds, mortgages, real estate leases, title policies, and zoning approvals

- Physical Assets: A list of Uniform Commercial Code (UCC) filings, leased equipment, major equipment sales and purchases over the past three years, as well as a schedule of fixed assets with locations

- Intellectual Property: A list of foreign and domestic patent applications, all licensing revenue and expenses, copyright, trademarks, and trade names both domestic and abroad, a description of methods used to protect trade secrets and all technical information within the company, patent clearance documents, work-for-hire agreements, a summary of claims or threatened claims on intellectual property, copies of all consulting agreements, invention agreements, and licenses of intellectual property to and from the company

- Employees and Benefits: Copies of stock purchase and stock option benefits for employees, worker’s compensation claims history, unemployment claims history, list of employees and their positions, current salaries, years of service, and total compensation over the past three years, an explanation of the company’s salary philosophy, pay history and pay freeze information, which helps you decide if current employees will expect a raise soon, resumes, history, and experience of key employees such as senior level management, a list of union affiliations and contracts, a list and description of all employee health and welfare insurance policies

- Compliance: Descriptions of any labor disputes, arbitration, or grievances settled or outstanding over the past three years, copies of collective bargaining agreements, evidence of compliance with IRS Section 409A in regards to stock options, evidence of compliance with IRS Section 280G in connection with the purchase, a list of any officers in criminal or civil litigation, actuarial reports for the past three years, a list of harassment, wrongful termination, and discrimination disputes within the past three years

- Employment Information: Turnover data for the past two years, documents on pension plan funding and distributions, copies of all Occupational Safety and Health Administration (OSHA) examinations, the results of formal and informal employee surveys, layoff and severance package information, all nondisclosure, noncompete, and nonsolicitation agreements between employees and company

- Organization and Good Standing of Company: The Articles of Incorporation and any amendments, list of company bylaws, amendments, and assumed names, a list of all states or countries where the company does business, has employees or owns/leases an asset, annual reports for the last three years, a copy of the company’s minute book and an organizational chart, a list of all shareholders and percentages owned, a Certificate of Good Standing from where the company does business, active status reports in the state of incorporation, agreements on voting trusts, subscriptions, puts, calls, options, and convertible securities

- Financial Statements: Audited financial statements (cash flow, balance sheet, income statement, footnotes) for the last three years, including an auditor’s report and quarterly and annual statements, auditor’s correspondence for the past five years. These are letters sent to management that outline areas to improve profits and efficiency, unaudited financial statements for comparison, company credit reports, etc.

- Accounts Receivable and Payable: Check these for any overdue or unpaid accounts that might impact profit—an aging schedule of accounts payable and accounts receivable

- Financial History: A list of outstanding debt, unrecorded liabilities, which you usually find when interviewing the seller or employees, collateral for debt, a schedule of depreciation and amortization methods over the past five years, analysis of gross margins and of fixed and variable expenses, a list of the company’s internal control procedures, assets, and liabilities, a schedule of inventory, projections, capital budgets, and strategic plans, as well as the general ledger, analyst reports and breakdown of sales and gross profits by geography, channel, and product type, planned projection vs. actual sales chart, capital structure

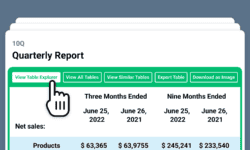

- Public Filings: If the company is publicly traded, it must file a Form 10-K annual report, Form 10-Q quarterly report, and other issues on the Form 8-K. You can get these from the Securities and Exchange Commission (SEC) website. The way a report is produced, ranging from what time it’s filed to the content inserted within the footnotes, reveals more than investors and the like may be aware of

- Revenue Streams: A recurring revenue stream that reveals customer loyalty and how much they bring to the business

- Backlog: Creating a monthly backlog of the past year shows true decreasing or increasing revenue trends

- Pricing & Estimating Philosophy: Pricing philosophy lets you know how the company prices its goods or services while estimating philosophy shows you if the company has a special order, it should have an estimate department, and analyzing this provides you with a detailed list of profits or losses

After Assembling Your Due Diligence Checklist

After you’ve collected all the necessary information you need to assess a deal, make sure to scout for

- Profit Margins – Compare the profit margins of the business to its competitors, if possible. It is also good to understand any competitive advantages that make the company a leader among its peers, and whether the overall industry is growing or not.

- Operational Efficiency Upgrades – Without assessing the full potential for operational savings and efficiency improvements, you could leave significant amounts of untapped value on the table.

- Market Review and Competition – Considers a company’s market share and competitive positioning, including its future prospects, growth opportunities, and how competitors could interfere with them.

- Market Trends – Understand which trends have the most influence on the target’s business and whether it is fully aligned with positive-growth trends then that will clarify where to deploy capital.

- New technology – Learning how a target company’s IT department can support future growth and use technology to streamline or expedite processes.

Tools for Conducting Due Diligence

To successfully complete thorough due diligence, you need to be privy to an assortment of content sets that are typically scattered amongst disparate sources—requiring various amounts of money and time to access. And in the age of information overload, where insights are buried by noise, professionals are unable to take advantage of the few, short-lived opportunities available today in our volatile market.

To succeed, you need to leverage a market intelligence platform that allows you to swiftly pinpoint and analyze crucial business information. The best market intelligence tools leverage artificial intelligence (AI) and automation technology to transform the due diligence process and widen the scope, scale, and level at which it’s performed. Today, you can access thousands of market updates in seconds, then cut through the noise to pinpoint the precise insights you need.

AlphaSense is a market intelligence platform that stands out from all the rest, both due to its extensive universe of content and its advanced AI search technology. Beyond access to an extensive content universe in one platform, AlphaSense offers features that accelerate the due diligence process:

Companies that are able to consistently outperform the market and gain an edge over their competitors are those who:

- Have access to all relevant perspectives they need in one place, so they never have to risk making the wrong decision due to research blind spots

- Embrace advanced technology to create new improved workflows, speed up time to insights, and do more with less

The most comprehensive due diligence processes stem from thorough research and the tools that aid it.

Accelerate Your Due Diligence with AlphaSense

Being able to answer all the questions that come with doing your diligence requires a tool that allows you to answer them quickly. AlphaSense’s AI search engine was purpose-built for business decisions, allowing you to pull out relevant insights and streamline your due diligence process.

Unsure of what are the most crucial questions you should be asking in your due diligence processes? Download our checklist, 5 Crucial Due Diligence Questions to Consider for PE, VC, and M&A Investors, to learn what you need to know before agreeing to a purchasing contract.

Sign up for your free trial today.