It is no secret that mergers and acquisitions (M&A) deal activity has declined over the last couple of years, leading investors to tread carefully. The healthcare sector, like others, has faced headwinds such as soaring interest rates, steep inflation, FTC regulatory challenges, post-pandemic supply chain issues, and market volatility that have flattened M&A deals.

There are early indicators of resurgence in deal volume, with notably large healthcare transactions closing at the beginning of the year and announced late last year. With steady interest rates paving the way for broader economic stabilization, investors have a much more optimistic outlook on future dealmaking opportunities in this space.

According to PwC’s Annual Global CEO survey, 54% of healthcare industry CEOs intend to make at least one acquisition in the next three years. With pharma companies sitting on an estimated $171 billion in cash reserves, it is expected that M&A dealmaking will heat up into 2024 and beyond.

Below we explore the following themes and most prevailing trends shaping the M&A landscape within the healthcare industry, as well as where opportunities may exist for investors:

- The Impact of AI on Pharmaceutical Development

- Race to bring GLP-1 Assets to Market

- Strategic Consolidation of Healthcare Systems

- Focus on Precision Medicine

- Niche Medtech Acquisitions to Expand and Diversify Capabilities

AI’s Impact on Pharmaceutical Development

Artificial intelligence (AI)’s far reach is transforming aspects of pharmaceutical development with the delivery and speed by which drugs are brought to the market. This emerging trend is allowing pharmaceutical companies—large and small—to distinguish themselves among competitors and investors as they pioneer advancements fueled by AI.

AI is solving challenges that come with traditional clinical processes, prompting a surge in AI-based initiatives aimed at reducing costs and expediting development timelines. With a total addressable market of nearly $50 billion for AI-enabled drug development, it is estimated that 30% of new drugs will be discovered using AI by 2025.

From identifying drug targets and candidates more accurately and expeditiously, to optimizing clinical trial design and recruitment, there is no questioning AI’s vast capabilities in the space.

Among 15 AI-derived drug candidates in clinical trials, one company in particular has been garnering attention: Insilico Medicine, for making the first drug entirely based on AI. Insilico Medicine developed INSO18-055 for the treatment of idiopathic pulmonary fibrosis (IPF) with the first AI-discovered molecule that was based on a novel AI-discovered target.

A senior scientist’s expert perspective, sourced from the AlphaSense platform, reflects on Insilico’s groundbreaking advancements:

“Insilico Medicine has [been] democratizing their own internal platform, which I think is really cool. They’re essentially saying, ‘We’ve developed these algorithms, the generative algorithm to identify new molecules and also our predictive models, and we’re making those models and algorithms available to you as a fee-for-service.’ They’re using that internally for a set of targets and then also partnering with large- and medium-sized pharma companies.”

– Senior Scientist, AI Provider | Expert Transcript

Pharmaceutical companies adopting AI technology into their research and development process are not only pioneering one-of-a-kind advancements—they are also attracting potential investors and lucrative deals. The ability to bring drugs and therapies to market sooner, with less intrinsic cost, ultimately leads to stronger valuations and greater stakeholder value. M&A will serve as an avenue for pharmaceutical companies and start-ups to continue making significant advancements in their respective fields.

Related Reading: How Artificial Intelligence is Reshaping Drug Development

Race to Bring GLP-1 Assets to Market

According to the Journal of the American Medical Association (JAMA), glucagon-like peptide 1 (GLP-1) agonists are medications approved for the treatment of diabetes that have also recently gained popularity for off-label weight loss. Amid the prevalence of metabolic diseases, GLP-1 agonists marketed under brand names such as Ozempic and Wegovy have taken the healthcare sector by storm.

With its traditional use now expanded to treat widespread obesity, the demand for GLP-1 agonists has far outpaced the available inventory, leaving pharmaceutical companies scrambling to procure and bring assets to the market amid shortages. The World Obesity Atlas estimates that nearly 4 billion people, or more than half of the world’s population, will be considered obese or overweight by 2035.

With such a staggering statistic, it is no surprise that large pharmaceutical companies are pivoting strategically. In January, Roche completed the $2.7 billion acquisition of Carmot Therapeutics, a clinical-stage biotechnology company with three GLP-1 assets in clinical production, including its CT-388 lead GLP-1 asset, in the hopes of gaining a competitive footing among Novo Nordisk and Eli Lilly’s products currently on the market (Ozempic, Wegovy, and Mounjaro, respectively).

According to an outlook published by PwC, “large-cap pharma companies are expected to continue pursuing mid-sized biotech companies to fill pipeline gaps in the face of impending patent cliffs. Investor interest in GLP-1 drugs, used to counter diabetes and enhance weight loss, is likely to fuel M&A activity in 2024.”

Strategic mergers and acquisitions targeting the advancement of GLP-1 agonists to market are likely to continue trending for years to come, as the most sophisticated assets are scooped up by well-established pharma leaders with the infrastructure and platform to bring them to mainstream successfully.

Strategic Consolidation of Healthcare Systems

Strategic consolidation among healthcare systems remains a trend shaping M&A activity into 2024 as well. Hospital and health system deal activity increased 27% year over year in 2023, and a flurry of deals has been announced since the beginning of the year. The deal market in this sub-sector is fueled by a continued effort to keep operating costs in check, increasing efficiencies and shared resources, and maintaining a high level of care delivery.

Notable deals announced since the start of the year include:

- University of Pennsylvania Health System announced its intent to acquire Doylestown Health into Penn Medicine’s six-hospital system

- CarePoint Health and Hudson Regional Hospital announced their intent to merge under a new management company

- The emergence of the new Aspire Rural Health System, marking the consolidation of Hills & Dales Healthcare and UnitedHealthcare Partners

- Huntsville Hospital Health System announced its intent to acquire DeKalb Regional Medical Center

- Novant Health’s acquisition of three Tenet Healthcare hospitals

- Northwell Health and Nuvance Health entered into a strategic agreement to merge, forming a 28-hospital network across New York and Connecticut

- St. Luke’s and Aspirus Health finalized their merger, forming a 19-hospital system

While a portion of M&A activity exists among healthcare systems, private equity and venture capital investors are making waves in the ecosystem as well. In October 2023, venture capital firm General Catalyst, in partnership with Dr. Marc Harrison, former CEO of Intermountain Health, launched a wholly owned subsidiary called Health Assurance Transformation Corporation (HATCo).

In January, HATCo announced its intent to acquire Summa Health of Ohio, a non-profit healthcare system, with a focus to “put innovation in.” HATCo added: “We intend to build modern, tech-enabled healthcare delivery platforms at scale, across all points of care, making care more proactive, accessible, and affordable for all people, everywhere.”

A Heightened Focus on Precision Medicine

In biopharma, the role of precision medicine is also shaping M&A healthcare trends. The National Institute of Health (NIH) defines precision medicine as “an innovative approach that takes into account individual differences in patients’ genes, environments, and lifestyles.”

Precision medicine—also known as personalized medicine—takes a customized approach to patient care in the fields of precision oncology, cancer immunotherapy, pharmacogenomics, and rare diseases. Recently, its focus has expanded to cardiology, immunology, and neurodegenerative diseases as well.

Precision medicine is expected to reach $175 billion by 2030, and is poised to grow at a compound annual growth rate (CAGR) of 11.5% during 2022 to 2030.

Recent large M&A deals highlight the role precision medicine is playing, including Pfizer’s $43 billion acquisition of Seagen. With the deal, Seagen’s antibody-drug conjugate (ADC) therapies doubled Pfizer’s oncology pipeline. ADC therapies have been hailed for their ability to deliver targeted chemotherapy agents to cancer cells, reducing the potential damage to healthy cells that comes with traditional chemotherapy.

The focus on ADC therapies has been central to other large recent transactions as well, including the completion of Bristol Myers Squibb’s development agreement with Systimmune at the end of February. Under the agreement, Bristol Myers Squibb obtained rights to Systimmune’s BL-B01D1, a first of its kind ADC oncology asset.

In October 2023, Merck penned a $5.5 billion deal to acquire three of Daiichi Sankyo’s MDCs, continuing the momentum of precision medicine as a dominating trend in healthcare M&A.

Medtech Acquisitions Reflect Niche Capabilities

Medtech acquisitions to enhance niche capabilities reflect another prominent M&A trend in the healthcare space. According to analyst research sourced from the AlphaSense platform, there is an anticipated uptick in M&A activity despite Federal Trade Commission scrutiny, and healthcare management teams appear to be more confident in their ability to close transactions, as evidenced by the $61 billion of deal values announced in Q4 2024.

According to a report by Bain & Company, “in medtech, we anticipate more deals in 2024 aimed at delivering growth, technology access, innovation, and category leadership. Companies will continue to rely on divestitures to optimize portfolios.”

Recent medtech deals such as the Enovis acquisition of Lima Corporate earlier this year reflects this dynamic, with management teams intent to “use strategic acquisitions to accelerate our growth, add great technologies and talent to our company, and drive compounding value for our shareholders.”

Analyst research sourced from the AlphaSense platform also expects M&A activity for medical devices to increase this year as certain companies, namely Becton Dickinson and Co, Stryker Corp, and Zimmer Biomet Holdings, have reached their delivering goals and are in the market for acquisitions.

Related Reading: Medtech and Medical Device Outlook for 2024 & Beyond

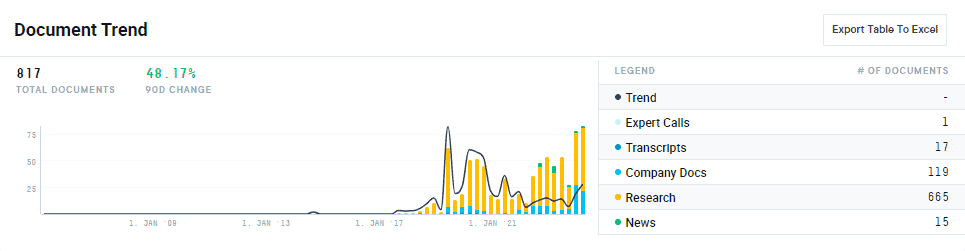

Gain the Competitive Edge on Healthcare M&A with AlphaSense

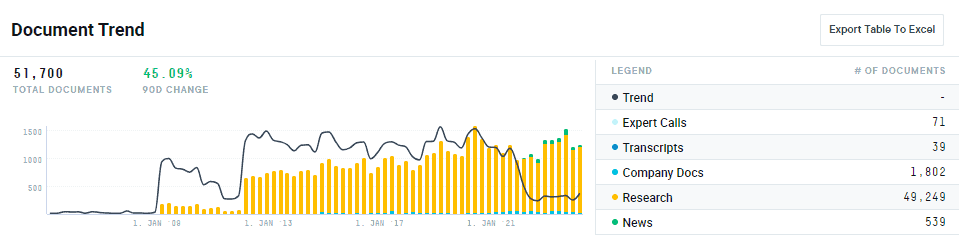

Keeping a pulse on M&A activity has never been easier with AlphaSense’s powerful AI platform. Eliminate the guesswork of locating crucial information by quickly parsing through our vast content universe of expert transcripts, broker research, financial documents, and more to pinpoint quality insights in seconds.

Our 10,000+ high-quality content sources from more than 1,500 leading research providers put you at the forefront of market intelligence—all within a single platform.

In the fast-changing world of M&A, staying informed on macroeconomic events and industry trends is critical in order to make confident, well-informed decisions. Streamline your research workflow, gain the competitive edge, and uncover new opportunities with AlphaSense.

Take your M&A due diligence to the next level with our Complete Guide to M&A Due Diligence.

Stay ahead of the rapidly evolving healthcare landscape and get your competitive edge with AlphaSense. Start your free trial today.