Medical technology, or medtech, lies at the intersection of two of the most fast-changing and innovative industries—healthcare and technology. Forward-thinking technological advancements such as automation, artificial intelligence (AI), and digital therapeutics have allowed the healthcare industry to transform and grow more rapidly than ever before.

With all this technological innovation, the healthcare industry—medtech in particular—is now ripe for investor interest. Past that, medtech has vastly improved patient outcomes, better efficiency in the healthcare industry overall, and greater health equity.

In the last few years, the medical field faced unprecedented pressures and challenges, as technology brought new possibilities and solutions to issues like staffing shortages, supply chain disruptions, and the quality of patient care. At the same time, consumers were more focused than ever on improving their health and also seeking greater personalization in their healthcare. This, in turn, has created areas of opportunity for entrant medtech and medical device companies to meet these demands.

In the last few years, the medtech market has grown exponentially and has transformed the healthcare industry as we know it—and it’s not stopping anytime soon. Valued at $456.9 billion in 2020, medtech is expected to grow to $800 billion by 2030. Additionally, healthcare companies are keen on expanding their valuation and capabilities through M&A with medtech companies to get a competitive edge.

Now, seven key trends emerge that are defining the medtech landscape in 2024 and paving the way for the future. Below, we cover these trends, as well as the outlook for the medtech space in 2024 and beyond.

Medical Technology Trends at a Glance

- Medtech companies are expanding beyond their core business.

- M&A activity is declining across global markets.

- There is an increased focus on global healthcare access equity.

- There is an increased focus on sustainability and ESG.

- Generative AI opportunities abound in the medtech space.

- Telemedicine and digital therapeutics usage are continuing to grow.

- The use of biometric technology and wearables is growing.

- Weight loss drugs are a key consideration in the space but are unlikely to affect industry growth.

Medtech Companies are Expanding Beyond their Core Business

The commercial landscape is evolving, and medtech companies need to build inventory resilience and find ways to diversify their offerings to stay profitable and competitive. That’s why many are seeking to expand their sphere of influence in patients’ health journeys by providing additional value through new services.

One example of this is Medtronic’s acquisition of Cardiocom, a telehealth and remote monitoring firm. By expanding from its core offering of medical devices to broader healthcare services and solutions, Medtronic was able to get a bigger stake in a patient’s health journey, while providing meaningful clinical and economic value for hospitals.

M&A Activity is in a Decline Across Global Markets

Though the medtech dealmaking space remained quiet in 2022, analysts predicted a resurgence in 2023. However, M&A deal activity is still currently lagging behind historical averages, and the total enterprise value of transactions YTD is running almost 50% shy of the historical average.

According to a recent report, there have been 173 medtech deals so far in 2023, totaling $13.6 billion. Neehdam & Co.’s analyst, Mike Matson, estimates that the total amount of deals will go up to 353 by the end of the year, totaling $27.7 billion—a sharp decline from 2022’s 422 deals totaling $67.2 billion.

For an industry that has previously turned dealmaking into a core competency, the current M&A slump brings two important questions to the forefront: why is this happening, and how long until we see a resurgence?

The simple explanation? Market volatility.

In an uncertain economy, sellers want to hold onto their highs, and most companies are looking for ways to trim down lower-margin businesses to tighten operating costs. Additionally, the Federal Trade Commission has recently been cracking down on several high-profile deals due to stricter antitrust regulations, leaving many companies more cautious in the deals they choose to pursue.

While this slump remains top of mind for the medtech space, the consensus among most analysts is that the farther we move from the 2020 pandemic, the more likely that conditions will begin improving. 2023 was slated to be the comeback year, but it appears market conditions are not stable enough to sustain a healthy dealmaking environment.

Analysts are expecting 2024 to be another slow year, though deals that are executed are likely to show more balance across deal sizes. Currently, there is a scarcity of high-growth, at-scale, profitable targets, so interested acquirers will need to act quickly if they wish to win deals.

Focus on Healthcare Access Equity

One of the most eye-opening revelations that has come from the pandemic has been the level of healthcare inequity in the U.S. and certain European countries. When holders of premium private insurance receive radically better care than those with government-subsidized insurance, this has an outsized impact on ethnic and racial minorities, rural communities, the underprivileged, and the elderly. Fortunately, medtech has provided a beacon of hope for greater equity in the future.

Digital health solutions that are designed to reach previously excluded or underrepresented groups can narrow health equity gaps and result in better patient outcomes. In turn, population growth and economic performance are positively affected.

Additionally, the rise of wearables and consumer devices that enable patients to manage their care from home is contributing to greater healthcare equity, empowering patients to take their health into their own hands and lessening dependence on healthcare institutions.

In a time when inflationary and economic pressures are exacerbating discrepancies in healthcare access, healthcare payers and providers are facing increasing cost pressures, labor shortages, and funding challenges. This is making them more open to medtech innovations—like consumer devices and diagnostics—that enable them to maintain a higher quality of care for their patients.

Focus on ESG

Sustainability is a key focus for most industries and investors right now, and medtech is no exception. The healthcare industry is responsible for generating over 4.6% of greenhouse gas emissions globally, with medical devices being a top contributor due to supply chain emissions, single-use devices, and consumables.

There is increasing pressure from both regulators and investors for industry players to develop clear strategies to move toward carbon neutrality. So far, some of the biggest medtech companies have already set their ambitious ESG targets for the next several decades. Data suggests that the medtech companies that will grow and thrive in the near future are those that disclose their ESG credentials and authentically integrate sustainability goals into their strategy.

Additionally, the advent of consumer devices and greater healthcare access equity addresses the social element of ESG—a trend that is expected to continue and strengthen in the next few years.

Generative AI Opportunities

Generative artificial intelligence (genAI) is the most recent development that has taken nearly every industry by storm. In the medtech space, generative AI has the capacity to vastly improve efficiency, lessening the pressure on healthcare workers and improving patient outcomes.

Some examples of how genAI can streamline healthcare processes include: a visual clinical activity monitoring system that ensures hand hygiene compliance, reading and properly interpreting diagnostic tests, analyzing vast amounts of patient data and picking up on patterns that may have been overlooked, and streamlining routine tasks like documentation.

While total integration of generative AI in medical products and services is a long way away, many companies are already utilizing this technology for productivity benefits and are exploring its potential applications in commercial and operational use cases.

This year, it is likely that more companies will be experimenting with genAI in new ways, such as the use of voice prompts, and they will need to acquire new capabilities and talent to reap the full benefits of this technology. Early adopters will have a competitive advantage over those who choose to resist change.

According to an expert call in our platform, genAI is a long-term tailwind for medtech. Though we are still in the early stages of its full impact and implementation, proper utilization of generative AI in the medtech space will enable healthcare providers to spend more time on higher-value tasks, reduce cost and time drain in hospitals, and improve patient outcomes. AI is also not expected to harm the medtech space in any way—in fact, resistance to AI adoption is what is most likely to negatively affect companies.

Continued Rise in Use of Telemedicine and Digital Therapeutics

Telemedicine skyrocketed in popularity during the COVID-19 pandemic, when it provided an alternative to risky in-person medical visits. Its initial widespread adoption underscored its convenience and utility, even in a post-pandemic world.

For patients with budget or geographic constraints who couldn’t travel to a medical office, telemedicine provided a way for them to still receive the care and attention they needed. Even for patients without constraints, telemedicine has enabled them to avoid going in person for questions or issues that could be resolved from the comfort of their home—leading to shorter wait times in medical offices, lessened pressure on medical providers, and a better patient experience.

Further, digital therapeutics—software-based medical devices—go hand-in-hand with telehealth and have also been booming during the pandemic. These devices are often AI-based and are used by clinicians to treat, manage, and prevent a wide array of diseases and disorders without having to necessarily physically see the patient.

Therefore, these devices improve the efficiency and accessibility of care by enabling patients to manage their own health, without compromising the quality or standards of care received. In a survey of medtech leaders, 63% of respondents agreed that digital therapeutics will have a major impact on the industry over the next ten years.

Both telemedicine and digital therapeutics are highly lucrative markets. The U.S. market for digital therapeutics is estimated to have a compound annual growth rate of 29.8% between 2020 and 2025, according to Frost & Sullivan. Meanwhile, the U.S. Telehealth market size was valued at US $23.8 billion in 2021 and is expected to hit US $309.9 billion by 2030, growing at a compound annual growth rate of 45.1% from 2022 to 2030.

Use of Biometric Technology and Wearables is Growing

Wearable and biometric technology has remained popular throughout 2023, and the market is not expected to slow down anytime soon. The global market for wearable technology is expected to reach $161 billion by 2033, a CAGR of 6% compared to 2023.

From mainstream wearable techs, like Fitbits and Apple Watches, to the more niche electrocardiogram (ECG) sensors, photoplethysmography (PPG) sensors, and hydration and sweat sensors, these devices have the unique capacity to empower consumers and patients to manage their own health.

The healthcare areas that are currently leading wearable adoption are: audiology, health science, kinesiology, nursing, occupational therapy, pharmacy, and physical therapy. While new devices are emerging at a rapid clip, the market is far from saturated. Opportunities abound for innovative medtech companies that can create a wearable or biometric device that can both provide value to consumers and ease pressure on hospitals and healthcare facilities.

Popularity of Weight Loss Drugs

Semaglutide injections have become one of the most popular and profitable developments in the biopharma industry in 2023. Once seen only as diabetes treatments, drugs like Ozempic and Wegovy have become popularized as highly effective weight-loss tools, leading to an unprecedented boom in weight loss drug development.

However, analysts do not anticipate that these drugs will have a meaningful impact on medtech industry growth this year, though some are concerned that GLP-1 agonists will render obesity-focused and adjacent medtech companies useless.

However, this concern is unlikely to come to pass. Medtech companies with products specifically focused on obesity are confident that their weight loss drugs would not replace, but rather complement, their products. And companies that focus more on cardiovascular conditions or sleep apnea do not believe that weight loss drugs will be effective enough on these conditions to permanently displace them.

Additionally, according to McKinsey’s analysis, low-single-digit percentages of patient populations will become long-term users of weight loss drugs—owing to reasons such as high cost, limited accessibility, and adverse side effects.

Global Medtech Outlook for 2024 and Beyond

The outlook for the medtech space remains overwhelmingly positive. Company valuations now exceed pre-pandemic levels, and analysts forecast continuous growth and margin improvement in the coming years. Additionally, macro trends—such as an aging population, increasing access to healthcare, and technological advances—are setting the stage for even more innovation and investment in this space.

In 2024, the United States, China, and Japan are expected to contribute two-thirds of near-term industry growth in medtech. India is an emerging player, as favorable government policies, increased investment flow, a maturing tech ecosystem, and the growth of new local businesses set the stage for greater innovation and investment in medtech.

Overall, as technology develops at an accelerated pace and wellness continues to be one of the top priorities for consumers and governments alike, the medtech industry is well situated for continued growth and expansion.

The overall positive outlook for this industry means the pressure is on for medtech companies to continue innovating and not fall behind. With investor interest in the space peaking and new industry disruptors continually entering the space, the time is now for incumbents to build a lasting strategy around growth and resilience.

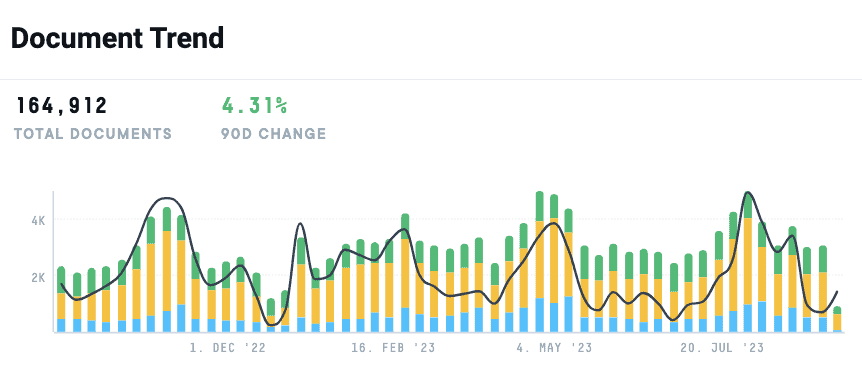

Stay on Top of the Evolving Medtech Landscape with AlphaSense

Staying ahead in the medtech industry requires sharp research efforts and confidence in decision-making. AlphaSense is a leading provider of market intelligence, including 10,000+ high-quality content sources from more than 1,500 leading research providers—all in a single platform.

Analysts, researchers, and decision-makers in the medtech sector can access exclusive research reports only found elsewhere in disparate locations and often behind expensive paywalls. With AlphaSense, companies can conduct comprehensive research that gives them a competitive edge with smarter, more confident decision-making.

Specific types of content you’ll find on the AlphaSense platform include:

- Healthcare news, industry reports, company reports, 510(k) filings, and regulatory content from sources such as PubMed, World Health Organization, MedlinePlus, and FDA

- Over 1,500 research providers including Wall Street Insights®, a premier and exclusive equity research collection for corporate teams (healthcare included)

- Expert call transcript library that gives access to thousands of insightful interviews with healthcare professionals, customers, competitors, and industry experts

The AlphaSense platform also delivers unmatched AI-search capabilities and features for analyzing qualitative and quantitative research, and can mine unstructured data for the most critical insights, including:

- Automated and customizable alerts for tracking regulatory filings, companies, industries, and potential investments

- Table export tools that support M&A workflows like target lists and due diligence

- Smart Synonyms™ technology that ensures you never miss a source important to your research

- Smart Summaries, our first generative AI feature, summarizes key insights from earnings calls for faster analysis

Stay ahead of the rapidly evolving medtech landscape and get your competitive edge with AlphaSense. Start your free trial today.