Environmental, Social, and Governance (ESG) investing continues to gain momentum in every corner of the financial services industry. In real estate, it’s taking the form of investment in green buildings — buildings designed and constructed to reduce or eliminate adverse impacts and increase the positive impact on the environment.

What do real estate investors think about the trend? How does green building affect returns and profitability? There’s been no shortage of industry discussion and debate around the green building trend and its financial impact, but one thing is clear: it’s here to stay.

Let’s take a deeper look at how green building is transforming real estate.

The ongoing fight against climate change

In the United States alone, buildings account for 39% of total energy use and 38% carbon emissions. Numbers look similar in developed cities and countries around the world. So as organizations and governments increase efforts to combat climate change, it’s natural to look toward real estate as a powerful way to make headway. Thus: green building.

AlphaSense research revealed dozens of examples of green building initiatives by corporations, governments, and partnerships between the two that focus on both new development and revamping existing buildings to eliminate outdated and environmentally detrimental features.

- The Canadian Green Building Council (CaCBG) recently awarded BentallGreenOak (BGO) its national Green Building Pioneer Award for its delivery of customized climate resilience plans to 413 properties in their North American portfolio encompassing 75 million square feet.

- As part of their Strengthened Climate Plan, the Canadian government is investing $1.5 billion over the next five years in building projects that increase energy efficiency and promote social inclusion in underserved communities.

- New York Governor Andrew Cuomo approved funding for the Career Pathway Training Partnerships Program to train the next generation of contractors in green building methods like high-efficiency ventilation.

- Earlier this year, climate-tech startup BlocPower raised $63 million in Series A funding to provide green heating and cool to aging buildings in U.S. urban cities.

- The World Resources Institute (WRI), backed by the UN and World Green Building Council (WGBC), launched the Zero Carbon Building Accelerator to eliminate carbon emissions from buildings by 2050. The program will be piloted in cities in Colombia and Turkey.

- Last month, smart rooms of the Future were unveiled at China’s Building Science Conference and Green Intelligent Building Expo. The rooms are designed to collect solar energy and share surplus electricity with city power grids, yielding economic and environmental benefits.

The pandemic spurs an interest in “healthy buildings”

The pandemic highlighted urban vulnerability to viral outbreaks. Urban city environments, substantial residential buildings were specifically resistant to attempts to control the spread of COVID-19, drawing concerns from governments and residents about how to prevent the spread of infectious disease in the Future.

Now, attention is turning to how many green building features can also contribute to disease prevention and societal health. People spend 90% of their time indoors, and developers see the growing importance of designing buildings that promote wellbeing. Natural light, ventilation, air quality — these are considerations that will stick around well after the pandemic is in the past.

China, whose densely inhabited cities were hard hit throughout the pandemic, has created a Healthy Assessment System for Residential Building Epidemic Prevention (HASRBEP) to design proactive measures for epidemic prevention and assess how buildings meet health standards.

The WELL Building Institute, an institution focused on setting healthy building standards, has enrolled more than a million square feet of real estate daily since the onset of the pandemic.

Green building certifications gain momentum

Green building certifications are gaining momentum as developers and investors look to build real estate that meets evolving societal and consumer expectations and new standards for qualifying as “green” or environmentally conscious.

There are more than a dozen certifications buildings can earn with varied areas of focus. For example, the Leadership in Energy and Environmental Design (LEED) focuses on energy savings and efficiency. At the same time, the WELL Building Standard was developed to assess how buildings meet health and wellness standards.

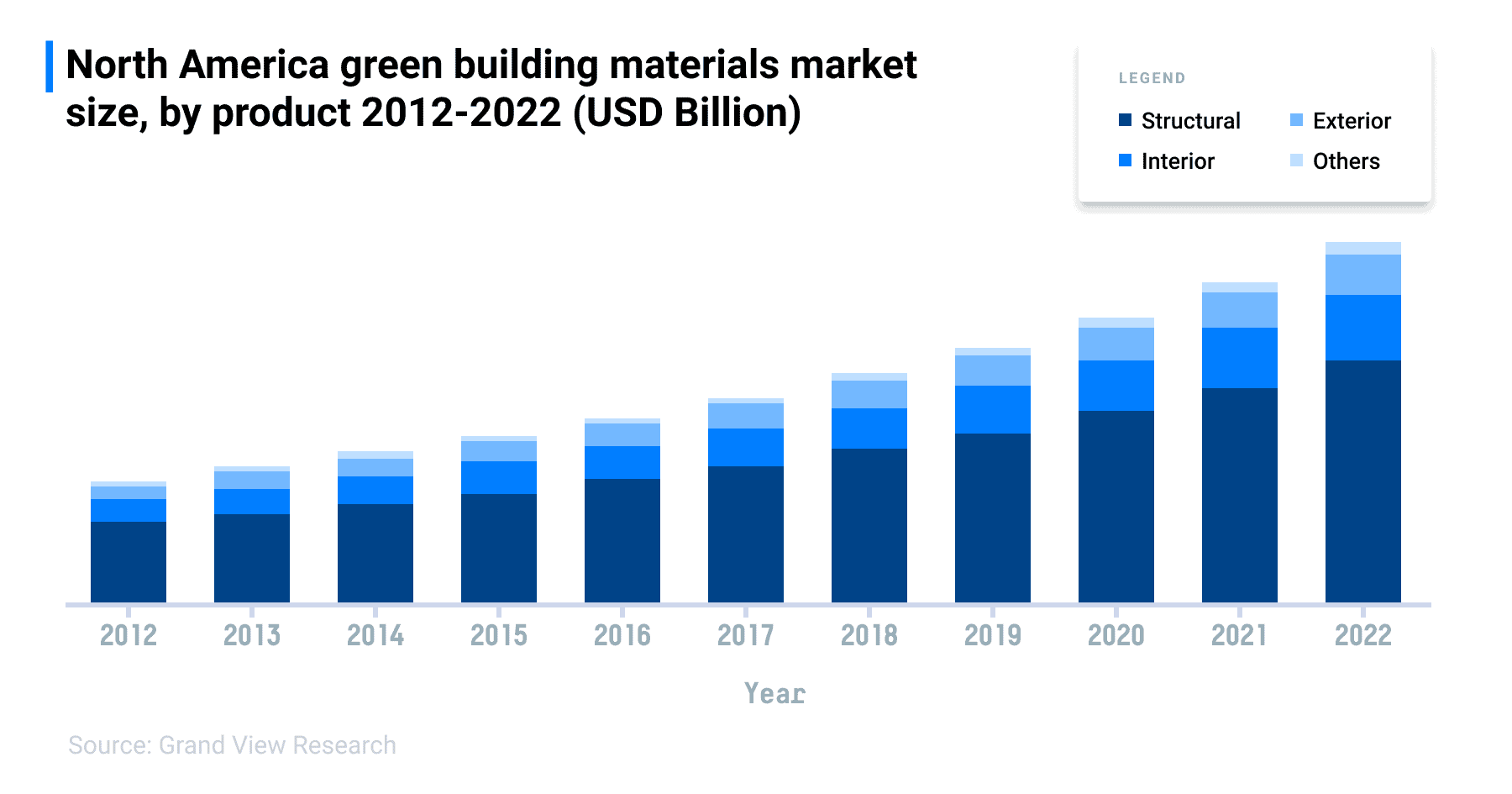

The green building materials market size had an estimated $238 billion in 2020 and is forecasted to continue in the same direction for the next several years.

As market growth happens more quickly than expertise is developing across the real estate industry, it’s spurring an entirely new sector of green consulting to guide the design and certification requirements of new properties in development and existing properties being renovated.

Consumer preferences turning green

Green efficiency topped the list of consumer preferences in a survey done by the National Association of Home Builders, indicating they would be willing to pay up to $9292 for more efficient homes that would save in utility costs in the long run.

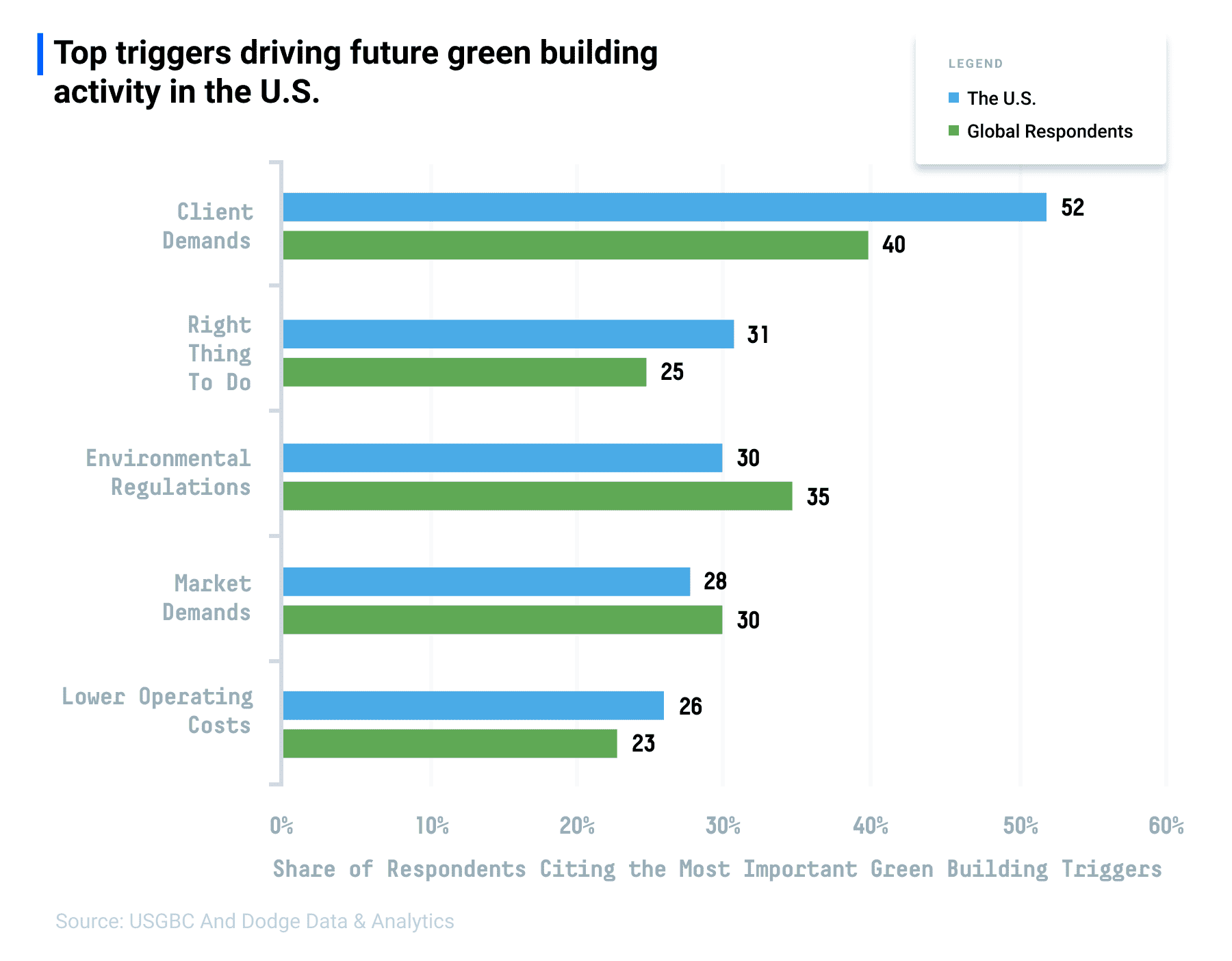

Building firms across the U.S. and global real estate industries have also indicated client demand is the main driver behind green building activity, at 52% and 40% (respectively), listing it above all other drivers.

The green investment market

PwC recently found that 77% of institutional investors intend to cease investments in non-ESG products by 2022. In alignment with this trend, real estate investors are increasingly turning to green buildings to fill their portfolios with properties that meet the ESG standards set for them by investors, regulators, and industry ethical standards.

Earlier in 2021, sustainable investment leader Invesco launched the first green building-focused ETF (GBLD), which will target property companies that support and specialize in buildings with high energy efficiency, sustainable materials, and healthier indoor environments. The ETF will track MSCI’s Global Green Building index when choosing stocks.

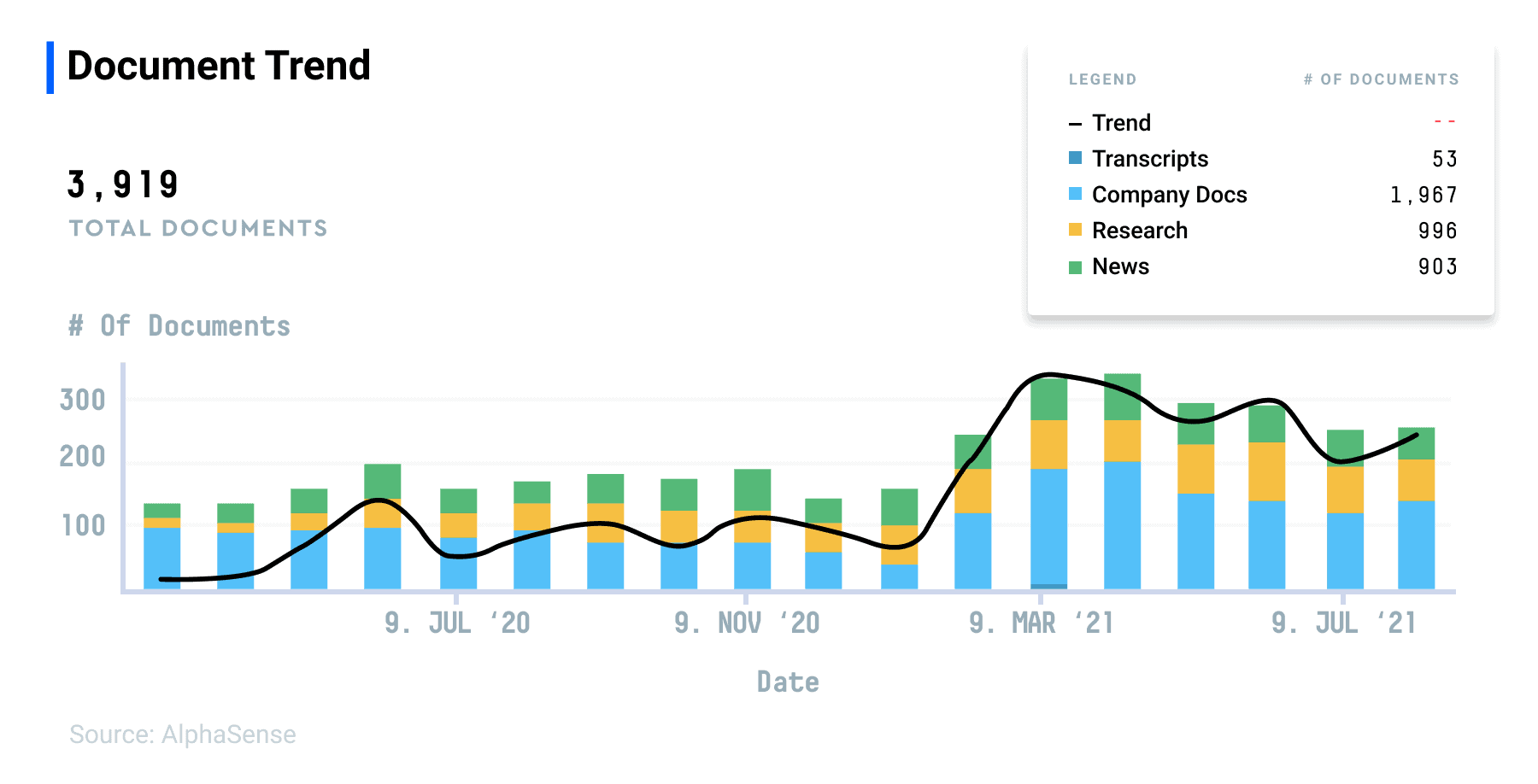

AlphaSense research shows a documented trend that aligns with the increase mentioned earlier in focus on green buildings throughout the pandemic and as we move into the post-pandemic period. The document trend shows an apparent uptick in saying “green building” and “investing” year-over-year. The mentions themselves reflect the increased emphasis by firms and funds on ESG and green building in real estate. Here is a snapshot showing the sheer volume of total documents in the AlphaSense platform for “green building” and “investing” over the last 18 months.

Some highlights from industry commentary:

Catherine McKenna, Canada’s Minister of Infrastructure and Communities | Press Release

“Through the new Green and Inclusive Community Building program, we’re investing $1.5 billion in energy-efficient retrofits and net-zero new community buildings that will create good local jobs, tackle climate change and save money, and serve disadvantaged Canadians.”

Christina Langrall, VP of Investments, LMC | Press Release

“Sustainability is a priority for [Lennar Multifamily Communities], and collaborations with organizations like ING allows us to expand our current ESG initiatives to lower building emissions and deliver green living experiences to our residents.”

Do green building drive profits?

Societal pressure and increased focus on ESG accountability are drivers behind the real estate’s shift toward green building. But what does it mean financially for developers and investors?

For a long time after its initial emergence, green building was perceived as an approach exclusively for high-end projects, establishing its reputation as expensive and ultimately less profitable.

But recent trends and research show that although building materials and construction costs may indeed cost more, green buildings make their money back in long-term efficiency and market desirability. According to the U.S. Green Building Council, upfront investing in green building can increase asset value by 10% or greater.

Lower long-term costs also balance higher expenses at the start. For example, LEED-certified buildings have maintenance costs 20% lower than traditional commercial buildings; when buildings are retrofitted to green standards, their operational costs decrease by up to 10%.

How to prepare for the future

It’s reasonable to assume that demand for green building investments will continue to rise as investors increasingly require ESG standards to be met across their portfolios. Moreover, incentivized by the post-pandemic societal demand for healthier indoor living and working experiences coupled with a continued worldwide focus on combating climate change, even green building laggards will need to jump on board.

As a result, the real estate industry will likely shift from the green building as an emerging trend to a green status quo.

Download Sustainable Success: The Rise of ESG and How to Prepare for the Future, to learn how ESG initiatives can bring an influx of new investments, how to avoid “greenwashing,” and what common ESG questions you should be expecting.