The hype around environmental, social, and corporate governance (ESG) is palpable. From projections of ESG funds to grow as much as $30 trillion by 2030 to large-scale PE firms like Apollo, Blackstone, and Carlyle ascribing ESG stock labels, it appears that transparent and authentic corporate policies and initiatives are cash-cow opportunities everyone wants to take advantage of.

Within the AlphaSense platform, we boast an extensive range of documents mentioning “ESG”—a testament that leadership across all industries is considering this an important facet to their business approach. And while some feel that ESG has become one of the standard criteria for investing, many are wondering: what value does it actually return?

Below, we break down the numbers of how ESG is improving metrics within corporate environments, impacting public perception and stock values, and saving organizations millions—and sometimes billions—of dollars.

Investing in a Better Future

It’s becoming increasingly clear that a rising class of investors and shareholders are taking notice of global warming, and specifically, the companies that contribute to it. That’s why, more than ever before, companies are concerning themselves with their ESG scores—a quantitative metric, such as a numerical score or letter rating, evaluating the environmental, social, and governance efforts undertaken by a specific organization.

There’s a fiscal reward for not just having a good ESG score, but a high one too. Between 2013 and 2020, companies that consistently scored high on ESG factors saw 2.6x greater shareholder returns than average scorers. And recent evidence links higher ESG scores to a 10 percent lower cost of capital. Further, companies with robust ESG practices displayed a lower cost of capital, lower volatility, and fewer instances of bribery, corruption, and fraud over certain periods.

Obviously the increase in renewable and other clean energy generation that’s coming from CKI’s acquisitions, which has the added benefit of improving the group’s overall ESG profile.”

– CK Hutchison Holdings Limited | H1 2024 Earnings Call

However, many business leaders still struggle to tackle ESG within their operations. Accenture cites that 44% of C-Suite personnel have an “inability to define/prioritize material ESG issues for disclosure” as one of the top challenges for measuring and reporting ESG performance.” But this inaction comes at a cost: according to MSCI, companies with lower ESG scores have a higher cost of capital, higher volatility due to controversies and other incidences such as spills, labor strikes and fraud, accounting, and other governance irregularities.

Ultimately, investing in ESG pays off, whether you view it as an investment into your company’s future or a compliance cost.

Creating Thriving Work Environments

It’s apparent that when C-Suite leaders implement ESG into their operations, they see a wide range of improvements—from attracting new desirable talent to improving productivity.

In an Accenture study, 28%+ of the 140 US companies surveyed that were leaders in diversity hiring, employment, and inclusion achieved, on average, 28% higher revenue, higher net income, and 30% higher profit margins.

These efforts also have a long-term effect on retaining the best talent: according to a LinkedIn survey, 80% of respondents want to work for a company that values DEI issues. Additionally, 76% of employees and job seekers said diversity was important when considering job offers.

Further, the study revealed that 19%+ diverse management teams deliver 19% higher revenues from innovation compared to less diverse company leadership. Gains are ample when your workforce is diverse and your corporation embraces the “S” of ESG.

And for some companies, ESG engagement extends beyond production methods and spending sheets:

“Another great example of how we are integrating ESG into our business. It is important in Crayon that we do not only treat ESG as a must-do but actually integrate it into our culture and our go-to-market. As an outcome of this, we created an innovation fund in 2021 as an internal initiative to inspire our employees to find creative ESG-related projects to impact society.”

– Crayon Group Holding ASA | Q1 2023 Earnings Call

More interestingly, integrating ESG policies can also result in up to a 50% increase in employee turnover, according to Brightest. But turnover is not always a bad thing and can, in fact, save your organization from having to make tough decisions and often improves productivity levels.

Ultimately, companies that practice and communicate strong ESG principles and performance are better at recruiting and retaining talent, have more productive employees, and are overall more profitable and innovative. For large companies, this can lead to revenue gains and cost reductions in the tens of millions of dollars each year.

We continue to invest in our sort of entry-level talent, and we see that as a really important kind of route to bring in the entry-level talent into our organization and having a positive impact from an ESG point of view.”

– Made Tech Group Plc | 2024 Earnings Call

Saving Capital Through Eco-Consciousness

There is no denying that ESG can also reduce costs substantially and even help combat rising operating expenses (such as raw-material costs and the true cost of water or carbon), which McKinsey research states can affect operating profits by up to 60%.

The American multinational conglomerate 3M is often touted as a prime example of how much capital can be saved through ESG efforts. To date, the company has saved $2.2 billion since introducing its “pollution prevention pays” (3Ps) program. This program was implemented in 1975 with the aim of preventing pollution by reformulating products, improving manufacturing processes, redesigning equipment, and recycling and reusing waste from production.

We’re actually looking at developing some of our own hybrid mining equipment, which, not only has a benefit in terms of our ESG credentials, but more significantly, has a benefit for us from a cost perspective.”

– NRW Holdings Limited | 2024 Earnings Call

FedEx is transitioning its entire parcel pickup and delivery fleet to “zero-emission electric vehicles” by 2040. As of today, more than 20% have been converted and jet fuel consumption has already decreased by more than 1.43 billion gallons since 2012.

The bottom line: a 2016 Aflac study showed that 61% of investors see strong ESG and corporate social responsibility (CSR) performance as a sign of “ethical corporate behavior, which reduces investment risk” and an “indicator of a corporate culture less likely to produce expensive missteps like financial fraud.”

I also think there is an opportunity to take advantage of our scale, for example, by taking a more group-wide approach to areas such as procurement and property, where we see an opportunity to deliver bottom line savings. These key areas of growth and operational excellence are underpinned by people, digital and ESG.”

– VP Plc | 2024 Earnings Call

Additionally, Gartner reported that 85% of institutional investors consider ESG factors in their investment decisions and similarly, global ESG assets and investments will exceed $50 trillion by 2025, says Bloomberg. Investing in becoming a more eco-efficient and socially responsible company means investing in a more sound future for your fiscal performance.

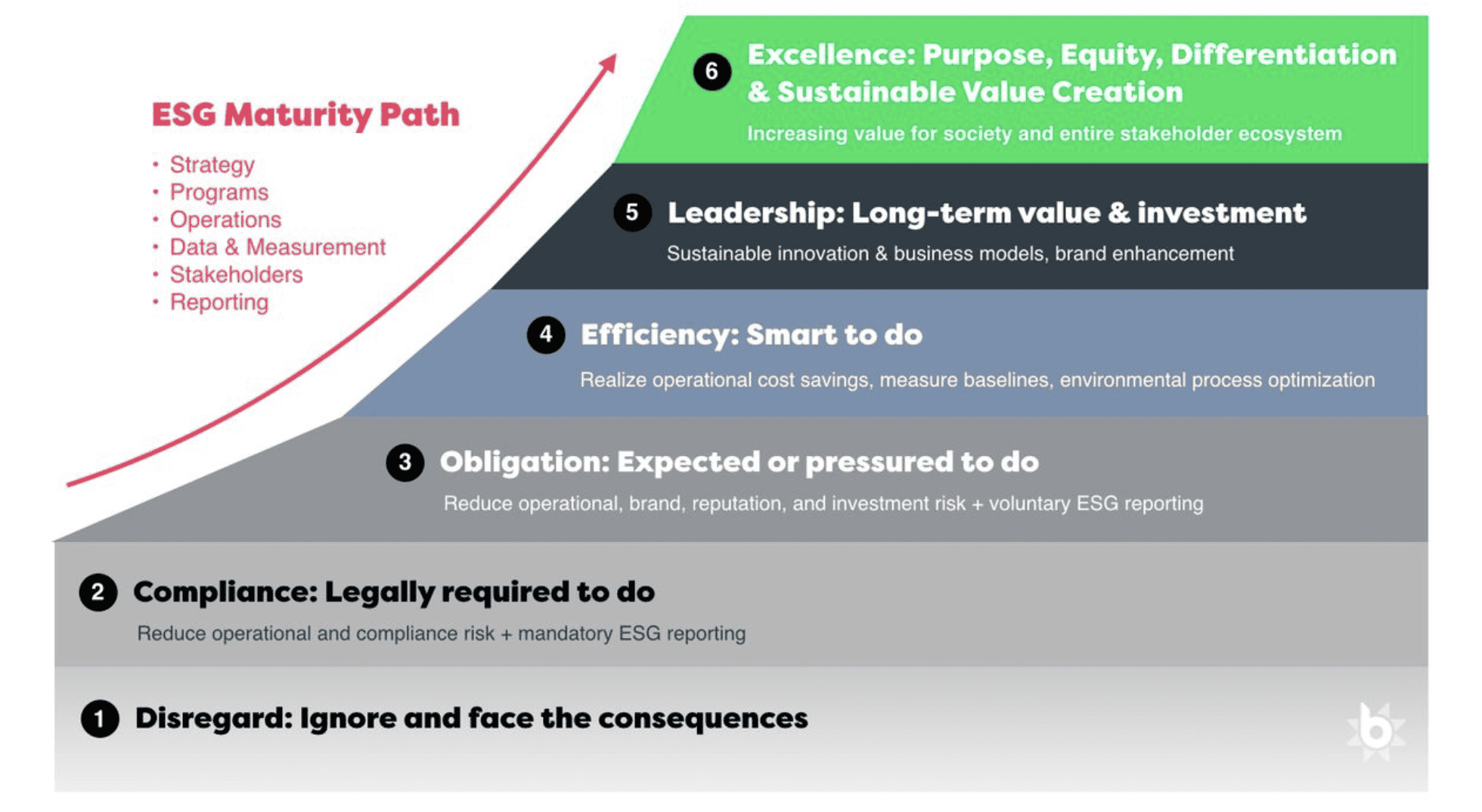

Now more than ever, thoughtful and strategic ESG performance is a competitive business advantage that delivers a wide range of ROI benefits. Most companies start ESG work due to compliance and investor pressures, but soon realize their investments, maturity, and capabilities evolve.

Gaining a Competitive Edge

Ultimately, investing in ESG not only proves to have ROI, but can put you at the forefront of your competitive landscape.

Kroll, a prominent independent provider of global risk and financial advisory solutions, conducted a recent study exploring the global connection between the historical returns of publicly traded companies and their ESG ratings. What the report revealed is that after analyzing data on over 13,000 companies across a variety of industries around the globe, Kroll found companies with better ESG ratings outperformed their peers with lower ratings.

But what does this mean in more tangible terms? “Globally, ESG leaders earned an average annual return of 12.9%, compared to an average 8.6% annual return earned by laggard companies. This represents an approximately 50% premium in terms of relative performance by top-rated ESG companies,” the report states.

Moreover, in the United States, which boasts the highest count of rated companies, those classified as ESG leaders achieved an average annual return of 20.3%, surpassing the 13.9% average annual return of laggard companies. Consistent with the global observations, the superior performance of top-rated ESG companies in the U.S. was nearly 50% more robust than that of their lower-rated counterparts.

Curious to determine the ROI of your market intelligence tools that lead to better investments? Try our ROI calculator to discover how a platform like AlphaSense can help you make confident, market-driven decisions.

A Greener Future with AlphaSense

With new regulations and metrics constantly emerging to fight greenwashing and report accurate ESG metrics, staying on top of new investment trends and disclosure standards is crucial for the business longevity of public and private companies. It’s a need that requires a tool that aggregates leading industry information, all while helping you cut through irrelevant noise. AlphaSense is that and more.

Using our innovative market intelligence platform, our clients can access broker research, company documents, expert calls, and more from over 10,000 content sources–everything they need for effective ESG due diligence and responsible investing.

If you want to stay at the forefront of new developments in ESG investing, start your free trial with AlphaSense today to learn how we can help keep you abreast of emerging sector trends and ahead of your competition.