When it comes to earnings season preparation, the name of the game is to be efficient, comprehensive, and strategic. But access to company filings is only part of the equation – you need to have tools and systems set in place that enable you to quickly read between the lines and pick out the hidden meanings and key insights that can ultimately help drive your strategy.

Read on to discover why artificial intelligence (AI) is the number one tool that will elevate your earnings season preparation and analysis and ensure you never miss a critical detail again.

What is Earnings Season?

Earnings season is a quarterly time period when a majority of publicly traded corporations report their earnings. Earnings are one of the most important drivers of individual stock performance, and ultimately, the market as a whole, ushering in a higher degree of volatility in stock prices for a period of time.

Earnings season usually begins a few weeks after the end of the fiscal quarter and lasts about six weeks in total. The general timeline is as follows:

- Q1 Earnings Season – begins in mid-April and ends in May

- Q2 Earnings Season – begins in mid-July and ends in August

- Q3 Earnings Season – begins in mid-October and ends in November

- Q4 Earnings Season – begins in mid-January and ends in February

Why Does Earnings Season Analysis Matter?

Earnings season is critical for anyone making investment decisions, creating investment strategy, or looking to gain intel on the competitive landscape to inform the following quarter’s business decisions. The filings companies publish are rich in financial data that can be used for benchmarking, forecasting, and evaluating companies for acquisition.

Because companies publish such a wide breadth of information during earnings season, it is important to identify the right sources you need to monitor, as well as, implement the right systems and processes to help make sense of all the data. Effective analysis will help you ensure you are not missing out on critical information and that you are extracting the most important insights that provide an edge over the competition.

How AI Leads to Better Earnings Season Analysis

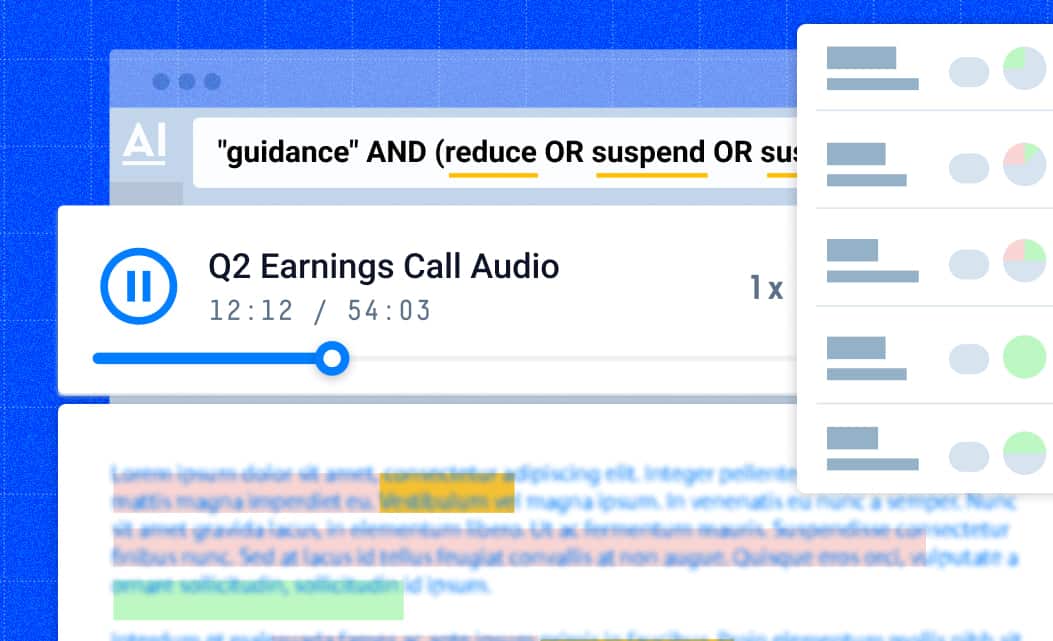

There are many different ways to search all the sources of competitive and market data and information, but sifting through irrelevant documents and pages of information wastes a significant amount of time.

AI technology, powered by Natural Language Processing (NLP) and Machine Learning, not only helps surface relevant results quickly, but it also provides key insights on underlying meanings across the content. This ensures you spend less time parsing through massive amounts of company data and more time transforming key insights into research reports or strategy.

Why are Tone and Messaging Important in Earnings Analysis?

During earnings season, it is critical to have a firm grasp on the implication behind earnings call messaging. Company sentiments conveyed in earnings calls often translates to shifts in the market, and having a tool that accurately analyzes tone in financial language can help you make better strategic decisions and answer the following questions:

- What are consumers, analysts, and management teams saying about your peers?

- What is the sentiment toward your own company?

- What is the sentiment of your peers on earnings calls?

- Are your peers speaking positively or negatively about key topics?

Earnings press releases are intended to put a company’s best foot forward, and though earnings calls are meticulously prepared and rehearsed, the company’s executive team will often make off-the-cuff remarks that can be highly valuable and revealing.

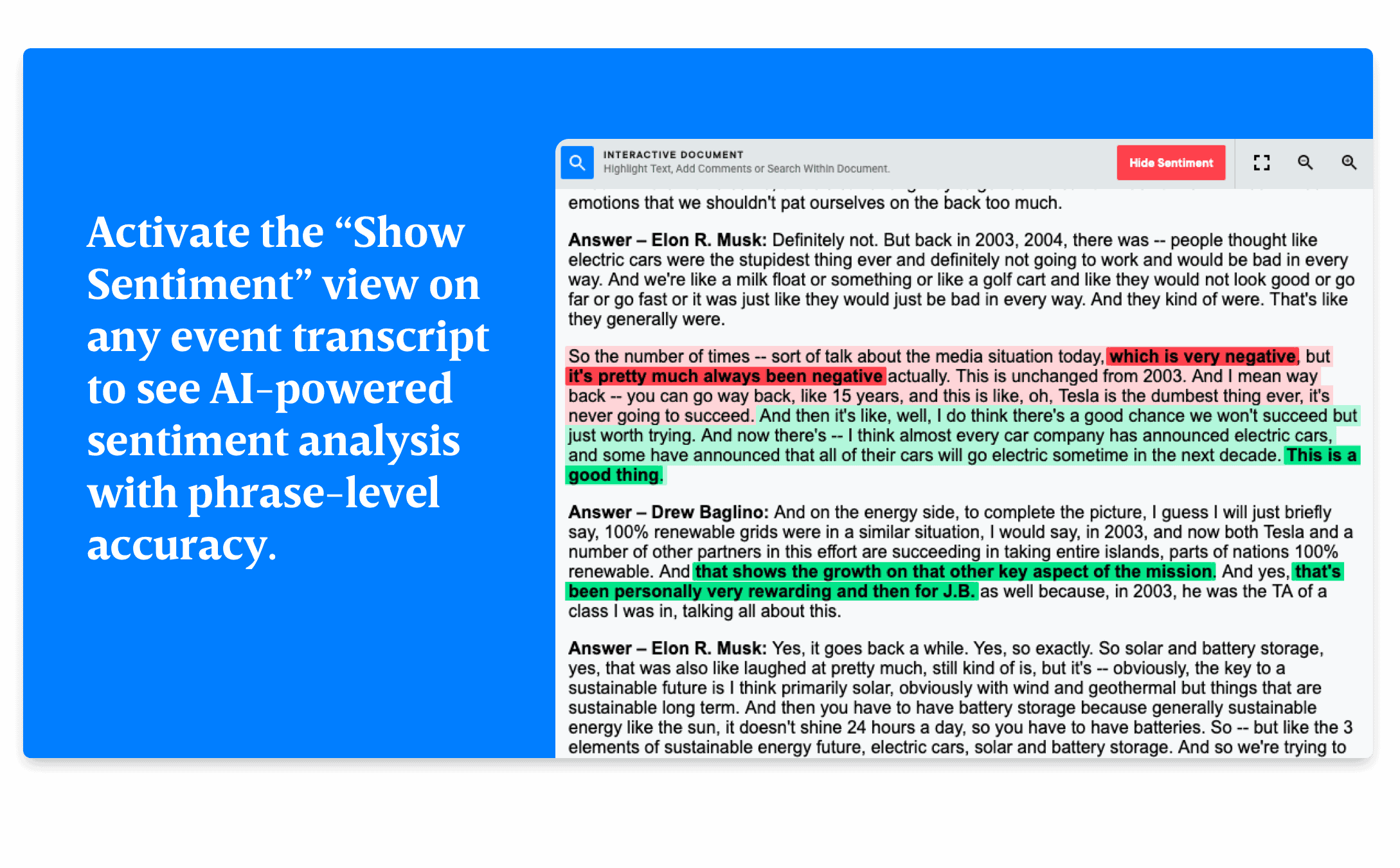

Comparing changes in language to prior earnings call transcripts can help you piece together a larger narrative, allowing you to spot compromises in continuity often indicating red flags. AI allows you to quickly uncover the subtle messaging and tonal cues that will ultimately allow you to draw conclusions and reveal relationships between key topics or themes that would otherwise be easily missed.

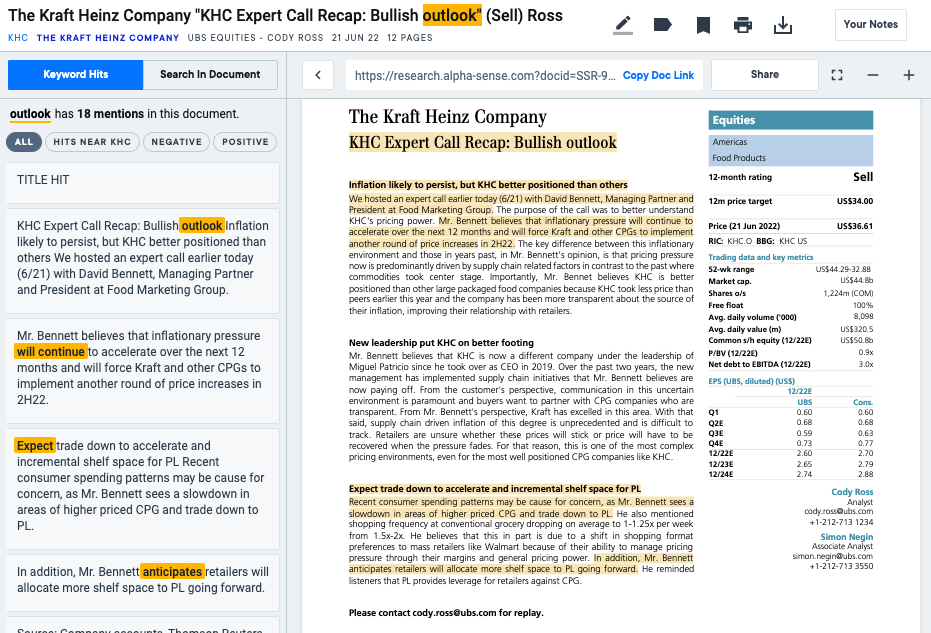

How to Use AlphaSense to Understand Sentiment

- Companies with the largest sentiment score shift from the previous quarter

- The most negative or positive documents, on a relative score from -100 to 100

- Highlighting of phrase-level positive or negative sentiment underlying score shifts, honing in on the specific tonal text that our model has identified with high confidence

AlphaSense sentiment takes a radically improved approach to applying the sentiment to financial documents than any product on the market. Here’s how:

Our AI model is trained on 10+ years of human-curated financial text to understand nuanced context. Like all of the most successful AI systems, our sentiment model is trained on a massive data set. Our AI model surpasses all past sentiment models, leveraging our proprietary access to the vast human-labeled training data we have meticulously built up. Unlike legacy approaches, our model understands the context and scale in financial language, beyond a narrow limited set of scenarios.

Our model is transparent. Simple dictionary-based approaches fail with many common scenarios like negations or co-references. Our AI model has learned these from vast training data and succeeds where past models have failed. We show phrase-level highlighting of positive/negative sentiment, so you can see exactly how we’re arriving at our insights.

Our AI model is built to recognize variation in language. When trying to gain a comprehensive understanding of what is happening in a market, traditional legacy platforms fall short because they fail to capture variances in industry terms. This can result in you missing certain critical insights in your analysis.

Synonym recognition is a proprietary AlphaSense AI technology that can greatly expand keyword searches and also screen out incorrect results for keywords with multiple meanings. With synonym recognition, you won’t miss any instances of the term you are interested in, and you can be sure your analysis is thorough and complete.

Summarize Earnings Transcripts With Generative AI

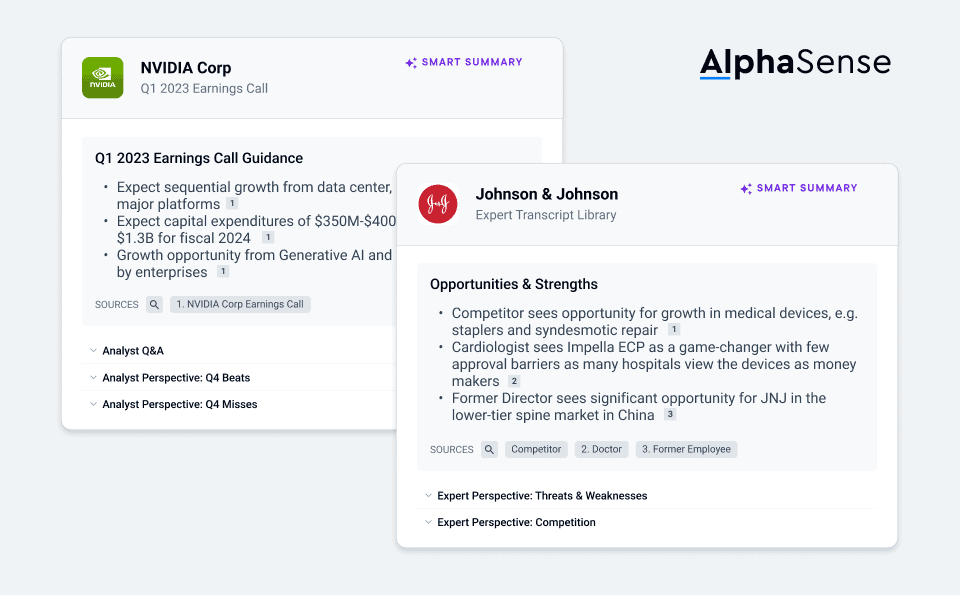

Many of our customers spend countless hours reading and summarizing earnings calls from across their portfolios, peer sets, clients, and competitors. AlphaSense makes this task infinitely easier, faster, and more error-proof with our newest generative AI feature, Smart Summaries.

With Smart Summaries, every earnings call in the AlphaSense platform contains an AI-generated summary that covers all key topics—organized in concise, bulleted form with all sources cited—ready within a few hours of the call.

Smart Summaries features:

- Bulleted summarizations that pull from the entire document and are ranked in order of importance; as more people interact with these, they become even smarter and more adaptable to your company’s specific needs

- Clickable citation links that take you to the exact places within the document from where the insight was sourced

- User feedback buttons that allow you to contribute to the continuous improvement and evolution of our models

With Smart Summaries, you can be confident in the accuracy and security of our technology because we guarantee:

- Better accuracy – Benefiting from our 10+ years of investment in AI, Smart Summaries is trained specifically on financial data, which means enhanced accuracy and relevance and reduced risk of hallucination.

- Verifiable information – With our linked citations, you can validate each of our summaries and gain trust in our model.

- Trustworthy content – Language models rely on curated content sets for the generation of summaries. AlphaSense’s model parses our premium, proprietary content sets to generate its high-accuracy summaries.

- Private data – Smart Summaries was built with security and privacy as top priorities. Even when other tools have been banned, our unique approach allows all companies to reap the benefits of generative AI, resting assured that their data is safe.

Transform your Earnings Season Analysis with AlphaSense

With AlphaSense, we help users cut through the noise using our proprietary AI search technology. Premium features like Smart Synonyms and Sentiment Analysis allow you to take the lead in your respective industry and amplify your ability to conduct competitive and market landscape analyses – in less time and with less of a headache. Start your free trial here.

If you are interested in elevating your competitive intelligence strategy in time for earnings season, don’t miss our Competitive Intelligence Guide to Earnings Analysis.

If you are an analyst and are looking for additional information on how you can leverage AI, check out our Earnings Season Analysis with Augmented Intelligence for Buy-Side and Sell-Side Analysts.