The Complete Guide to Conducting Competitive & Market Landscape Analyses

Get the guide

The speed of data creation, and the level of information bombardment in our professional and personal lives, makes it increasingly difficult to weed out the noise and to know when we have the right information to make decisions.

Nothing typifies this more than the first step in any market and competitive landscape analysis or due diligence effort — mapping the landscape. Typically, mapping the landscape involves gaining an understanding of the key organizations operating in a given sector and identifying their revenue streams and product offerings.

The worst-case scenario is you dedicate a lot of time and resources to painstakingly trawl through hard-to-search sources. This scenario is made only slightly better if you can turn to a trusted source such as a curated industry or broker research report, but those often come at a high cost, cover a narrow part of the market landscape, and have limited ongoing use. The situation becomes even more demanding if a critical market event has happened (e.g. global financial crisis), or is currently happening and you need information quickly to inform an urgent business decision (e.g. onset of the COVID pandemic and impact on business).

This is why thousands of professionals have turned to AlphaSense. They now have the solution they need to navigate the breadth of information around them and pinpoint the impact of external factors and critical market events.

With AlphaSense, users can conduct a landscape analysis in a fraction of the time it would otherwise take — and with the confidence that they have all the relevant insights right at their fingertips.

As part of a comprehensive market landscape analysis, let’s start with the first step: mapping the landscape.

Search Across Curated and Premium Content in One Place

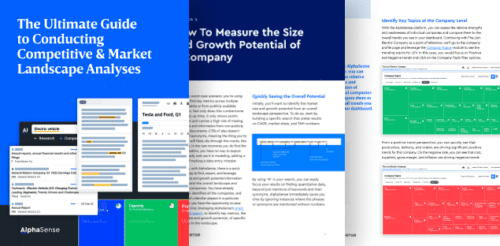

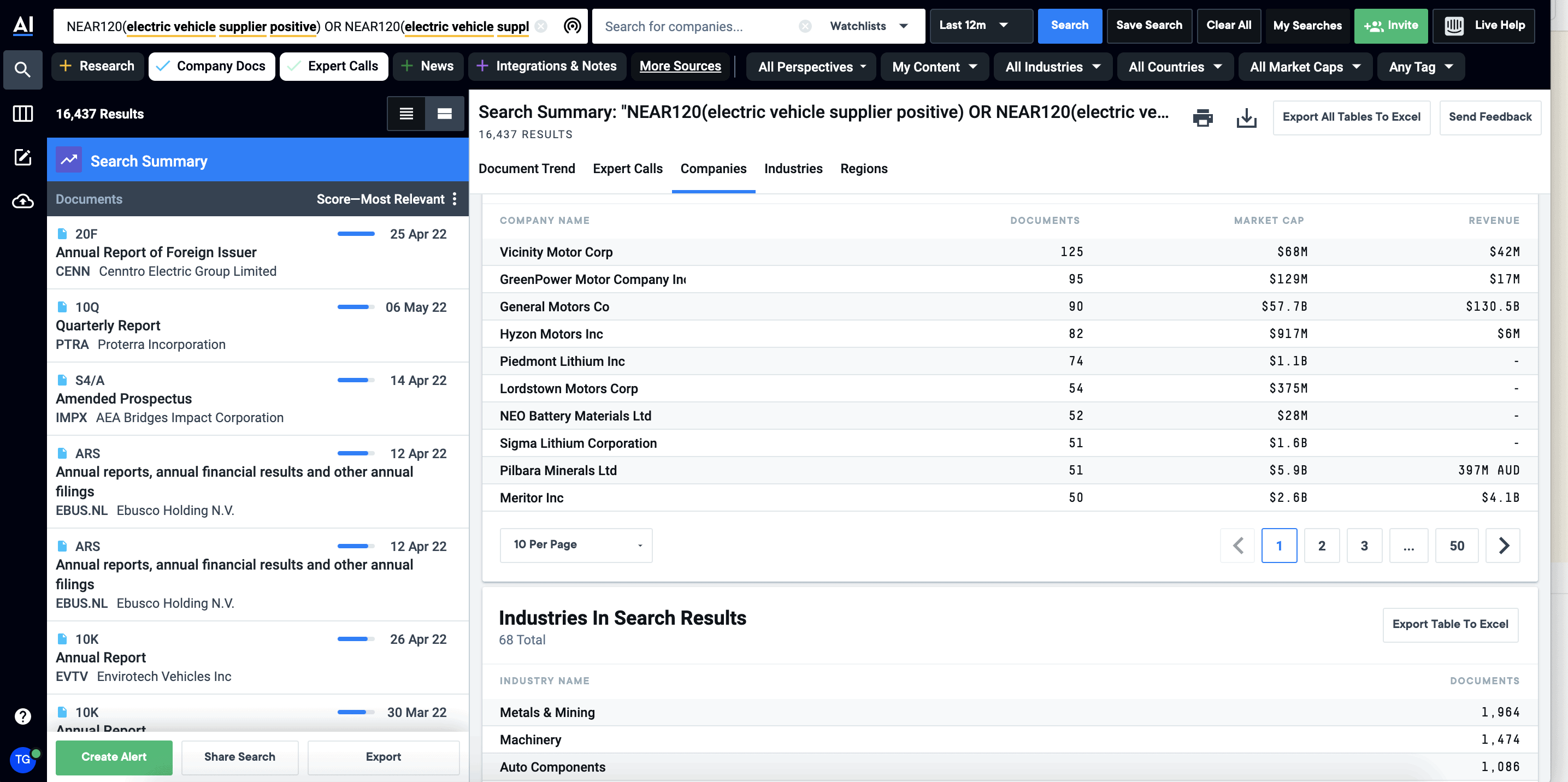

To illustrate a more prescriptive example of how to conduct market landscape analysis, I’ll map the electric vehicle industry.

I start by performing a simple keyword search for “electric vehicles”. By searching for a topic using a keyword, AlphaSense’s smart synonym technology instantly searches across millions of content sources to find all mentions of this term and all related synonyms. For this keyword search, smart synonym is surfacing non-exact keywords such as “EVs” “electric autonomous vehicle” “BEV” “electric fleet vehicle” “HEV” and many other tangential and relevant terms.

And the best part? AlphaSense’s AI excludes terms that add unnecessary noise to search results.

To enhance the search further, I select the company documents quick filter. This quick filter helps narrow down the results to only companies who mention electric vehicles in their own company documents such as filings, presentations, PR, earning transcripts, and more. What would have typically taken days to pull together, is instantly available.

Now I have a list of the players, peers, competitors, and suppliers talking about this topic. I can sort the top companies by market cap, revenue, or other benchmarks. Beyond the list of companies, I also have a list of industries and geographies covered, so I can easily see the spread and impact. Critically, I can export these datasets to Excel for further analysis.

Quickly Classify the Landscape

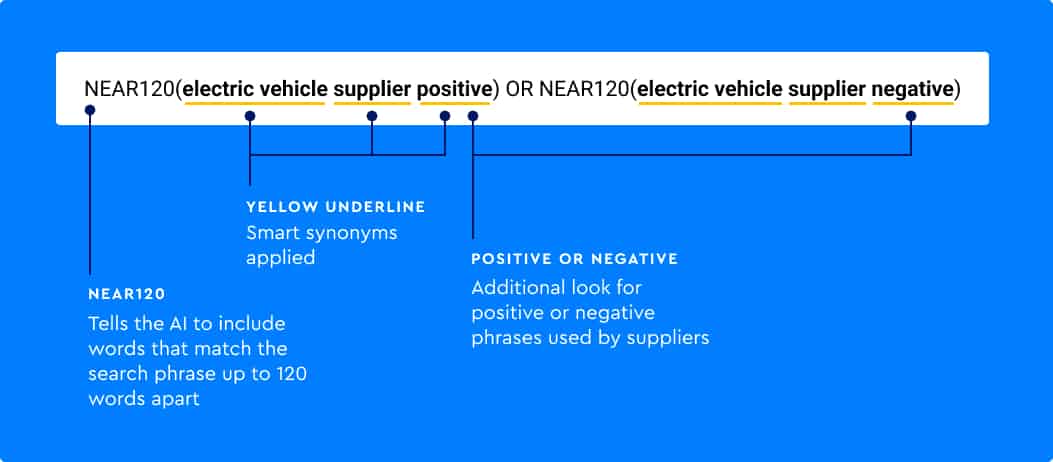

As I start to dive deeper, I split the landscape of companies into distinct buckets – n this specific example, suppliers vs. manufacturers. Next, I expand my search criteria in order to find the answers I’m seeking faster.

To start, I hunt for companies that are supplying this industry (electric vehicle suppliers) and amend my search in two ways. Next, I add in key additional phrases to focus on suppliers of the industry. I also append positive and negative sentiment, to highlight occasions where the mention is positive or negative in any earnings transcript documents. This saves additional research time in classifying the suppliers and sentiment analysis.

Continuing my search for suppliers, I expand the content filters to include Company Documents and Expert Calls. This means I am getting results directly from companies and in expert interviews about electric vehicle suppliers.

Exporting this list of electric vehicle suppliers to Excel allows me to compare this list with the original list of companies — and identify the suppliers vs. manufacturers.

In AlphaSense, I also have the benefit of searching across broker and industry research. This enables me to leverage insights already compiled on the industry and companies by expert researchers. I can use these insights to validate my findings on which companies are suppliers vs. manufacturers, and get additional insights into performance and future outlook. As I scroll through the content results, AlphaSense’s AI is scoring each document according to relevance.

Identify Core Product Offerings and Revenue Streams

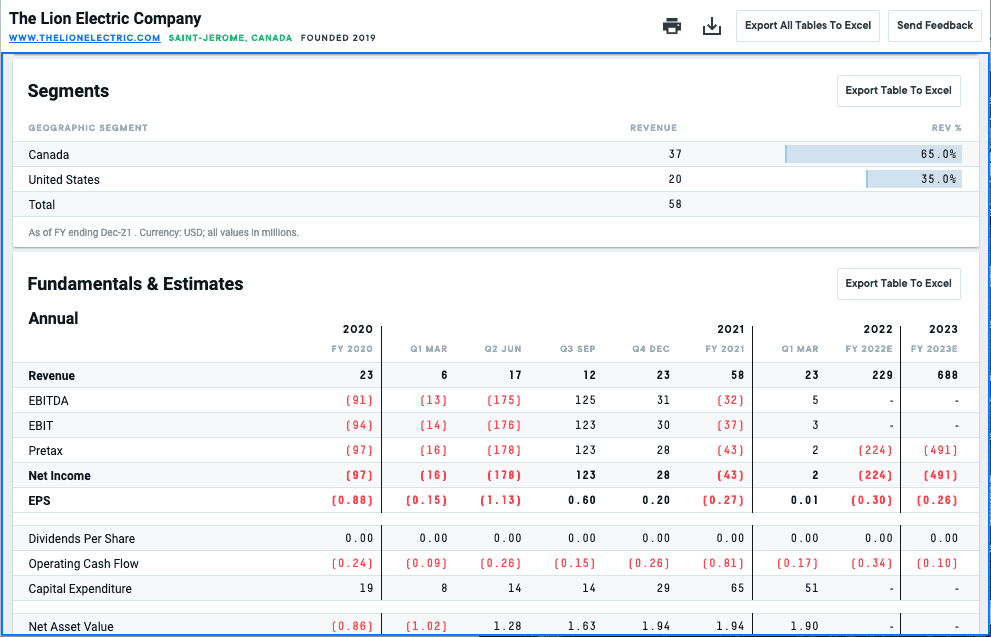

As I come across companies I might not be familiar with, AlphaSense’s AI tools dive deeper, identifying their key markets, product offerings, and revenue streams. In the electric vehicle space, I come across a company I am unfamiliar with – The Lion Electric Company.

I begin by checking the segment and fundamental sections of the company profile. I can see financial performance metrics, in this case, across key geographies and the company as a whole.

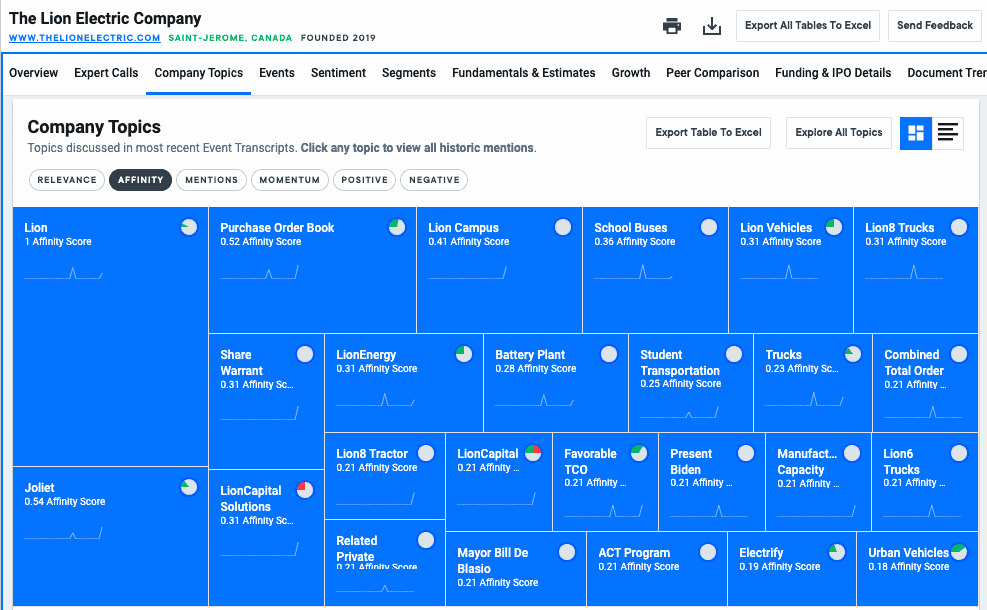

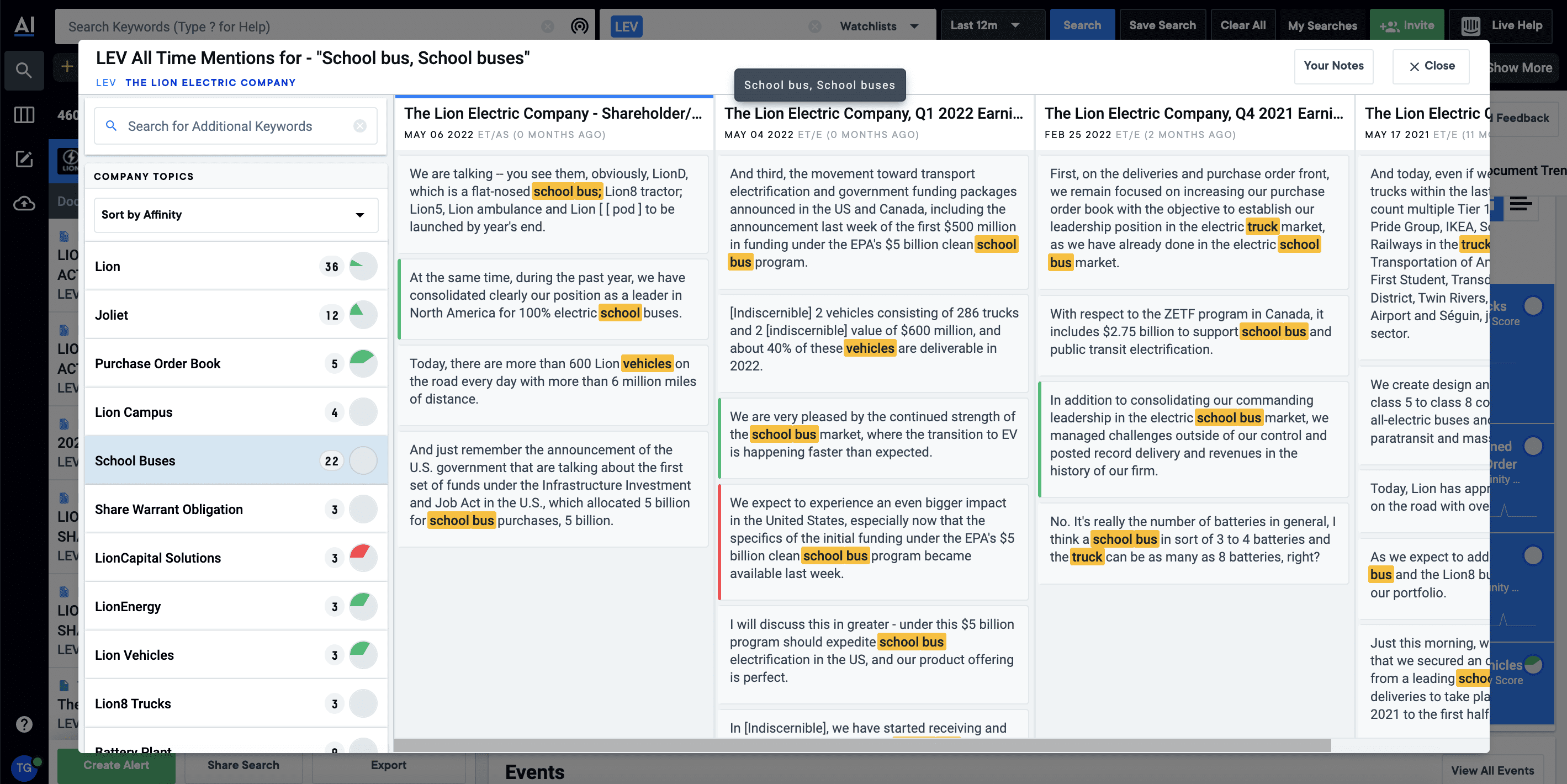

Using the Company Topics module and selecting affinity, I can see the topics that are uniquely relevant to this company, giving me a headstart on identifying key product offerings. In this particular example, I see The Lion Electric Company has key products around electric school buses, trucks, and tractors.

If I need further historical details of any of these product offerings, I can dive into Snippet Explorer and instantly see the history of mentions across all prior earnings transcripts. This helps me quickly get up-to-speed on a new company, its product offerings, and past performance.

Using AlphaSense’s AI tools, I have quickly gathered all the data and information to complete my mapping exercise, document all the players in the space, bucket them into suppliers and manufacturers, and identify key markets, revenue streams, and product offerings for any companies I am unfamiliar with.

In minutes we have a comprehensive market landscape report that would previously have taken days or weeks and likely still would have had gaps in the analysis.

Check out this video on how to conduct a more comprehensive landscape analysis in less time. Want to get in the platform and see for yourself? Unlock a free trial of AlphaSense here.