When choosing an investment research tool, it’s important to consider your specific business needs and the capabilities you require, not just to do your job but to get an edge over your competitors. In today’s age of information overload, investors differentiate themselves by using tools that help them surface the right insights from the infinite amount of qualitative data at their fingertips.

Bloomberg Terminal is a popular investment research tool, which checks many boxes for investors. It’s a powerful quantitative research tool that excels at providing real-time financial data and news, as well as insights and trading tools. For many in the financial services space, Bloomberg’s screening and visualization tools are useful and necessary, and these offerings are unmatched by most other platforms.

However, when analysts rely solely on Bloomberg, they miss out on key features and valuable content sets that can accelerate and enhance their research. For this reason, many professionals choose to supplement Bloomberg with other tools.

For example, when analysts incorporate both Bloomberg and AlphaSense into their workflow, they get the proprietary news, screening tools, and visualization capabilities of Bloomberg Terminal, coupled with the premium content libraries (broker research and expert calls) and powerful AI-based search functionality of AlphaSense.

Here are seven things you miss out on by only using Bloomberg for your investment research.

Related Reading:

Top 10 Alternatives to Bloomberg Terminal

Premium Content Libraries

In market research, the more diversified content sources you have access to, the better and more accurate your insights will be. While Bloomberg Terminal provides access to company filings, documents, broker research, and internal content, it does not have a proprietary expert transcript library. This content set is a critical primary resource to supplement secondary research, as it provides first-hand perspectives from company or industry operators to make your research more proactive.

In AlphaSense, you can access our expert transcript library containing tens of thousands of calls with former and current company executives, customers, partners, and thought leaders. Because these calls are unique and proprietary to the AlphaSense platform, your competitors do not have access to these differentiated insights, giving you a competitive advantage.

The AlphaSense platform makes it easy to ramp up on new topics before conducting your own one-on-one calls to reduce the need for discovery calls. With the platform, you get instant access to a wealth of primary and secondary data in the platform, reducing reliance on frequent expert calls and maximizing your primary investment research budget.

Additionally, though Bloomberg Terminal provides access to broker research, it is inaccessible to corporate users. Meanwhile, AlphaSense offers a premium content set called Wall Street Insights®—a centralized, indexed, searchable library of the world’s leading analyst research, specifically for corporate audiences.

In addition to these content sets, AlphaSense provides access to company documents, earnings transcripts, news, and regulatory filings. Together, all of these content sets make up a full-scale, comprehensive research strategy. Bloomberg Terminal simply cannot compete with the breadth and depth of content the AlphaSense platform offers.

Smart Synonyms™

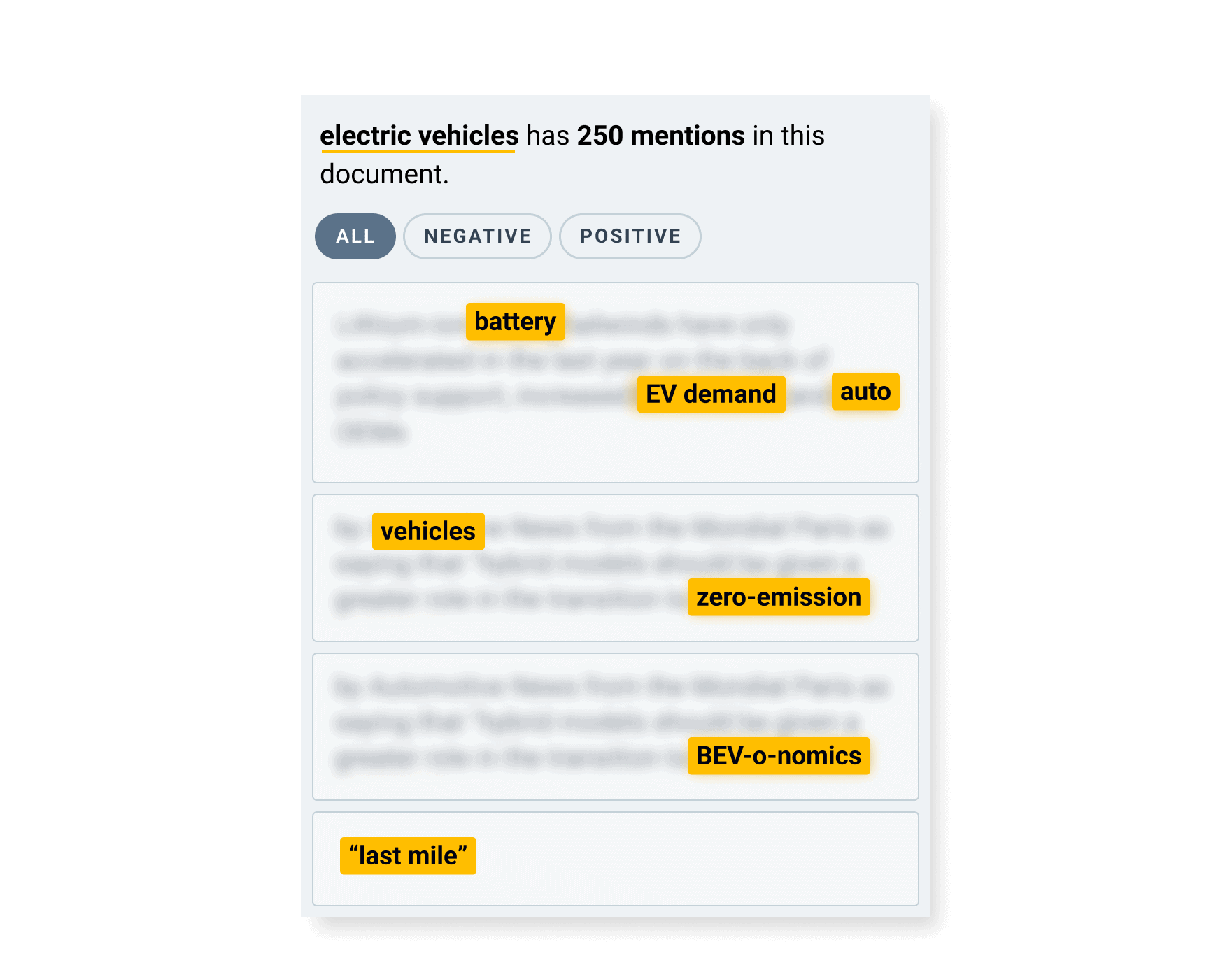

Analysts are most effective when they can spend their time on actual research—not curating sources. While Bloomberg Terminal has a synonym library, it requires users to manually eliminate false positives and noise from their query and spend their valuable time and energy on something AI can do automatically. AlphaSense’s Smart Synonyms™ technology enables you to access every relevant source and insight in a single search, while filtering out results that contain synonyms irrelevant to your search.

Smart Synonyms™ can recognize the intent behind your search, then automatically include results for your search terms and those with the same or similar meaning. For example: searching for “electric vehicles” will also yield results for “EV” and “autonomous vehicles.” Thus, there is much less opportunity for user error, and you can be more confident in the insights you uncover, even while saving hours on research.

While Bloomberg requires users to manually apply the synonym finder, AlphaSense’s Smart Synonyms™ feature turns on automatically, and it assesses the entire phrase as well as each individual word. Bloomberg synonym recognition can only assess the phrase, which leads to missing key results.

Document Trend Analysis

When conducting research or analysis on a particular topic or company, it is important to understand the frequency and context in which the search term appears across content sources in a given time period. With Bloomberg Terminal, you might get thousands of search results for your query, but there is no way to quickly see patterns or to understand how the results have shifted over time.

With AlphaSense, each user search generates a document trend analysis—a visualization of how often a keyword, company, or topic is mentioned across content sources on the platform over a given time period. This is a powerful way to understand the evolution of trends and evaluate their relevance over time.

Document trend analyses can be sorted by content type for a more detailed understanding of how a topic is being discussed and by whom. You can also see a quarter on quarter (QoQ) view of keywords and topics a company has used in its event transcripts, which is highly valuable for corporate and investor relations users.

Relying only on Bloomberg can lead to a misinterpretation of trends, which can undermine your research and prevent you from accurately forecasting future market movements.

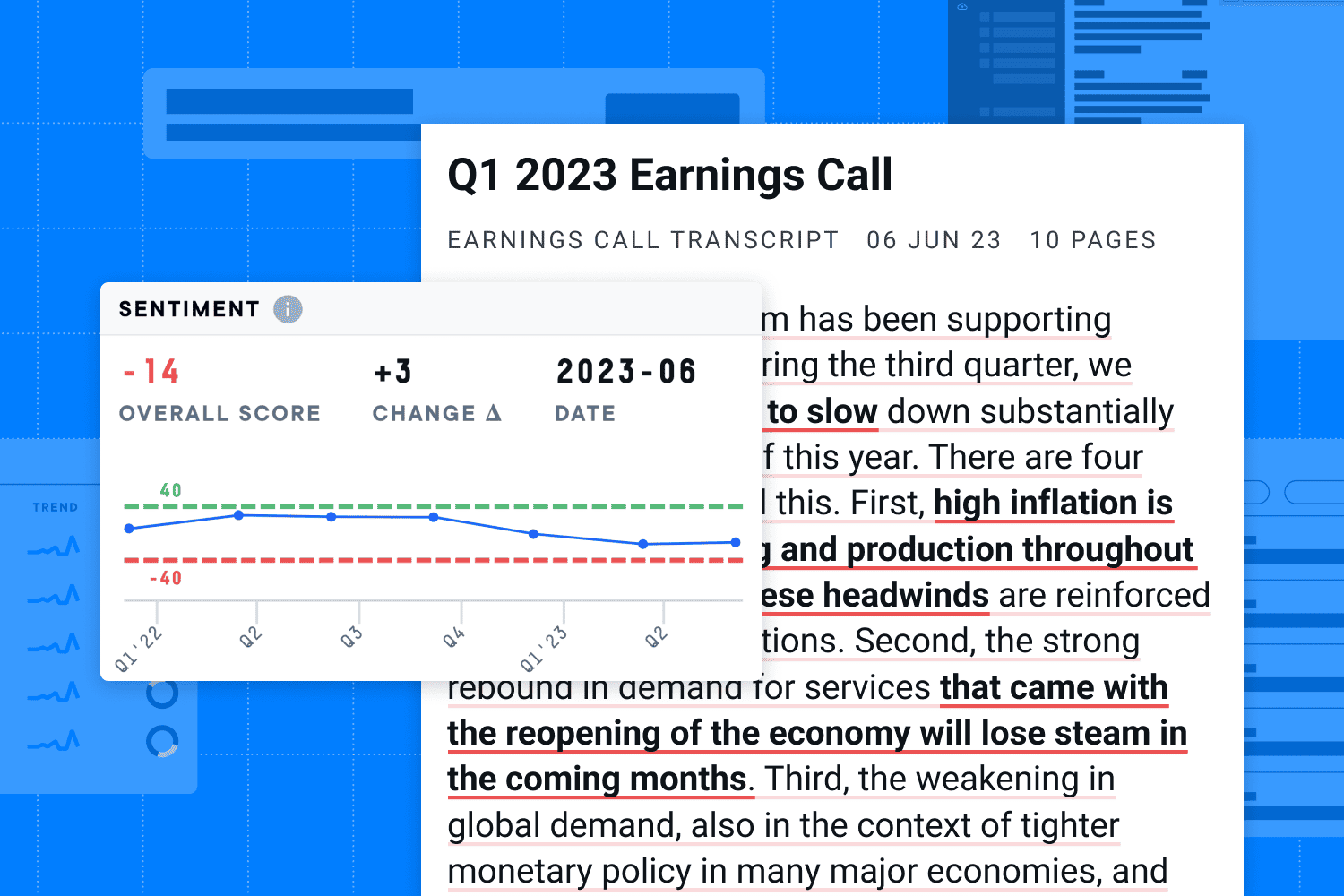

Sentiment Analysis

One of Bloomberg Terminal’s limitations is its lack of sentiment analysis functionality. AlphaSense’s sentiment analysis is a natural language processing (NLP) feature that parses through content and identifies nuances in the tone and subjective meaning of text. It then uses color coding to help users identify positive, negative, or neutral sentiments throughout the document.

This feature is instrumental in getting a deeper understanding of various documents, especially earnings calls and expert transcripts, since it allows you to quickly understand a company’s or thought leader’s positive and negative perspectives on certain topics.

AlphaSense’s sentiment analysis feature also assigns each search term a numerical sentiment change score to help users track any slight change in market sentiments over time. This feature can help users make better-informed investment decisions and improve risk management strategies.

Generative AI

Generative AI (genAI) has taken the world by storm in recent years, bringing rapid transformation and evolution to a range of industries and workflows. In the realm of investment research, genAI brings profound possibilities—it streamlines the research process by reducing the time spent on routine manual tasks and enhancing the depth and accuracy of analyses.

While Bloomberg Terminal jumped on the genAI train with its rollout of BloombergGPT, the model has left much to be desired. Though it is trained on a vast range of financial data and is built for finance, the model is not as effective at picking up on the level of nuance and detail that is needed to defy doubt in their research. It’s also been shown to underperform relative to multiple non-financial GPT tools, as the model lacks any task-specific fine-tuning.

Meanwhile, AlphaSense’s industry-leading suite of generative AI tools is purpose-built to deliver investment-grade insights, leveraging 10+ years of AI tech development. This includes our retrieval-augmented generation (RAG) approach and our proprietary AlphaSense Large Language Model (ASLLM)—trained specifically on business and financial data—which matches or beats the leading third-party LLMs over 90% of the time.

Our suite of genAI tools currently includes:

This feature allows you to glean instant earnings insights (reducing time spent on research during earnings season), quickly capture company outlook, see bull and bear cases from analysts, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees. All summaries provide you with citations to the exact snippets of text from where the summaries are sourced—combining high accuracy with easy verification. We also apply this same technology to our collection of expert calls.

Our generative AI chat experience transforms how users can extract insights from hundreds of millions of premium content sources. Our chatbot is trained to think like an analyst, so it understands the market research intent behind your natural language queries. Whenever you search for information, genAI summarizes key company events, emerging topics, and industry-wide viewpoints. You can dig deeper into topics by asking follow-up questions or diving into the source document with one click.

Seamless User Interface

Bloomberg’s research solution started out as a physical terminal, and the modern-day interface poses a steep learning curve for new users, as it is not particularly user-friendly or intuitive. Additionally, many users have to share access to the terminal, which requires them to take turns using it because the tool is housed on a particular computer.

In contrast, the AlphaSense platform is accessed through the cloud, making it easy to collaborate and work in various locations. Additionally, the AlphaSense mobile app allows you to access crucial insights on the go and experience an uninterrupted workflow wherever you are.

That’s why AlphaSense has consistently been rated highly for its seamless UX interface, intuitive features, and fast learning curve—easily accessible for all users at any time, from any device.

Multiple Integration Options

The power of a research tool like AlphaSense or Bloomberg lies in its ability to integrate with your larger systems and processes. However, Bloomberg cannot integrate natively with many commonly used programs, such as Box, OneNote, Sharepoint, and Evernote, for direct content sharing or syncing. Instead, Bloomberg users need to use third-party solutions to simulate seamless integrations, or they need to manually export data to these platforms themselves.

AlphaSense customers can easily integrate content at enterprise scale through our Ingestion API or Enterprise-Grade Connectors, such as Microsoft 365/Sharepoint, Box, OneNote, Evernote, S3, and more. Enterprise Intelligence supports the upload and management of tens of millions of documents.

Integrations are vital in improving your team’s workflow in a secure and automated way. AlphaSense integrations are powered by AI and allow users to easily search across all internal and external content, collaborate with team members, and amplify team productivity.

Uplevel Your Investment Research with AlphaSense

The AlphaSense platform offers a comprehensive set of features so you never have to sacrifice one capability for another—you’ll have the tools, resources, and support you need to execute a full-scale investment research strategy to drive results.

Discover the power of AlphaSense and start your free trial today.