Overview

Note: The following chart displays only a sample of the competitors listed in this page.

| Bloomberg | AlphaSense | PitchBook | Koyfin | YCharts | |

| Best For | Vast repository of financial data and live financial news | Conducting comprehensive qualitative market research and analysis | Private market financial data for fundraising, deal sourcing, and due diligence | Advanced financial data visualization on a budget | Creating compelling visuals |

| Company Documents | ✅ | ✅ | Limited | ❌ | ❌ |

| News | ✅ | ✅ | ✅ | ❌ | ❌ |

| Broker Research | ✅ | ✅ | ❌ | ❌ | ❌ |

| Expert Calls | ❌ | ✅ | ❌ | ❌ | ❌ |

| Generative AI | ✅ | ✅ | ❌ | ❌ | ❌ |

| Smart Synonyms | ❌ | ✅ | ✅ | ❌ | ❌ |

| Sentiment Analysis | ❌ | ✅ | ✅ | ❌ | ❌ |

| G2 Rating | 4.3/5 | 4.7/5 | 4.5/5 | 4.8/5 | 4.6/5 |

| Enterprise Compatibility | Yes | Yes | Yes | Limited | Limited |

AlphaSense

Best for: Conducting comprehensive qualitative research and analysis with advanced AI features for added speed, accuracy, and scope

AlphaSense is a market-leading, all-in-one smart search engine and market research platform. It’s the ideal tool for research and business professionals—from analysts and financial researchers to corporate professionals—looking to implement a qualitative research strategy powered by proprietary AI technology and automation.

AlphaSense is an industry leader on TrustRadius and G2, and has been recognized by Forbes in 2023 as one of the top 50 AI companies.

Compared to many of its peers, AlphaSense offers a much more holistic approach to market research through its extensive content universe. The content database contains documents from over 10,000 public, private, and proprietary sources—indexed, searchable, and all in one place—and is organized by the four key perspectives of market research:

- Company – Documents published by public and private companies, including SEC and company filings, earnings reports, presentations, transcripts, and ESG reports

- Journalist – Content published in major news networks, trade journals, and government and NGO publications

- Analyst – Equity research published by financial analysts from leading Wall Street firms, focusing on national and global issues. AlphaSense offers a library of equity research specifically for corporate clients, which is called Wall Street Insights®, as well as a library of aftermarket and real-time research for financial services clients

- Expert – Hundreds of thousands of interviews conducted by experienced buy-side analysts with pre-vetted industry experts with direct operator experience.

Additionally, AlphaSense comes with smart search and AI capabilities that reduce time to insight, while increasing accuracy and confidence in the research.

Product Features

Generative Search

Our generative AI chat experience transforms how users can extract insights from hundreds of millions of premium content sources. Our chatbot is trained to think like an analyst, so it understands the market research intent behind your natural language queries. Whenever you search for information, generative AI is there to help you get up to speed on a company or topic by instantly getting you the answers you need. You can dig deeper into topics by asking follow-up questions or choosing a suggested query. Each answer will always provide citations to the exact snippet of text from where the information was sourced.

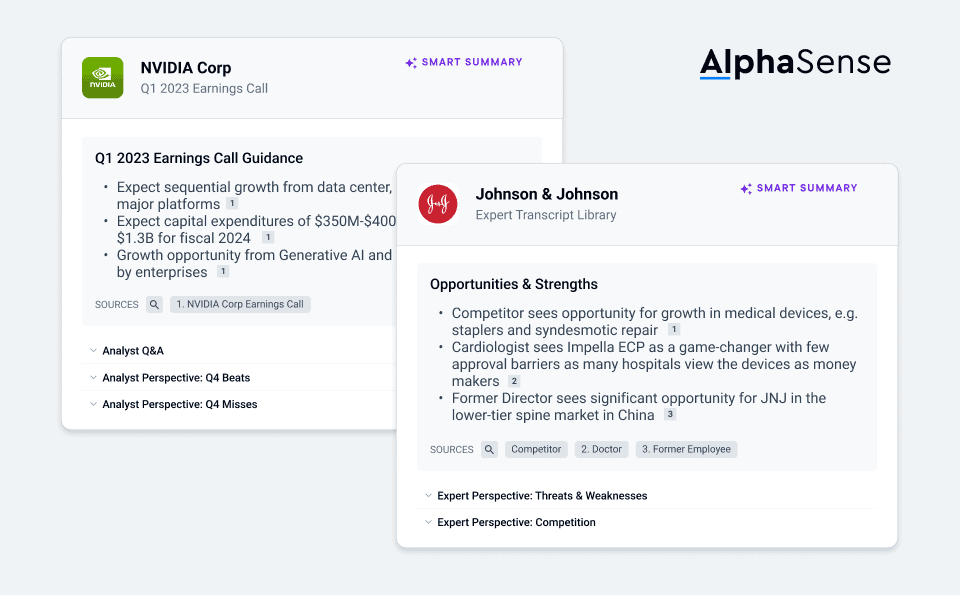

Smart Summaries

This feature allows you to glean instant earnings insights (reducing time spent on research during earnings season), quickly capture company outlook, bull/bear cases, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees. All Summaries provide you with citations to the exact snippets of text from where the summaries are sourced—combining high accuracy with easy verification. We also apply this same technology to our collection of expert calls.

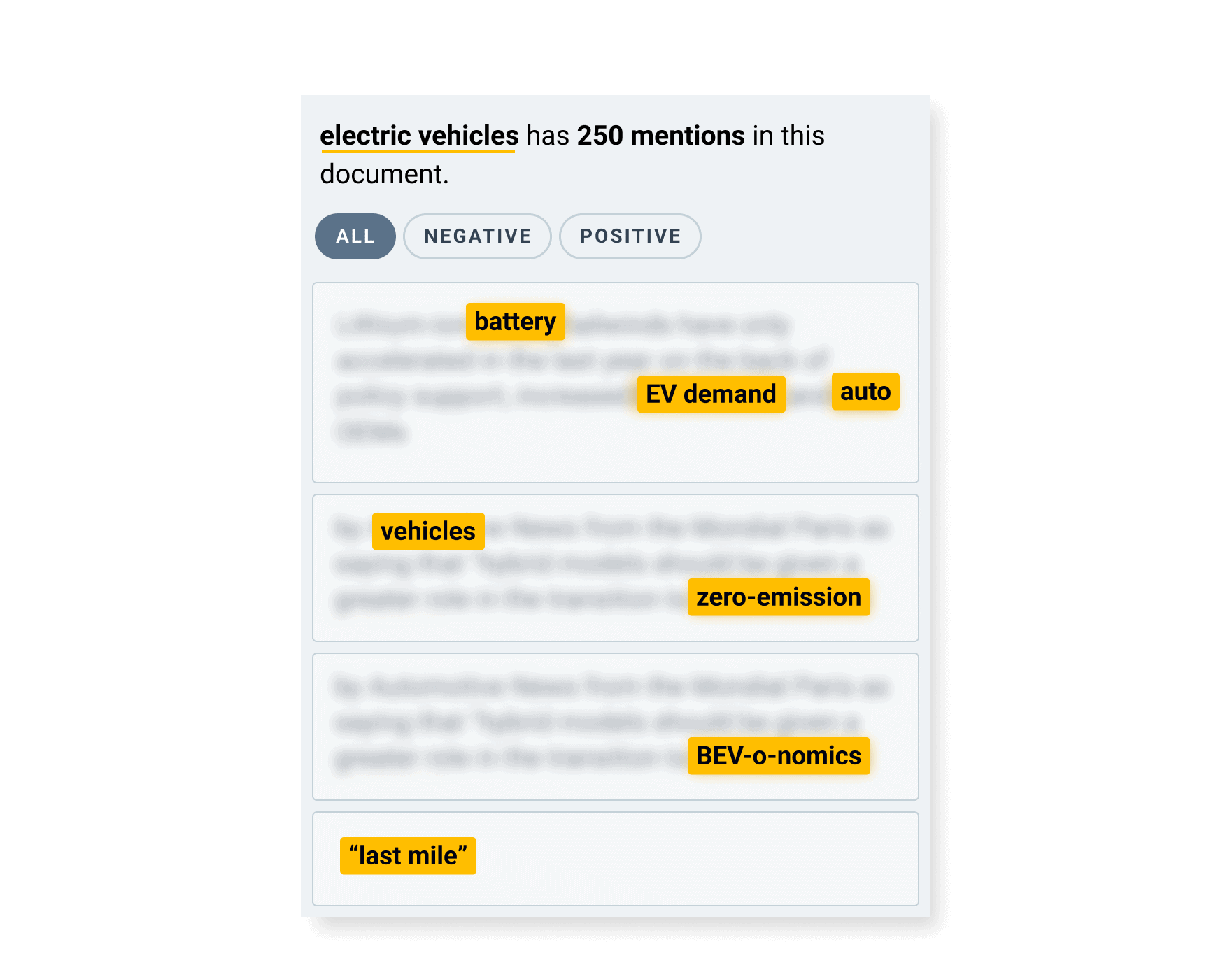

Smart Synonyms™

Smart Synonyms™ is a proprietary AlphaSense feature that uses AI technology to recognize both the keyword and search intent behind any query.

AlphaSense uses advanced algorithms to eliminate noise from your search (i.e., content with matching keywords but ultimately irrelevant to your search objective) and leverages variations in language (for example, “impact investing” vs. “ESG investing”) to pinpoint the exact information you need.

AI search functionality allows you to easily find the exact documents and snippets that are most relevant to your search, giving you back time and energy to spend on more high-level tasks, like analysis.

Instant Company Insights

With Search Analytics and Company Tearsheets, you can get updates on any companies currently on your radar, giving you an in-depth reach across industries, regions, and more. These company insights keep you focused and grounded in your research on the competitors of your choosing, cutting out noise and enhancing your competitive advantage.

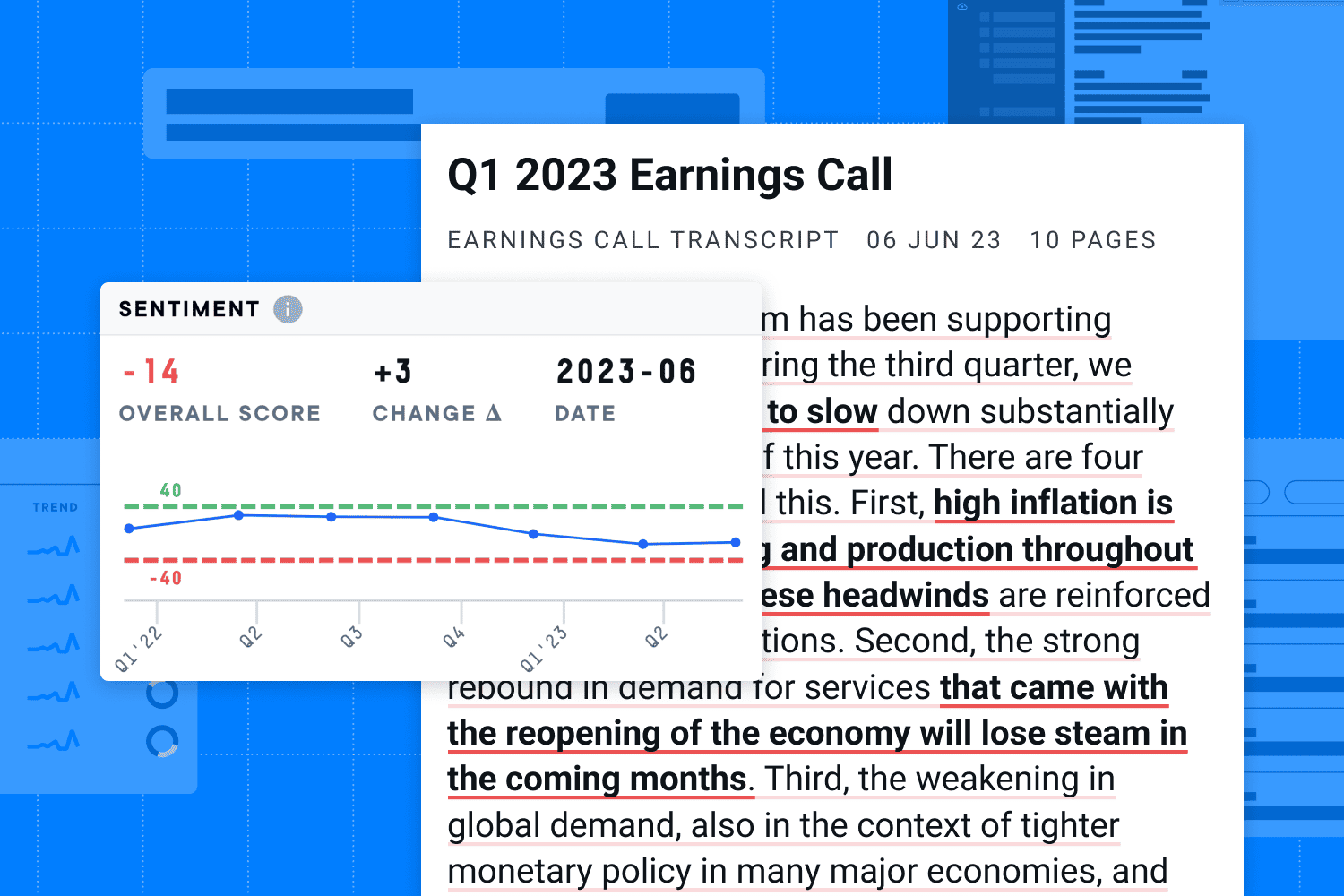

Sentiment Analysis

Sentiment analysis, a natural language processing (NLP)-based feature, parses through content and identifies nuances in the tone and subjective meaning of text. It then uses color coding to help readers identify the document’s positive, negative, and neutral sentiments.

This technology assigns each search term a numerical sentiment change score to help users track any slight change in market sentiments across time. Users can take advantage of it to make better-informed investment decisions and improve their risk management strategies.

This feature can be instrumental in picking up on subtle sentiment shifts in expert interviews that go beyond expert-level commentary. But it can also be applied to company documents—such as earnings transcripts and company presentations—to gain much deeper insight into the perspective of an individual, company, or the market on a key topic.

Integrations and APIs

AlphaSense provides integration with commonly used programs like OneNote, Sharepoint, and Evernote, enabling streamlined collaboration with members across your organization and improving team productivity. It also allows you to search across all internal and external company content to find key insights, and the proprietary AI technology catches what other platforms miss in a secure and automated way.

Automated Monitoring

Instead of wasting hours manually monitoring, AlphaSense offers real-time alerts to keep users updated with trending topics, companies, and industries of interest. Users can also take snapshots of multiple companies frequently within the AlphaSense platform, staying in touch with the most critical insights, news, and market changes they need to know.

AlphaSense Pros:

- All-in-one research and intelligence platform

- Extensive content database that spans the four key perspectives of market research, including broker research and expert calls

- Incorporates AI search technology and sentiment analysis

- Industry-leading generative AI features like Generative Search and Smart Summaries

- Automated and customizable alerts

- User-friendly interface

- Internal messaging and collaboration features

- Support for APIs and integrations

AlphaSense Cons:

- Visualization tools are limited to financial data at this time

- Collaboration tools are limited to users with AlphaSense licenses

Symphony

Best for: Secure data sharing

Symphony is a different kind of solution than the rest on our list, built not for direct research but rather collaboration between financial services teams, clients, and organizations.

Still, its impressive communication features make it an indirect competitor for Bloomberg — a powerful tool for organizations that need to work securely online with clients, partners, and other industry counterparts.

Symphony’s features include:

- Direct chat

- Digital workspaces (“Rooms”)

- Live video conferencing

- Screen sharing

- Global user directory

- Tagging capabilities

Most importantly, every Symphony message is encrypted as soon as it’s sent, meaning users can communicate with confidence and never be constrained by geographic distance or security concerns.

Pricing is unavailable on Symphony’s website, but they do offer separate sales services for small firms vs. large institutions, suggesting that separate pricing options exist for both.

Symphony Pros:

- End-to-end encryption and adherence to security protocols for safe collaboration in industries like finance and law

- Specialized for financial services with tailored features and integrations

- Customizable workflows and options for app integrations

- Enables secure communication between users at different organizations

- Integrates with financial tools like Bloomberg, Refinitiv, and Salesforce

Symphony Cons:

- Serves limited use cases beyond financial services

- Some critical functionalities rely on third-party integrations

- Limited market penetration, relative to some competitors, leading to a smaller network

- Occasional lag in performance reported by users

- Limited customization for organizations needing highly bespoke solutions

YCharts

Best for: Creating compelling visuals

YCharts is an investment research platform originally built to make investing accessible for firm and individual investors alike. Its core features are its data visualization capabilities that make insights more compelling for analysts, investors, and other stakeholders, as well as its fund screener that allows you to filter mutual funds and ETFs by specific metrics.

While YCharts provides financial data, analytics, and visualization tools, it does not include premium or proprietary content sets that are necessary for full-scale market or investment research, such as company documents, news, expert call transcripts, and broker reports.

The YCharts solution is comprised of three main tools:

- Model Portfolios – Users can build and analyze portfolios using metrics visualizations, custom strategy comparison reports, and benchmark modeling. Pre-built customizable templates are also available and can fit with any model you create.

- Stock Screeners – Features 4000+ financial metrics users can filter to find stocks based on custom criteria and build custom analysis formulas

- Fundamental Charts – Charting tools that enable easy sharing of data visualizations, including the ability to embed them as images in other content (like blogs or emails)

YCharts offers a free 7-day trial and three pricing levels: Enterprise (for firms and advising teams), Professional (for individual investors and portfolio managers), and Standard (for students and beginner investors). Client-specific pricing for each level is available upon request from YCharts.

YCharts Pros:

- Powerful data visualization capabilities

- Comprehensive financial data

- Ability to build custom portfolios and proposals

- Collaboration and sharing tools

- Well-suited for wealth managers and advisors

- User-friendly interface

YCharts Cons:

- No access to premium content sets like company documents, expert calls, broker research, or news

- Limited coverage of companies and industries across markets

- No AI search technology or sentiment analysis

PitchBook

Best for: Private market financial data for deal sourcing, fundraising, and due diligence

PitchBook is a research and intelligent platform built for venture capital, private equity, and M&A investors. It provides financial data on public and private companies, deals made across public and private equity markets, investor track records, and specific funds.

PitchBook’s features not only provide data insights but powerful deal sourcing, business development, and networking capabilities for active investors and firms in the space. For firms or investors specializing in VC, PE, or M&A, PitchBook presents a more valuable alternative to Bloomberg in that it fits uniquely to their needs.

Specific PitchBook features include:

- Advanced search filters for deep insights on companies, deals, investors, debts, and lenders

- Emerging Spaces feature that introduces investors and financial experts to new and emerging spaces

- Integrations and APIs that allow users to import and export data to other applications

According to customer reports, PitchBook is priced at $25,000 per year for three users, plus $7000 for every additional user (per TrustRadius). For more current and specific numbers, as they pertain to your team size and needs, contact PitchBook directly.

Related Reading: PitchBook vs Crunchbase

PitchBook Pros:

- Provides access to a wide array of information, including company patents, financial analysis, information on former and current company investors, and more

- Advanced search filters available, though many users leverage simple search

- User-friendly interface

- You can create custom alerts and monitor your dashboard for news

- Supports integrations from third-party software; has Excel plug-in

PitchBook Cons:

- Much better suited to financial services; lacks key features for corporate users

- Lacks access to an expert call library

- Limited access to earning transcripts and no SEC or global filings

- No advanced AI search functionality or synonym recognition

- Sentiment analysis feature limited to stocks

- Users cannot upload internal content to the platform

- No broker research or aftermarket research. Equity research is available for an additional charge but is mostly for private companies

- Often receives criticism about data accuracy and recency

Morningstar Premium

Best for: Expert portfolio analysis

Morningstar Premium covers a wide range of financial solutions, but those most relevant to audiences similar to Bloomberg’s are Morningstar Direct (built for professional investors and firms) and Morningstar Investor (built for individual investors).

Both solutions provide premium quality data and exclusive insights directly from Morningstar experts. On the Direct solution, those insights come in the form of stock and portfolio research and ratings, while the Investor solution offers analysis that helps users make smart investment decisions. Morningstar does not provide access to premium, proprietary content sets that are necessary for holistic market or investment research, such as expert calls, company documents, or news. It also does not offer a robust suite of AI tools for enhanced research and analysis.

Notable features of the Morningstar platforms include:

Morningstar Direct:

- Analytics lab for investment analysis

- Pre-built Morningstar datasets

- Custom investment scorecards and risk scenario analysis

- Sustainability-focused ratings

Morningstar Investor:

- Simplified stock ratings

- Stock screeners and pre-filtered investment lists

- Morningstar® Portfolio X-Ray® for portfolio analysis

Morningstar Investor is $250 for an annual subscription. Morningstar Direct pricing is available by direct request only.

Morningstar Pros:

- Provides extensive research covering mutual funds, ETFs, stocks, and bonds

- Independent, unbiased, and trusted stock ratings

- Robust portfolio management tools

- Customizable filters and screens for investments

- Educational resources for improving investment knowledge

- Extensive coverage that includes global markets and diverse investment types

- User-friendly interface

Morningstar Cons:

- Lacks content sets necessary for full-scale market and investment research

- Limited AI capabilities

- Limited real-time updates

The Motley Fool

Best for: Investors and teams who want to learn while they invest

The Motley Fool’s investment research tool offers an exceptional range of features to meet the needs of both beginner and professional investors. Their mission — “to make the world smarter, happier, and richer” — is met by the many resources they provide in addition to their actual platform solution, including multiple podcasts, a blog, and discussion board.

The solution itself is comprehensive, with features built to inform investors while providing guidance around the right picks. Users get access to varying levels of expert advice depending on the subscription level they choose. Key features include:

- Stock recommendations and detailed analyses on selected stocks

- Personalized watchlists for monitoring stock performance

- Financial education content

- Community forums and discussion boards

- Real-time market analysis and news

- Premium in-depth reports on market trends, industries, and individual stocks

The main drawback of The Motley Fool as compared to Bloomberg is that it’s not built for doing independent research or larger market intelligence. But if you’re looking for ready-made expert insight or the ability to get granular about stock selection and analysis, this tool is a solid choice.

The Motley Fool Stock Advisor — their proprietary stock picking service and most popular tool — comes in at $199/year. For more comprehensive bundled services, users can choose The Epic Bundle (recommended for larger portfolios) which includes more frequent recommendations and closer advising services, or one of their other higher-priced bundles. For more details on pricing, contact The Motley Fool directly.

The Motley Fool Pros:

- High-quality educational resources for learning about investing and finance

- Reputable brand, known for its good track record in stock analysis and financial education

- Multiple subscription tiers to fit various needs and budgets

The Motley Fool Cons:

- Primarily focused on US markets with limited international coverage

- Mixed performance of stock recommendations

- Limited coverage of alternative assets

- Bias toward growth stocks

- No premium or proprietary content sets for market or investment research

- No advanced AI capabilities

Best Free Bloomberg Terminal Alternatives

Koyfin

Best for: Investors and analysts seeking advanced financial data visualization, on a budget

Koyfin is a solution built for investors at every experience level — professional, individual, and student. Known for its user-friendly features and in-depth qualitative data, the Koyfin platform makes investing more accessible without sacrificing the sophistication and accuracy needed by firms managing real client portfolios.

Here’s what Koyfin offers:

- A stock screener with 5900+ features for finding the right stocks

- Detailed and accessible company snapshots, financial statements, and valuation analysis

- Customizable dashboards for holistic snapshot views of trends

- Advanced graphic to create compelling visuals and customizable graphs

- Powerful visualization tools that provide a full picture of financial markets

Although not necessarily a drawback, Koyfin is more focused on managing investments than larger market research. If a market intelligence strategy is your goal, this tool may be too limited for you.

Koyfin comes at a much more affordable price than Bloomberg and many of the other tools on our list, starting with a free option that includes limited versions of the platform’s most important features.

Beyond that is the Basic option ($15/month) which adds Market News and Snapshots to the available features, Plus ($35/month) for more unlimited features and export options, and Pro ($70/month) which adds advanced search capabilities and priority support.

Koyfin Pros:

- Comprehensive data visualization

- User-friendly interface

- Free tier with robust tools and features

- Customizable dashboards

- Provides real-time updates on US stocks

- Features a powerful stock screener

Koyfin Cons:

- Limited historical data

- Lacks proprietary research

- Primarily focuses on US and select global markets; limited data on many regions outside US

- Technical indicators and charting capabilities are not as advanced as competitors’

- No integration with trading platforms

- Some advanced features and datasets are not available for the free tier

- Lacks features for team collaboration

Yahoo Finance

Best for: Casual investors looking for basic financial data and news

Yahoo Finance is a free offering from Yahoo, geared toward casual investors, retail investors, and market enthusiasts. This tool has everything individuals need to monitor their portfolios, stay updated on market news, and get smart quickly on financial and economic trends.

However, Yahoo Finance does not have any advanced analytical tools, nor does it offer the breadth and depth of datasets that are integral for institutional investors and enterprise organizations. Also, the platform offers limited data coverage for markets outside the US, making it unsuitable for global investment strategies.

Yahoo Finance offers the following features:

- Real-time stock data where users can track indices, stocks, ETFs, cryptocurrencies, and commodities

- Portfolio management, which allows users to create and track virtual portfolios

- Stock screener for filtering investments based on criteria like market cap, price-to-earnings ratio, and dividend yield

- Financial news and insights from various sources

- Company information like income statements, balance sheets, cash flow statements, and valuation ratios

Yahoo Finance operates on a freemium model, where the basic version of their platform is free and has ads, while the other pricing tiers offer additional features and no ads. The pricing tiers are as follows:

- Free – $0. Best for personalized market news, quotes, and alerts

- Bronze – $7.95/month. Best for monitoring 401Ks, IRAs, and other investment accounts

- Silver – $19.95/month. Best for fundamental investing in stocks, ETFs, and mutual funds

- Gold – $39.95/month. Best for active trading in stocks, options, crypto, and more

Yahoo Finance Pros:

- User-friendly interface

- Free access to most features, including portfolio management and stock quotes

- Covers a broad range of asset classes in its financial data

- Integrates relevant news with financial data, providing context for market movements

- User comments and discussions provide community aspect

Yahoo Finance Cons:

- Limited depth of data; does not offer premium datasets beyond basic financial data that are necessary for full-scale market and investment research

- Limited analytical tools

- Lack of customization for dashboards and screening tools

- Lacks proprietary research necessary for professional investors

- Free version is cluttered with ads and promotions

- Limited data coverage for non-US markets

- Lacks integration with advanced financial modeling software or trading platforms

Google Finance

Best for: Users looking for quick and easy access to real-time market data

A free platform created by Google, this is a great option for individual investors and casual users who are looking for basic financial information and market data. Google Finance is not suitable for institutional investors or enterprise organizations due to its limitations in features and data.

Google Finance offers the following features:

- Stock quotes for US and international markets

- Interactive charts with historical data spanning up to five years

- Portfolio tracking

- News integration from various reputable sources

- Basic screening tools

- Integration with Google ecosystem

Google Finance does not offer access to premium or proprietary content sets that are integral for full-scale investment research, such as broker research and expert calls. It also does not offer advanced analytics, risk management tools, or scenario modeling, which are essential for institutional decision-making. Google Finance is an entirely free tool.

Google Finance Pros:

- Free and accessible to anyone

- Covers stocks from major exchanges around the world, with some limitations in detail

- Comprehensive news aggregation

- Seamless integration with Google ecosystem

- No subscription or lengthy sign-up process required

Google Finance Cons:

- Lack of advanced tools and analytics

- Limited data coverage globally and no support for alternative asset classes like derivatives, fixed income, or private equity

- No real-time data updates

- No collaboration features

- Minimal customization for reports, screens, or data visualization

- No integration with professional tools like trading platforms or financial modeling software

TradingView

Best for: Traders interested in advanced charting and a trading community

TradingView is a popular online platform for traders, investors, and financial enthusiasts, used to analyze financial markets, create charts, and access real-time data. Though TradingView can be used by institutional investors, it’s not tailored specifically for their needs.

The platform is not sufficient for conducting deep fundamental research, and it lacks certain tools like risk management dashboards, portfolio analytics, and compliance features that are standard in institutional platforms. Additionally, the platform offers no premium or proprietary content sets that are necessary for full-scale market and investment research, such as expert calls, broker research, and company documents.

Main features of TradingView include:

- Advanced charting tools with customization options and the ability to overlay multiple assets for comparison

- Real-time market data from a variety of markets, including stocks, cryptocurrencies, indices, and commodities

- Social network and community discussion for sharing trade ideas and market analyses

- Custom alerts and notifications

- Supports direct integration with several brokers, enabling users to execute trades without leaving the TradingView interface

TradingView offers several pricing tiers to suit different needs:

- Basic – $0. Ads, limited real-time data, chart layouts, and indicators

- Essential – $14.95/month. Best for casual traders seeking enhanced functionality without a significant investment

- Plus – $29.95/month. Best for intermediate traders needing more advanced tools and flexibility

- Premium – $59.95/month. Best for professional traders needing the most advanced tools and extensive data

TradingView also typically offers a 30 day free trial for its paid plans.

TradingView Pros:

- Advanced charting tools

- User-friendly interface

- Global market access (though limited for free tier users)

- Community and social network for discussion and idea sharing

- Real-time alerts

- Cross-platform availability

TradingView Cons:

- Access to real-time data for certain exchanges is limited to paid tiers

- Limited fundamental analysis

- Advanced features are only available for higher-tier plans

- No premium or proprietary content sets

FinViz

Best for: Traders and investors seeking robust stock screening and market visualization tools

FinViz is a popular online platform designed for traders and investors to perform stock market research and analysis. Best suited for beginners and retail traders, this platform does not have the premium, proprietary datasets needed for full-scale investment research, nor the advanced analytical tools that are necessary for institutional investors.

FinViz features include:

- Stock screener with customizable filters

- Interactive charts and heatmaps for deep analysis

- News integration from sources like Bloomberg, Reuters, and CNBC

- Portfolio tracking with real-time price updates and performance metrics

FinViz offers several pricing tiers:

- Free Plan – Ads, limited customization options; no access to real-time data or advanced charting tools

- Registered Plan – $0. Limited portfolio tracking options; no access to advanced features like real-time data or backtesting

- FinViz Elite – $39.50/month. No ads, advanced charting capabilities, real-time stock quotes

FinViz Pros:

- User-friendly interface

- Powerful stock screener and comprehensive heatmaps

- Aggregates news from reputable sources

- Provides a variety of technical charting tools (some are limited to paid tiers)

FinViz Cons:

- Real-time data only available for paid tiers

- Does not allow direct trading or integration with brokers

- Ads on Free and Registered plans

- Mostly focused on US markets, with limited coverage in international markets

- Real-time alerts and notifications only available for paid tiers

- Limited tools for fundamental analysis

OpenBB Terminal

Best for: Retail investors and quant traders looking for an AI-powered open-source solution

OpenBB Terminal is an open-source investment research platform that provides advanced financial data and analysis tools. The platform is highly customizable and integrates with a variety of other tools for added functionality. Though it provides some institutional-grade tools, OpenBB Terminal is primarily designed for retail and individual investors.

The platform lacks premium and proprietary content sets necessary for full-scale investment research, and the data they do provide is not always real-time or as comprehensive as institutional investing platforms like Bloomberg.

OpenBB Terminal features include:

- Wide range of financial data sourced from other platforms and sources

- Advanced charting and technical analysis

- Integrates with alternative data for more holistic investment analysis

- Customizable screening tools

- AI tools like NLP, sentiment analysis, predictive analytics, pattern recognition, and recommendations that enhance financial analysis and decision-making

- Backtesting and quantitative analysis tools

- Real-time financial news and sentiment analysis for assessing market trends

- Integration with external tools

Since OpenBB is an open-source platform, it is entirely free. The only costs incurred would come from integrating premium third-party data sources or running the software on specific cloud-based infrastructure.

OpenBB Terminal Pros:

- Completely free and open-source

- Extensive data coverage, sourced from reputable providers

- Advanced charting and technical analysis capabilities

- Includes multiple features for quantitative traders

- Integrates with external tools

- AI capabilities for deeper financial analysis

OpenBB Terminal Cons:

- Limited real-time data

- Dependence on external data sources; no data native to the platform

- Updates and new features depend on community contributions, leading to inconsistent quality and longer development cycles

- Minimal support for non-financial markets

- Lack of institutional features