Overview

CB Insights

CB Insights is a market intelligence platform that provides technology insights and analysis on private companies, venture capital, angel investments, and mergers and acquisitions.

With their business information database, users can track private companies, investors, and industries based on their use of technology.

CB Insights also uses machine learning and data analysis to provide users with information on emerging industries, market trends, and investment opportunities. Through its platform, you can find:

- Emerging and trending tech companies

- A mosaic score that predicts the success or failure of a company

- In-depth data and analytics on a company

Moreover, CB Insights offers data that informs users on company financing, business relationships, proprietary company data, earnings transcripts, patent analytics and more. This data is primarily acquired through machine learning and analyst briefings.

CB Insights also provides up-to-date research that helps users understand competitor strategy, keep up with future trends, and make better investment decisions.

CB Insights Pros

- Great platform for finding new opportunities in the tech space

- Provides information for hard-to-access private companies

- Has access to in-depth data and research analytics

- Supports APIs and integrations with other apps

- Uses machine learning and analyst briefings to collect data on companies

CB Insights Cons

- Focuses primarily on private tech companies with no focus on public companies unless concerning their interactions with startups

- No access to global/SEC filings, ESG reports, newspapers, trade journals, expert calls, or broker research

- No generative AI capabilities

- No image search

- No smart synonym search functionality

- Pricing locks users to a team of five members with no flexibility for smaller teams

- Ideal only for niche tech-related use cases

- Not suitable for small-scale firms

If you’re looking for a more holistic market approach, CB Insights may not be the most ideal tool for your needs. Below are several alternatives you may explore.

AlphaSense

AlphaSense is an all-in-one market intelligence platform for organizations and professionals looking for a full-scale research solution with AI search technology and automation.

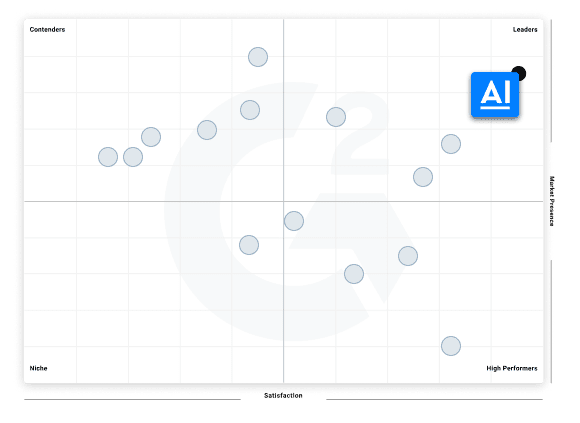

AlphaSense is consistently ranked as an industry leader by TrustRadius and G2, and was recently named the leader in G2’s Winter 2023 Grid Report for Financial Research, beating out all competitors in this category.

Unlike CB Insights, which focuses solely on tech companies, AlphaSense gives users 360 degree market coverage across all industries, from life sciences and industrials to consumer products and technology. The AlphaSense user base encompasses users from both the corporate world and financial services.

AlphaSense’s extensive content universe provides access to 10,000+ sources of private, public, premium, and proprietary content—indexed, searchable, and all in one place. That content is organized by the four key perspectives for full-scale research:

- Journalist – Content published in major news outlets, government and trade journals, and NGO publications.

- Expert – Expert Insights is a proprietary expert transcript library available to all AlphaSense Users as an add-on product and includes 40,000+ interviews by buy-side analysts with validated industry experts who have direct operational experience.

- Company – These are documents published by public and private companies. They include SEC filings, company filings, presentations, transcripts, earnings reports, and ESG reports.

- Analyst – Our equity research content library Wall Street Insights® covers global sector themes, industries, and companies from over 1,000 independent and sell-side firms.

Product Features

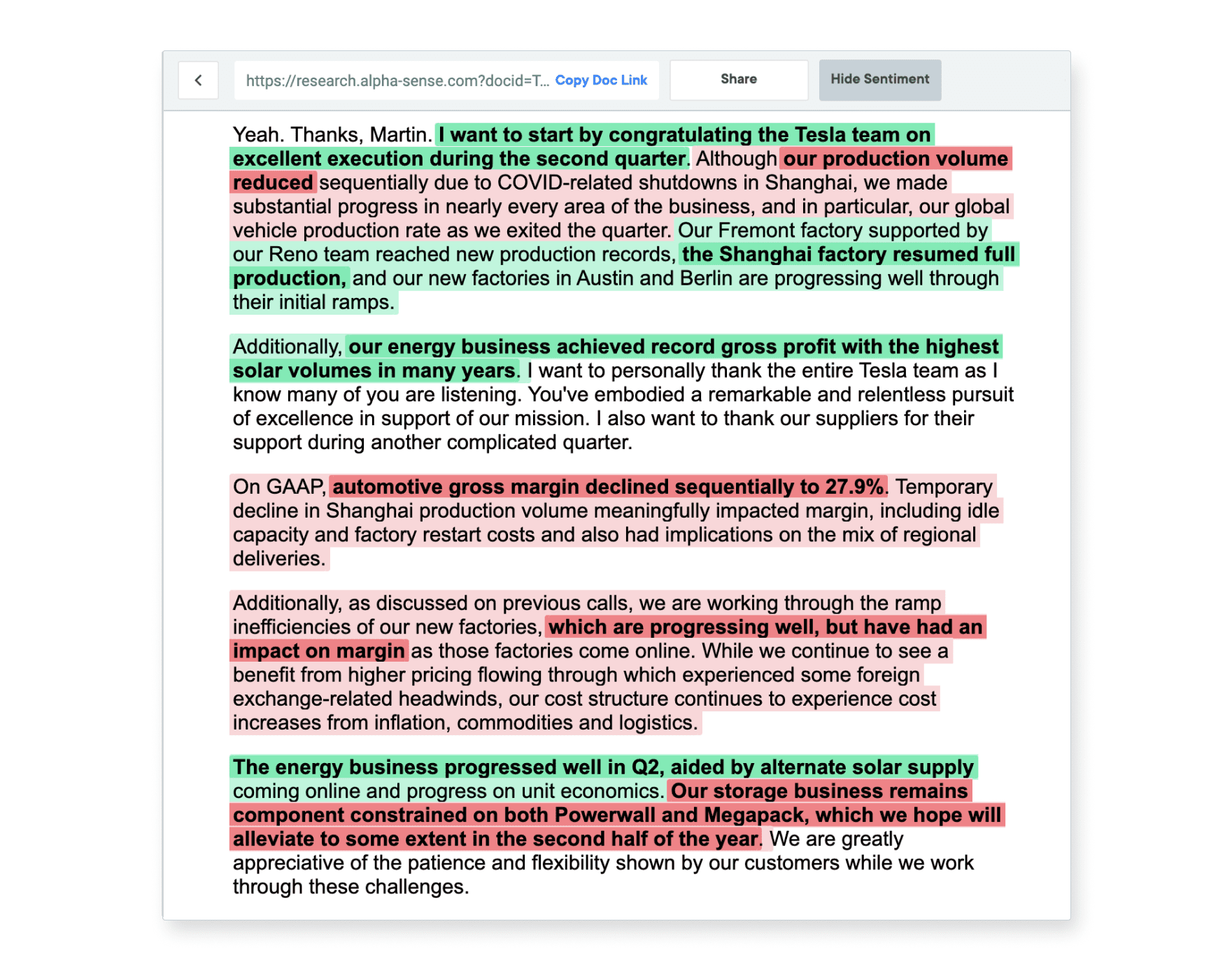

Sentiment Analysis

Powered by Natural Language Processing (NLP), sentiment analysis identifies shifts in a text’s tone and subjective meaning. It also helps readers identify a document’s positive, neutral, or negative sentiments using color coding. Users can take advantage of this feature to read between the lines in their research and make better informed investment decisions. Users can also track changes in sentiment over time, resulting in a more in-depth understanding of a company or industry.

Expert Insights

Expert Insights is an add-on content set on the AlphaSense platform. Expert Insights aggregates research and experience directly from former employees, channel partners, customers, and competitors talking about a company. These 40,000+ transcripts offer powerful insight into company/competitor dynamics, reactions to service/product updates, and competitive perspectives on the market landscape.

Expert Insights is also equipped with the same sentiment analysis technology, allowing you to quickly pick up on nuances beyond surface commentary, leading to better risk management strategies and more confident decision making.

Smart Synonyms™

AlphaSense also features Smart Synonyms™ technology. This feature is a patented AI search innovation that identifies the search intent behind queries and surfaces keywords that are truly relevant to your search goals.

Smart Synonyms™ identifies phrases and keywords that are meaningfully related (for example, “ESG investing” and “impact investing”) to provide relevant and useful data for your search query and make sure you don’t miss any crucial information.

Smart Synonyms™ make it easy to find the resources and documents with the keywords that meet your search intentions, cutting the energy and time spent on research—freeing up your time for more high-level analysis and management tasks.

Generative AI

Unlike other consumer-grade generative AI (genAI) tools trained on publicly available data, AlphaSense takes an entirely different approach. Our industry-leading suite of generative AI tools is purpose-built to deliver business-grade insights and leans on 10+ years of AI tech development. Our proprietary AlphaSense Large Language Model (ASLLM)—trained specifically on business and financial data—matches or beats the leading third-party LLMs over 90% of the time.

Our suite of tools currently includes:

- Smart Summaries – this feature allows you to glean instant earnings insights—reducing time spent on research during earnings season, quickly capture company outlook, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees

- Enterprise Intelligence – a first-of-its-kind offering that delivers AlphaSense’s AI-powered search and summarization capabilities to customers’ internal organizational knowledge.

- AlphaSense Assistant – a generative AI chat experience that transforms how users can extract insights from hundreds of millions of premium content sources

APIs and Integrations

You can also take the AlphaSense experience into other parts of your strategy with our API capabilities. These allow you to build your own tools to get maximum ROI from the content sources you can now access.

Some examples include:

- Search API: Provides real-time access to AlphaSense search infrastructure to query and filter the document database from a third-party domain.

- Alert Feed API: Presents a live data feed based on saved searches & alerts.

- AI API: Enriches your experience by enabling company recognition, sentiment, themes, and KPI services for internal content.

- Ingestion API: Provides integration, processing, and enrichment capabilities for internal or custom content sets.

Exceptional User Experience

AlphaSense is built to fit into a modern professional’s processes and workflow seamlessly. In addition to an intuitive user-friendly interface to display data and information, it allows professionals to export crucial data to their mobile devices or PCs.

AlphaSense also boasts exceptional customer service. Multiple product specialists are on call 24/7 to assist with putting together searches, which users find helpful in streamlining workflows.

AlphaSense Pros

- Extensive access to a content universe with over 10,000 premium resources

- Access to the four key perspectives of market research all in one place

- Incorporates AI search technology, machine learning, and sentiment analysis

- User-friendly interface and exceptional 24/7 customer service

- Generative AI capabilities and image search

- Support for Integrations and APIs that enable better collaboration and productivity across teams

- Supports enterprise-level organizations and teams

AlphaSense Cons

- Visualization tools are limited to financial data at this time

- Collaboration tools are limited to users with AlphaSense licenses

PitchBook

PitchBook is a world-renowned private equity, venture capital, and M&A database with an extensive client base of over 70,000 individual users.

The platform is best known for its private market database, as well as its reporting and data visualization features, which are primarily utilized by sales, investment, and finance professionals. PitchBook provides game-changing insights on over 3.5 million private and public companies worldwide, including their financial histories, valuations, executives, and investors.

PitchBook provides valuable business intelligence, and its platform maintains a continuously expanding database of resources and records from over 1.9 million business deals worldwide, involving more than 450,000 investors and 110,000 funds.

If you’re deal sourcing, looking for venture capital, private market intelligence, and performing due diligence on startups or other businesses, PitchBook can be an ideal platform.

PitchBook also has information that facilitates networking, fundraising, benchmarking competitors, and allocating different asset classes across investment portfolios. While PitchBook offers numerous advantages, it also has some drawbacks, which we will explore below.

Related Reading: AlphaSense vs. PitchBook

PitchBook Pros

- PitchBook offers a broad range of information, including company patents, financial analysis, data on current and previous company investors, and more.

- It has advanced search filters that give investors deep insights into companies.

- Its proprietary “Emerging spaces” feature caters to investors seeking to capitalize on new and alternative markets.

- PitchBook is customizable; users can create custom alerts and monitor their dashboard for news updates.

- PitchBook supports integrations with third-party applications, allowing for further customization and convenience.

PitchBook Cons

- No expert call library

- No AI search functionality or sentiment analysis features

- No SEC and global filings and limited access to earning transcripts.

- No portal for users to upload internal content

- Lacks access to broker research and trade journals

Related Reading: Top 5 PitchBook Alternatives & Competitors

Crunchbase

Crunchbase is a sales intelligence platform used by over 75 million people worldwide. Crunchbase sources data from its investor network, contributor community, and company self-submissions.

It is a popular tool for identifying key contacts within startups, prospecting for new business opportunities, deal sourcing, and outreach. Although users can easily integrate Crunchbase with most sales tools, it has limited market intelligence compared to CB Insights and many of its competitors.

Additionally, Crunchbase lacks advanced search capabilities such as synonym recognition, and its resource base does not have expert calls, earnings transcripts, or brokerage reports. It also has issues with duplicate entries and outdated information on its platform.

While Crunchbase can provide company overviews and organization charts, it is best suited for salespeople, entrepreneurs, investors, and market researchers looking to prospect for new business opportunities. However, it may fall short for enterprise users or those seeking in-depth research on markets and companies.

Related Reading: Crunchbase vs. PitchBook

Crunchbase Pros

- Provides valuable data for sales prospecting

- Ability to easily export the data

- Ability to filter by several categories including stage and location

Crunchbase Cons

- Recurring issues with data accuracy and recency

- Database is not comprehensive, even for private companies

- No advanced search capabilities such as synonym recognition

- Lack of additional content sources like expert calls, earnings transcripts, or brokerage reports

FactSet

FactSet has been providing financial research tools for a massive buy and sell-side user base since the 1970s. Its tools are in use in more than 7,000 financial services firms, and it has over 180,000 individual subscribers.

FactSet is a reliable resource platform for asset managers, traders, investment bankers, and investors worldwide. One of its most remarkable features is the massive data library with over 30 different datasets, including 24 proprietary ones, which makes it ideal for:

- Quantitative research

- ESG investing

- Investment research

- Portfolio analysis

- Data solutions

- Professional services.

However, in terms of qualitative analysis, FactSet lags behind many of its competitors. FactSet does not have an expert call transcript library, and its broker research offering is much more limited than its competitors’. Despite these drawbacks, FactSet has a loyal customer base, due to its excellent customer support and user experience.

FactSet Pros

- Focus on financial industry research

- Focus on quantitative data and workflows

- Availability of structured data sets

- Advanced data visualization capabilities

- Excellent customer service and user experience

FactSet Cons

- Limited qualitative data sets, with limited equity research and no expert calls

- Notoriously slow speed

- No advanced search capabilities, such as synonym recognition

Semrush

Semrush is a popular marketing SaaS platform with over 14 years of market experience and 10 million users. Its client base includes digital marketing professionals, SEOs, PPC advertisers, content marketers, social media marketers, PR professionals, and anyone else looking to gain insight into a company’s online visibility.

Semrush helps users discover new organic and paid search opportunities, track keyword rankings, conduct a backlink and competitor analysis, and analyze competitor ad strategies.

Semrush features include:

- Domain Analytics to analyze websites and assess their search engine visibility, traffic, top organic keywords, and more.

- Keyword Research for insights into what keywords a website ranks for and suggestions for new keywords to target.

- Site Audit feature to analyze a website’s technical SEO performance and identify any issues that could impact its SERP rankings.

- Backlink Analysis to allow users to see who is linking to their website and identify potential link-building opportunities.

- Advertising Research to analyze competitor advertising strategies, including ad copy, landing pages, and keywords.

- Social Media Management tools for users to schedule posts, monitor their social media accounts, and track their performance.

- Content Marketing tools, including a content analyzer that can help users optimize their content for search engines and identify new content ideas.

Unlike the other tools listed, Semrush is geared toward digital marketing and SEO research. That makes it a less ideal option for sell or buy-side traders looking for actionable information on private or public companies. Moreover, Semrush lacks the content sets necessary for holistic market research—company documents, news, broker research, and expert calls—though it does have sentiment analysis in its media monitoring.

Semrush Pros

- Ideal tool for SEO research and website optimization, particularly for individual users

- Largest keyword and backlink databases on the market

- Uses sentiment analysis in its media monitoring

Semrush Cons

- Certain competitive intelligence features can only be unlocked with a steep monthly add-on fee

- No access to content sets necessary for market intelligence, such as company documents, news, broker research, and expert calls

- Not suitable for financial services or corporate professionals looking for advanced market insights to drive business strategy and decision-making

How to Choose an Alternative to CB Insights

With CB Insights, you can access market intelligence for most private tech companies. While it may meet some expectations and be the perfect tool for certain organizations and individuals, it certainly won’t work for everyone. When assessing potential alternatives, consider the following benchmarks:

- Pricing: Consider what it may cost to replace CB Insights with your preferred alternative. Ensure you choose a platform that gives you the most value for your budget. Also, choose a platform that offers flexible plans based on your needed platform seats.

- Data coverage: CB Insights offers multiple data points on tech companies, including venture capital, financing, valuations, and proprietary data. Ensure your chosen alternative can access similar metrics or offers deeper data coverage.

- Additional features: Can your alternative give you more value for your purchase than what CB Insights offers? Ensure your chosen alternative offers extra features that make a difference, like ESG reports, broker research, and smart AI search capabilities.