Overview

PitchBook

Founded in 2007, PitchBook is an award-winning private equity, venture capital, and M&A database with over 70,000 individual users across its client base. It is most known for its private market database, as well as its reporting and data visualization features that are primarily used by finance, investment, and sales professionals. The platform contains profound insights into over 3.5 million private and public companies worldwide, with access to their financial histories, valuations, executives, and investors.

PitchBook also maintains an ever-expanding set of facts and records from over 1.9 million business deals worldwide, involving more than 450,000 investors and 110,000 funds.

PitchBook is a valuable platform if you’re looking for business intelligence, venture capital, deal sourcing, private market intelligence, or performing due diligence on startups and other businesses. It’s also an ideal platform for networking, fundraising, benchmarking competitors, and allocating different asset classes across your investment portfolio.

Like all market intelligence platforms, PitchBook has its benefits and drawbacks. Let’s explore them below:

PitchBook Pros:

- Provides access to a wide array of information, including company patents, financial analysis, information on former and current company investors and more

- Advanced search filters help investors access deep insights into companies

- Emerging spaces for investors looking to capitalize on new and alternative markets

- You can create custom alerts and monitor your dashboard for news

- Supports integrations from third-party software

PitchBook Cons:

- Lacks access to an expert call library

- Limited access to earning transcripts, and no SEC and global filings

- No access to advanced AI search functionality or sentiment analysis

- Users cannot upload internal content to the platform

- Lacks trade journals and access to broker research

Related Reading: PitchBook vs CB Insights

AlphaSense

Best for: Conducting comprehensive competitive research and analysis with advanced AI features for added speed, accuracy, and scope—all in one place

AlphaSense is a leading all-in-one market intelligence platform and smart search engine. It’s the ideal tool for research and business professionals—from analysts and financial researchers to corporate professionals—looking to implement a qualitative research strategy powered by proprietary AI technology and automation.

AlphaSense users include 80% of the top consultancies, 85% of the S&P 100, 75% of the top asset management firms, and 20 of the largest pharmaceutical companies.

AlphaSense is also consistently ranked as an industry leader on TrustRadius and G2, and it was recently recognized by Forbes as one of the top AI companies in 2023.

In order to help users get a complete picture of the market, AlphaSense’s extensive content universe provides access to over 10,000 sources of private, public, premium, and proprietary content—indexed, searchable, and all in one place.

This content is organized by the four key perspectives of market research:

- Expert – 40,000+ interviews conducted by experienced buy-side analysts with pre-vetted industry experts with direct operator experience. With AlphaSense Expert Insights, you can conduct your own 1:1 calls for less.

- Analyst – Equity research published by financial analysts from leading Wall Street firms, focusing on national and global issues. AlphaSense offers a library of equity research specifically for corporate clients, which is called Wall Street Insights®, as well as a library of aftermarket and real-time research for financial services client.

- Company – Documents published by public and private companies, including SEC and company filings, earnings reports, presentations, transcripts, and ESG reports

- Journalist – Content published in major news networks, trade journals, and government and NGO publications

Alongside this vast content universe is AlphaSense’s smart search and AI capabilities, which speed up research and cut a user’s time to insight, making the research process more proactive, efficient, and accurate.

This platform serves various needs for all its corporate clients, including corporate development, competitive intelligence, strategy, and market landscaping. Beyond that, IR and financial professionals use AlphaSense for, due diligence, messaging research, market monitoring, and deal sourcing.

Other unique features within the AlphaSense platform designed to enhance your research process include:

Smart Synonyms™

Smart Synonyms™ is a proprietary feature that uses AI technology to understand your search intent and deliver results relevant to your initial query, as well as all relevant synonyms.

This feature uses advanced algorithms to eliminate noise from your search by cutting out irrelevant content that includes any matching keywords with unrelated search objectives. This leads to less information overload and saves valuable time for other business-critical strategy and analysis tasks.

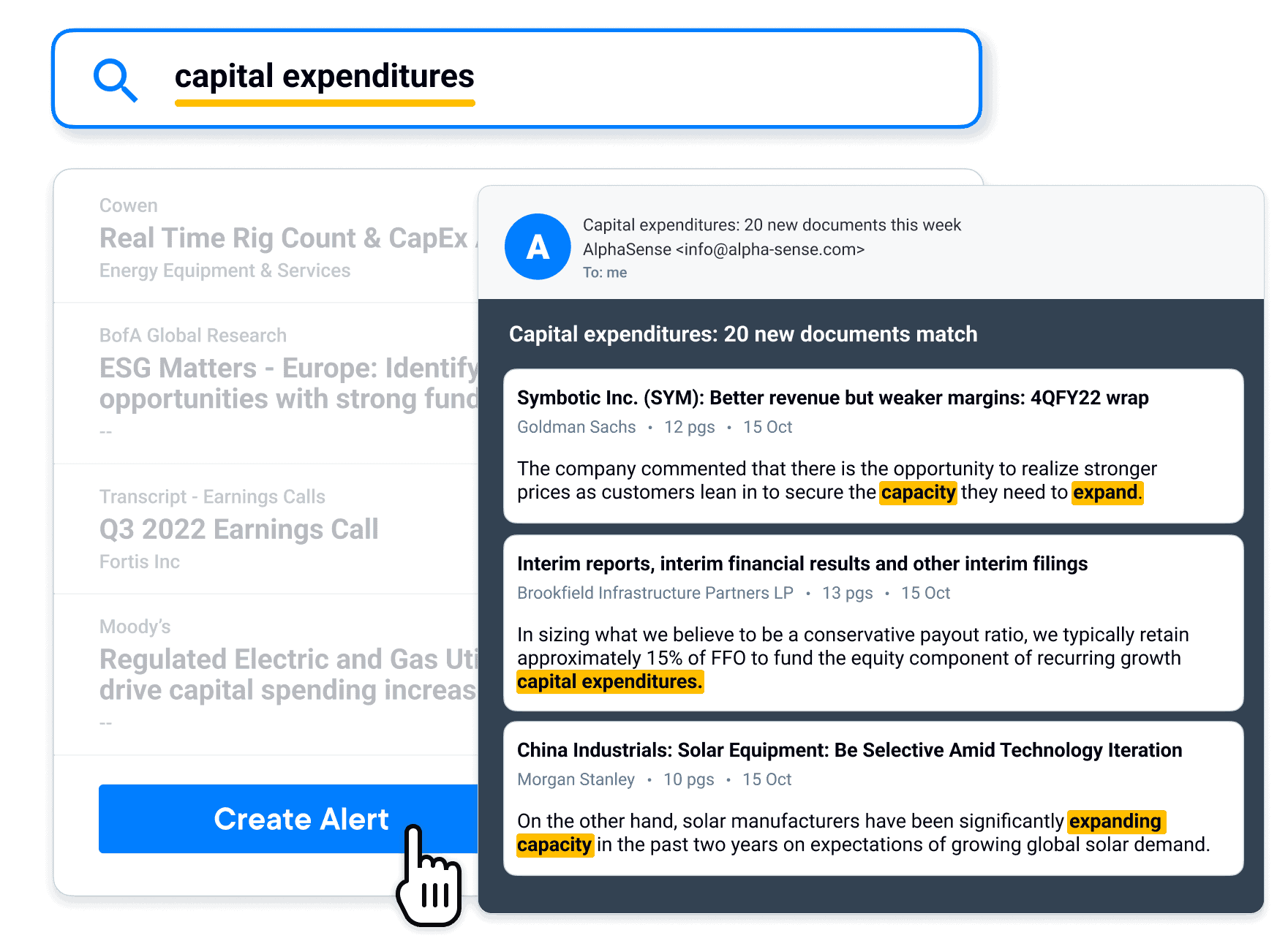

Automated Monitoring

AlphaSense helps you stay updated on any trend, breaking news, or other relevant updates through real-time alerts. These customizable alerts automatically notify you about any news, market movements, emerging trends, industries, key topics and competitor companies of interest. Additionally, AlphaSense generates and sends frequent snapshots of companies, keeping users abreast of intelligence, critical insights, and market changes.

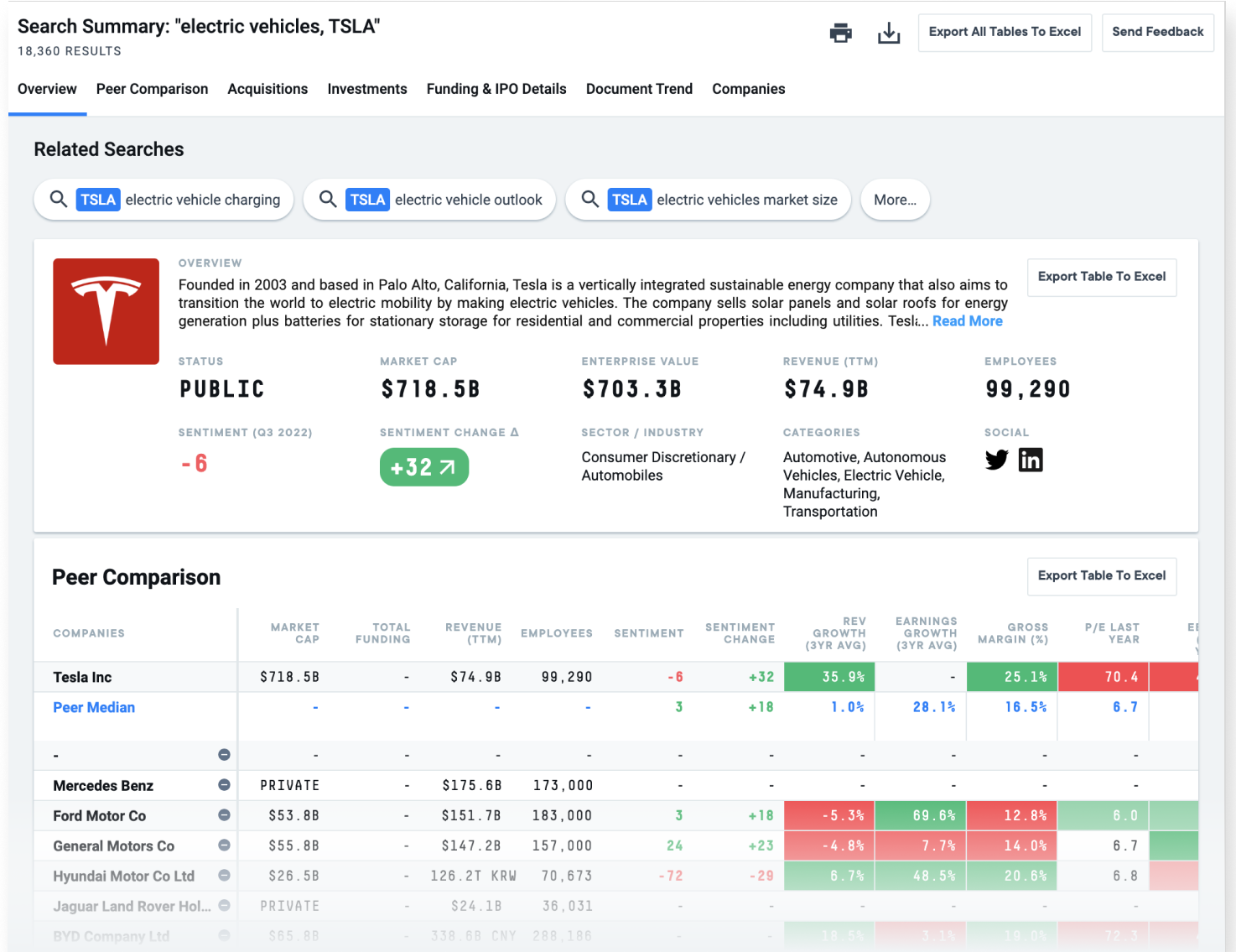

Instant Company Insights

AlphaSense offers Search Analytics and Company Tearsheets to help you keep tabs on specific companies. These tearsheets provide updates on any companies currently on your radar, while delivering deep and wide reach across countries, regions, document types, industries, and more.

Instant company insights can also help you focus your research on a particular competitor, discovering critical insights that can push your competitive advantage to the next level.

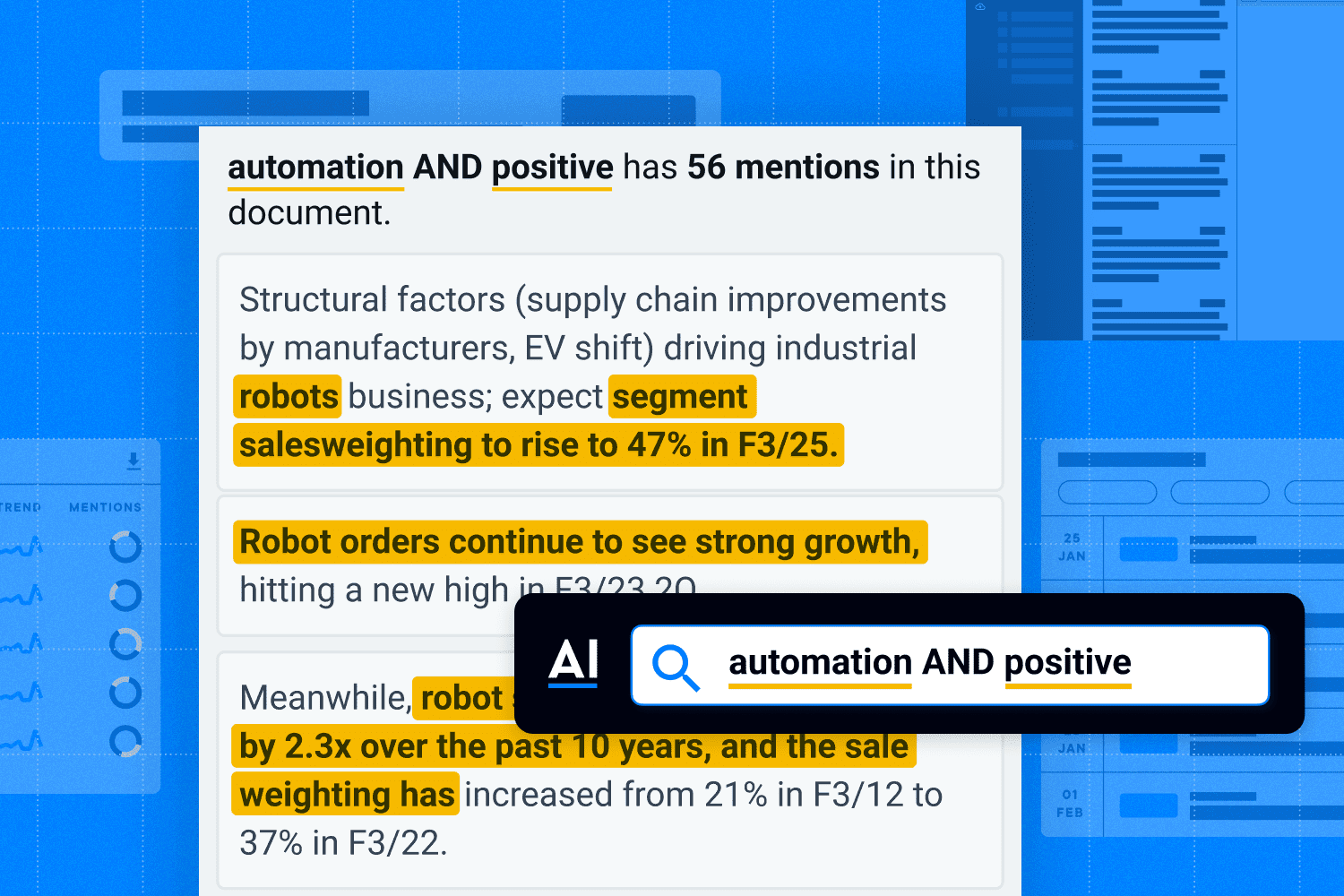

Sentiment Analysis

Sentiment analysis is a natural language processing (NLP)-based feature that mines content and identifies the sentiment behind the language in earnings and expert calls. The text is then color-coded for users to indicate positive, neutral, and negative sentiments.

AlphaSense also gives each search term and document a sentiment score, illustrating how positively or negatively a company or the market at large feels about a particular topic, as well as how sentiment has evolved over time. Sentiment analysis enables users to pick up on subtle shifts in tone that could signal upcoming market movements and gain a deeper understanding of an industry or trend.

Smart Summaries

Unlike other generative AI (genAI) tools that are consumer-grade and trained on publicly available content across the web, AlphaSense takes an entirely different approach. As a platform purpose-built to drive the world’s biggest business and financial decisions, our newest Smart Summaries feature leverages our 10+ years of AI tech development and draws from a curated collection of high-quality business content.

With Smart Summaries, you can glean instant earnings insights—reducing time spent on research during earnings season, quickly capture company outlook, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees.

AlphaSense Pros:

- All-in-one research and intelligence platform

- Extensive content database that spans the four key perspectives of market research, including broker research and expert calls

- Incorporates sentiment analysis, NLP, generative AI, and AI search technology

- Smart Summaries generative AI feature for earnings and image search

- Automated and customizable alerts

- User-friendly interface

- Internal messaging and collaboration features

- Support for APIs and integrations

AlphaSense Cons:

- Visualization tools are limited to financial data at this time

- Collaboration tools are limited to users with AlphaSense licenses

Related Reading: AlphaSense vs PitchBook

Bloomberg Terminal

Best for: Qualitative research for hedge funds and institutional investors

Bloomberg Terminal is an excellent alternative to PitchBook, especially for qualitative research. It’s a pioneer in the financial market data space as it was one of the first software solutions launched before computers and the internet were common in business.

For investment banks, asset managers, traders and hedge fund managers worldwide, Bloomberg Terminal is a reliable source of :

- Proprietary research and analytics from internal and external sources

- Collaboration opportunities with over 325,000 experts and decision makers.

- Market execution and order management tools.

- Pre and post-trade analyses

- Access to capital markets

- Custom charts, monitors and alerts for market information

Much like PitchBook, Bloomberg Terminal is a costly solution that charges about $2,000 a month or $24,000 annually, way beyond the budget of most small and medium-sized businesses. Moreover, it has a steep learning curve with a more complex and clunky user interface geared toward financial service users.

Bloomberg Pros:

- Proprietary news, research and analytics from internal and external sources

- Tools for internal collaboration opportunities

- Market execution and order management tools

- Access to stock markets and other asset classes

- Custom charts, monitors, and alerts for market information

Bloomberg Cons:

- An expensive option, costing about $2,000 a month

- A steep learning curve for new users

- No sentiment analysis or synonym recognition

- No proprietary expert calls and transcripts (but do offer access to GLG Expert Transcripts and Insights)

- Lack of broker research access for corporates

Related Reading: Bloomberg Terminal Alternatives

Factset

Best for: Business insights for asset managers, traders, investment bankers, and investors worldwide

Factset is one of the most long-standing financial research tools in the market today, as it has been in operation since the 1970s. Therefore, it also has a massive buy and sell-side user base, with over 7000 firms and 180,000 individual subscribers. It is a reliable platform for investors, asset managers, traders and investment bankers worldwide.

One of its most outstanding features as a PitchBook competitor is a massive data library with over 30 different datasets. Of these, 24 are proprietary. It’s an ideal platform for:

- Investment research

- Portfolio analysis

- Data solution

- Professional services

- Quantitative research

- ESG investing

Although Factset has one of the world’s most remarkable customer support and experience, it still lags behind some competitors, especially with qualitative analysis. Moreover, it does not encompass other forms of research, like broker analysis and expert calls.

Factset Pros:

- Focus on financial industry research

- Focus on quantitative data and workflows

- Availability of structured data sets

- Advanced data visualization capabilities

- Excellent customer service and user experience

Factset Cons:

- Limited qualitative data sets, with limited equity research and no expert calls

- Notoriously slow speed

- No advanced search capabilities, such as synonym recognition

Crunchbase

Best for: Identifying decision-makers and key contacts for outbound sales, sourcing deals, and overall business outreach

Crunchbase is a sales intelligence platform with over 75 million users, free and paid accounts combined. Holding data sourced from their investor network, contributor community, and company self-submissions, Crunchbase is a popular option for:

- Identifying key contacts within companies, particularly within the startup ecosystem

- Prospecting for new business opportunities, particularly for individual consumers or small businesses

- Outreach and deal sourcing

While users appreciate that the platform easily integrates with most sales tools like CRMs and outreach platforms, the market intelligence scope and depth is much more limited than with most competitors.

Additionally, Crunchbase lacks advanced search capabilities, such as synonym recognition, and their data sets do not include expert calls, earnings transcripts, or brokerage reports. Duplicate entries and outdated information have also been ongoing issues, even for company overviews and organization charts that Crunchbase is known for.

Overall, Crunchbase works well for individual consumers or small businesses—salespeople, entrepreneurs, investors, and market researchers use it to prospect for new business opportunities—but it falls short for enterprise users and individual users looking to research markets and companies more deeply.

Crunchbase Pros

- Provides valuable data for sales prospecting

- Ability to easily export the data

- Ability to filter by several categories including stage and location

Crunchbase Cons

- Recurring issues with data accuracy and recency

- Database is not comprehensive, even for private companies

- No advanced search capabilities such as synonym recognition

- Lack of additional content sources like expert calls, earnings transcripts, or brokerage reports

Related Reading: PitchBook vs Crunchbase

How to Choose an Alternative to PitchBook

PitchBook is a comprehensive solution for most market intelligence. While it may meet some expectations, it has its shortcomings. If you’re looking for an alternative consider these features:

- Pricing: PitchBook is an expensive solution for many businesses, so consider your budget when choosing an alternative. Choose a platform with a pricing plan that falls within your budget limits or offers flexible subscriptions.

- User interface and user experience: PitchBook offers an intuitive customer experience, compared to many competitors. Ensure you opt for a navigable platform with a user-friendly interface that can filter and customize data.

- Data coverage: PitchBook offers plenty of data points on various markets, including private equity, venture capital, and M&A. But with no broker research or expert calls, as well as limited access to company documents, the coverage is much less broad than a platform like AlphaSense provides. Ensure your chosen alternative has access to markets you’re interested in and has comprehensive data coverage in those areas.

- Data quality: Find a platform with accurate, up-to-date, and reliable data. User reviews and ratings will help you make better decisions here.

- Additional features: Make sure to opt for a platform that offers extra features that make a difference, such as analytics, news, broker research reports, expert calls, generative AI, and smart search functionality. Value-added services like these can help you make more informed investment decisions.