Market intelligence helps businesses, firms, entrepreneurs, and professionals make confident, more informed decisions. From identifying opportunities in the market and mitigating risk to keeping tabs on competitors and how they respond to market changes on the micro and micro level, market intelligence research is the backbone of any sound business strategy.

However, most modern research professionals are constantly inundated with information overload. It is no longer enough to simply be aware of market-moving events—you must be able to separate the signal from the noise so you can extract critical insights from the data at hand.

That’s why more and more professionals and businesses are incorporating market intelligence platforms into their research workflows. Beyond aggregating data, these platforms use artificial intelligence (AI) and automation to enable quick surfacing of relevant insights, enabling users to spend more time on higher-value tasks like analysis and strategy, and increasing the efficiency of market research.

What’s the Best Market Intelligence Software?

When choosing a market intelligence solution, it is important to consider your unique business needs and research workflow. What supports and drives success for one team may barely move the needle for another. What is too great an expense for a small business may be the most worthwhile investment for a firm that values speed to insights and proactive research.

The bottom line is: choosing the best market intelligence platform for your business and research needs requires taking inventory of your firm’s goals, priorities, and resources. After establishing those baseline needs, you need to find the right tool that has the features, capabilities, and pricing that most aligns with them.

In this post, we compare PitchBook with Crunchbase, exploring who each platform works best for and where each falls short. We also contrast them both against our all-in-one market intelligence platform to show how AlphaSense fills in the gaps and meets your business and research needs better.

The platform comparisons are based around the following criteria:

- Features and data types

- Usability

- Customer service & support

- Reviews and ratings

- Pricing

Here’s a quick overview of each one:

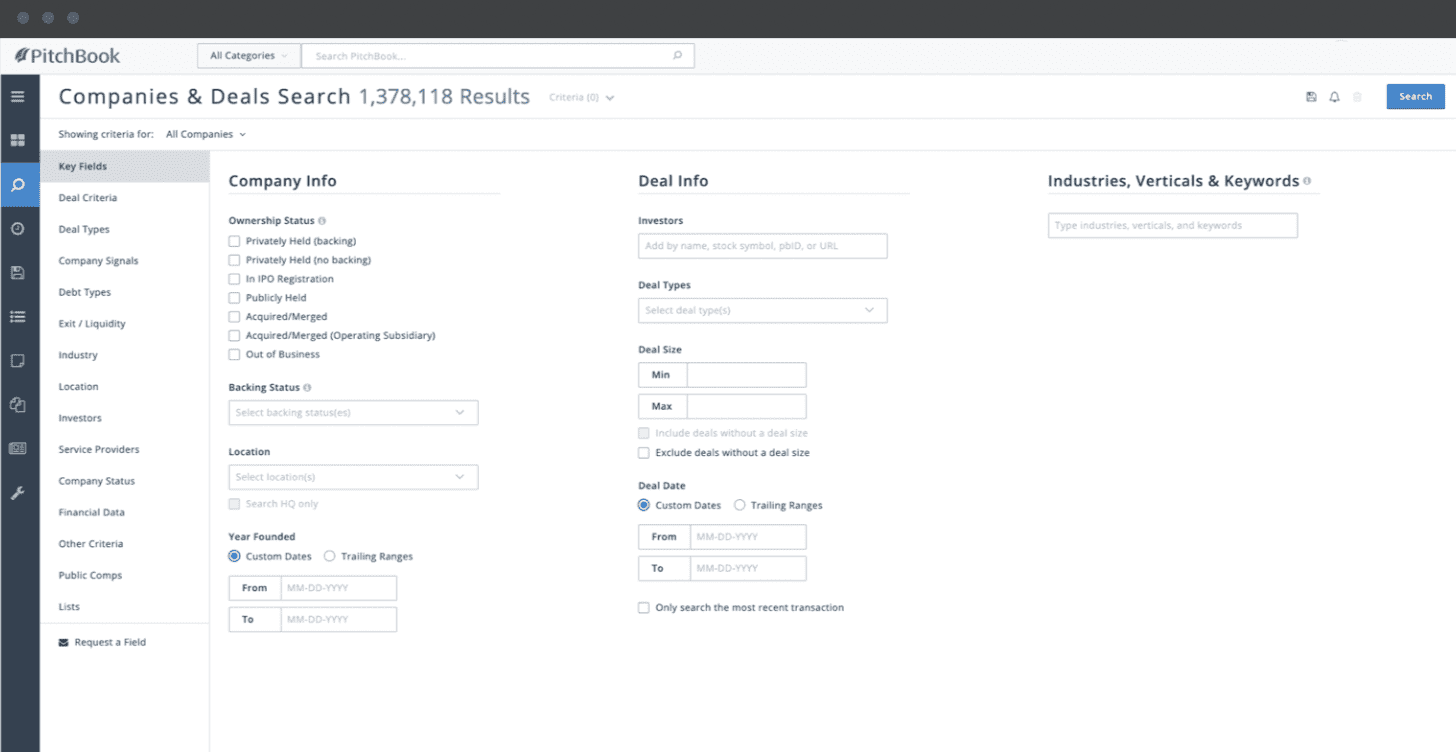

PitchBook

Best for: private market financial data for deal sourcing, fundraising, and due diligence

Founded in 2007, PitchBook is an award-winning private equity, venture capital, and M&A database with over 70,000 individual users across its client base. It is most known for its private market database, as well as its reporting and data visualization features that are primarily used by finance, investment, and sales professionals.

PitchBook is limited by its lack of content around regulatory filings, expert research and analysis, and trade journals. It also lacks smart search capabilities, making it more challenging to gather the right insights quickly.

PitchBook Pros

- A strong and robust library of private company data, including financial (M&A activity, funding rounds, revenue estimates, and more) and non-financial data (employee counts, and more)

- Visibility into who within private companies are the top professionals

- Infographics & market maps

- Ability to use keyword search and powerful filtering to create private company screeners and results which pinpoint specific private companies of interest

- Content offering includes datasets such as patents

Pitchbook Cons

- Lacks synonym recognition in search

- No broker research or aftermarket research. Equity research is an additional charge of 5k + 500 Per User

- Criticized about data accuracy and recency

- No SEC or global filings

- Limited earnings transcripts

- No expert call library

- ESG reports created in house

Related Reading: PitchBook Alternatives & Competitors

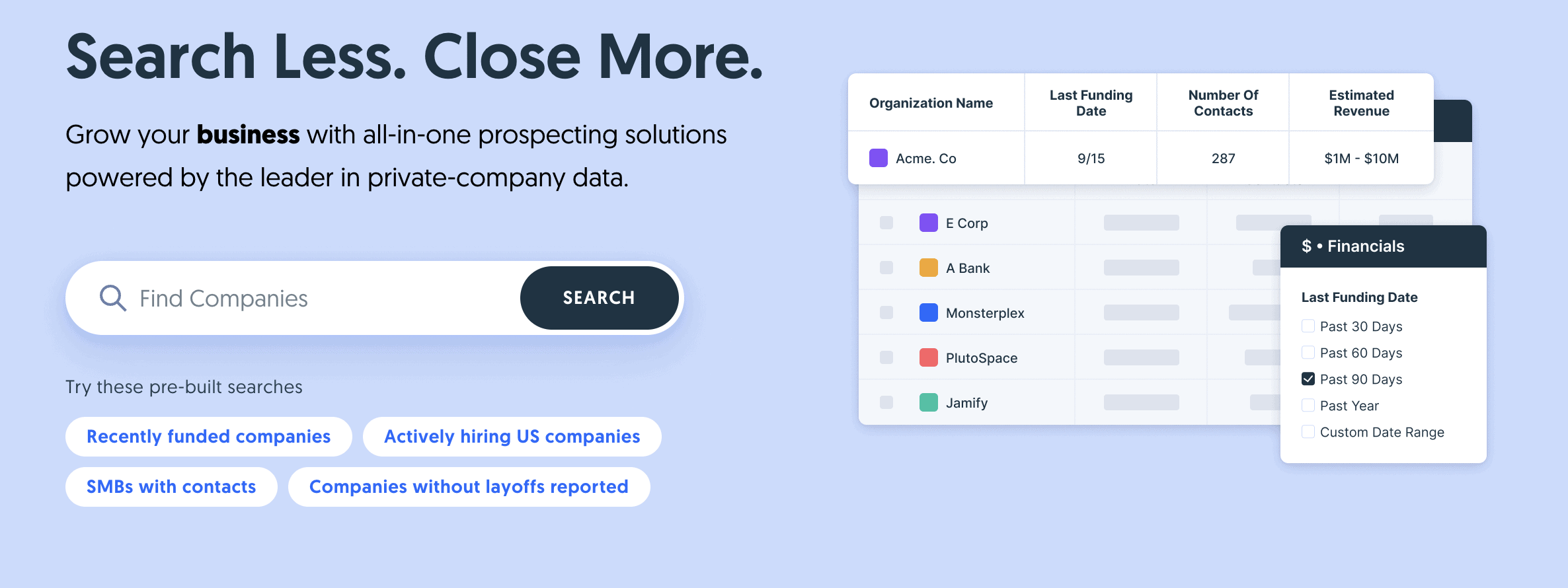

Crunchbase

Best for: identifying key contacts for outreach and deal sourcing

Founded in 2007, Crunchbase is a sales intelligence platform with over 75 million users, free and paid accounts combined. Holding data sourced from their investor network, contributor community, and company self-submissions, Crunchbase is a popular option for identifying key contacts within companies, especially within the startup ecosystem, including stealth, seed-round, early-stage, and late-stage startups.

While users appreciate that the platform easily integrates with most sales tools like CRMs and outreach platforms, the market intelligence scope and depth is much more limited than with most competitors. For the most part, Crunchbase is used by sales professionals, executives, investors, startup founders, and researchers looking to identify key contacts for outreach and deal sourcing. Researchers and analysts can benefit from Crunchbase but only as a source for high-level company information and personnel.

Crunchbase Pros

- Valuable data for sales prospecting

- Ability to export the data

- Ease of use

- Ability to filter by several categories including stage and location

Crunchbase Cons

- Alert fatigue

- Issues with data accuracy and recency

- CRM integration isn’t seamless

- Database isn’t comprehensive, even for private companies

- No advanced search capabilities including synonym recognition

- Lack of additional content sources such as expert calls, earnings transcripts, and brokerage reports

Related Reading: CB Insights vs Crunchbase

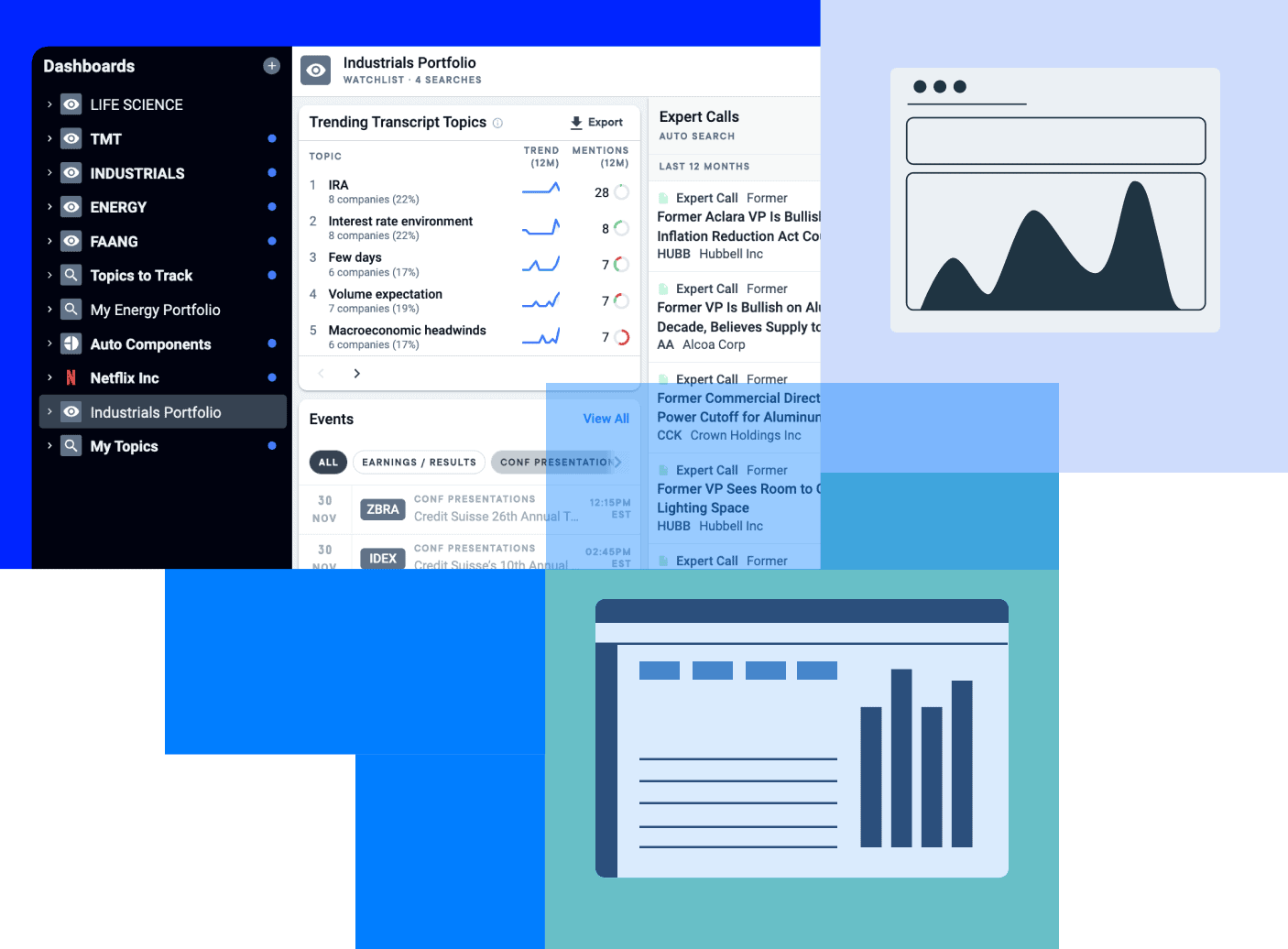

AlphaSense

Best for: conducting comprehensive qualitative research and analysis, with an emphasis on speed, accuracy, and scope

Founded in 2011, AlphaSense has close to 4,000 enterprise clients, including 85% of the S&P 100, 80% of the top consultancies, 75% of the top asset management firms, and 20 of the largest pharmaceutical companies. This platform is used by corporations for strategy, competitive intelligence, and market landscaping, as well as by IR and financial professionals for messaging research, due diligence, market monitoring, and deal sourcing.

AlphaSense sets itself apart with its extensive content universe—covering company documents and regulatory filings, news and trade journals, broker research, and expert call transcripts—as well as its powerful AI search technology and filtering tools. With this combination of comprehensive private, public, premium, and proprietary content and smart search capabilities, AlphaSense helps shorten the time to insight and takes your research process from reactive to proactive.

AlphaSense Pros

- Extensive content universe organized around the four key perspectives

- NLP and AI-based search technology and sentiment analysis

- All-in-one research platform

- Intuitive user interface

- Collaboration and integration features

- Automated and customizable alerts

AlphaSense Cons

- Visualization tools are limited to financial data at this time

- Collaboration tools are limited to users with AlphaSense licenses

Data: Types, Coverage, Source

PitchBook

PitchBook is best known for private market data as it continues improving its public market data and expert analysis offerings. PitchBook coverage includes financials, stock updates, financing histories and company development information, deals and acquisitions, funds, detailed organization charts, personnel contact, and leadership information.

PitchBook sources data from publicly available datasets, processed through their “specialized data operations associates paired with fine-tuned processes and algorithms.” Their market analysis and company-specific equity research add-on is from their in-house Institutional Research Group (by their parent company Morningstar).

Crunchbase

Crunchbase covers the private market, with data focused on company information, financing updates and funding rounds, growth trends, tech stack, investments, leadership and org charts, and overviews of financials. Crunchbase sources data through its investor network, community contributors, and company self-submissions. They use artificial intelligence and machine learning to “validate data accuracy and scan for anomalies.”

AlphaSense

AlphaSense covers market, company, and investor data for both the public and private markets, and provides access to the four key perspectives of research: company, journalist/regulator, broker, and expert.

AlphaSense provides access to 10,000+ premium sources of information—such as international regulatory filings, company disclosures and filings, transcripts of earnings calls and conferences, expert call transcripts, news and trade publications, broker reports, and independent research reports—indexed, searchable, and all in one place.

Moreover, AlphaSense offers access to two highly valuable proprietary content offerings:

- Expert Transcript Library – 40,000+ transcripts of one-on-one calls with industry experts, customers, professionals, competitors, and former and current executives, available as an add-on to the AlphaSense package.

- Wall Street Insights® – A collection of broker research from Wall Street’s leading firms, covering global sector themes, industries, and companies from 1,000+ sell-side and independent firms, available within the AlphaSense platform. Research professionals can even preview the contents of a broker report, saving them wasted time and money on potentially fruitless research.

Usability

PitchBook

PitchBook’s web interface has been described as easy to navigate, with a clean layout. Some users find their filters and search features helpful, although there are reports of difficulty surfacing specific information as queries and filter combinations increase in complexity.

Most notably, reports of inaccurate and outdated data are a huge letdown for the typical use cases for market intelligence. The lack of confidence in PitchBook’s data adds an additional layer of work, compromising efficiency gains.

Crunchbase

Users find the Crunchbase website easy to use due to its simplicity and social-media-like interface. For salespeople, integrations with popular sales tools make prospecting and lead enrichment easier and faster. However, CB’s limited data beyond detailed company profiles is a significant roadblock for users looking to research markets and companies deeply. Duplicate entries and outdated information have also been ongoing issues, even for company overviews and organization charts that Crunchbase is known for.

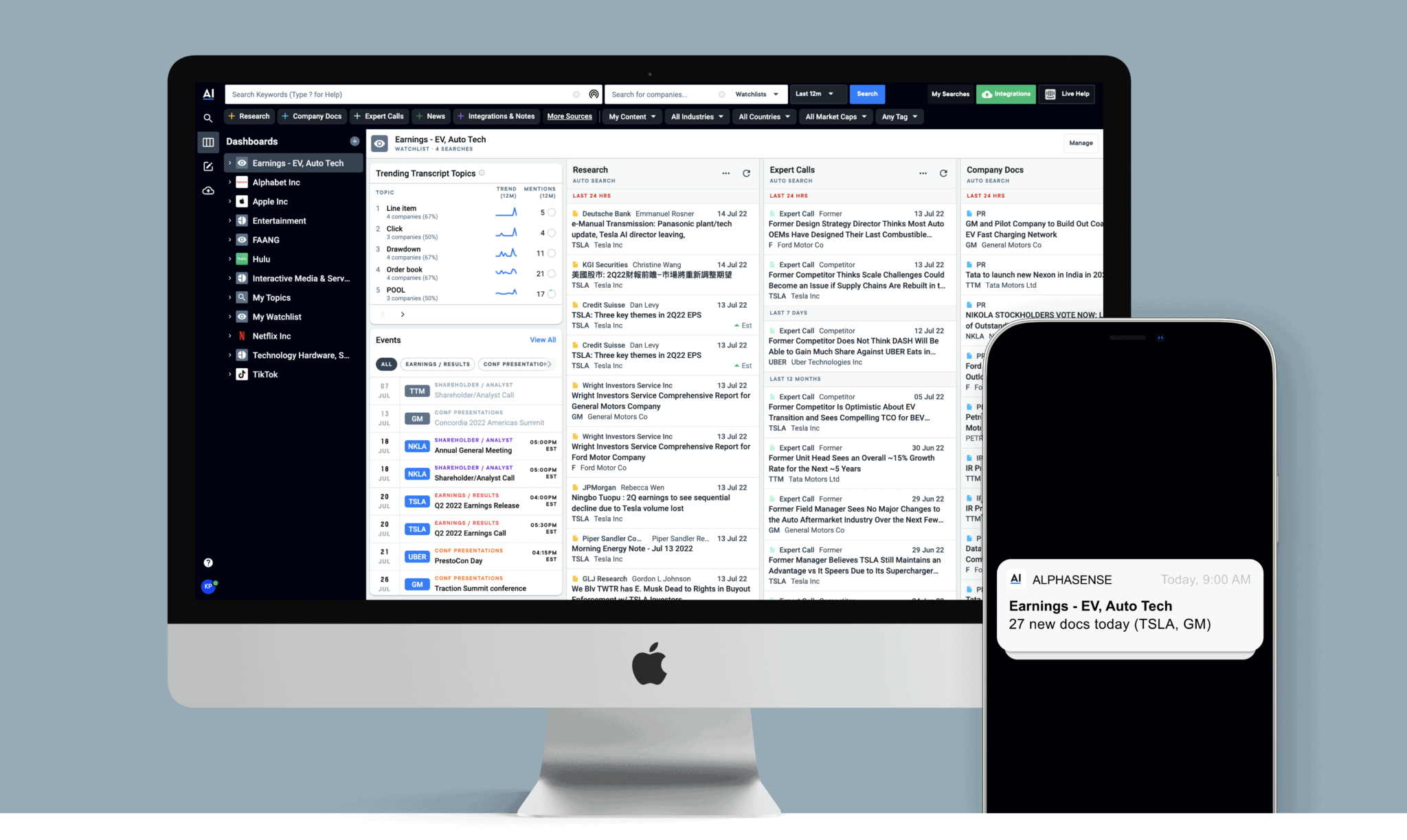

AlphaSense

With AlphaSense, users can cut out cumbersome manual research tasks like multiple tabs of research reports and CTRL+F’ing through documents with limited keywords.The AlphaSense UI has been designed to work seamlessly with market research workflows and is customizable for further fine-tuning.

Clients from a wide range of verticals—from life sciences and technology to investment banking and asset management—find that AlphaSense’s AI search technology, like synonym recognition, pre-set search feeds, and smart keyword suggestions speed up data and insight discovery even when searching across different sources. Two key reasons users stick to AlphaSense are the speed of surfacing valuable data and the access to premium content like broker research and expert call transcripts.

Customer Service & Support

PitchBook

PitchBook provides a tailored onboarding experience for each client, assigning a dedicated account team for new customers. The account team stays in contact with the clients throughout their customer journey, providing unlimited training and advice where needed. PitchBook also offers live chat and phone support during business hours, and they have a self-service Help Center on their website with FAQs, product video demos, and interactive walk-throughs.

Crunchbase

Crunchbase offers self-guided signups for Free until Pro users, assisted by a knowledge base, while Enterprise and Data Enrichment tiers get access to direct onboarding support. The latter groups are matched with a dedicated customer success manager, and all clients have access to the self-service knowledge center on the Crunchbase website, as well as email support.

AlphaSense

AlphaSense’s product and customer education teams provide ramp-up and learning sessions with hands-on training and demonstrations. Additionally, all AlphaSense users have a dedicated account representative available for questions and guidance. For instance, the product specialist team can even put together searches for research professionals to streamline their workflows.

AlphaSense also maintains a regular training calendar for live, virtual, instructor-led AlphaSense Education webinars. Like the other two platforms, the website has a self-service knowledge base with product and user guides, but unlike Pitchbook or Crunchbase, AlphaSense also has a live Help button on the website, where users can chat with product specialists 24/7 and receive instant support for any issues or queries.

Ratings & Reviews

PitchBook

Rating: 4.2 out of 5 on G2, 8.2 out of 10 on TrustRadius

Popular positives

- Comprehensive data on private market financials, deal flow, and market transactions

Popular negatives

- Public market data can be improved

- Daunting interface for new users with features not synced with typical market research workflow

- Hard to drill down and isolate insights due to incomplete data and delayed updates

- Misleading trial terms

Crunchbase

Rating: 4.5 out of 5 on G2, 7.5 out of 10 on TrustRadius

Popular positives

- Good for identifying core people and getting contact information

Popular negatives

- More sales intelligence than market research

- Not enough global data

- Sometimes inaccurate data

AlphaSense

Rating: 4.8 out of 5 on G2, 9.4 out of 10 on TrustRadius

Popular positives

- Comprehensive data and analysis on public and private markets

- Real-time data availability

- Easy-to-find relevant and high-quality results

- Intuitive interface and great customer support

- Smart AI-powered search leads to quicker, more accurate insights

Popular negatives

- Visualization tools are limited to financial data at this time

- Lack of collaborative tools for knowledge management

Pricing & Billing

PitchBook

- Average $12k/user or $25k/3 users, annual billing

- Pricing comes down as seat numbers go up

- Equity research comes at an additional fee

- Free trial may be available upon request

Crunchbase

- Free tier

- Starter: $29/user, annual billing, 7-day trial

- Pro: $49/user, annual billing, 7-day trial

- Data Enrichment license: $2K per user, annual billing – Free trial possible by request for teams of 10+

AlphaSense

An AlphaSense user can access smarter features, a better user experience, and an extensive content universe at a more reasonable price. With AlphaSense, you’ll either pay by the enterprise or per seat. Contact us for more information on pricing options, or start a free 2-week trial here.

AlphaSense: A Better Alternative to Crunchbase and PitchBook?

Both Pitchbook and Crunchbase have carved out a respectable niche by providing private company data that’s often hard to find, challenging to validate, or is otherwise siloed to a point where it’s unusable.

Overall, Crunchbase works well for individual consumers or small businesses—particularly for identifying key contacts for outreach and deal sourcing—but it falls short for enterprise users and individual users looking to research markets and companies more deeply. This is mostly due to its lack of a comprehensive database and lack of valuable content sources such as expert calls, earnings transcripts, and brokerage reports.

Meanwhile, PitchBook markets itself as a more enterprise-grade platform including a dedicated customer success manager, personalized onboarding, and industry expert analysis. PitchBook is a valuable platform if you’re looking for business intelligence, venture capital, deal sourcing, private market intelligence, or performing due diligence on startups and other businesses. It’s also an ideal platform for networking, fundraising, benchmarking competitors, and allocating different asset classes across your investment portfolio.

However, PitchBook has no expert call library, limited access to earnings transcripts, and no SEC or global filings. Also without advanced AI search functionality or sentiment analysis, research takes longer and is more likely to introduce blind spots.

Though both solutions claim to supply comprehensive, accurate data for startups and private companies, users have noted objective concerns about both databases, including questions about exactly how comprehensive and accurate their data is.

AlphaSense is the best choice for modern research and corporate professionals who are ready to level up their market intelligence strategies. With its comprehensive content universe of private, public, premium, and proprietary content sources, paired with advanced AI search technology, AlphaSense helps you uncover the crucial insights you need to make well-informed business decisions, stay ahead of market-moving trends, and get the competitive edge.