The Competitive Intelligence Guide to Earnings Analysis

Get the guide

Earnings season. The quarterly event means quick turnarounds, tight deadlines, and analyzing tiny, easy-to-miss details.

Many professionals’ ultimate goal during earnings is to spot the quarter-over-quarter differences in guidance numbers and performance metrics and uncover the most substantial viewpoints, positive or negative, from commentary. These slight variations and small nuances are business-critical as they serve as the foundation for investment decisions, financial models, due diligence reports, and corporate strategic initiatives.

Moreover, with today’s competitive markets, time is of the essence. As a result, the companies quickly make relevant decisions based on the available information, often rewarded for their speed, agility, and adaptability.

Reasons to analyze earnings documents

You might be among the diverse set of professionals that pay close attention to earnings calls to help inform your investment or strategic decisions. Maybe this sounds familiar?

The earnings workflow

Whether it’s a peer set, competitive landscape, portfolio, sector, client list, or coverage universe, if you’re paying attention to earnings, you’re likely tasked with the earnings season pre-work of looking back on the critical insights from previous calls before combing through current earnings transcripts each quarter. After collecting every relevant document, you’ll identify how the company discussed key topics and share your findings with relevant stakeholders. The problem? With high call volumes in a condensed time frame, the manual task to synthesize the most salient information and report on the necessary details hidden within these calls means long hours and the potential for missing insights.

Advancements powering the future of earnings research

Technology advancements now allow you to automate much of the once-manual line-by-line read-throughs used to define earnings workflows. From understanding nuances in tone and extracting and aggregating key themes and performance metrics to highlighting quarter-over-quarter shifts in commentary, new technology is helping make quick work of detailed earnings research. At the forefront of this tech breakthroughs are AI algorithms that are now powering the future of earnings research.

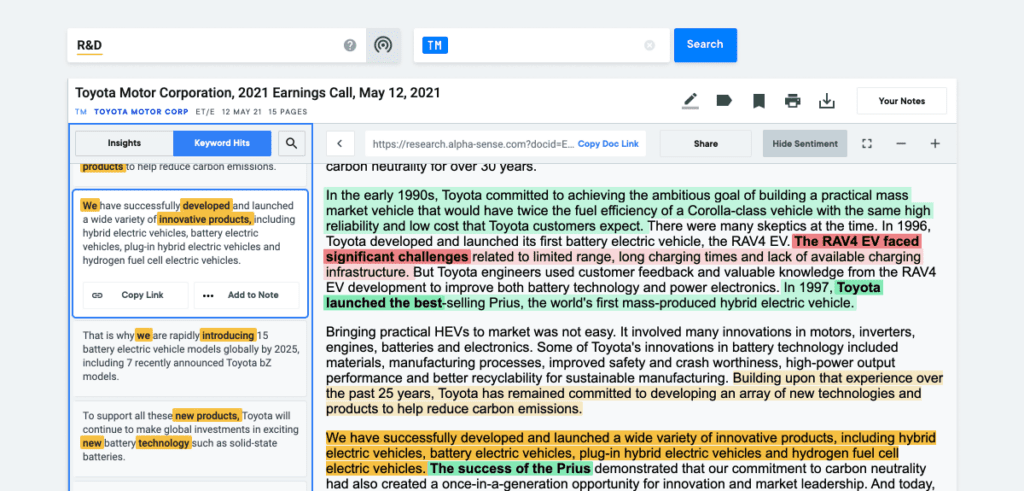

Automatically extract changes in strategy

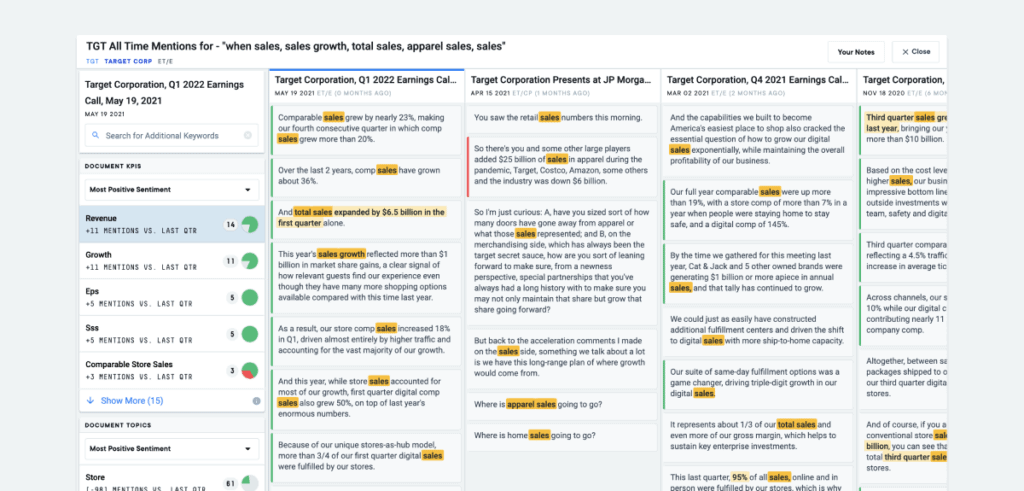

AlphaSense’s AI algorithms are trained in the language of business and can read through and analyze millions of data points within text-based documents like earnings transcripts in real-time. As they scan through earnings calls, these NLP algorithms pick up on the nuances in human language and understand related terms to provide a comprehensive analysis. This ‘smart synonym’ AI technology also automatically aggregates and groups together the most relevant topics and KPIs from the transcript and showcases the most impactful commentary.

These easily digestible document-level themes and KPIs allow you to save time by navigating directly to the most critical topics and associated mentions throughout the transcript. AlphaSense’s algorithms then analyze these document-level themes quarter-over-quarter to provide a high-level understanding of the topics a company is discussing most frequently, whether mentions have a positive or negative sentiment, what topics are unique to them and how those themes have changed over time.

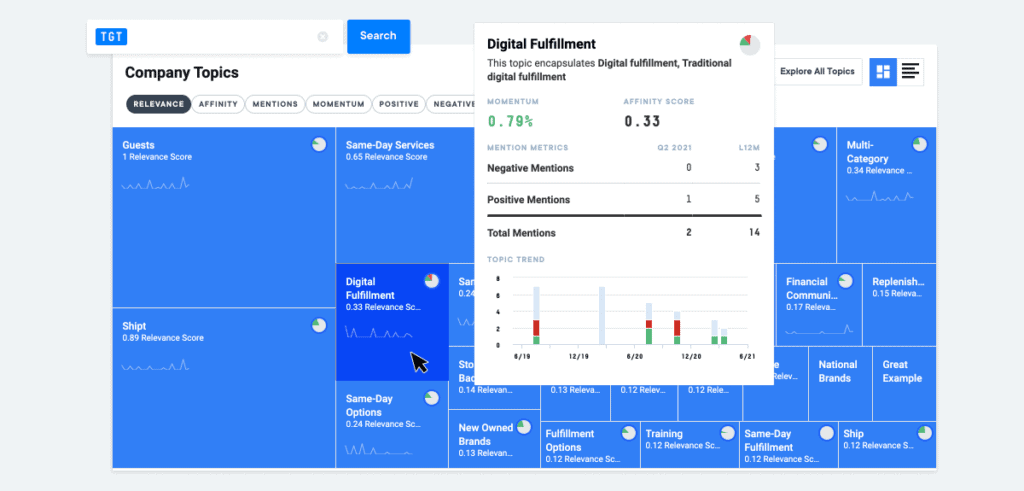

Pooling those document-level insights into one single view, Company Topics enables quick insights, generates new ideas, and compels deeper analysis on critical themes found within earnings transcripts. Allowing AI to guide and direct you to the most relevant information within an earnings call saves time and improves investment theses.

Benchmark language and analyze shifts in commentary

The NLP and Deep Learning algorithms powering AlphaSense’s theme extraction also scan transcripts with an ear for shifts in an executive commentary. In allowing AI to pinpoint minor inflections in tone, you can simplify the benchmarking process or quickly uncover inconsistencies in how a company speaks to a topic each quarter – something that both financial services and investor relations professionals care about deeply.

Historical context, consistency in messaging, and tonality were once tasks that only a human could accomplish. With NLP reading through millions of pages of text-based documents and proactively providing context, sentiment analysis, and summaries, you can spend more time on strategic activities.

Simplify tedious workflows

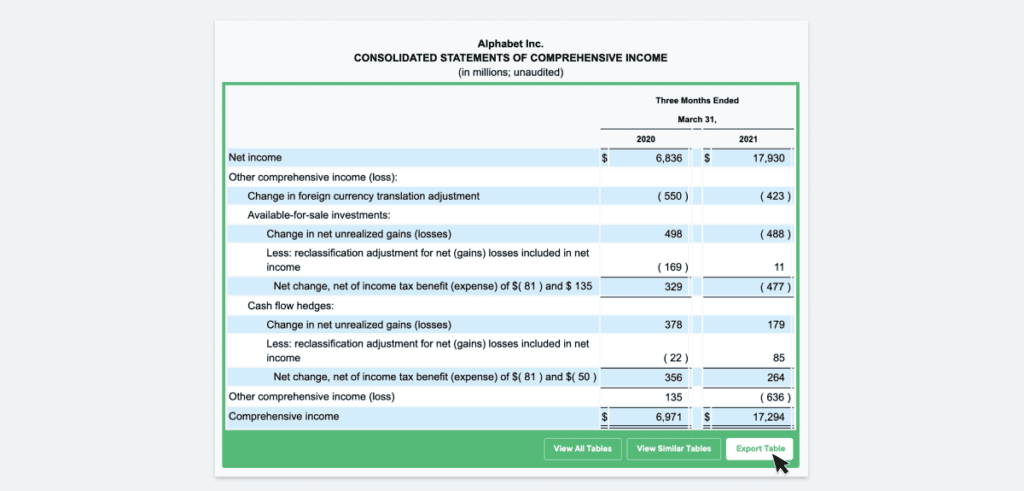

While qualitative analysis is essential during earnings season, quantitative measurements of a company’s performance are also critical. To mitigate the risk of inaccurate data and speed up the process of manual data entry, AlphaSense allows you to export modeled time-series data on balance sheets, income statements, and cash-flow statements. In addition, the quantitative tools suite extends beyond modeling to extract or clip tables from SEC filings, broker research, global filings, company presentations, and ESG reports to boot.

In using AlphaSense’s suite of productivity tools, one analyst found that he saved 25% of his time by using AlphaSense during earnings, allowing him to reallocate his time to strengthen and refine his strategy. Check out this video of best practices in leveraging AI to increase productivity and beat deadlines during earnings season or unlock a free trial of AlphaSense here.

Here are a few scenarios and how AlphaSense’s smart AI can tackle your earnings workflow:

| Role | Why do you care about earnings | What you might be paying attention to in earnings documents |

| Investor Relations (IR) | Earnings is a megaphone to communicate key performance metrics, strategic initiatives, and growth plans to investors. IR professionals help write the script and pay close attention to the clarity and consistency of messaging over time. |

|

| Competitive Intelligence (CI) | Earnings is an insightful window for CI to discover new product releases, understand the impact of different business lines and map the overall performance of your competitive landscape. |

|

| Corporate Strategy | With eyes to the future, corporate strategy teams use earnings to assess potential threats and weaknesses of their current strategy and get smart on new companies or topics to generate new ideas. |

|

| Private Equity & Corporate Development | During earnings season, they’re looking for unique insights to help improve their investment theses. |

|

| Buy or sell-side | Earnings represent an opportunity to find data points that support investment recommendations or identify risk across their portfolio. |

|

| Role | Scenario |

How to do it in AlphaSense |

| Investor Relations (IR) | Identify inflection points in executive commentary from last quarter’s call | Turn Sentiment on to gain a visual representation of the document tone |

| Competitive Intelligence (CI) | Report on KPIs and biggest themes competitors are discussing | Leverage document themes & KPIs to save time in identifying the most salient topics of the call |

| Corporate Strategy | Discover emerging issues from industry leaders | Find topics that a company is talking about more often this quarter than last with momentum scoring. |

| Private Equity & Corporate Development | Uncover how a company has spoken about a topic on their past ten transcripts | Gain instant QoQ context by seeing every mention of a topic in one single view with Snippet Explorer |

| Buy or sell-side | Update models to reflect most recent earnings data | Seamlessly export the past year’s worth of financial data into Excel with Table Extraction |