The company

This healthcare private equity firm is primarily focused on the innovative areas of life sciences and seeks to generate superior returns through idiosyncratic, catalyst-driven investing with a focus on complex and niche opportunities in the Public and Private space. Their analysts are tasked with performing the detailed research and due diligence required as the team puts together complex transactions.

The challenge

Earnings season is particularly busy for the team as they actively work to cover 25+ companies in real-time, and track the themes of 75+ others within the life sciences industry. Historically, one analyst shared with us that he would jump between platforms, company websites and analyst emails to uncover all the information he needed, losing valuable time in the process. With the high volume of research, combined with the demand for real-time information, this firm was seeking a solution to keep pace with the fast-paced market and ultimately, improve their investment theses.

I’ve been using AlphaSense for several years now and I took it from my previous firm to my current firm. I just love the platform, it saves me a ton of time.”

Private Equity Analyst

Results

Instant historical context: Thorough due diligence is a must for this analyst, who is tasked with understanding the history of a space and competitive landscape to inform his investment theses. Critical to his workflow is the ability to quickly analyze earnings calls and other event transcripts, taking particular note of how a company’s position – on drug pipelines, sales guidance and more – may have changed overtime.

Describing his previous process, the analyst shared that it often “felt like a black hole.” He noted that sometimes IR presentations or filings were no longer available on a company’s website and tracking them down could often take hours. Once he found the documents he was looking for, he was once again slowed down by manually identifying meaningful quotes hidden within the dense documents. “I don’t need to look at the whole document, I just need to navigate to the key snippets on the most critical themes.”

In using AlphaSense, he has found that Company Topics helps him to quickly sift through the most salient themes from earnings calls and Snippet Explorer then allows him to pinpoint the mentions he’s seeking in seconds. “It’s seamless to see only the passages you care about. It saves a ton of time”, he shared.

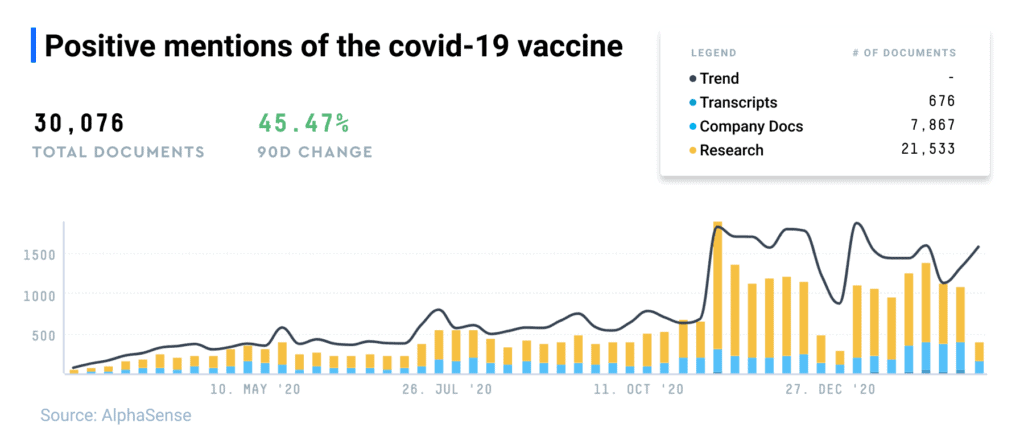

Uncovering hidden insights: To gain a more complete picture of his coverage universe, the analyst uses AlphaSense to ask questions about the unknown and discover new information he may have been missing. To help him uncover those needles in the haystack that are critical to deepening his understanding, he runs thematic searches about a topic across his coverage universe and generates new ideas by looking at how the mention-count has changed overtime and taking note on what companies are discussing the topic. “I like to look at the ‘islands’ and the ‘deserts’ and ask myself why did people start or stop talking about something?”

Search for positive mentions of the covid-19 vaccine

Similarly, he uses the platform to reveal information that companies typically will not disclose on their websites or PR statements. One of his favorite tips – set Alerts that will automatically notify you in real-time if a company executive resigns from a company you cover. In automating this process, he saves time and alleviates the fear of missing important shifts within the companies he covers.

In using AlphaSense, this private equity analyst has not only reduced the time to find critical insights, he has also been able to generate new ideas and uncover information buried in lengthy filings, strengthening his overall investment theses.

Get started today

The world’s leading corporations and financial institutions—including a majority of the S&P 500, over 85% of the S&P 100, and 75% of the top asset management firms—trust AlphaSense for smarter, faster decisions.

Start my free trial