The Complete Guide to Conducting Competitive & Market Landscape Analyses

Get the guide

Cocktailing–it’s an American pastime that’s traditionally taken place at bars and restaurants. But with the inception of the COVID-19 pandemic, drinking in public spaces posed a threat and forced millions to start mixing their spirits at home. And beverage producers took notice, creating Ready-To-Drink (RTD) or canned cocktails that led to the rise of hard seltzer from companies like White Claw, High Noon, Truly, and many more. Impressive quarterly revenues from the like have shed light on the countless market opportunities RTD have within the United States.

Without a doubt, canned cocktails are projected to continue performing well in future fiscal years but how much revenue they’ll generate depends entirely on product and consumer strategies. Below, we dive into the conversations and trends shaping the Ready-To-Drink market–from developments driving demand in the industry to the trends dominating the alcohol beverage market–so you can act on this liquid goldmine.

Ready-To-Drink Cocktail Market Trends

A Move Away From Hard Seltzer

The canned cocktail industry’s growth can be attributed to the explosion in hard seltzer options in the market. In 2019, the hard seltzer market was evaluated at $4.4 billion, with only 26 brands controlling the market. Today, the estimated market size value is $13.47, with revenues projected to reach $57.34 billion and experience a CAGR growth rate of 22.9% from 2022 to 2030.

But beverage producers are expanding their offerings, specifically to cash in on the RTD demand. Research sourced within the AlphaSense platform points to cocktails and long drinks commanding a more significant share of the RTD category by 2026, with volumes for both expected to overtake hard seltzers in 2025.

“Consumers in the U.S. have grown accustomed to the convenience and variety offered by RTDs, which has increasingly led to people trading up to spirit-based cocktails,” says Brandy Rand, Chief Strategy Officer at IWSR Drinks Market Analysis. “This reflects the overall spirits premiumization trend in the U.S. and the popularity of bar-made cocktails.”

What’s driving innovation forward in the RTD market and away from hard seltzer? Premium and fuller-flavored drinks. Over the past two years, premium-priced RTDs have experienced growth faster than any other segment due to a smaller volume base and a slew of new, higher-priced products. As consumers are turning towards spirit-based offerings with higher ABVS and reputable brand extensions.

A Move Toward Wellness

Scientifically, there are no health benefits to consuming alcohol, and in the past two years, this conclusion has been reflected in consumer behavior: 60% of U.S. adults surveyed by Gallup reported that they drank alcoholic beverages in 2021–a 5% lower statistic compared to 2019. More so, a NielsenIQ survey said that 22% of consumers were cutting back on alcohol for health and wellness purposes in 2021.

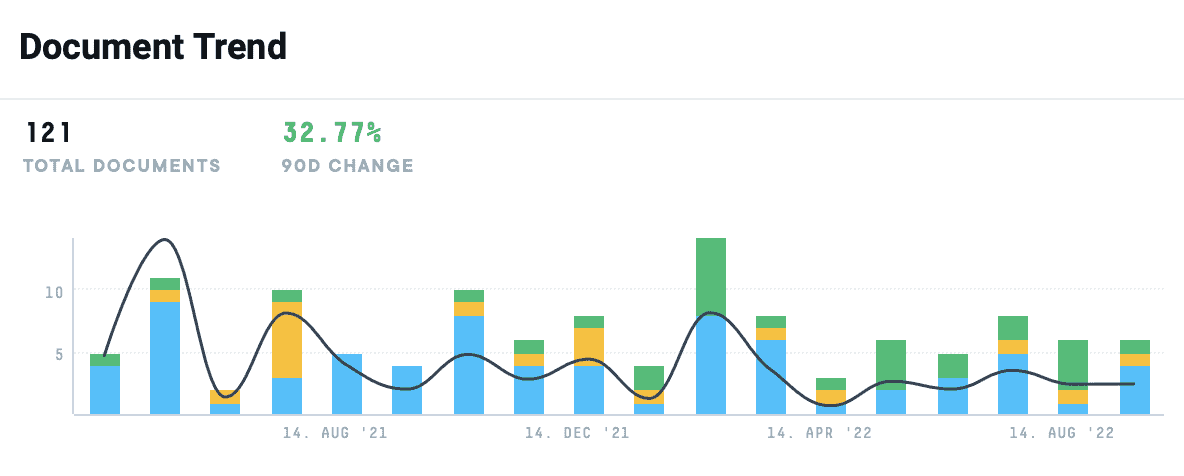

As an increasing number of Americans prioritize wellness in their lifestyle choices, they’re increasingly selecting non-alcoholic sodas, sparkling waters, and energy drinks that promote cognitive and digestive health benefits. And while this shift in consumer behavior sounds counterintuitive to alcoholic beverage producers, many have found lucrative opportunities to leverage these demands into a variation of RTDs. In the platform, documentation around “RTD” and “wellness” is up 32% over the last 18 months, with topics ranging from mushroom energy elixirs to RTD collagen beauty shots.

Beverage producers are noting a growing niche market for non-alcoholic versions of beers, wines, and spirits that supplement, rather than replace, a consumer’s desire for alcohol. At the same time, “healthy beverage” producers are also implementing alcohol into their products, like Boochcraft’s hard kombucha, which promotes a gamut of health benefits while still incorporating low amounts of alcohol in their RTDs.

Focus on Sustainability

Similarly to alcoholic beverage companies creating more wellness-oriented products, some brands within the industry have begun implementing and embracing sustainable practices–particularly as a means of attracting younger, socially-conscious generations.

Overall, Gen Z consumers are loyal to purchasing natural and environmentally friendly products, and thus more willing to pay higher prices for sustainable beer, wine, and liquor. On a broader range, research suggests that nearly half (48%) of all American consumers consider the sustainability or environmental initiatives of an alcohol company before making a purchase.

Already, a number of small alcoholic beverage brewers and distillers have begun incorporating more eco-conscious practices in their manufacturing processes. Tetra Pak and American beverage brand buzzbox™ recently partnered to craft cocktails in recyclable aseptic carton packages. And the taste of Tetra Pak’s drinks is not at the expense of buzzbox’s packaging–the cocktails come in 200 ml recyclable aseptic carton packages, which allow the drinks to stay safe and taste fresh without the need for preservatives.

“The quality of the package’s aseptic technology makes our product possible,” says Rod Vandenbos, CEO and founder of buzzbox™. “Without it, we could not focus on using fresh ingredients or offer a long shelf life (up to 18 months un-refrigerated). The carton package is also very durable, making shipping and transport more economical and sustainable.”

There are endless ways to incorporate environmental, social, and governance policies into how an alcohol producer operates. However, the main takeaway from incorporating more sustainable preferences is to embrace and display a more authentic, transparent way of operating.

The Ready-To-Drink Brand Transformation

Over the past few fiscal quarters, we’ve noticed more traditional, reputable alcohol brands embrace RTDs in their product lineup. Based on market research in the platform, many have experienced revenue growth with product expansions but realize the market is rapidly changing from increased competition. This is especially true in the case of Jack Daniel’s and Boston Beer Company’s Truly Hard Seltzer.

In a recent press release, Jack Daniel’s RTD products (Jack Daniel’s & Cola, Jack Daniel’s & Ginger, Jack Daniel’s Country Cocktails, and Jack Daniel’s New Mix) are performing exceptionally within the market. They grew volumes by 12% globally on a nine-liter case basis in fiscal 2010 and 3% on an equivalent basis. In addition, ready-to-Drink beverages delivered double-digit reported net sales growth.

And while companies like Jack Daniels are experiencing financial success, other beverage producers who have had a stake in the market are taking note of their new competition. In the Boston Beer Company’s Q2 2022 earnings call, they noted how much noise is in the space.

“There’s a lot of noise in the RTD cocktail space, right? They are having an impact,” says David A. Burwick, President, CEO & Director of the Boston Beer Company. “I think the interesting thing I just looked at the other day in RTDs is that they have about the same number of brands and SKUs, like call it, 250 brands and over 1,000 SKUs as hard seltzers do right now in the market, but there are 7% of Beyond Beer, and hard seltzers are 48% of Beyond Beer. So clearly, there’s a lot of noise and excitement.

But is all the market penetration warranted?

“I think what you have in the marketplace is that everybody goes in one direction really hard. And in some cases, we saw with hard seltzer, it can become self-fulfilling. In others, they might hit a dead end, and it doesn’t play out the way they think, and they’ll go somewhere else. So right now, I’d say there’s more support and execution and focus on RTD cocktails that maybe is warranted by what the consumer is saying–and all of that has had a bit of an impact.”

The bottom line: just like the hard seltzer market, the ready-to-drink cocktail market and the nature of how a product resonates with one customer over another are completely unpredictable. While there is explosive growth in the space, the key is to keep a pulse on the changing customer preference landscape.

Today, CPG professionals in the RTD space are facing an increasing amount of challenges in finding the competitive and market information they need to make quick, strategic decisions. Download our white paper, The Complete Guide to Conducting Competitive & Market Landscape Analyses to learn how to monitor market happenings in real-time so you never miss out on important business opportunities.