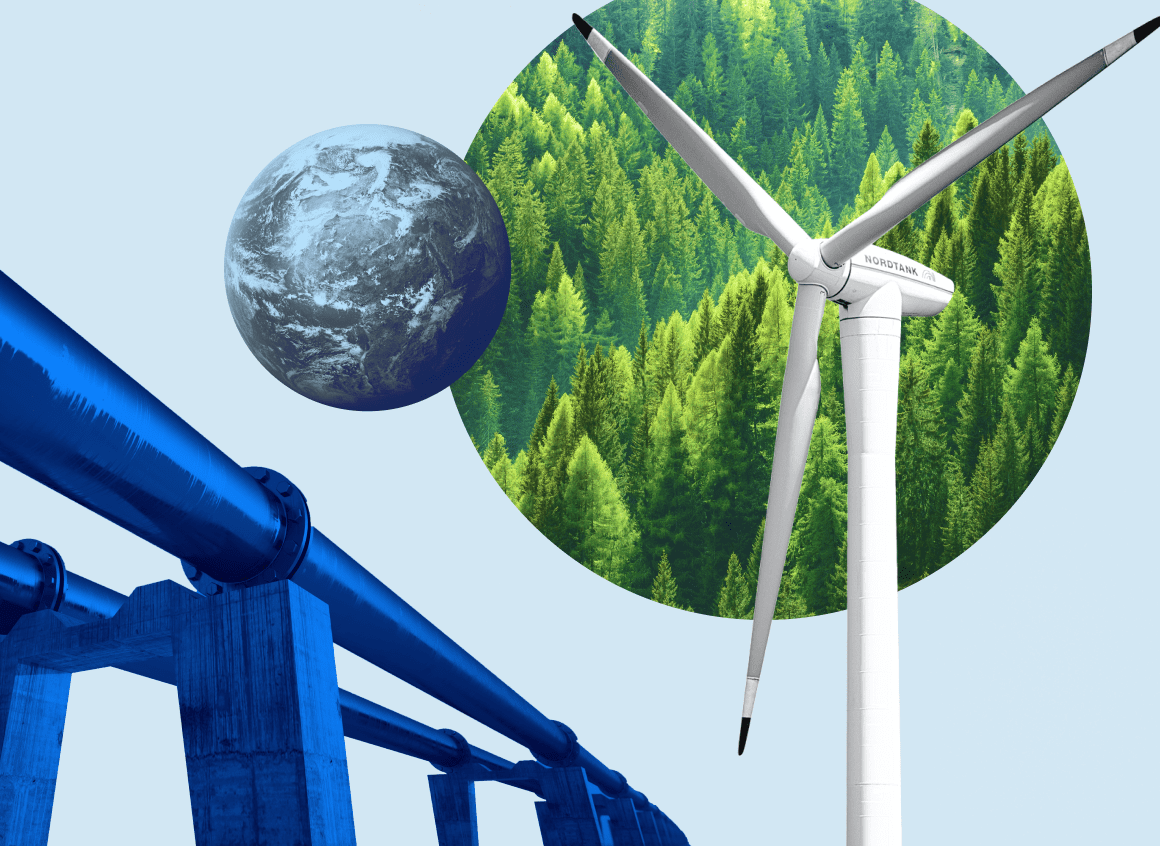

There’s no doubt about it: ESG is one of the hottest investing practices today.

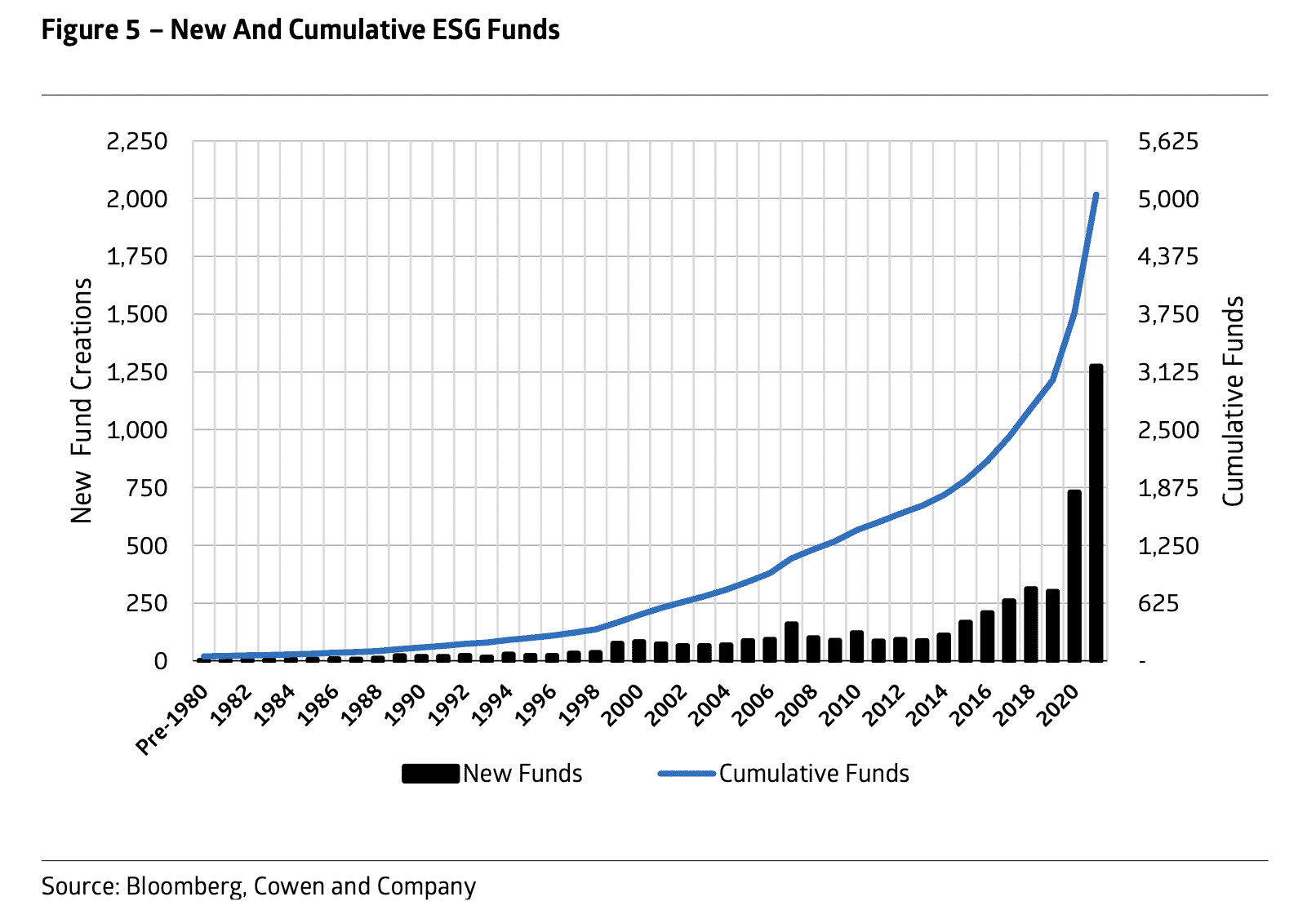

After slow and steady growth for many years, the number of ESG funds skyrocketed around 2018. Research from Cowen reports that new ESG funds quadrupled over the past 4 years and are expected to stay on the rise.

Amidst its rapid growth, ESG investing has evolved significantly from a fund, shareholder, and corporate perspective.

In the sections that follow, we’ll take a look at how ESG is different now than in the past and the trends we can expect to see going forward in 2022 and beyond.

Don’t miss this post on the 5 key steps to building an effective ESG investing strategy.

ESG in 2022

There have been three notable shifts in very recent years that make today’s ESG environment foundationally different from what we’ve seen in the past.

First, shareholders are active in determining and enforcing ESG investment criteria. Information accessibility has spurred a decline in negative screening in favor of investment in companies that are proactively and demonstrably committed to ESG issues. Shareholders know about the issues they care about and want to know how the companies in their portfolios address them.

Second, there is higher demand for ESG transparency and corporate accountability today than ever before. It’s no longer possible for companies to commit in word but not in action. Shareholders and fund managers alike want to see the true impact (usually in the form of hard data) of ESG efforts made by companies they invest in.

Finally, global momentum around ESG issues has transformed the old view of ESG as a potential risk. Today it’s seen as an alpha-generating opportunity for investors who can ask the right questions, attach to high-potential new entrants into the ESG space, and spot emerging trends on the horizon.

Let’s look at 4 ESG trends to keep watch on in the coming months and beyond.

Climate Change Remains a Priority

Geopolitical issues around fossil fuels and renewable energy alternatives have surged to the forefront amidst Russia’s invasion of Ukraine earlier this year. As the economic stronghold fossil fuel exporters have has become abundantly clear, so has the need for true renewable energy security and an acceleration of renewable alternatives to oil and gas.

In the coming months, expect to see an increase in climate-related regulations, policies, and laws. In response, we’re likely to see more companies working to find innovative solutions to renewable energy roadblocks and increased support from ESG funds for those with the most potential.

Move Toward Regionalization

There is no global model for renewable energy transition. Compounded by an increase in regionalist sentiment amidst the pandemic, it’s likely we’ll see the U.S. and other countries seek solutions (and ESG investors supporting solutions) that may not necessarily extend beyond their borders (at least at the time).

This trend is less about a lack of desire for global collaboration on climate change solutions and more about practicality of implementation. The energy transition can’t happen overnight, yet citizens desire and even demand solutions. Those solutions can be implemented more rapidly at a national level.

There are also immediate economic considerations that come into play. The U.S., for example, will likely maintain or increase production of hydrocarbons for export in the near future while also decarbonizing its internal economy.

What seems like a dichotomy between policy and practice, could be an opportunity for faster solutions and more progress long-term. Solutions that are implemented regionally and proven successful may then see faster scaling and expansion later on.

Higher Demand for Corporate Transparency

Greenwashing occurs when companies misrepresent their ESG commitment and practices to appear more attractive to ESG investors. It’s a problem that has persisted throughout SRI and ESG history and is finally on the decline today.

Data accessibility, better reporting standards, and shareholder demand for accountability have all combined to create a new ESG environment in which companies are required to demonstrate how they’re actually making the impact they say they are.

Public policy is supporting this effort. On January 1 of this year, the EU’s Taxonomy Regulations went into effect, and in the U.S. the SEC will soon debate initial rules around corporate disclosure requirements. In the meantime, shareholders are likely to demand more voluntary disclosure.

Impact as a Top Shareholder Priority

Alongside greater data transparency and corporate responsibility, ESG fund shareholders now expect increasingly specific impact indicators at both a fund and company level. They want to see quantifiable results related to impact and use them to determine how they allocate funds over time.

With environmental, social, and corporate governance (ESG) strategies skyrocketing in popularity amongst shareholders and analysts on earnings calls, we’ve long since moved past the few and far between “compassionate capitalist” and are ushering in the Investor Revolution. Going forward, expect to see ESG funds reporting more frequently and in-depth on quantitative performance and impact metrics to keep shareholders satisfied.

Last month AlphaSense, in partnership with Cowen, hosted A Cowen Exclusive: The Biggest ESG Trends and Predictions for 2022. Access the webinar for more expert insight on the future landscape of ESG investing.

Explore our comprehensive list of the best stock and investment research tools to level up your financial research this year.