When we talk about earnings season, we’re often focusing on the slew of new content released during the first few weeks of the quarter. Rightfully so, as that is when many of the highest earning public companies post financials, release press statements, and host calls to answer investor questions.

Beyond earnings calls providing a fertile ground of rich, business-impacting insights, there is one unique and largely untapped content set when it comes to preparing for and staying a step ahead during earnings: Expert Insights.

Whether you’re an IRO preparing for calls, an analyst looking to stay a step ahead, or a business professional using earnings season to glean competitive strategy information, expert interviews are essential in preparing for, supplementing, and contextualizing earnings content.

With AlphaSense, financial professionals can easily prepare for earnings season with powerful artificial intelligence by leveraging our all-in-one market intelligence platform for financial research and Expert Insights.

There are tons of reasons to leverage expert calls in your earnings strategy—but, for now, we’ve compiled three cases to illustrate their importance below with real-world examples from PayPal, Target, and Netflix.

1. Identify Leading Indicators and Potential Trends Before an Earnings Call

By their very nature, experts have intangible, anecdotal insights that pull back the curtain into the inner workings of a company or industry before big news becomes public or trends officially take shape. Take Peloton’s landmark partnership with Amazon, announced in August–the writing had been on the wall for 2+ quarters that Peloton was a singular modality company in need of a behemoth retail partnership to survive.

Leaning on expert calls to help understand the landscape of what’s happening within a company can apply outside of attempting to predict or prepare for major partnerships and acquisitions, of course.

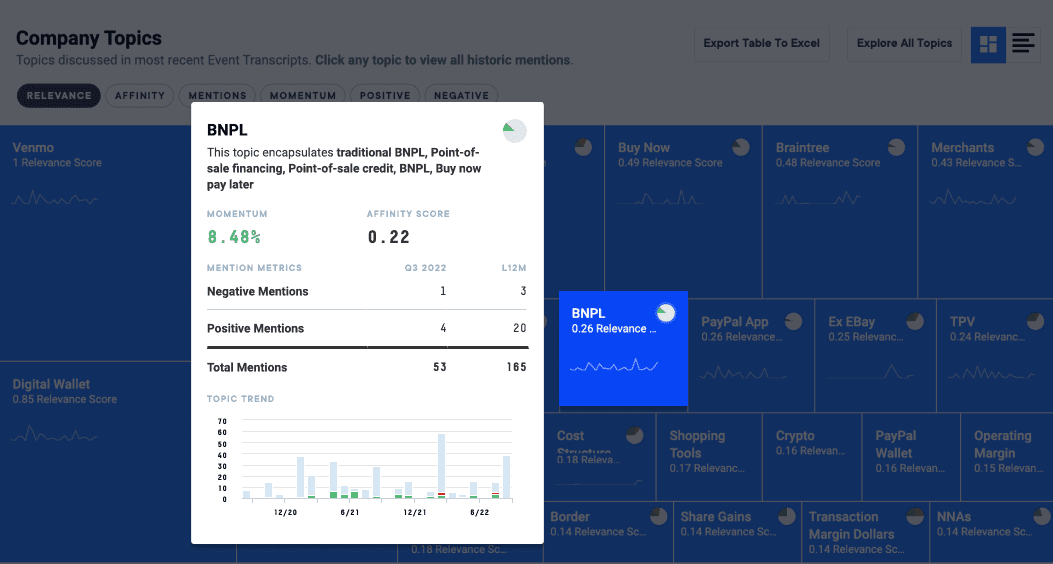

Let’s use PayPal as an example—Digital Wallets, BNPL (Buy Now, Pay Later), and the company’s various subsidiaries (e.g. Venmo, eBay, etc) were some of the most popular discussion points in 2022 earnings calls.

Because of its halo effect on revenue, BNPL played a major part in earnings activities for PayPal in 2022; so, understanding not only the Buy Now, Pay Later landscape, but also how it fits into PayPal’s overall strategy will be critical going into Q3 earnings.

Looking at relevant expert calls, one interesting throughline is brewing cynicism about BNPL’s staying power:

“I don’t understand what all the hubbub is about with buy now, pay later. Truly, I just don’t. I don’t really get the attraction, but that’s just me. I think if you were working for one of those organizations, my opinion, it’d be a pretty tough sell.”

– Former Executive, Hyperwallet | Expert Transcript

And while PayPal is uniquely positioned to outlast smaller players in the space due to its strong history of risk management, it’s got an emerging problem in attracting the customers that use BNPL the most–Gen Z and Millenials:

“PayPal is losing ground a bit with the younger customers. BNPL is a preferred option for younger customers. While PayPal, from an internal perspective, can do very well in the BNPL, its main challenge will really be to attract the consumers to use PayPal when they want to buy something and pay for it over time.”

– Former Head of Large Enterprise Risk, PayPal | Expert Transcript

TL;DR: PayPal is relying heavily on BNPL’s halo effect to drive revenue growth and hit earnings numbers; it has the potential to conquer the space, if only it can attract the right generation to its platform.

2. Contextualize Earnings Performance

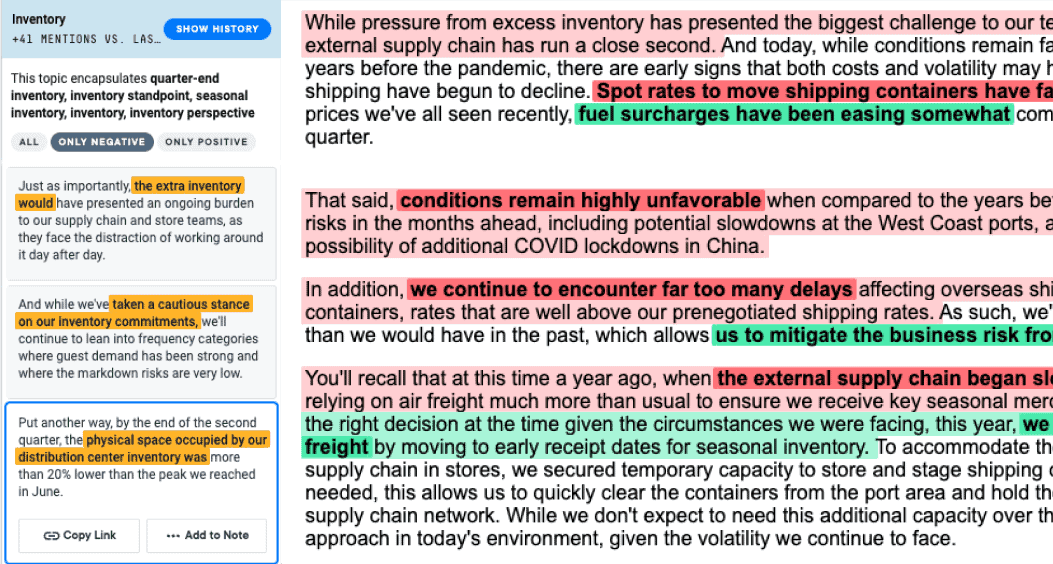

When we look at the winners and losers of Q2 earnings, Target’s margin decompression (down to 1.2% from 9.8% in 2021) and 90% decrease in profit certainly make for some of the most jarring headlines.

Looking more granularly into the poor performance, inventory (or really, markdowns on excess inventory) has been the star of the show. Target executives made the decision to “rightsize [their] inventory position in the categories through which demand patterns have rapidly changed” at the expense of a “short-term impact on financial results”. And while the volatility of inventory is certainly not exclusive to any retailer, it has had an outsized impact on Target in Q2 2022.

Focusing on how Target’s challenges stack up against counterparts like Costco (who had a much stronger Q2), it becomes clear that there’s a fundamental difference in how the two retailers treat inventory:

“Costco’s SKU count is a lot lower than Target. We have less exposure to markdowns which can kill and will kill your apparel gross margin…Kirkland Signature is recognized as a great quality brand, but also value. That’s the difference between us and Target. Again, we don’t carry the size range that you might see in a Target. All those factors lead to less markdowns, less salvage…

Keep in mind that we can go with thinner margins there because we have less shrink than a Target or a Walmart might have there. First of all, less staff and less markdown. Customers automatically recognize the value because let’s say that they’re paying $19.99 for a piece of apparel in a Target. You’re going to find a Costco somewhere around $11.99 because Target has to have that margin in order to cover their labor but also to cover their markdowns.”

– Former SVP, Costco | Expert Transcript

Additionally, according to a former director of e-commerce at Walmart, subpar performance for home goods has been a major culprit for excess inventory:

“The inventory problem might also be strategic bad decision making on everybody’s part, not just Walmart. Just the thinking that that gold rush on home is going to go forever and not anticipating discretionary spending pullback because it’s everybody. Target has it, Wayfair has it, everybody’s got all this excess inventory. They’re just sitting on their crap.”

– Former Director of E-Commerce, Walmart | Expert Transcript

However, this could be a positive indicator for Target’s performance in 2H, as that’s when home spending naturally begins to pick up:

“The home business always comes up in Q3 and Q4 because it starts in September, October, and then it just lifts every single month through the end of the year because of holiday travel.”

– Former Director of E-Commerce, Walmart | Expert Transcript

TL;DR: Target had a rough Q2, much to do with the markdowns it deployed on excess inventory. Though this is a problem affecting many big box retailers, Target’s approach to SKU count and reliance on home goods may have cemented its losing position in Q2. Taking this loss in Q2 could be promising for the rest of 2022, though.

3. Read Beneath (and Between) the Company Line(s)

It shouldn’t surprise anyone that the company line is always going to err bullish; the challenge of synthesizing and analyzing earnings calls often relies on your ability to read between the lines and fact-check the company narrative with external quantitative and qualitative data.

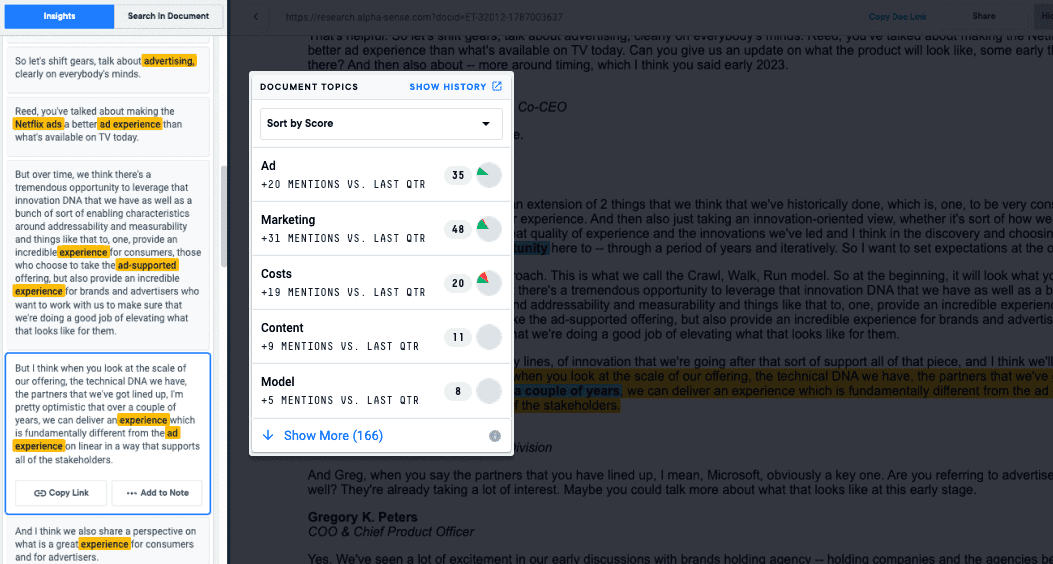

Let’s take Netflix’s Q2 earnings call. Advertising was one of the foremost topics mentioned on the call (second only to “Marketing”).

This makes sense as Netflix plans to launch an ad-supported subscription tier through a partnership with Microsoft in early 2023. Rightfully, there have been concerns from investors about what this could mean for subscriber churn, especially after Netflix saw a net loss of 1 million subscribers in Q2. However, Gregory Peters (COO & CPO at Netflix) remained optimistic throughout the Q2 earnings call that ads will be a significant driver of revenue and subscriber growth.

While this insight from Peters is crucial (it’s why these earnings calls are held, after all), it’s hardly unbiased. Cross-referencing the company line with first-hand perspectives from experts with diverse backgrounds allows us to paint a more nuanced–and realistic–picture of what the future of ads at Netflix could look like. Read the full call here.

There are many early indicators of success when it comes to the opportunity space for ads on streaming platforms. One former director at Amazon asserts that ads have had no measurable impact on engagement, assuaging worries about churn and laying out the attractiveness of the space for advertisers:

“There was no impact on engagement. No impact on hours watched. As you’re trying to get advertisers into streaming, telling them that it’s a relatively uncluttered environment versus traditional television…it’s going to be more impactful. It’s also good for customers to get them into streaming. Ultimately, I believe that those ad loads will increase over time in order to drive monetization and because the customers don’t seem to be impacted by it.”

– Former Director, Amazon | Expert Transcript

Good news, certainly, at least at a thousand-foot view. But, this same director is not as bullish when it comes to Netflix’s partnership with Microsoft:

“My biggest concern actually for Netflix is they don’t know what they’re doing in advertising. They hired a third party who is not the, what I would say, the leader in the space to handle that. It’s a difficult thing to get right. All you have to do is watch the advertising and see the slates you see or see the repetitive ads, etc. It’s a difficult thing to get right from a customer experience.”

“Netflix handed over what will be the second biggest revenue stream for them. In some countries, globally, will probably be the first revenue stream for them to a third party to handle from a technology standpoint and a sales standpoint. I don’t know if they see that as their long-term solution or a short-term solution, but I would be very focused on that and how that’s working and concerned about it as an outsider.”

– Former Director, Amazon | Expert Transcript

TL;DR: Netflix is quite bullish on the potential for ads to bolster revenue and drive new user adoption. Ads spell mostly good news for streaming services as they stand now, driving revenue without significant effects on customer engagement; however, Netflix’s choice of Microsoft as a partner could put it in a worse position than its competitors.

Gear Up for Earnings Season with Expert Insights

Expert calls are an essential part of the equation, for earnings season and beyond. With AlphaSense’s ever-growing expert transcript library, users can gain access to over 40,000 expert transcripts to contextualize quantitative and qualitative company data.

Additionally, customers can leverage AlphaSense’s Expert Call Services to gain expert interpretations of nuanced topics during earnings seasons and gain a comprehensive view of company performance.

Don’t miss our 1:1 comparison of AlphaSense vs. Tegus and AlphaSense vs GLG. To see how AlphaSense compares with some of the top expert network companies, don’t miss our Top Expert Network Companies Buyer’s Guide.

Not yet an AlphaSense customer? Request a free trial.