Despite supply chain constraints impacting production at factories across the United States, businesses producing capital goods experienced (surprisingly) positive growth in June.

New orders for primary non-defense capital goods rose 0.8% — from $255.5 billion in May to $257.6 billion in June. So why is this data point crucial?

Core capital good orders or durable goods (those that are not aircraft or defense-related) act as a proxy for better understanding business investments. Continued growth around this sort of business investment suggests that the current economic growth experienced today is more than likely not the peak.

Consumer spending shifts from services to goods

During the COVID-19 pandemic, business investment in equipment boomed. This laid the foundation for manufacturing, which accounts for 11.9% of the U.S. economy.

The catalyst for this growth is the shift in consumer spending towards goods as millions of Americans spent their days cooped up at home. Additionally, low-interest record rates and fiscal stimulus measures added to the boost.

Demand is reverting to services, with just under half of the population vaccinated and states continuing to reopen. However, even with increased demand for services, spending on goods will remain steady and robust, especially with continued consumer confidence.

According to the Consumer Confidence Survey conducted in July 2021 that interviewed over 36 million consumers, “Consumer confidence was flat in July but remained at its highest level since February 2020,” which suggests that “economic growth in Q3 is off to a strong start.” Lynn Franco, Senior Director of Economic Indicators at The Conference Board, attributes this steadiness to “consumers’ optimism” that “business conditions, jobs, and personal financial prospects will improve.”

Additionally, consumers’ spending intentions increased in July, and Franco says that a “larger percentage of consumers said they planned to purchase homes, automobiles, and major appliances in the coming months. Thus, consumer spending should continue to support robust economic growth in the second half of 2021.“

Businesses are optimistic and spending more to meet future demand

Capital goods are not sold directly to consumers but are considered tangible goods used in manufacturing consumer goods. This means, when looking at business investments, core capital goods can be leveraged as a proxy for measuring growth.

The Commerce Department released a report highlighting the continued growth in June for the new U.S. manufactured durable goods orders. The report mentioned that durable goods orders climbed by 0.8 percent in June, after spiking in May.

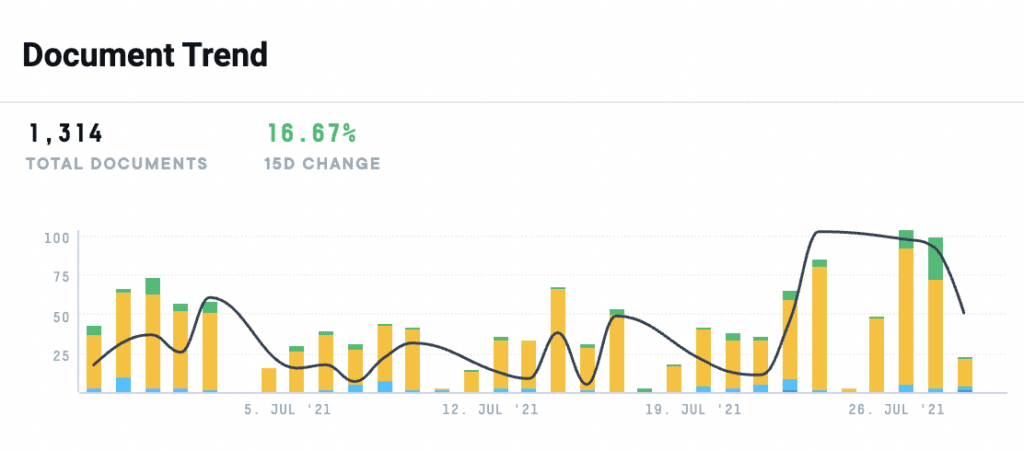

And this growth is not going unnoticed. For example, in the last 30 days, 1,314 documents published in the AlphaSense platform mention “durable goods.”

This indicates that the economy is coming back as states reopen. The better-than-expected numbers are encouraging, as it points to optimism for businesses’ desire to meet future demand. A resurgent U.S. economy has ignited an explosion in demand for cars, computers, and consumer electronics. Outside of transportation, orders also increased for primary metals, machinery, and networking gear.

The increased document count in the platform over the last 30 days spans several industries, all providing insights from the increase in core capital goods investing. We dug into the broker research documents and found six consistent takeaways.

Takeaways

- Companies feel that investment growth could be underestimated. CapEx to sales is low, and core capital goods orders typically lead to investment growth.

- Organic revenues are often tightly correlated with U.S. core capital goods shipments and global industrial production on a sector-wide basis. In the last few quarters, these indicators have shown a steady bounce back from 2Q20 lows.

- Despite transportation being considered a volatile commodity, there has been a continued recovery in commercial aircraft orders as air traffic returns. This is predicted to continue aiding in a rise in core capital goods categories, in line with the upsurge in capacity utilization in the industrial sector.

- U.S. inventory levels are low, especially across retail sectors, which signals a stock rebuild that will boost growth well into 2022.

- Increased core capital spending could reflect a desire to restructure supply chains or merely a reaction to supply chain shortages. Regardless, the key message here is that coming quarters will likely see the most substantial growth in private investment spending.

- While goods and services inflation overall has accelerated, core capital goods price inflation has remained more restrained.

Core capital spending still didn’t meet expectations

Expectations are a funny thing. Often the bar is set too high, and failure to meet them can be self-fulfilling, especially regarding economic indicators.

Investment has picked up as the initial shockwaves of the pandemic fade. Due to the robust fiscal and monetary stimulus, durable goods orders have exceeded pre-crisis levels. However, economists are not all-knowing; despite the core capital spending increase of June, it still fell slightly below predicted levels.

One of the biggest reasons for the shortfall is directly due to worker shortages and lack of materials. In addition, rapid reopenings across the nation have often provided too great demand, making it hard to match exact forecasts.

Despite the roadblocks, an increase in core capital goods orders demonstrates that businesses confidently invest more in themselves. So while we still don’t know whether or not we see the peak of economic activity, one thing is clear: businesses are gearing up for growth in the last half of 2021.

Search for mentions of core capital goods and other relevant trends in company documents. Request a free trial to AlphaSense and access data from over 10,000 content sources. Sign up here.