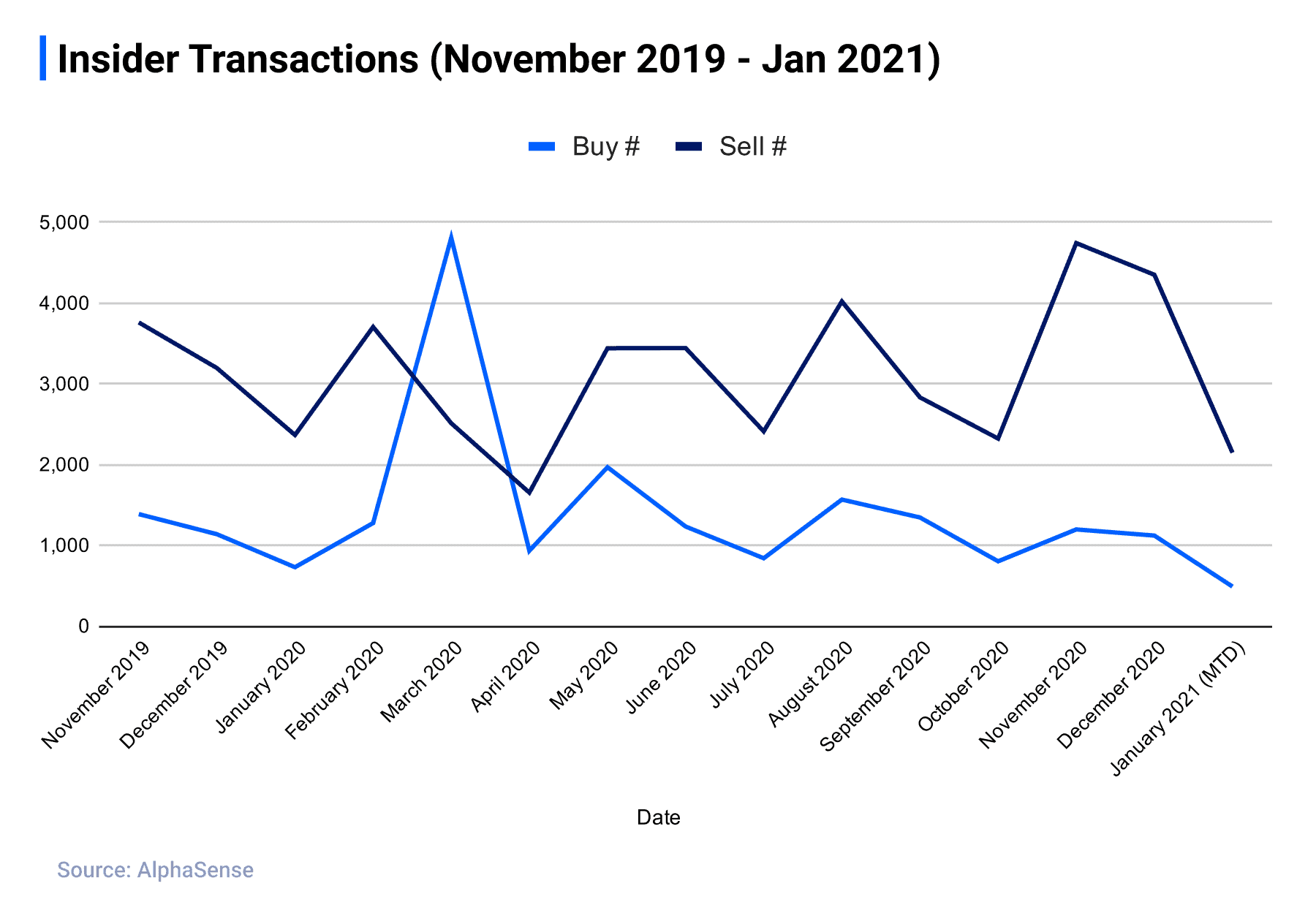

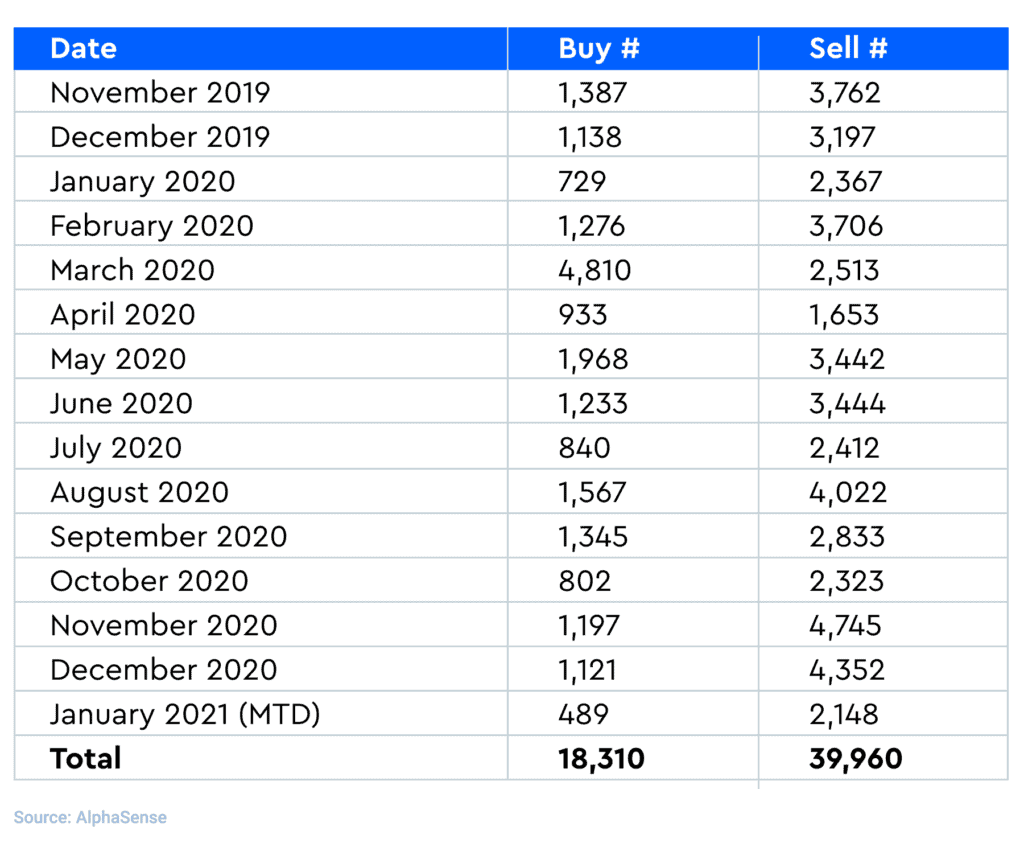

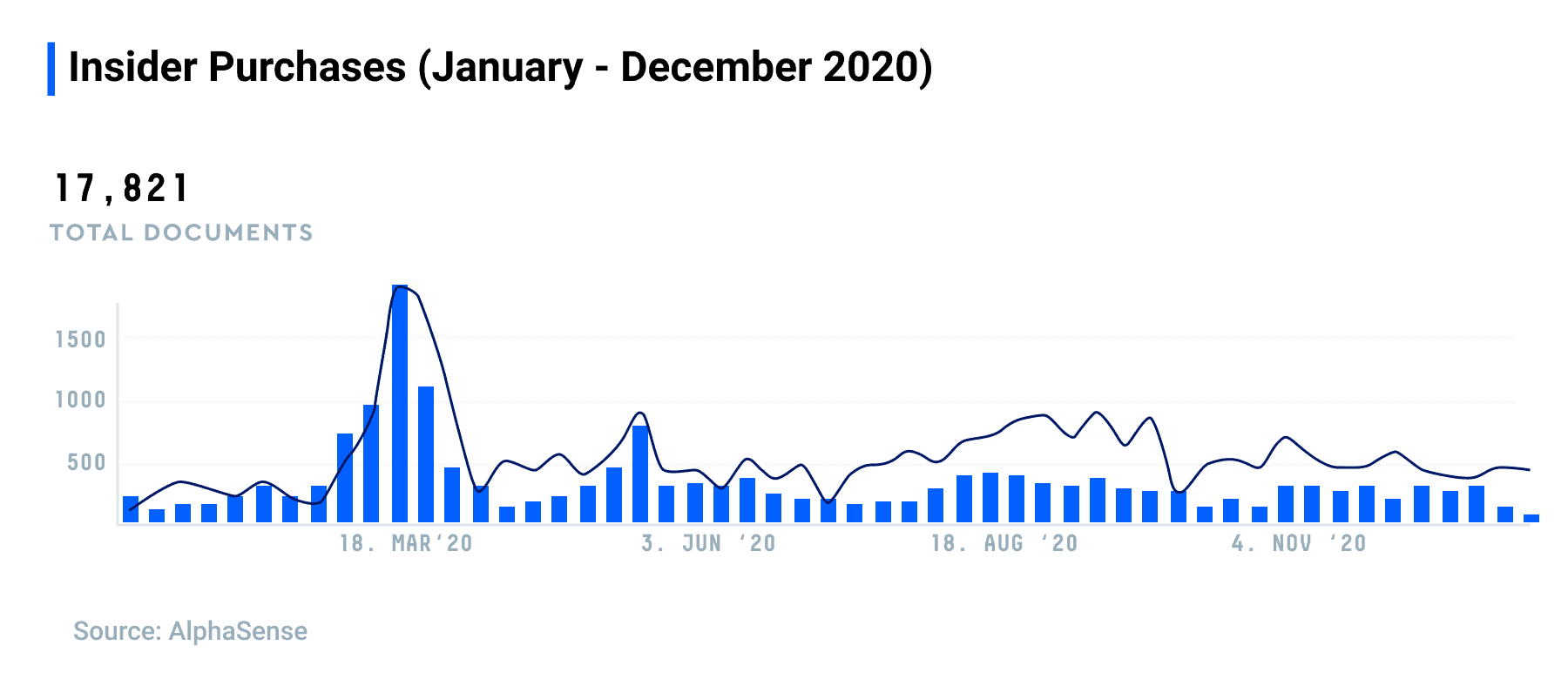

In March of 2020, AlphaSense noted a spike in insider buying, as corporate insiders bought up shares of their own companies at record rates–well exceeding 2009’s previous record. The momentum died off shortly thereafter, with the sell-buy ratio returning to “normal” a mere month later.

Within the first three weeks of 2021, over 2,148 insiders have sold their stock and 489 have bought shares. This follows a strong quarter of increased buybacks and a spike of insider sales in November and December, where the sell-buy ratio tracked by Washington Service exceeded 4-to-1 for the first time since 2017.

Insider sales spiked in November and December following the 2020 Presidential election, leading into January 2021 where AlphaSense has noted what appears to be a negative outlook for the total market.

According to the data, company executives sold $300 million worth of shares in 2020, 16 times the total they purchased. You can see every transaction from 2020 on AlphaSense’s Insider Transactions Feed. Dive deeper into January’s insider sales and insider purchases for more.

For a full recap of the trends shaping the decade, including insider transactions and buybacks, read AlphaSense’s 2020 Year in Review: Analyzing a Pandemic-Struck Market.

Insider selling: where were we in 2020, and how are we starting 2021?

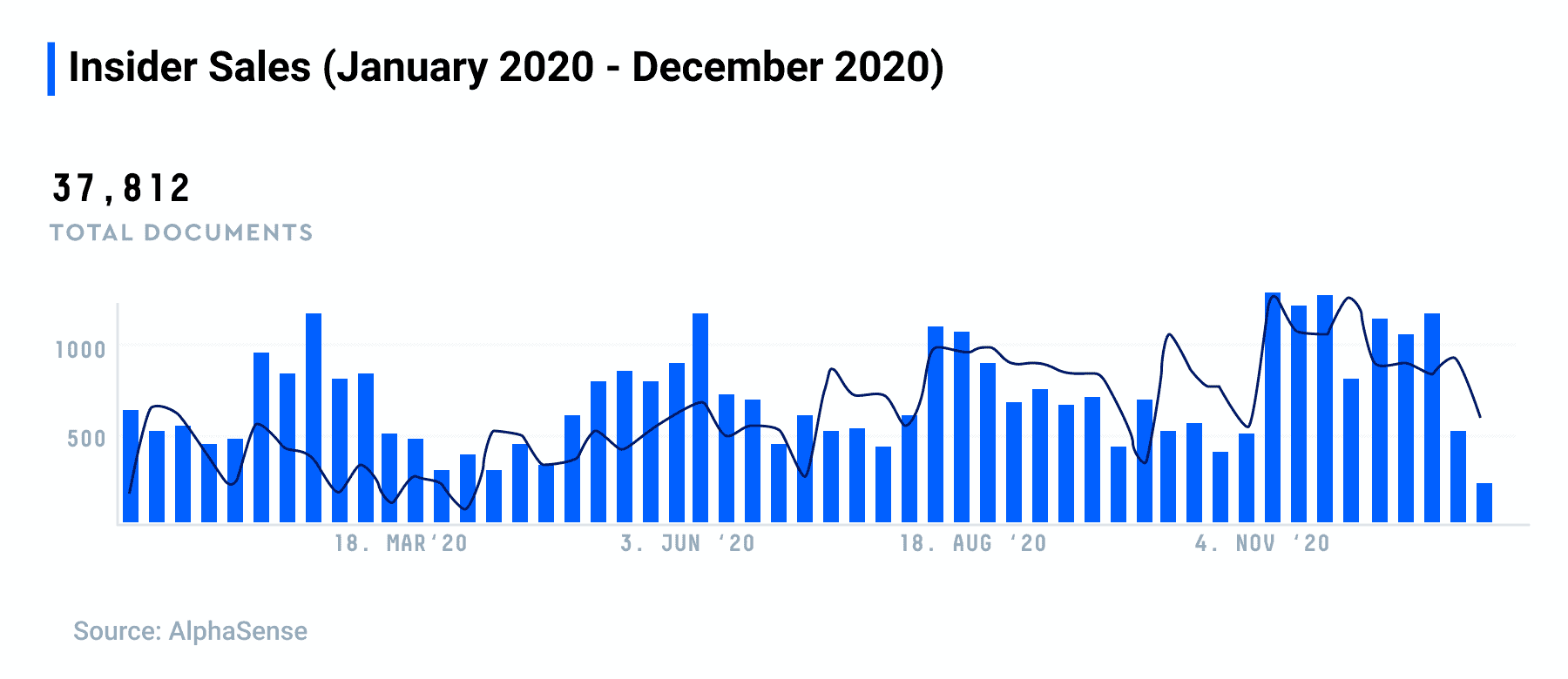

Insider selling reaching a new high in November and December of 2020, following the 46th Presidential Election. The spike signaled what appeared to be a negative outlook on the market moving into 2021.

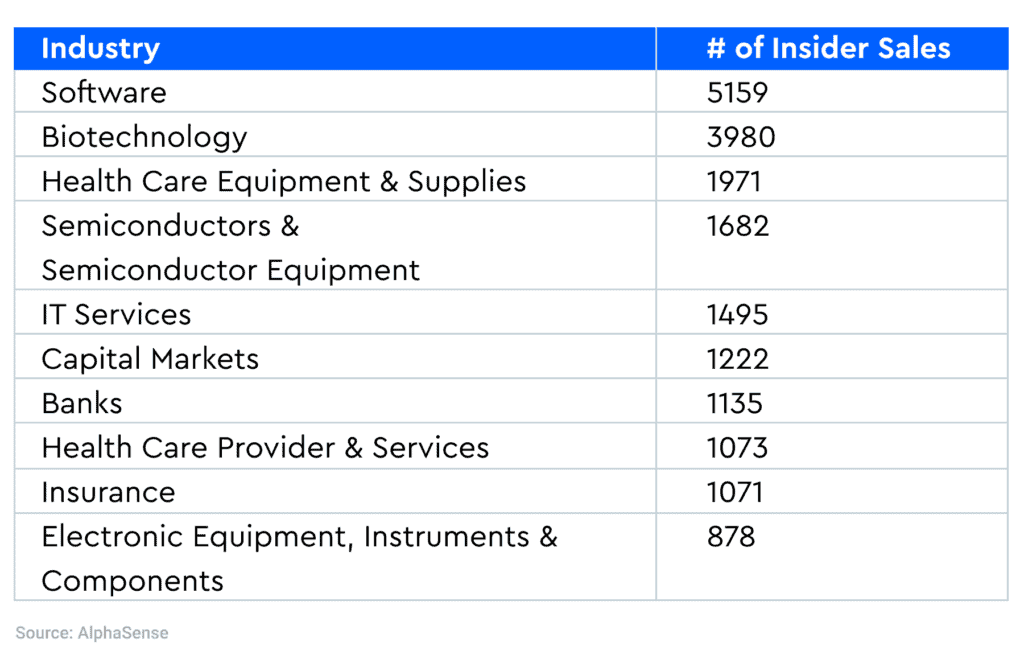

Zooming out to all of 2020, we saw the highest concentration of insider selling in Software, Biotechnology, and Healthcare Equipment & Supplies.

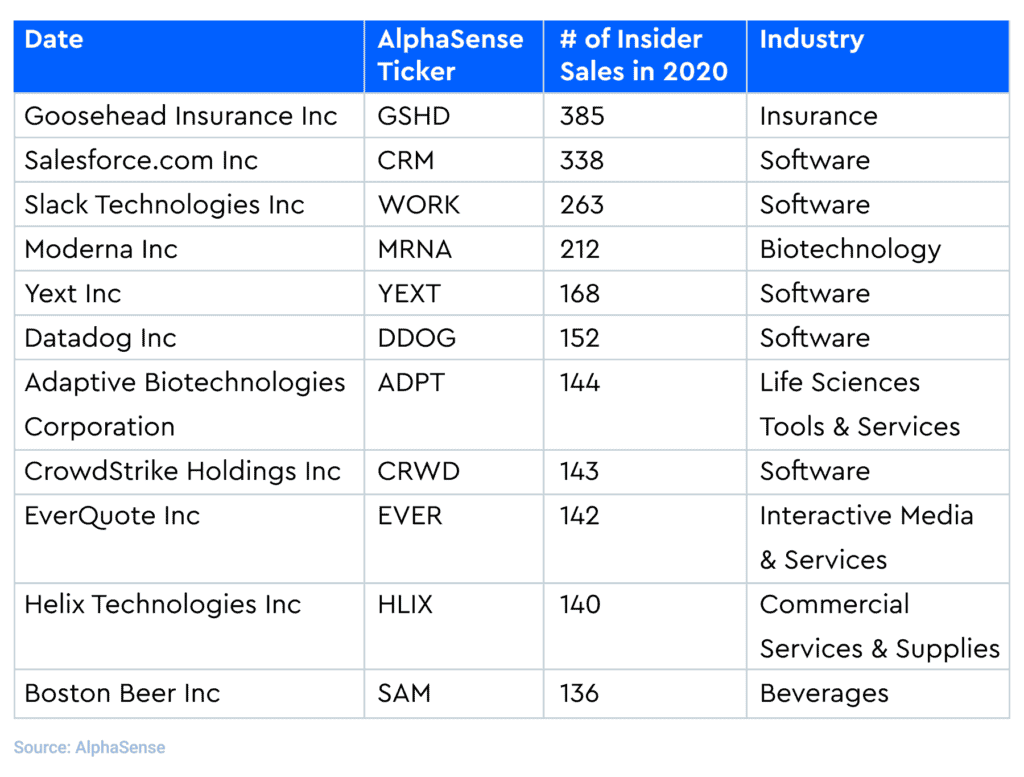

Goosehead Insurance led with the largest number of Insider Selling documents within AlphaSense, followed by Salesforce, Slack, Moderna, and Yext.

Insider purchases: after the spike in March 2020, will we continue to see decreases?

In March 2020, the U.S. economy came to a halt as COVID-19 caused country-wide shutdowns. Corporate executives took advantage by purchasing shares of their own companies at record rates, causing the largest spike of insider purchases since 2011. Since, insider buying has decreased significantly, only to rebound slightly in January 2021.

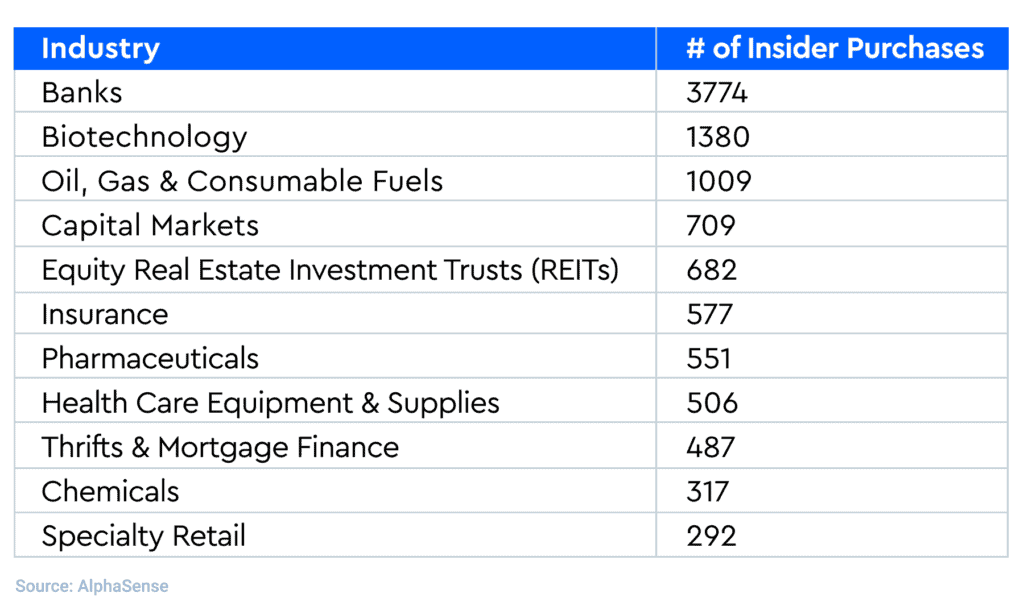

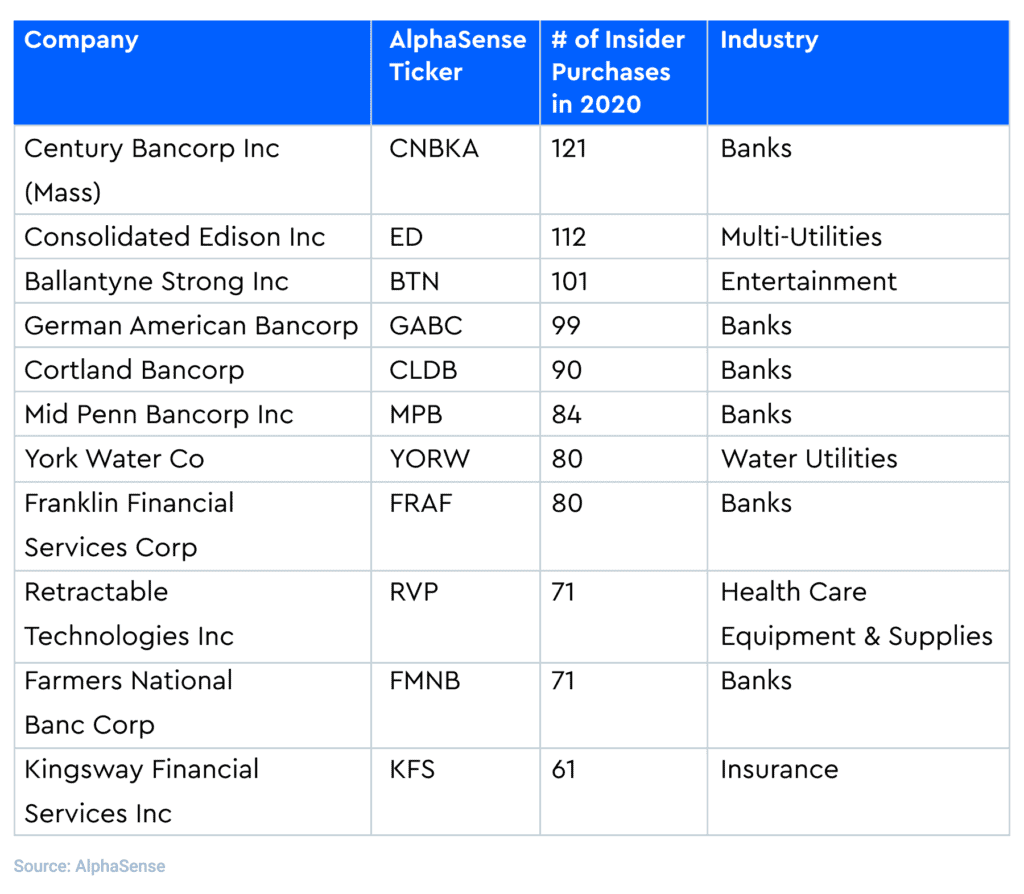

Last year, we saw the highest concentration of insider buying in Banks, Biotechnology, and Oil & Gas.

Boaz Weinstein and Saba Captial Management group (followed by Horizon Asset Management, Fundamental Global Investors, and Renaissance CapitaCl Group, and big banks) significantly led insider purchases over the public companies. However, Century Bancorp leads the top 10 public stocks with the highest amount of insider purchases.

Stay up-to-date on insider transactions with AlphaSense’s Insider Transactions Feed, or login to AlphaSense. Don’t have an AlphaSense account? Request a free trial today.