COVID-19 has fundamentally changed health systems’, providers’, and patients’ relationships with telehealth and telemedicine. Prior to the raft of shutdowns and social distancing that began in February/March of 2020, the sector had historically struggled with low adoption rates.

According to FAIR Health, an independent nonprofit that analyzes one of the most extensive repositories of health plan data in the country, only .17% of medical claims in March 2019 were telehealth related. By March 2020, however, 7.52% of claims were related to telehealth. This increase – over 1,000% in one year – indicates that healthcare services providers forced themselves to adapt to meet their patients’ needs and provide sufficient revenue to survive the widespread prohibitions on elective procedures and non-essential in-person care.

Telehealth usage was further encouraged by federal agencies and policymakers. The Center for Medicare & Medicaid Services (CMS), for instance, temporarily increased the number of services covered through telemedicine. Platforms such as Skype and Facetime were also allowed due to a temporary relaxation of stringent HIPAA security requirements.

Illustrating the rapid adoption, the Primary Care Collaborative (PCC) surveyed providers the week of March 22 and 60% of survey respondents worked at practices with no telehealth options. The following week that number was down to 39%. What’s more interesting is that in both surveys, a significant number of respondents stated their intention to keep telemedicine as an option after the pandemic subsides.

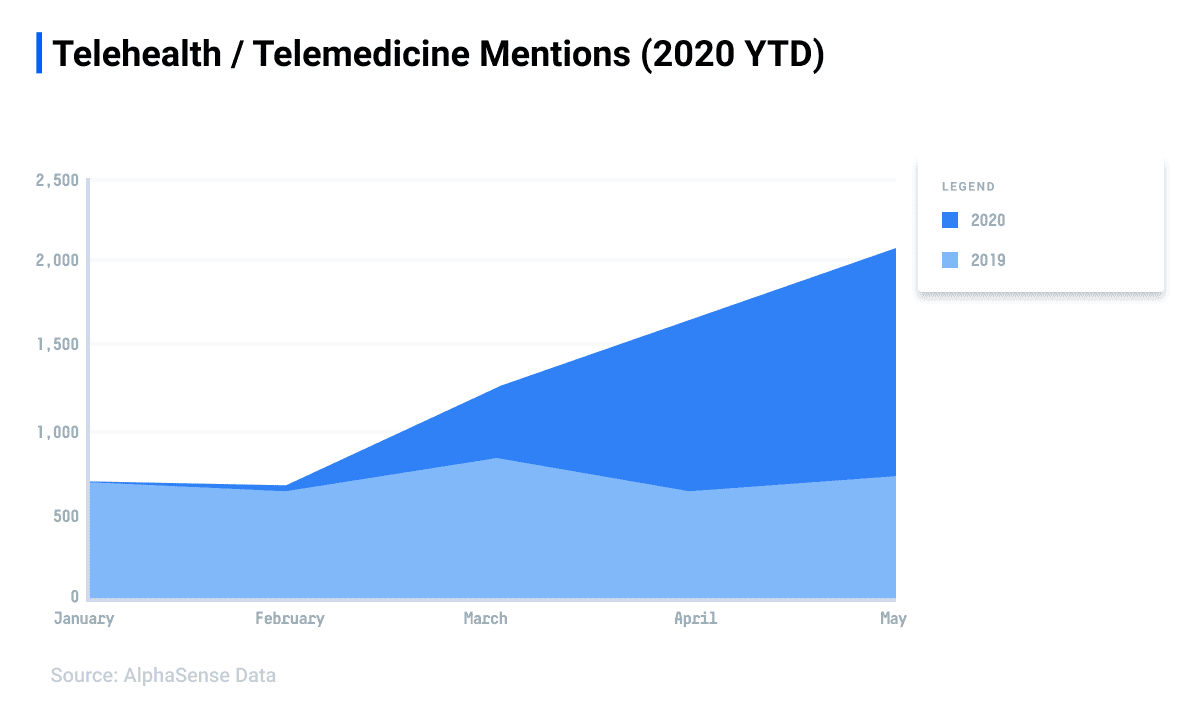

According to AlphaSense data, corporate leaders and research analysts alike rapidly turned their attention to digital health in early 2020, evidenced by a sharp increase in mentions of telehealth and related terms. In fact, more mentions of terms encompassing telehealth and telemedicine were logged in the first six months of 2020 than in all of 2019.

Future Possibilities

Assuming telehealth remains a mainstay within healthcare post-COVID, McKinsey analysts estimate that telemedicine can grow from $3 billion in revenue to $250 billion. McKinsey further estimates that telemedicine could replace 35% of home health visits and 24% of office encounters. The analysis identified five areas of outpatient care that telemedicine could transform:

- Remote medication management

- Virtual home health with remote patient monitoring

- Virtual provider care combined with distributed lab and immunization sites

- On-demand urgent care

- Virtual e-visits at clinics for established patients

Capitalizing on this opportunity, companies such as GlobalMed are introducing new payment models for telehealth platforms such as their fixed-cost telemedicine solution for providers and hospitals ($799/month) to lower the capital requirements for health care organizations to scale telehealth services.

CMS also recently announced their intention to maximize allowable (barring legislation) telemedicine uses to increase the momentum towards more substantial adoption by providers and patients.

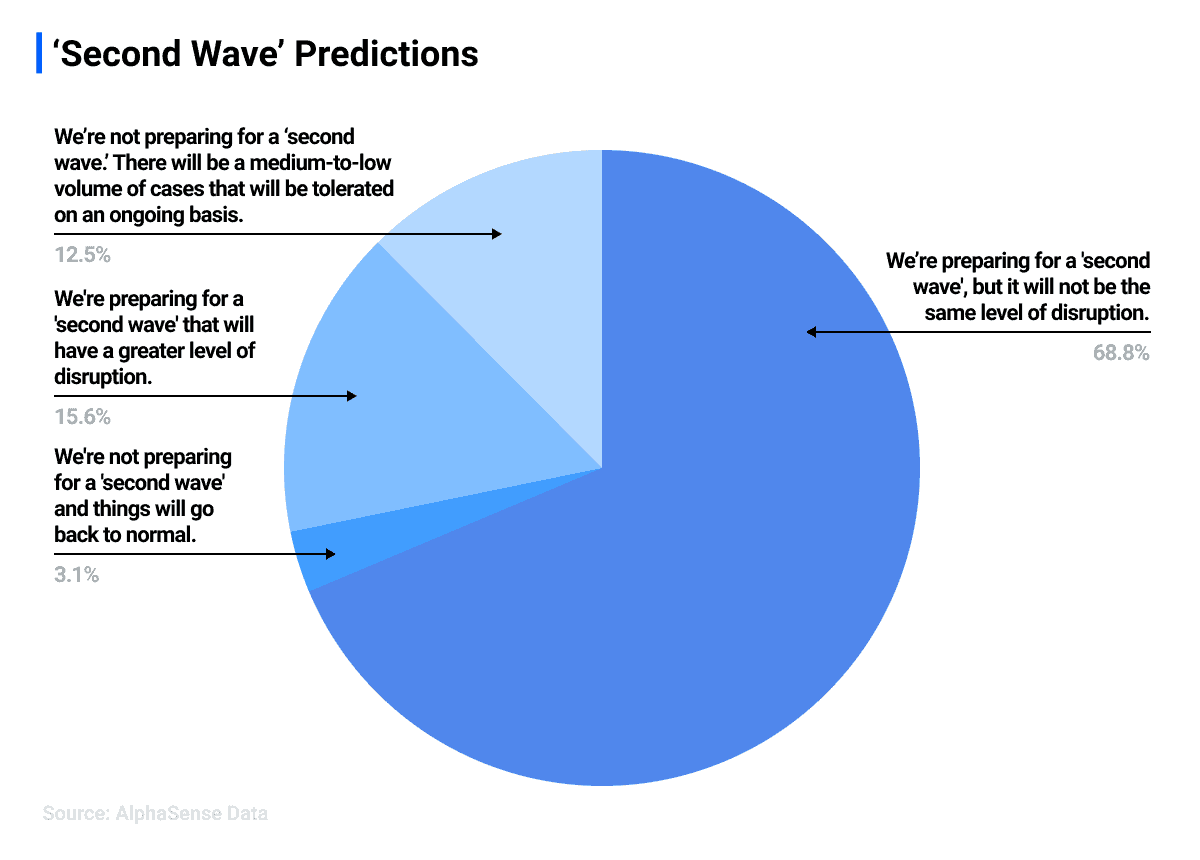

This momentum is likely to continue throughout 2020, with corporate leaders already starting their preparations for an impending “second wave” of the virus. When AlphaSense polled healthcare and lifesciences professionals about how they are thinking about the “second wave,” 84% mentioned that they are currently making “second wave” preparations.

Source: AlphaSense webinar poll with healthcare/life sciences professionals

Likely, some providers, especially those involved in value-based payment modes with strong cost-based incentives, will continue to increase their use of telehealth when clinically appropriate. Technologies such as remote patient monitoring not only hold the potential to improve outcomes but also increase the likelihood of reducing care costs for fragile patients. This cost-savings potential is especially true for patients with costly chronic conditions such as diabetes, chronic obstructive pulmonary disease (COPD), and congestive heart failure (CHF).

Challenges

While now is a more opportune time than ever for telemedicine to expand and become a mainstay in healthcare, significant challenges still exist, If not addressed, these challenges will hinder permanent, widespread adoption. State boards determine medical licensing in the United States, and it is more often than not the case that providers must be licensed in a state to see patients (even virtually). While there have been movements to harmonize licensing, such efforts have not achieved widespread support for political and economic reasons. This limitation makes it difficult for companies to provide sufficient scale to offer competitive specialized services to patients.

Additionally, in many cases, especially with commercial health plans, reimbursements for telemedicine are lower than comparative in-office visits. This financial disincentive may lead to a situation where providers have to spend the same or more time (due to technology challenges and having to compensate for not having direct physical contact with the patient) for less revenue.

Connectivity is also a challenge. In underserved areas, where telehealth could be an ideal remedy for physician shortages, there are still limitations on broadband access. Telemedicine requires that the patient and the provider possess stable, high-quality internet connectivity to ensure that an adequate examination can occur (or for remote monitoring, to ensure that devices are regularly updating providers on a patient’s condition).

Data also appears to indicate that telemedicine visits, as a percentage of total visits, have been declining since their peak. This decline is occurring even though outpatient visits have still not returned to pre-pandemic levels. While COVID-19 has provided a proving ground for telehealth on a large scale, providers and their support staff have yet developed workflows to integrate it into daily practice and have, as opportunity has allowed, reverted to traditional in-office visits in some cases.

Possible Future Trends

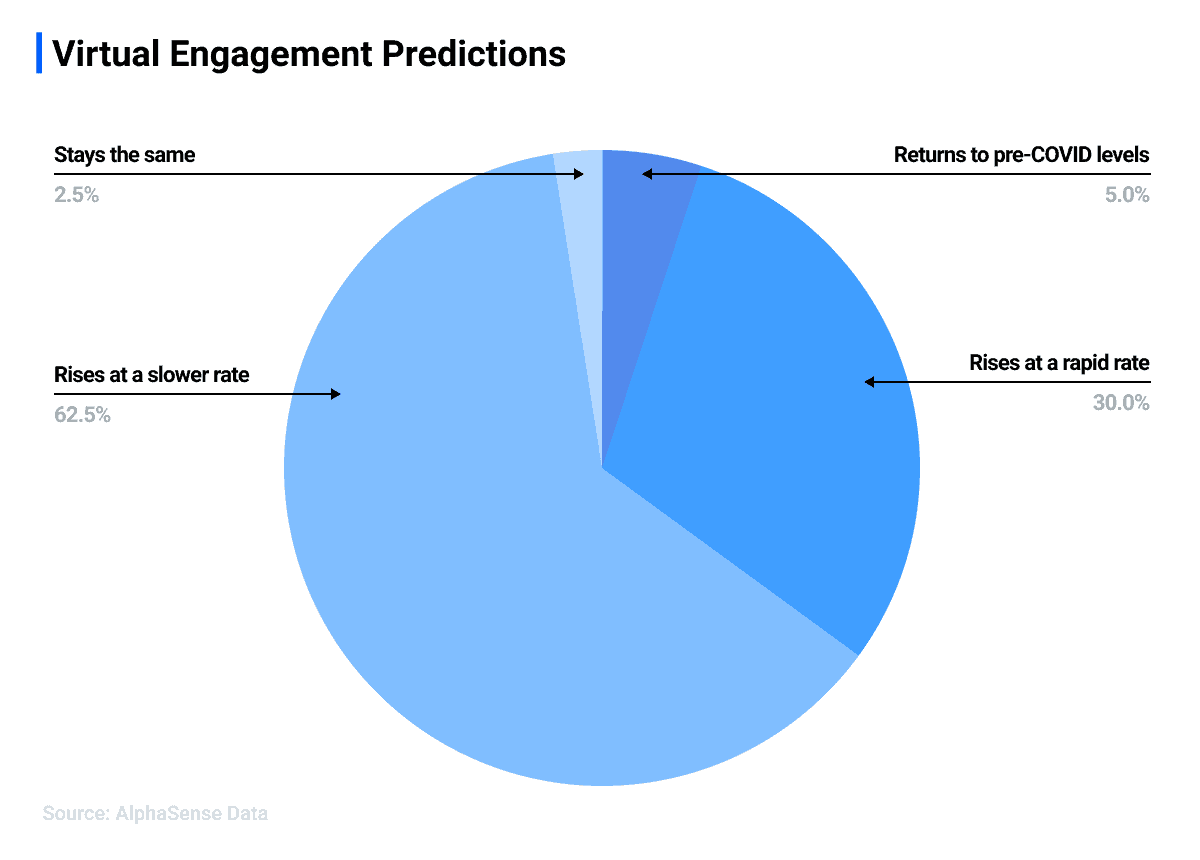

If social distancing continues as a mid-long term measure while the research and development of other adequate treatments continue, telemedicine usage will likely continue to exceed pre-pandemic levels. According to an AlphaSense survey, Healthcare and Life Sciences professionals agree, with 92.5% agreeing that virtual engagement is here to stay.

Source: AlphaSense webinar poll with Healthcare/Life Sciences professionals

To convert this into a more viable—and when medically possible, preferred—option, care delivery method payment policies, provider incentives, and connectivity challenges will need to be addressed. Provider clinics will also need to invest resources in developing efficient workflows that combine virtual and in-office visits. Pre-pandemic efforts to move towards value and cost-drive care models (e.g., direct primary care, accountable care organizations, bundled payments, and capitation) provide an inherent incentive to promote telehealth. It is more likely than not that more significant numbers of providers will be more amenable after having had exposure to it.

Edward Worthington is the owner of Advanced Health Technology Solutions – a healthcare IT consulting firm that advises and develops custom IT solutions for startups, ACOs, and physician organizations. He has over fifteen years of healthcare IT experience in HIE development, analytics implementation, data integration, HEDIS reporting, and application development.

If you are interested in AlphaSense content, visit our Resources Center. For more data and analysis about telehealth and telemedicine, start your free trial of AlphaSense or log into your account.