The industry

Investment banks assist large, corporate clients across the globe on a myriad of complex financial transactions. M&A bankers are well-regarded for their deep sector and industry knowledge; providing their clients with market and company-level insights. When advising clients on various types of M&A activity bankers must deliver a strong investment thesis and company valuation.

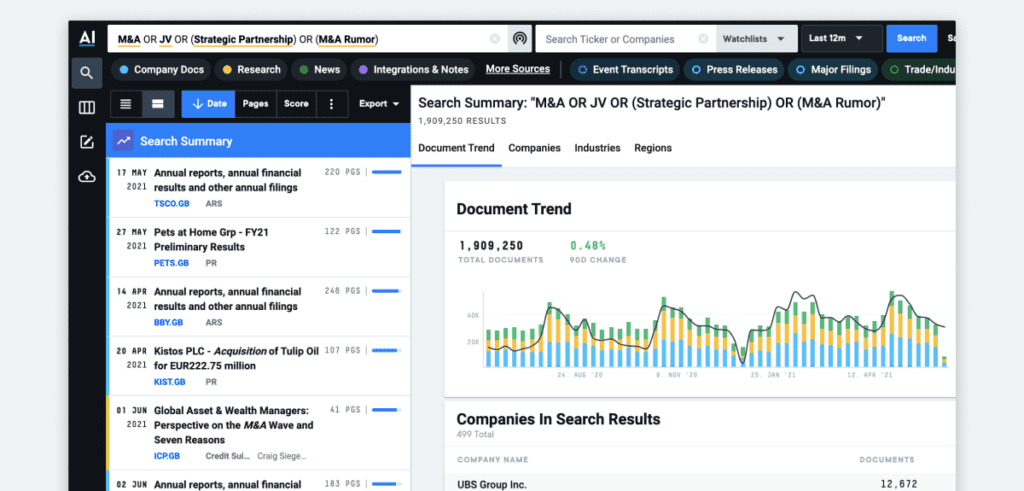

The majority of bulge bracket firms, in addition to many middle-market and boutique firms, utilize AlphaSense. We interviewed M&A banking teams at various firms to understand how the platform has changed the way they source and monetize financial intelligence through AlphaSense.

The challenge

Often covering 50 to 60 companies at once, it’s critical that bankers stay on top of macro trends, transaction activity, executive commentary and industry developments to understand potential impacts to their clients. However, to produce detailed and accurate comp spreads or profiles on potential targets, analysts must sift through all the relevant research reports and articles they can find – across various platforms – to uncover specific financial metrics. Major pain points are:

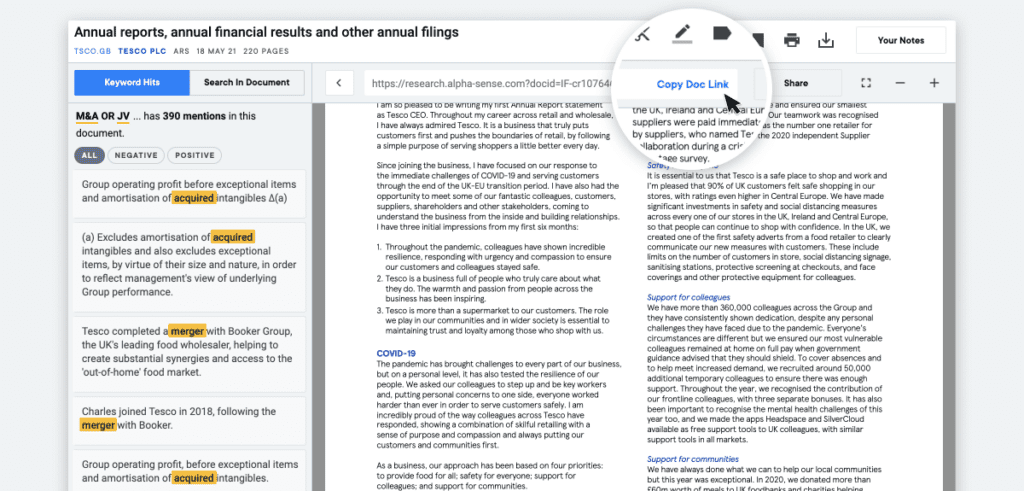

Hard to find information

Key financial metrics are often buried within non-traditional sources of information like IR presentations, press releases, and call transcripts. If a company is private or not covered by equity research, finding relevant financial information on headcount, growth, or CapEx becomes an even greater challenge. “It might take me three hours to CTRL+F through reports to find what I’m looking for,” said one analyst.

Low confidence in completeness of data

Finding esoteric company information is just as important as knowing when it can’t be found. Bankers often waste hours looking through various sources and research platforms to ensure they’ve covered all bases.

Not knowing when deals are scrapped

One associate noted “A deal gets canceled and you have no idea unless you constantly refresh BamSEC throughout the day, which is not practical, timely, or a good use of time.” Smaller companies that don’t get as much news coverage often go missed.

Multiple high-cost subscriptions & platforms slow the process and can cost millions of dollars annually

In order to execute a thorough and well-sourced due diligence process, bankers retain multiple vendors to help them source and cite credible information. As a result, there is no centralized place to cite and share information with the broader deal team.

Results

Higher Confidence, Sharper Thesis

One tech analyst stated that “if I can’t find it in AlphaSense, I am 99% sure it doesn’t exist.” Not only does he feel confident in “coming to a conclusion quicker,” the unique insights he garners from AlphaSense allow him to “adapt a thesis.” How? Groundbreaking AI technology built to understand financial language allows analysts to move fast and capture all the relevant information around a topic that a simple CTRL+F can’t match. “AlphaSense knows banking terms” and fills in the blanks by finding nuanced financial metrics that aren’t on standard 10-Ks and 10-Qs. It effectively parses through alternatives of information sources which are especially critical when a company isn’t covered or is in an emerging industry. Ultimately, these insights “reflect directly back on the high quality of work and strengthen the client relationship.”

“This project would typically take five hours over the span of a few days and I did it myself in 10 minutes…while we were on the phone with the client.”

Diversified Industries Associate, bulge bracket firm

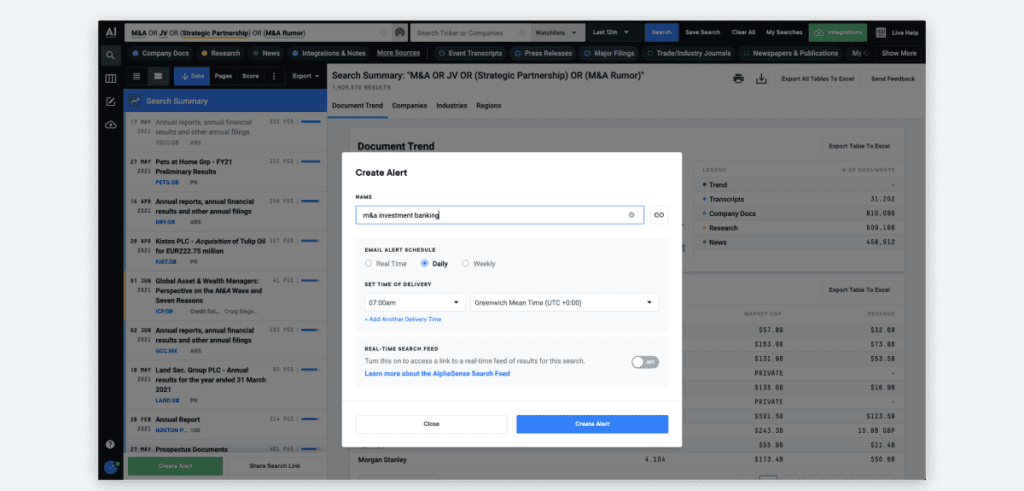

Critical information in real-time

AlphaSense aggregates and proactively alerts users of relevant news they would have otherwise missed. “I’m blown away. Making a profile on a potential target and AlphaSense has been great as a one-stop-shop” shared a diversified industries associate. Since implementing AlphaSense watchlists, bankers are finding more information on companies than they had before and are mitigating the risk of missed information and incomplete due diligence.

Another analyst noted that other platforms are limited to US-only company information and don’t provide alerts when statements are out. She needs to know what other banks are covering and when there is new transaction information. Knowing which deals have closed can “affect the valuation.” With AlphaSense alerts, it’s all tracked in one spot and “I look smart.”

“There’s no search tool that’s even close to as robust… to get [all the information] here is great and mitigates the risk of missing information.”

Analyst, bulge bracket firm

Cost-savings

While bankers work smarter and faster with AlphaSense, there is the added benefit of significant cost savings. One COO was excited to share that not only did he consider AlphaSense’s offering to be “superior,” but he was able to eliminate a redundant research platform, saving the firm 72% annually on research costs. Analysts and associates echoed this sentiment, sharing that their firms could eliminate “one or two” other research platforms currently in use.

Organizational efficiency

With the cost of research high and the underlying process slow, banks increase efficiency with AlphaSense. Bankers find the platform contains all of the reputable sources they need to conduct their research. One analyst stated that AlphaSense “helps me quickly source, aggregate, validate and share information.” When searching for a non-covered consumer company on Google, another analyst shared that she had “wasted a ton of time” and found many of the sources to be “unreputable.” “Where AlphaSense changed my life was M&A comps.” It was “easy to find reputable sources that lawyers were okay with.” When she’s ready to disseminate her work, the analyst simply shares the document link with the team and “they’re taken to the exact mention.”

Bankers have more information than ever before at their disposal, but AlphaSense is the competitive edge empowering them to extract meaningful insights from nuanced, financial information that other platforms simply can’t find.

Get started today

The world’s leading corporations and financial institutions—including a majority of the S&P 500, over 85% of the S&P 100, and 75% of the top asset management firms—trust AlphaSense for smarter, faster decisions.

Start my free trial