The government is going after Big Tech – again. In June, House lawmakers unveiled their most ambitious move against tech giants yet. They proposed five bills designed to rein in Big Tech and loosen their grip on digital industries. While it is easy to dismiss the latest round of hearings as a purely political spectacle with no concrete momentum, the behavior of these companies has evolved under the spotlight and under government pressure.

Ultimately, regulation takes time and a lot of hearings to bring about tangible results. But the goal isn’t necessarily to pass a law. Instead, Congress can use these hearings as a bully pulpit to twist the arms of these companies and push them towards self-regulation.

A new administration signals a new approach to big tech

The Biden Administration has ushered in a new wave of interest around Big Tech.

One of the most defining moves thus far has been the swearing-in of progressive tech critic Lina Khan, as chair of the Federal Trade Commission. News of her agency leadership dropped just hours after the Senate confirmed her to serve as a commissioner. The announcement acts as a significant statement on President Joe Biden’s intended direction for the FTC. Beyond the president, Khan’s confirmation signals a bipartisan desire to push forward tech giants’ regulations. She received significant support from several Republicans.

No stranger to the antitrust circles, Khan rose to fame within the field through her work for the Yale Law Review in 2017, titled “Amazon’s Antitrust Paradox.” In the years since she has become a recognizable figure and noted amongst progressives as a stringent proponent of antitrust laws. As chair, she will be tasked with voting on enforcement matters in both competition and consumer protection.

Doubling down further on this administration’s new direction, Biden signed an executive order to crack down on anti-competitive practices in Big Tech and other sectors. The sweeping order includes 72 actions and recommendations intended to reshape the thinking around corporate consolidation and antitrust laws.

“Let me be obvious: Capitalism without competition isn’t capitalism. It’s exploitation. Big players can change and charge whatever they want without healthy competition and treat you however they want. And for too many Americans that means accepting a bad deal for things you can’t go without. So, we know we’ve got a problem, a major problem,” Biden said at the White House in a speech he delivered before signing the directive.

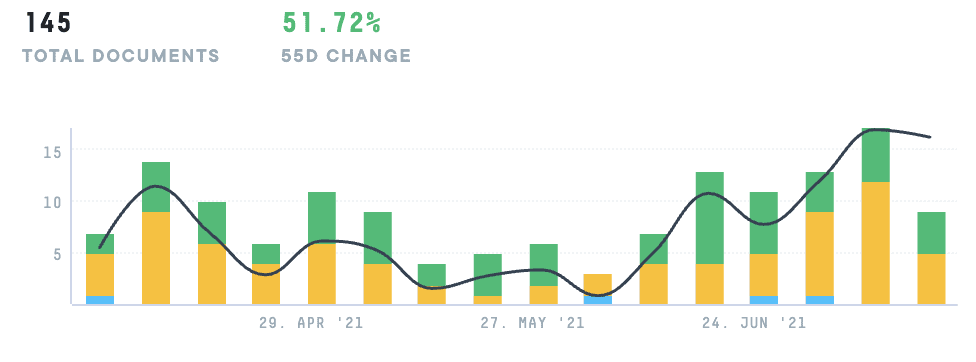

And Biden’s progressive directives are not going unnoticed. For example, in the last 90 days, there has been a 291.25% increase in documents in the AlphaSense platform for “Biden” and “big tech.” Similarly, since the hearings in April, “big tech” and “regulation” have seen an increase in search and document volume, as seen below.

These upticks feel anything but surprising. But, given that Big Tech touches virtually every aspect of our lives, both professionally and personally, it is no wonder that the documented trend remains steadily searched for.

Inside congress’ latest five bipartisan bills

The proposed legislation seems to specifically target the biggest tech companies, all of which have faced intense scrutiny over antitrust issues in recent years. The bills aim to equip regulators with more power to control big tech firms from asserting market dominance.

Antitrust subcommittee Chair Rep. David Cicilline (D-R.I.), one of the leading proponents behind stronger regulation, said that Congress needs to curtail the power of tech giants. The antitrust legislation “is fundamentally about whether or not we have an economy where businesses fighting for economic survival can succeed,” Cicilline said. “It is about whether our economic future is going to be defined by the success of the best businesses with the best ideas, or simply the biggest companies with the biggest lobbying budgets.”

Here are the five bills being proposed and what they intend to do:

- American Innovation and Choice Online Act: prohibits companies from discriminating against smaller competitors and prioritizing their products ahead of others.

- Platform Competition and Opportunity Act: empowers regulators to block dominant companies from acquiring would-be competitors.

- Ending Platform Monopolies Act: prohibits companies from crushing smaller competitors and undermining fair and accessible online competition.

- Augmenting Compatibility and Competition by Enabling Service Switching (ACCESS) Act: allows new companies to quickly enter the market by changing requirements that affect costs for businesses.

- Merger Filing Fee Modernization Act: updates are filing fees for mergers so that regulators could better enforce antitrust laws.

Tech companies lean into transparency

After four years of high-profile hearings, tech companies have become increasingly transparent.

After the hearings that followed the 2016 election, the biggest concern from Congress was how little they understood about how tech platforms operated. However, lawmakers have since come a long way with their understanding of these business models.

Across the aisle, criticism of Big Tech has accelerated. Over the last few years, Congress has been asking itself, are existing competition policies and century-old antitrust laws adequate for overseeing tech giants, or is new legislation and enforcement needed?

As this question continues to seek answers throughout Washington D.C., these companies have lawyered up in significant ways. They use hearings to time policy their announcements, frequently aligning with the proposed legislation, showing they are responsive to lawmakers’ concerns.

Takeaways

We dug into the broker research documents on the AlphaSense platform and gathered several key insights and takeaways.

- Big Tech is now structurally more profitable than before, with only a gradual resumption of previous costs. There are record levels of profitability and cash generation, aided by Big Tech’s expenses during the pandemic.

- Following the announcement that a federal judge dismissed antitrust lawsuits filed by the Federal Trade Commission (FTC) and 46 states, Facebook shares increased, resulting in market capitalization of more than $1T for the first time, joining an exclusive club that currently only includes Amazon, Apple, Google, and Microsoft.

- The bills are not simply the pet projects of a few anti-tech legislations but instead the definitive statement of an overall agenda to confront Big Tech that will roll into 2022 midterm elections.

- The market believes that the risks are manageable and that regulations and tax changes would take years to enact.

Looking for tips that you can use for future market-impacting events to better prep and plan for the future? Look no further. Download our white paper, Four Ways to Approach Global Market Impacting Events.