Since 2020, the global economy has undergone its fair share of volatility due to a host of macroeconomic and geopolitical factors. And though the economy seems positioned to be significantly more stable already in the early months of 2024—with the toll of inflation, unemployment rates, and the threat of a looming recession mitigated—a universal economic outlook remains uncertain.

With new and ongoing wars plaguing Europe and the Middle East, intensifying climate concerns, and an upcoming U.S. presidential election, business leaders have to be more resilient and adaptable than ever before.

By this point in 2024, most business leaders have recognized the value of adopting resilience measures in order to effectively manage uncontrollable circumstances and even gain a competitive advantage amidst hardship. Further, they have seen the importance of understanding a market landscape from all possible angles and perspectives, so as to be prepared and proactive in the face of unforeseen macroeconomic events.

In today’s age of information overload, separating critical signals from irrelevant noise is a full-time job. So, how can companies and investors efficiently find the information that helps them make smart decisions and keep turning profit?

The secret lies in combining premium content sets with an AI-based research tool that parses, connects, and analyzes various disparate sources of information. The best organizations continuously evolve to free their knowledge workers from the confines of repetitive, low-value research. This is especially true during moments of economic uncertainty, where time is a particularly precious resource and leveraging accurate insights is crucial to success.

Combine Content with AI

AlphaSense is a market intelligence platform that stands apart from other research solutions due to its extensive universe of content and its advanced AI search technology.

Our platform provides access to 10,000+ premium sources of private, public, and proprietary business information all in one place—combining the four key perspectives for effective market research. Then, its powerful, patented AI search technology works to uncover and extract the most relevant,impactful insights from that content in seconds—eliminating the need to rely on CTRL+F and parse through multiple tabs of documents. AlphaSense allows you to easily track the evolution of industry trends and market information over a period of time so as to give you a better understanding of what to expect in the future.

Companies that are able to consistently outperform the market and gain an edge over their competitors are those who:

- Have access to all relevant perspectives they need in one place, so that they never risk making the wrong decision due to research blind spots

- Embrace advanced technology to create new improved workflows, speed up time to insights, and do more with less

Below, we go over the content sets and perspectives you need to navigate economic uncertainty, as well as provide examples of how AI can maximize the value of your research efforts.

Related Reading:

10 Market-Moving Trends to Watch in 2024

Content Sets You Need to Navigate Economic Uncertainty

While each individual content set outlined below offers tremendous benefit and insights to any researcher, investor, or corporate professional, the true value comes from having them indexed, searchable, and all in one place. This allows you to quickly gain a full 360 view of the market landscape and eliminate blind spots in your research, thus avoiding poor, uninformed, and often costly decisions.

The four main content sets every professional needs to look at when navigating economic uncertainty include:

Company Documents

Company documents include SEC and global filings, earnings transcripts, ESG reports, press releases, company presentations, events transcripts, and more. They provide first-hand information about specific companies, directly from the source.

The following document types are some of the most useful when navigating economic uncertainty:

Earnings Transcripts

Earnings transcripts are crucial to understanding the performance of your competitors and/or companies you are interested in on a quarter-by-quarter basis.

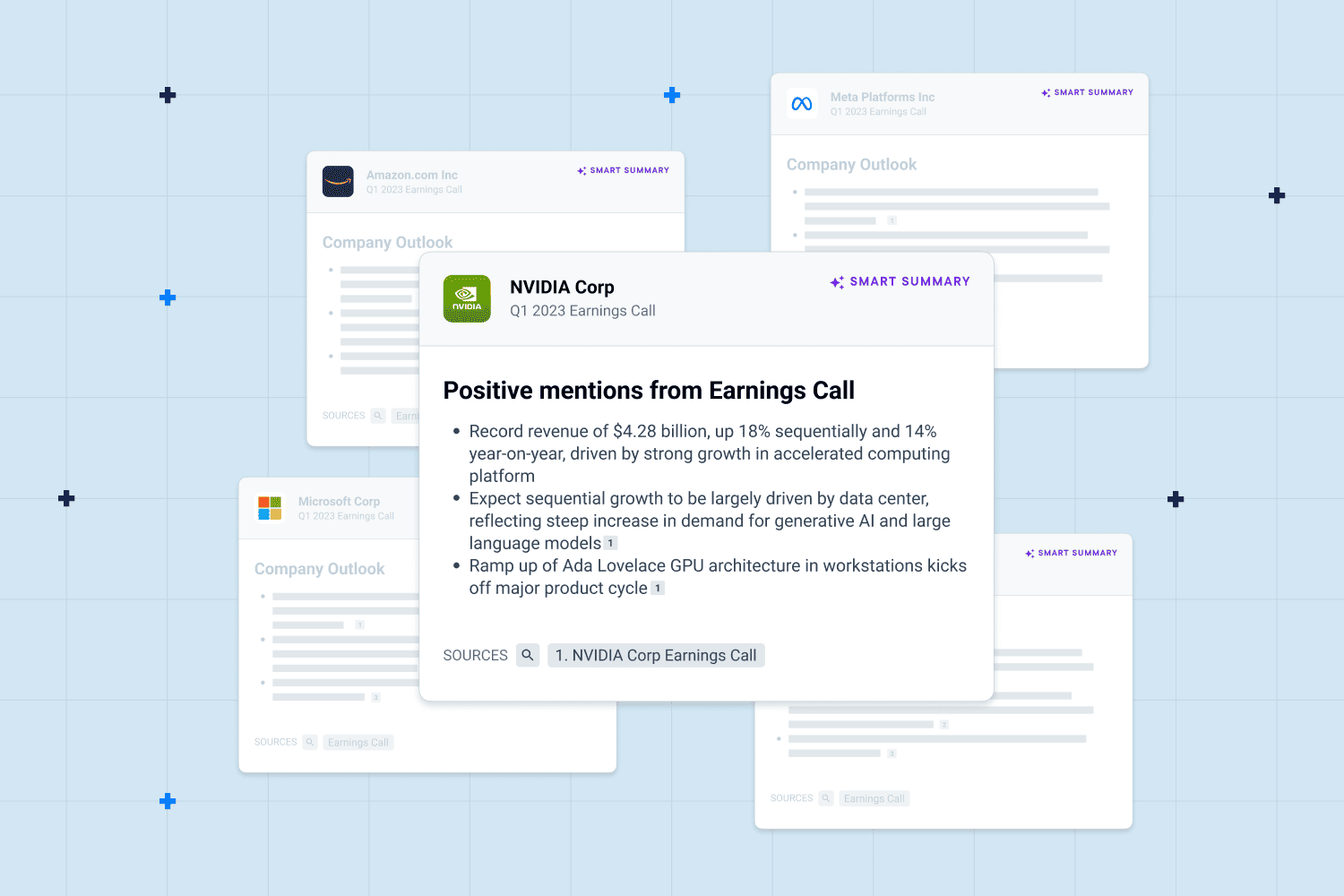

As earnings transcripts tend to be pages long, simply skimming through them will likely lead you to miss key details and nuances in the commentary. AlphaSense’s algorithm automatically aggregates and groups relevant themes and KPIs from the transcripts, and then analyzes them quarter-over-quarter.

With Company Topics and sentiment analysis, you get a high-level understanding of the topics a company is discussing most frequently, whether mentions have a positive or negative sentiment, and how those themes evolve over time. Sentiment analysis can read between the lines in nuanced ways that humans often cannot do on their own. And our generative AI feature, Smart Summaries, generates instant summarizations of earnings transcripts, allowing you to accelerate your earnings analysis and spend more time on high-value tasks.

Related Reading: How to Prepare for Earnings Season With Artificial Intelligence

SEC Filings

Company filings offer the most detailed and objective view into a company’s financial standing. They often include information that is not found in corporate press releases or earnings transcripts, and investors can use filings from institutional investors to generate future investment ideas. AlphaSense aggregates all of these filings from thousands of companies in one place, making it easy to perform seamless due diligence and faster research.

Related Reading: Identifying Red Flags in SEC Filings

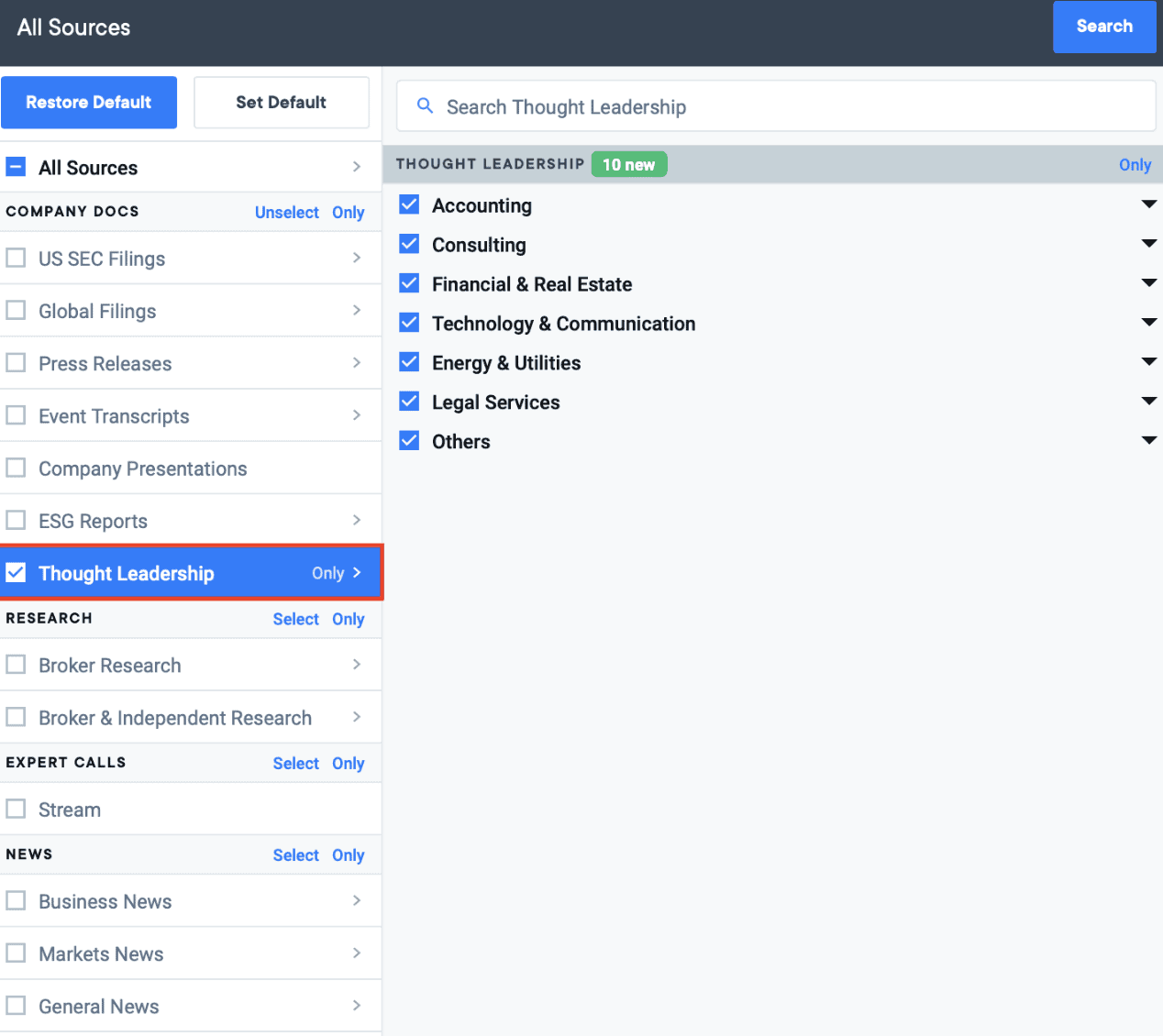

Thought Leadership

Produced by consulting firms, these documents include insights into industry trends, expert perspectives, market outlooks, forecasts, and other market analyses. AlphaSense provides access to insights, commentaries, surveys, and market research published by 70+ firms including McKinsey, BCG, Bain, Deloitte, PwC, EY, and more.

Thought leadership has the power to give you clarity on market-moving trends likely to affect the companies and industries of interest to you.

Broker Research

Broker research, also known as equity research or industry analyst research, is imperative to investor and hedge fund manager workflows, helping them stay on top of the ever-evolving investment landscape.

These days, cutting-edge corporations also utilize broker research and reports to understand analysts’ expectations on market trends and industry and peer performance. This content set can be particularly useful during times of uncertainty because analysts are often the first to produce outlooks on emerging economic trends, opportunities, or challenges. Broker research is not readily available to just anyone—it requires special access, which means that companies with access tend to have a competitive advantage over their peers.

AlphaSense’s premium broker research offering, Wall Street Insights®, is the only collection available for the corporate market that aggregates reports from all leading global banks, including Goldman Sachs, Citi, Bank of America, and Bernstein Research. That, paired with AlphaSense’s Smart Search technology, allows you to easily parse through thousands of reports and glean crucial insights in a fraction of the time.

News & Trade Journals

News insights often reflect public sentiment—both from industry players and the general public—around a particular event, trend, or company. While broker reports allow you to go granular on a topic, it’s equally important to step back and see the larger picture. News and trade journals allow you to track how the wider world is reacting to events, topics, and news, as well as updates from government agencies.

Journals allow you to keep up with the fast-changing and fast-moving narratives of market events in real time. Yet relying on the same few top news outlets for all your information is risky, as you may miss pivotal information reported by other outlets.

Take, for instance, the collapse of Silicon Valley Bank in 2023, where in just two days, a major bank that had been operating for nearly 40 years ceased to exist. What followed were repercussions that were felt across industries and companies. By setting up alerts for all “Silicon Valley Bank” mentions within the AlphaSense platforms, our clients were able to track the progression of SVB’s downfall in real time and get insights from every news outlet discussing the bank. This, in turn, reduced knowledge gaps and time spent on information-gathering.

With AlphaSense, you get access to top-tier news sources and trade journals from every major industry.And with customizable alerts, you will never miss a pertinent news report about the topics or companies you care about.

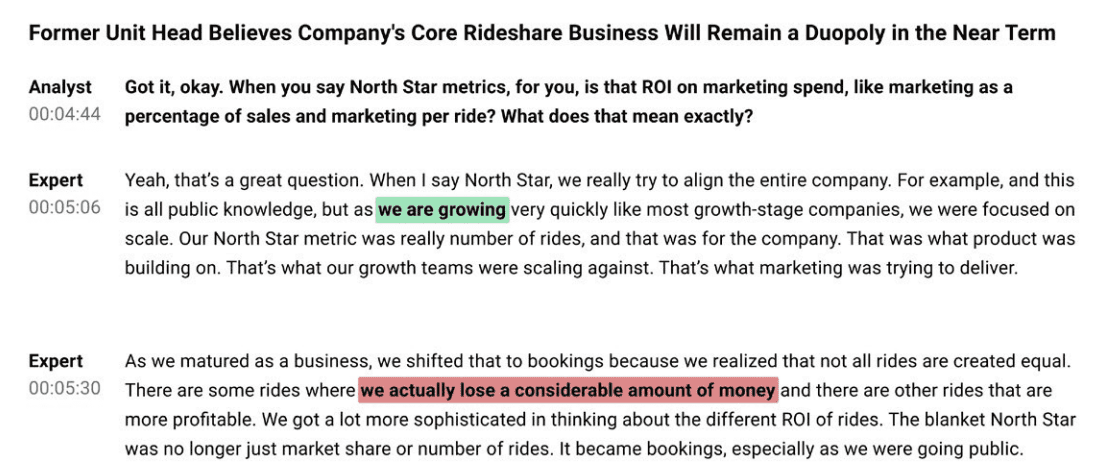

Expert Transcripts

While most corporate professionals only utilize secondary research in their market intelligence process, investors have long known the unique value of primary research. For anyone conducting market research, primary research—such as expert calls—offers the kind of first-hand experiential knowledge that is critical for developing a holistic view of any market, industry, or trend.

AlphaSense Expert Insights provides access to over 40,000 expert call transcripts, as well as the opportunity to conduct your own 1:1 expert calls for less. These proprietary expert calls provide you with exclusive perspectives on potential investment and growth opportunities during periods of market volatility. Experts can help professionals understand how certain trends could impact their companies, how their peers are being affected, and how historical events can be used to predict the outcomes of current macroeconomic hurdles.

During periods of economic uncertainty, time is of the essence. AlphaSense’s expert transcript library increases the speed and efficiency of your research with the platform’s AI-driven search features. Call summary, table of contents, and audio timestamps are just a few of the functionalities that enable you to discover the most critical insights in seconds.

Sentiment analysis, a natural language processing (NLP) feature, parses out the tone and language nuance in call transcripts and calculates a sentiment score, according to how positive or negative the sentiment is.

We add thousands of new transcripts monthly, which means you always get fresh, timely insights from our custom recruited experts. Additionally, experts recruited by AlphaSense for Expert Insights are thoroughly screened for expertise and compliance to ensure that any information gathered mitigates risk of exposure to material non-public information (MNPI).

Discover the Power of AlphaSense

AlphaSense is the only market intelligence platform that elevates your ability to locate critical information on macro themes, industries, and private and public companies, with our extensive content universe and proprietary AI technology. Our AI search engine was built for business decisions, allowing you to pull out relevant insights and streamline your research process.

Economic uncertainty necessitates agility and adaptability. With fewer employees and more risk in the market, you need a tool that helps you answer questions faster and with more confidence. Improve your decision making and help your business thrive with limited resources—no matter if it’s a bull or bear market.

Sign up for your free trial today.