How to Calculate the ROI of Market Intelligence

Get the guide

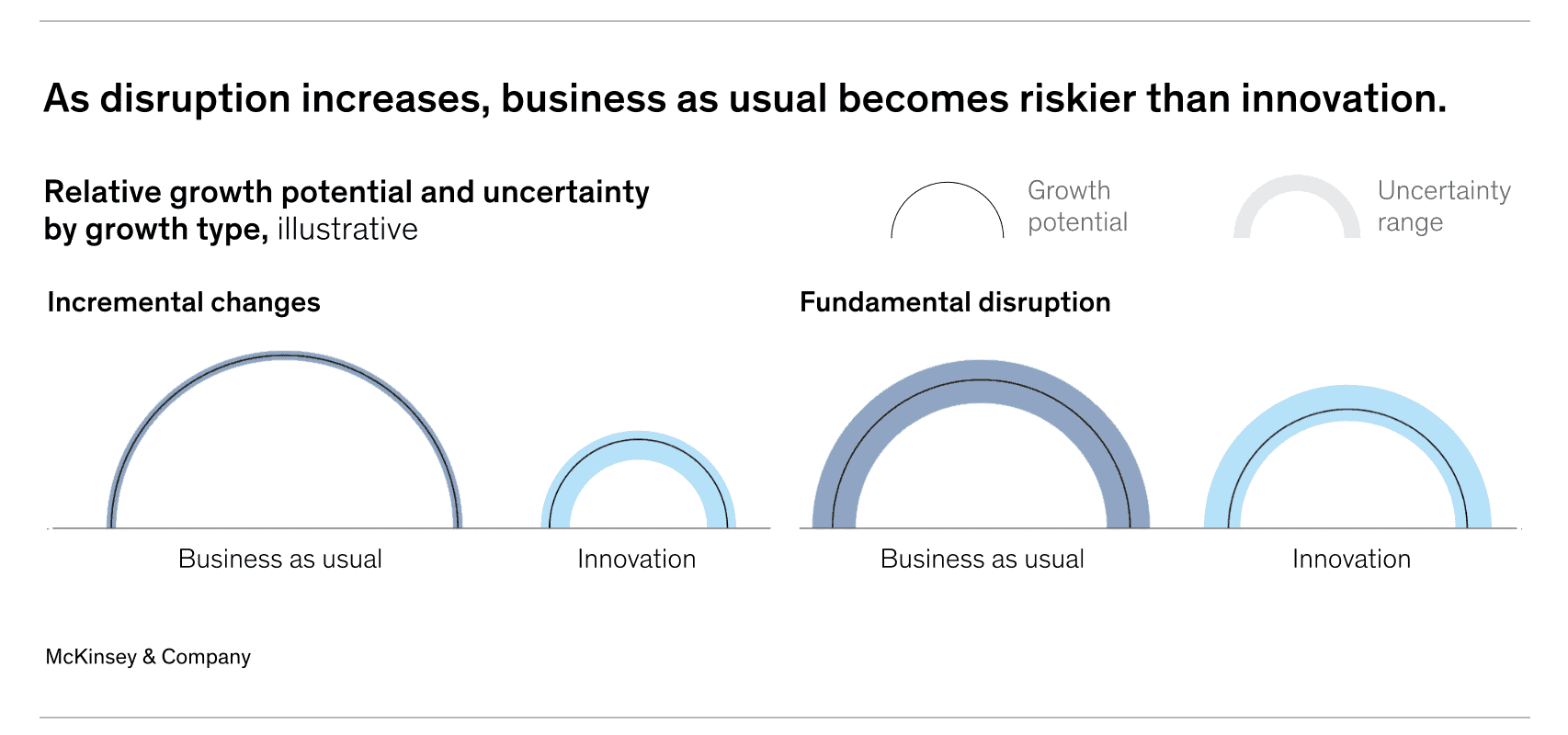

With talks of recession against the backdrop of extreme market volatility, C-Suite leaders continue to debate strategies for enduring a potential financial crisis. Historically, the predominant strategy has been to resort to reactionary tactics like layoffs, salary cuts, and hiring freezes in order to stay in the green.

However, sector titans like Apple, Block (formerly Square), Groupon, Mailchimp, and Amazon have often chosen an alternative solution: innovation.

Whether their strategy involves introducing new products to the market, changing business models, or even expanding services through a new platform—these corporations not only survive but thrive in unpredictable times.

Using the AlphaSense platform, we dug through documents dating back to the Great Recession (December 2007 – June 2009) and beyond to see how major corporations sought out growth and flourished against market volatility.

Game-Changing Offerings

A pioneer in driving demand with product updates and releases, Apple expanded its brand to encapsulate everything from wireless headphones to a credit card without fees. But how did it grow so exponentially that in 2010, a year after the Great Recession, the company recorded $65.2 billion in sales—a 52% increase from the previous year?

The release of the iPod and iTunes positioned the company as an innovation powerhouse, capable of consistently delivering new technology despite economic uncertainty.

Every year, Apple launches a new or updated product, adding to Steve Jobs’s “digital hub” of technologies that have revolutionized how consumers listen to music, watch movies and televisions, and even spend their money. With each new innovation, Apple seeks to optimize the customer experience, which has proven an effective strategy for long-term success.

As iTunes served as the basis for the iPod, the iPod laid the foundation for the iPhone and, thereafter, the iPad. Apple sold over 250 million iPods (first released in 2001) within a decade.

“Despite the decline in our sales, our research shows that about 50% of our recent traditional iPod purchasers are buying their first iPod, including those in our high market share countries such as the U.S., Japan, Australia, Canada, and the U.K. The iPod touch did extremely well in the quarter, growing more than 130% year-over-year. Customers continue to embrace this outstanding platform experience, which has been increasingly enhanced by the tremendous offerings of the App Store.”

– Apple Inc. | Q3 2009 Earnings Call

But Apple isn’t the only company to forge forward with game-changing offerings despite a volatile economic climate. Founded in the midst of the Great Recession (2009), Block—a mobile payment device for credit cards intended for small vendors, merchants, and businesses—is valued at $26 billion today. Founders Jack Dorsey and Jim McKelvey saw an opportunity in the greatest challenge business owners faced: processing credit card payments.

Payment processing might seem like the last thing on the minds of business owners and consumers during economic uncertainty (as consumer spending tends to dip), but Block was able to leverage convenience and access to its advantage. Block provided a solution by establishing key partnerships with well-known, nationwide companies that could offer immediate access to their credit card processing infrastructure, which was integrated into tens of thousands of physical stores. By focusing their innovation efforts on directly meeting customer needs, Block gained a competitive advantage that has cemented them as a leader in the fintech space even to this day.

“Square is an ecosystem for businesses to start, run, and grow their business. And it was revolutionary because we gave them software, analytics, and things they’d never known about their businesses before. We gave them the next-day settlement of funds, which was totally wowing and still is quite wowing in the industry today. And we did that all for one single cost, 2.75% to process. Today, we think of our sweet spot as sellers who do $20 million in revenue or below, and that kind of has an opportunity in almost the trillions of dollars in terms of revenue or GPV that we would see crossing our platform.”

– Square, Inc. Presents at Goldman Sachs Technology and Internet Conference 2016

Simple, Affordable Solutions

In 2008, Groupon was just a small startup offering subscribers discounts for activities, travel, goods, and services sold by local merchants. However, the Great Recession pushed Groupon to soar quickly rather than sink. Why? In a time when consumers wanted to spend less and save money, Groupon aided in helping consumers cut costs wherever they could and survive economic instability.

“Remember, this business was started in October of 2008, so it’s really grown through kind of a variety of economic conditions. Demand is very strong globally. Its international launch was in May of 2010, with the acquisition of CityDeal, which at the time had about $5 million in revenue and about 500 employees. It has now grown to about 45 countries outside the U.S., and it’s now between $2 billion and $2.5 billion run rate in gross billings and close to $1 billion in net revenue.”

– Groupon, Inc. Presents at Credit Suisse Technology Conference 2011

During the height of the Great Recession, Mailchimp (acquired by Intuit in 2021) adopted a freemium business model—a pricing strategy where their product is free but additional features and services that expand functionality come at an additional cost.

Shortly after, the company’s revenue skyrocketed due to customers wanting to spend less and use free email marketing software services during a financially difficult time. By acknowledging the financial burdens Mailchimp’s customers faced, the company flourished and is now valued at $12 billion.

According to broker research, Mailchimp’s adoption of a freemium business model grew its net y/y income by 650%, as the company saw >30,000 new users and 4,000 new paying customers per month in its first freemium year. Overall, the company has experienced a 150% y/y increase in paying customers and a sequential 8% decline in customer acquisition cost (CAC) in its fourth quarter after transitioning.

“One of the things we love about Mailchimp is their freemium model. They actually allow customers to come in and dip their toe in, get started with growing their customer lists. And then they get so much value, they grow with them. As their customers grow, as their business grows, they’re able to now monetize it.”

– Intuit Inc. Presents at Citi 2021 Global Technology Virtual Conference

Bold Strategic Initiatives

From an investor’s perspective, a pizza chain like Domino’s should have been well-positioned to endure the Great Recession, offering affordable food at a time when people wanted to spend less.

But Domino’s stock bottomed out at under $3 a share in 2008. Why? Domino’s customers were unsatisfied, leaving a slew of negative online reviews. The pizza chain’s reputation proved to be a roadblock in strategizing with the economic climate and against competition. The debacle led Domino’s CEO, Patrick Doyle, to launch the “pizza turnaround” in 2010 and introduce a new pizza recipe.By listening to customers and investing in recipe development, Doyle’s innovation strategy ultimately saved the company from financial ruin.

“But I will tell you this, Marketing 101 says that you should see a declination after a period of time in the velocity of any of these promotions when you throw big advertising, a big price point, and a new recipe out there. And truthfully, as we sit here today, it has surpassed our expectations in the stability to sustain itself. We went into this knowing exactly based on the few pennies that were invested in the product to get the new recipe implemented. We knew exactly what the store sales needed to be to break even, if you will, on that investment, and we have gone way beyond that break-even point.”

– Domino’s Pizza, Inc., Q4 2009 Earnings Call

Amazon also embraced fundamental business changes in the wake of the economic volatility. In 2001, the online retailer launched its Amazon Web Services (AWS) platform amid the Dot Com Bubble Burst.

And between 2006 and 2008, during the Great Recession, the company introduced its Amazon Prime, Amazon Kindle, and its hosting services on AWS. This past June, Amazon’s market share for leading retail e-commerce companies in the United States was forecasted at 37.8% by Statista. This ability to pivot and create new business even in times of crisis has enabled Amazon to maintain consistent growth and success.

“This week, we started shipping Kindle with U.S. & International Wireless and lowered its price to $259 from $279. Worldwide gross profit was $1.27 billion and up 27%, North America segment operating income increased 77% to $156 million, a 5.5% operating margin.In the International segment, revenue grew 33% to $2.61 billion.”

– Amazon.com Inc., Q3 2009 Earnings Call

Even with rumors of an oncoming recession, Amazon continues to make bold moves by exploring new markets. This past August, the e-tailer announced that it would sell Peloton bikes and gear, offer three-hour delivery time increments, and the option for free assembly with every stationary-bike purchase–a way to appeal to a new customer base.

Resilience and Adaptability

Research shows businesses that are more resilient tend to anticipate, cope with and then adapt to new circumstances. However, even the strongest industries, like technology, have and continue to feel the heat of inflation and a potentia recession—and resort to antiquated tactics to offset them. Yahoo, Spotify, and Google announced massive layoffs last year, with more to come in 2023 to cut corporate costs. But rather than preserve capital, a study from the Centre of Innovation Management Research shows that some companies increase spending to innovate and become resilient in the face of economic downturns.

For example, financial technology companies like Paypal may have performed well during the pandemic but were outshined by traditional finance powerhouses like DBS Bank of Singapore this year. As fintech companies attempt to bypass traditional financial services providers with digital services, many longstanding corporations have begun expanding their businesses digitally. DBS has developed a marketplace for selling cars, renting property, and getting deals on electricity, mobile, and broadband services. And it’s paid off, as the bank’s latest quarterly earnings revealed growth despite weak markets.

“The DBS Car Marketplace is the largest direct seller-to-buyer car market in Singapore. Since its launch in August 2017, DBS CarMarketplace has attracted more than half a million unique visits, while the property marketplace generated more than SGD 300 million in home loan requests within 12 months.”

– DBS Group Holdings LTD., ARS

“We recently marked 1 year into the COVID-19 pandemic. We’re off to a great start to the year. In Q1, we outperformed on both revenue and earnings and built on our operational and financial momentum exiting 2020. Total payment volume grew 50% at spot and 46% on a currency-neutral basis. This is the strongest quarterly growth we’ve ever reported. Our Q1 TPV grew at a 2-year compound annual growth rate of 33%, accelerating from 30% in Q4 and reflecting our strong momentum in user growth.”

– PayPal Holdings, Inc., Q1 2021 Earnings Call

Preparing for Economic Uncertainty

Staying ahead of economic volatility requires the ability to conceptualize innovation for your company at a moment’s notice. To do that, business leaders are relying on market intelligence platforms to sort insights from the noise and inform their business strategy. AlphaSense does that and more with our extensive universe of public and private content (aggregating over 10,000 trusted business sources) with proprietary AI. Sign up for your free trial of AlphaSense today.

Unsure of what your investment in a market intelligence platform will return? Download our guide, “How To Calculate the ROI of Market Intelligence,” to discover how upleveling your research methods with artificial intelligence can benefit your time, budget, and team.