The Complete Guide to Conducting Competitive & Market Landscape Analyses

Get the guide

Across industries, consumers are facing escalating prices for everyday commodities due to a myriad of reasons: inflation, macroeconomic events hindering supply chains, workforce shortages, and the list goes on. And while, unanimously, this trend seems to be growing amongst most manufacturers and retailers, the challenges influencing their price markups are unique and individual.

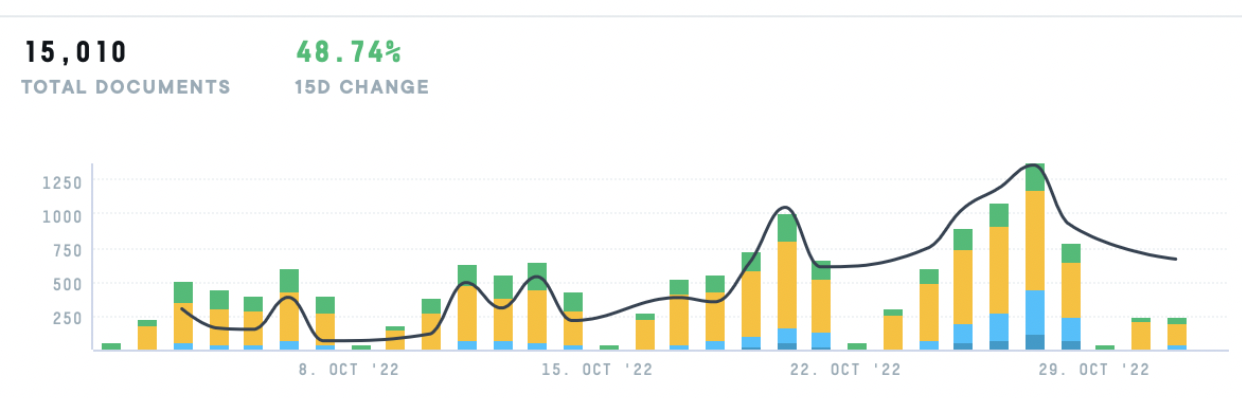

Last month, we saw a nearly 50% increase in documentation within the AlphaSense platform mentioning “price increase” with documentation spanning from broker research to company documents.

Company Sentiment Across Key Subsectors

There were 70 industries total that came up across a search for “price increases” in the AlphaSense platform. Among those 70, there were a handful of industries most concerned with this topic.

Industrials

Industrial companies seem to experience the brunt of supply chain issues directly related to macroeconomic events (COVID-19, Russia-Ukraine war, etc.). In the AlphaSense platform, the most common citings for price markups focused on the increasing cost of raw materials and freight transportation for materials and finished products. To compensate for potentially lost profit margins, most executives have resorted to increasing consumer prices until inflation has lessened–some even reported already seeing inflated prices drop associated with production.

“However, at present we are facing an extremely severe external environment, with problems such as the COVID-19 pandemic, shortages and soaring price of raw materials including semiconductors, and supply chain disruptions. As a result, although demand for coatings themselves has been firm, we are temporarily facing a difficult situation in terms of profits due to the significant impact of soaring raw material costs, despite repeated management efforts such as price increases and cost reductions.”

– KanSai Paint Co Ltd | ARS

“Domestic average price also increased by 7.5% due to customer mix while also factoring in the overall annual market price increase… The higher sales prices were due to strong demand in the domestic and international markets. Cost of products sold, including depreciation, depletion and amortization expense, freight costs and affiliates increased due to freight cost, more specifically due to significant ocean freight cost increases impacted by recent global supply chain constraints as well as price increases in fuel.”

– Sisecam Resources LP | Press Release

Beverages

Trade down is a concern for most CPG subsectors, however, earning calls, company presentations, and news reporting on financial earnings relayed that leading beverage companies have not been financially exposed to the revenue-damaging trend. While consumer behavior has certainly changed, with more Gen-Zers and Millennials choosing to drink less or choose sobriety, beverage companies are expanding their product lines to maintain profitability in upcoming quarters.

“UBL, which is backed by the Dutch multinational brewing company Heineken, is likely to pursue price increases due to offset cost impacts due to inflationary pressures. He further told on the call that inflation pressure on the cost of goods sold will most likely continue in the foreseeable future and hence, they will continue to pursue further price increases to strengthen their earnings, in combination with cost measures to mitigate these cost impacts.”

– United Breweries Ltd. | News Article

“Our depletions and inventory levels demonstrate a stronger and unaffected demand. As of today, we have not seen any signs of trade down. We are reassured by our portfolio of options and price points for consumers. There is this concern of a slowing of the economy, but our costs have increased — are increasing and so we look to try to pass those costs or at least part of those costs as price increases.”

– Becle, S.A.B. de C.V. | Earnings Call

Machinery

The machinery industry has also been greatly impacted by the Russia-Ukraine war, and the long-lasting workforce shortages brought on by the COVID-19 pandemic. Many are reporting that even with price increases intended to account for capital spent on higher raw materials and transportation prices, they cannot maintain their profit margins. Moreover, inflation is devaluing foreign currencies and, as a result, has led to lost quarterly revenue for international businesses.

“We expect these trends to continue throughout 2022, and potentially be further impacted by the ongoing conflict in Ukraine, as we anticipate continued disruptions, shortages and price increases – the effect of which will depend in part on our ability to successfully mitigate and offset the impact of these events. Thus far, actions taken by us to mitigate supply chain disruptions and inflation, including productivity improvements, expanding our supplier network, and price increases, have generally been successful in offsetting some, but not all, of the impact of these trends.”

– John Bean Technologies Corp | 10Q

“However, the adjusted return on sales decreased by 1.1 percentage points to 1.5%, mainly driven by lower production utilization and higher material and energy prices. We’re seeing very good price increases, we see very good mix effects by prioritizing the high-priced markets, and we still don’t see the vehicle margins where they should be.”

– Traton SE | 2022 Earnings Call

Food Products

For large-scale food producers around the world, the most prevalent issues mentioned within their 10Qs and earnings calls focused on the competitive market for labor (a lack of trucking and container transporters, demand for increased salaries), as well as increased costs for ingredients (skyrocketing eggs prices being heavily mentioned) and packaging. While some retailers have been able to retain their customer base with increased prices to offset manufacturing costs, others have reported concerns of losing their customers to trade down behavior or competitors offering similar products at a lower price.

Manufacturers also expressed concerns that some retailers would not tolerate price increases on their products, effectively forcing manufacturers to take the brunt of inflationary costs rather than consumers.

“Our shell eggs are sold to consumers at a premium price point, and when prices for commodity shell eggs fall relative to the price of our shell eggs (including due to any price increases we may implement), price-sensitive consumers may choose to purchase commodity shell eggs offered by our competitors instead of our eggs. We may not be able to increase our product prices enough or in a timely manner to sufficiently offset increased commodity costs due to consumer price sensitivity or the pricing postures of our competitors and, in many cases, our retailers may not accept a price increase or may require price increases to occur after a specified period of time elapses.”

– Vital Farms Inc. | 10Q

“We continue to face elevated input cost inflation, especially in the areas of energy, transportation, packaging, wheat, dairy and edible oils. To offset these challenges, we have implemented appropriate price increases across key markets, including Europe.”

– Mondelez International Inc. | Earnings Call

Hotels & Restaurants

Across earning calls and 10Qs, restaurants and hotels implemented price increases with their services and menu items to overcome inflationary costs, with most being able to retain customers or brand-client engagement. More restaurants than hotels, there was heavy discussion in the AlphaSense platform around approaching price increases through various methods (raising delivery feeds, widening product offerings on a national and local level) in order to overcome potential revenue losses. Others shared troubles of procuring ingredients central to their operations due to macroeconomic events. COVID-19 also haunts workforces for these industries, with most C-level suite leaders sharing the troubles of finding affordable workers.

“First, while we continue to explore options to further optimize our consumer pricing architecture in the United States, it is important to highlight that the average price increase we realized in the second quarter across our U.S. system was nearly 6%. We have successfully pulled many pricing levers, including our standard menu pricing, our national offers, our local offers and our delivery fees. This has helped us cover some of the cost increases we are incurring in both the food basket and labor market while also ensuring we continue to deliver terrific value to our consumers.”

– Domino’s Pizza Inc. | Earnings Call

“Due to the inflationary cost pressures we are experiencing, we implemented menu price increases above our historical levels in the first and third quarters of fiscal 2022 to support our longer-term restaurant-level margin objectives and are in the process of implementing an incremental price increase in the fourth quarter of fiscal 2022.”

– Cheesecake Factory Inc. | 10Q

Commercial Services

COVID-19 was a common mention in the 10Ks of commercial service business, ranging from how the virus is still affecting sourcing talent to pricing strategies.. At the beginning of the pandemic, some companies offered clients the opportunity to delay payment for their services, and now as the number of daily COVID-19 cases is dropping, C-Suite leaders are raising fees and even increasing them. This is partially due to inflating gasoline prices, which most companies take into account for transportation between jobs.

“While labor markets throughout the region remain tight, we’ve been very effective at managing the pressure. Colleague retention rates remain very high across the region in the mid-90% range. Despite price increases, customer retention at 86.5% is now actually above pre-pandemic levels. We’ve also sustained our investment in colleagues and services. This has led to further improvement in colleague retention to pre-pandemic levels.”

– Rentokil Official Plc | Earnings Call

“Our outperformance on price was a function of higher price increases, better retention and a pull forward of price increases in certain markets. Compared to our guidance, incremental fuel surcharges recovered approximately 20% of the increase we saw in fuel cost during the quarter. Part of this is a timing lag that will be recovered, but on balance, this is an area where we see significant opportunity within our existing customer book. Many of our industry peers have done a great job at mitigating rising fuel costs, and we see meaningful upside as we migrate our practices in this area closer to the industry norm.”

– GFL Environmental Inc. | Earnings Call

Insurance

Price increases for insurance companies globally reflected the number of claims sourcing from the COVID-19 pandemic, as well as national disasters and occurrences that have and continue to affect Americans this year (Hurricane Ian, etc.).

In accordance, insurance companies are still reporting high demands for their services, and without any challenges of acquiring the talent or materials these companies need to conduct business, revenue streams are not experiencing significant loss in comparison to other industries.

“Interest rates move up, war inflation, uncertainty hit nearly all asset classes that were down, and our total investment return for the quarter is minus DKK 348 million. For Sweden, price increases are somewhat lower, reflecting a generally lower inflation level up until now.”

– Tryg A/S | Earnings Call

“Inflation continues to be a global challenge. Claims inflation so far has been in line with our expectations and we have not had any significant challenges related to supply of materials or labor. Demand for our products and services remains strong and we are able to pass on necessary price increases to stay ahead of the inflation curve. Global economic and geopolitical uncertainty have reached new heights. Strong governance finances, particularly in Norway mitigate the risk of a grave recession in our region.”

– Gjensidige Forsikring ASA | Earnings Call

Whether it’s staying on top of cross-industry price increases or other market-moving events, AlphaSense helps you unlock insights and empowers you to make well-informed business and financial decisions.

Never miss an opportunity to penetrate a market or seize a new investment opportunity. Download our guide, The Complete Guide to Conducting Competitive & Market Landscape Analyses, to easily identify the strengths, and weaknesses of a company, monitor market happenings in real-time, and realize the power of AI search to bring you straight to key insights faster.