While inflationary and supply chain pressures have eased considerably in the past couple years, most industries and global regions are still feeling the impacts of economic volatility.

And the consumer and retail sector, in particular, is sensitive to the ups and downs of the market, as this industry is usually the most heavily impacted by periods of economic uncertainty. Unlike most other industries, the consumer and retail space is directly affected by changes in consumer psychology, attitudes, and preferences. In times of economic uncertainty, consumers tend to shift their spending patterns and behaviors, often in unpredictable ways.

Below, we dive into the major impacts the current economic state is having on the consumer and retail sector, as well as some best practices for companies in this space to not just survive, but thrive, through these periods of uncertainty.

How Economic Uncertainty Impacts the Consumer & Retail Sector

In the last few years, as the economy has gone through various ups and downs, consumer behavior has shifted in some surprising ways.

During periods of economic instability, it is logical to assume that consumers will try to decrease their discretionary spending and generally try to save on unnecessary purchases. During inflationary episodes, we see a trade-down effect—consumers switching to cheaper products to save money.

In McKinsey’s latest Consumer Pulse Survey, it’s evident that respondents have unified concerns that are shaping their buying patterns: while three-quarters of consumers are trading down across categories, 50% of respondents cited inflation as the reason for seeking less expensive alternatives and the other 43% cited concerns about the economy.

This can be highly beneficial for organizations that build their business models around affordability, and as such, become more appealing to consumers attempting to cut costs. This is especially true in the age of social media, when companies can lean on marketing tactics to capitalize on shifting consumer spending habits and generate buzz around lower-cost products.

One example is makeup company e.l.f., which markets itself as an affordable, everyday luxury beauty brand and was able to gain substantial market share in mass makeup in the last few years. This company has not only been able to appeal to consumers who normally choose cheaper brands, but also has captured the consumers of more expensive companies by keeping prices low and quality high.

“I think the good news is that they continue to keep their eye on that on price and being accessible, but being able to still deliver the innovation that other mass brands are delivering, if not better.”

– Senior Director of Sales (Former) at e.l.f. | Expert Call

The trade-down effect generally harms companies that are less marketing and social media savvy, thus inspiring lower levels of loyalty from consumers. Household product companies are a great example of this. Consumers are less likely to have a strong affinity to a household product brand than to their favorite food, beverage, or beauty brand—as prices rise, consumers will have less qualms about simply switching to the next best lower-priced alternative to clean and maintain their homes.

Trade down has also been affecting the automobile industry, with consumers increasingly opting for small cars over large ones, not out of preference but simply because they are more affordable. In this instance, consumers reject the product they want in favor of the product they can afford.

At the same time, one of the biggest priorities for consumers in uncertain times is value—they are occasionally willing to spend more if it means getting a greater ‘bang for their buck’. That’s why wholesale club and convenience store channels with a much larger spending CAGR are doing better than smaller drug stores or grocery stores. Further, consumers are also spending more on private label goods than ever before, as those options tend to be cheaper than the alternative.

Discount stores such as Walmart and Dollar Tree tend to be positively affected by economic uncertainty, as consumers trade down from more expensive shopping options. Meanwhile, mid-range department stores, grocery stores, and many fashion retailers often take harder hits because consumers see them as too expensive for the value or quality they offer.

However, consumers are more likely to spend on high-quality and high-value items that they see as investments for the future. This is why we also see a greater propensity for spending more on luxury brands in times of economic uncertainty. So while they are more selective about what they spend money on, consumers are less reluctant to splurge on things they deem worthwhile.

In sum, companies that truly invest in the customer experience and provide value in their offerings are the ones that are best positioned to navigate this period of economic uncertainty.

Best Practices for Consumer and Retail Companies During Economic Uncertainty

Prioritizing the Customer Experience

Economic uncertainty means that consumers are no longer driven by brand loyalty. Rather, they are choosing products that will give them the most value per money spent. This could mean choosing higher-cost or higher-quality products that they see as investments for the future, or it could mean choosing a lower-cost option because the value per dollar is deemed greater than the higher-cost alternative.

One of the key ways consumer and retail companies can increase the value they offer to their customers is prioritizing the customer experience. An example of a company doing this well is Trader Joe’s. Widely seen as a budget-friendly grocery store that keeps prices low by relying on private label, Trader Joe’s still manages to create a premium shopping experience for its customers that keeps them wanting to come back.

Their shelves are stocked with a variety of novelty items shoppers cannot find anywhere else; their customer service is stellar; their products are highly convenient without sacrificing on quality; and the entire shopping experience is designed to incite delight and whimsy. Trader Joes’ unique ability to keep prices lower than its competitors, while creating a fun experience out of an ostensibly mundane task, is precisely what keeps customers coming back.

FIGS, a scrubs company that is particularly popular among younger medical professionals, is another example of a company that is thriving in an economically volatile time, even as many of its competitors flail. Though their products are on the higher end of the cost spectrum, their commitment to quality, aesthetics, and comfort have made them well worth the price point. Additionally, their social media presence and marketing have allowed them to generate a cult following among younger consumers:

“I think their marketing is phenomenal. They’re appealing to a younger audience. Also, FIGS seem to be more of a status scrub versus other scrubs. Especially for a younger consumer, it’s more like wearing a higher-end type of jeans. I feel like it’s more fun. They’re also very engaging on social medias. There is multiple Facebook pages dedicated to swapping scrubs where no other competitor has been able to engage the consumer like that.”

– Director of FIGS Competitor | Expert Call

The companies that rise to the top during periods of economic volatility are those that not only understand what their customers want, but are able to clearly demonstrate how their products will add value to customers’ lives. Pricing is important, of course, but at the end of the day, it matters significantly less than perceived value.

Increasing Value with Technology and Innovation

In today’s age, every industry is touched by technology and artificial intelligence (AI). These are great assets for increasing value for their customers, as there are infinite possibilities for utilizing AI to enhance the customer experience.

It can be used to collect, process, and analyze customer data, which companies can then use to create more personalized and high-value experiences and products. It can also be used to optimize operations and create more efficiency in supply and fulfillment chains, forecast demand more accurately, and improve R&D efforts. AI can also be instrumental in market intelligence efforts, such as conducting market research and competitive differentiation.

With the advent of generative AI, the possibilities have expanded even more. GenAI can be used to provide smart product recommendations to consumers, streamline supply chain operations, optimize the product development process, and more.

Generally, AI is one of the best ways consumer and retail companies can build trust with their consumers. The goal, when using it to analyze customer data, should always be to increase value for the consumer through innovative solutions and experiences. Only then will the consumer trust your company enough to supply more of their data, resulting in a positive feedback loop of customer-driven innovation.

Prioritizing Transparency and Sustainability

One of the best ways for consumer and retail companies to smooth sail through times of economic uncertainty is to put their focus into initiatives that truly matter for their customers and their stakeholders. One of the biggest issues on the minds of consumers and stakeholders today is sustainability and ESG.

Gartner reported that 85% of institutional investors consider ESG factors in their investment decisions. For companies across all industries, choosing to invest in becoming more eco-efficient and socially responsible means investing in a more sound future for their fiscal performance.

The CPG industry is by far the largest distributor of single-use plastics, but many companies have demonstrated a strong commitment to reducing their carbon footprint—with positive results. The current highest performers in this industry are particularly focused on their ESG ratings, which in turn improves their profitability, since consumers are drawn to companies demonstrating sustainable practices.

Equally important to sustainability is transparency—consumers and stakeholders want to invest in companies that are clear and honest about their values and actions. Consumer and retail companies that are open about their manufacturing processes, labor practices, and sustainability progress are significantly more likely to retain their customers—and even gain new ones—amidst economic turmoil. Even in uncertain times, consumers want to purchase from companies that display similar values to their own.

One of the best ways for companies in the consumer and retail space to always be informed on competitors’ ESG efforts and the ESG landscape is large is to rely on a market intelligence platform—like AlphaSense—that aggregates ESG data and reports across companies and industries and uses AI to surface the most relevant ESG insights for your specific goals.

Strengthening Omnichannel Capabilities

Offering a compelling omnichannel experience used to be the mark of a highly innovative and forward-thinking organization. Now, it’s a necessity for survival. Consumers, particularly those belonging to Gen Z and younger, expect a seamless shopping experience that blends the digital with the physical and maximizes value.

According to McKinsey, over one-third of Americans made omnichannel features—such as purchasing online and picking up in store or curbside—part of their regular routines in recent years. Two-thirds of those people plan to continue doing so in the future. Additionally, a report by Deloitte found that omnichannel customers have a 30% higher lifetime value than customers who shop through a single channel—which can have a big impact on a retailer’s bottom line.

The key here is that any omnichannel innovation must be driven not by striving to utilize the most advanced technology, but rather creating the best experience for customers. Particularly in a time of economic uncertainty, it is unwise to invest large amounts of resources into flashy tech that does not actually meet the needs of consumers.

The best omnichannel strategy will be one that is unique to your business and to your customers’ needs. Once you understand the key value drivers for your customers, you can create a differentiated strategy that sets you apart from the competition.

Finally, it’s important to note that building omnichannel capabilities is not an isolated process. Most often, it requires reorganizing your resources, raising spend on technology, increasing headcount, and continuously collecting and analyzing data.

Developing Supply Chain Resilience

In the last three years, almost every single industry has felt the effects of supply chain disruption. The COVID-19 pandemic, global geopolitical events, and domestic tensions have resulted in global supply chain shortages and contributed heavily to elevated inflation. And though these are temporary, they provide a great learning opportunity for consumer and retail companies on the importance of supply chain risk management. In a time of economic uncertainty, the best way for companies to safeguard themselves is to develop supply chain resilience—through automation and technology and diversification of suppliers and partners.

Gartner predicts that by 2025, supply chain resilience will be a key success driver for over 50% of organizations. Some proven ways to do so are creating end-to-end transparency, investing in digitization and generative AI, improving communication and collaboration with suppliers and customers, embracing e-commerce, and hiring the right talent.

By investing in supply chain resilience now, consumer and retail companies can build critical agility and flexibility into their supply chains, which will help them not only survive this period, but any future economic turbulence to come.

Following Emerging Trends and Macroeconomic Landscape

Always, but particularly in times of economic uncertainty, it is crucial for companies to stay aware of emerging industry and market trends, and to have a deep understanding of the macroeconomic landscape. Only then can they be proactive, rather than reactive, in their strategy and avoid being blindsided by unexpected market events or movements.

A key example is the Amazon/Peloton partnership that sent shockwaves through the retail industry. And yet, when utilizing AlphaSense to analyze the conversations that laid the foundation for Amazon’s interest in Peloton, it’s clear that this partnership was a long time coming. Having an all-in-one market intelligence tool allows you to stay ahead of any new market developments and always maintain a competitive advantage—no matter the state of the economy.

Related Reading: Consumer Goods Trends and Outlook for 2024

How AlphaSense Can Help Navigate Economic Uncertainty

Two key elements to successfully navigating economically uncertain or tumultuous times are speed and access to the right information. AlphaSense is an all-in-one market intelligence platform that delivers on both accounts.

Access to Information

AlphaSense’s extensive content universe provides access to 10,000+ sources of private, public, premium, and proprietary content—indexed, searchable, and all in one place.

Analysts, researchers, and decision-makers in the consumer and retail space have access to documents including but not limited to:

- Company documents (global and SEC filings, ESG reports, etc.)

- Company and competitor websites

- Government and trade publications

- Press releases

- Earnings call transcripts and company presentations

- News outlets

In addition, AlphaSense provides access to the following proprietary content sets:

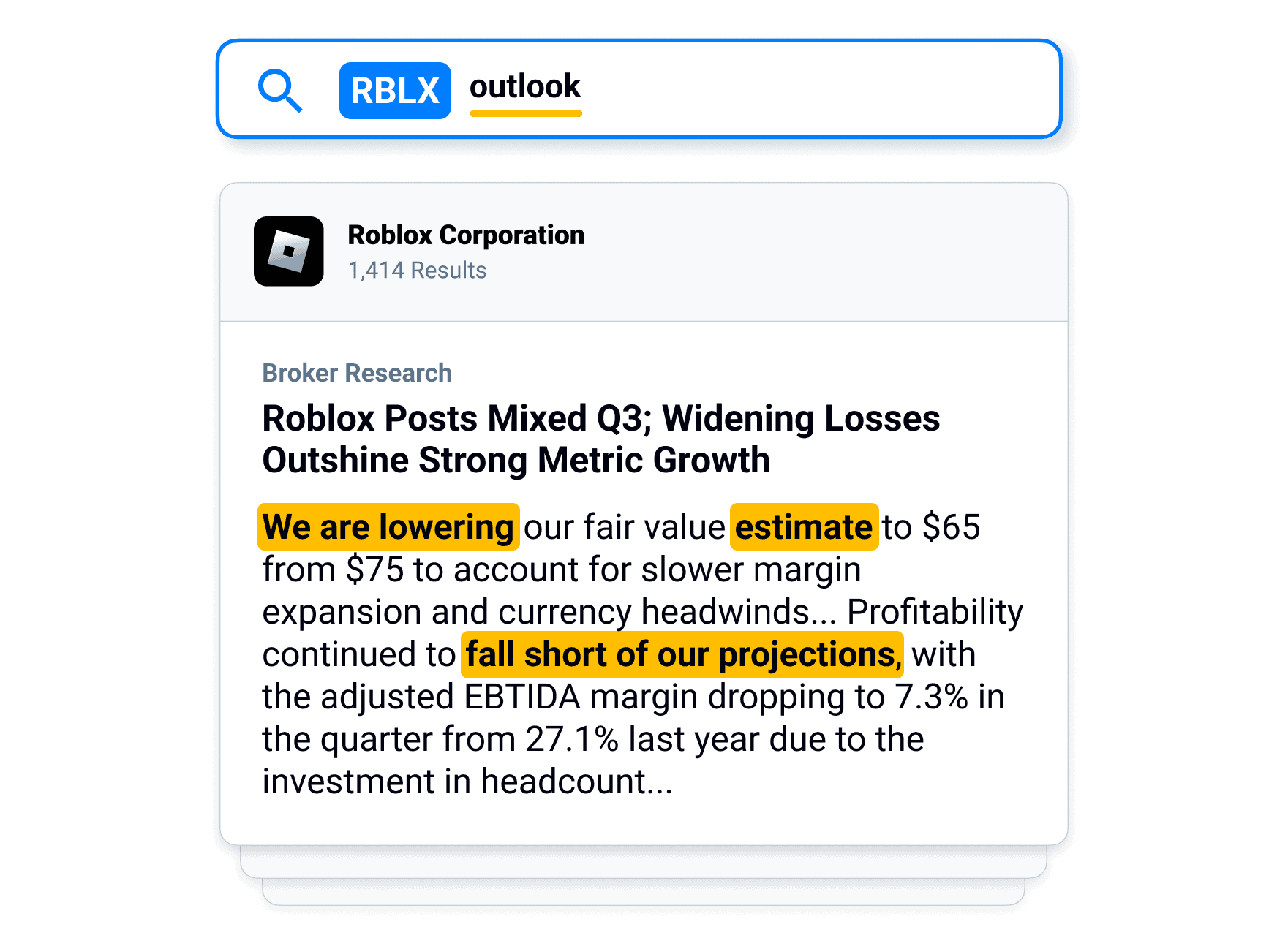

- Wall Street Insights® – A collection of leading equity research from 1,000+ sell-side and independent firms, covering global industries, sector themes, and companies.

- Expert Insights – Expert Insights solutions includes the Expert Transcript Library—an ever-expanding library that currently hosts 45,000+ expert call transcripts with competitors, industry experts, professionals, customers, and former and current executives—as well as Expert Call Services. Expert Insights prioritizes compliance throughout the content development process and has a team of trained compliance reviewers who ensure research safety for clients.

Armed with these data sources, companies are able to gain a full 360 view of the market landscape and eliminate blind spots in their research, leading to smarter and better decision-making.

Speed Up Time to Insight

Companies that are able to consistently outperform the market and gain an edge over their competitors are those who embrace advanced technology to create new and improved workflows, speed up time to insight, and do more with less.

AlphaSense’s powerful patented AI search technology works to uncover and extract the most impactful and relevant insights from each content source. Instead of relying on CTRL+F to parse through multiple tabs of documents, you can trust our search platform to yield the most relevant results for your research instantly. Here’s how our platform features help you maximize the value of your research and spend more time on important tasks, like strategy and analysis..

Semantic Search

AlphaSense’s smart AI search technology recognizes the intent of your search and surfaces key insights without you having to perform multiple manual searches or spend time reading through the entirety of multiple long documents.

Our Smart Synonyms™ technology analyzes speech patterns across tens of millions of search documents, resulting in a robust library of synonymous words. The platform ensures you get all the relevant search results—without any of the excess noise or extraneous effort.

Trending Topics

Our Trending Topics tool is key for unlocking critical insights from a vast body of data—in seconds. This AI tool, accessible via the main dashboard, allows you to see the top 100 topics that are trending for a single company or a group of companies in a watchlist or industry.

Try this feature for free here.

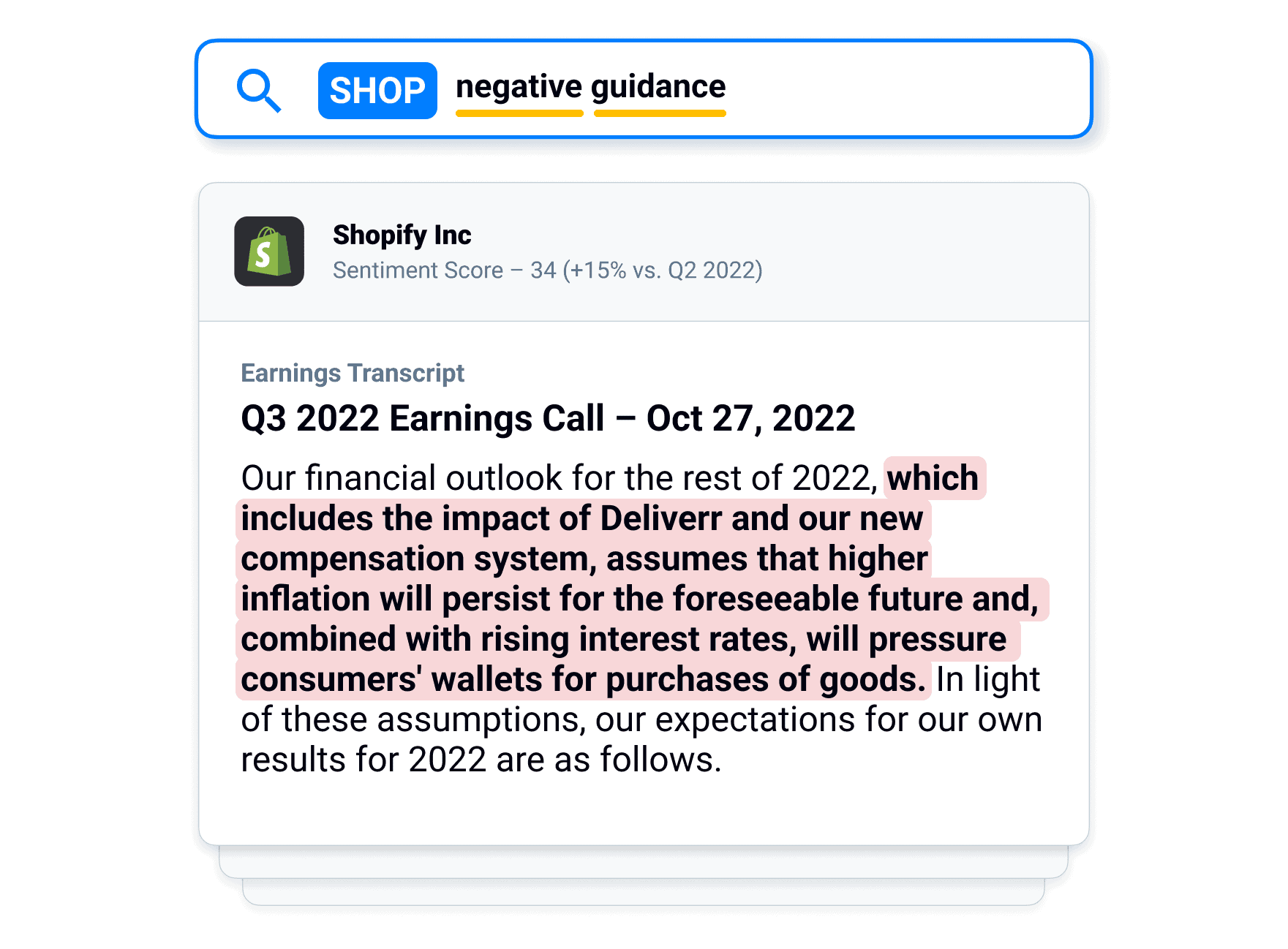

Sentiment Analysis

Our sentiment analysis technology utilizes Natural Language Processing (NLP) to uncover market perceptions about any given topic. Further, it color-codes positive and negative sentiment for easy recognition as you browse search results. These AI features are executed in seconds, saving analysts precious hours that would have previously been spent combing through multiple earnings call transcripts.

Generative AI

As a platform purpose-built to drive the world’s biggest business and financial decisions, our Smart Summaries feature leverages our 10+ years of AI tech development and draws from a curated collection of high-quality business content.

Our Smart Summaries feature summarizes earnings documents, expert calls, and broker research—allowing you to speed up your earnings research process and quickly understand company outlook—so you can spend more time on high-value tasks.

Theme Extraction

This tool allows users to extract the most important topics from earnings transcripts in the context of key metrics, such as QoQ increase in mentions, positive/negative sentiment, and overall mentions.

With this tool, users save time while identifying the most relevant information at scale across every single competitor’s transcript. And because our model is trained specifically on financial language, it can pinpoint the most valuable and important company insights.

Surviving and Thriving in Economic Uncertainty

With AlphaSense’s vast content universe and advanced AI search technology, you can conduct deep, comprehensive, and accurate research—in a fraction of the time it takes your competitors. No matter the state of the economy, utilizing AlphaSense for your market intelligence will help you make better, smarter decisions and keep your organization on the leading edge.

For additional industry insights, don’t miss our industry market research pages:

Start your free trial with AlphaSense today.