Projected revenue value for retail media is forecasted to exceed television revenue by 2028. Already, major companies are pouring capital into how they can take advantage of this new practice.

In the AlphaSense platform, we’re seeing retailers including Amazon, Walmart, and Target, as well as grocers like Carrefour, Ahold Delhaize, Tesco, and Sainsbury’s, strategizing how to attract big advertisers to their websites. Amazon, the pioneer in retail media, disclosed $11.6 billion in revenue from its ad business in its Q4 2022 Earnings Call, while Walmart’s retail media business, Walmart Connect, has seen sales rise nearly 30% to $2.7 billion in its fiscal year-end this past January.

But while mammoth corporations are reporting major earnings from this advertisement strategy, most C-Suite leaders are simply asking: what is retail media? Below, we dive into the logistics behind retail media, why it’s gained recent popularity within the market, and who’s leading in terms of operations.

What is Retail Media?

Since 2020 and the onset of the coronavirus pandemic, consumer behavior has dramatically changed. Since shopping in-person posed the threat of contracting COVID-19, consumers converted to cybershopping. It’s a pattern that hasn’t slowed down in momentum and consequently, 20.8% of retail purchases are expected to take place online in 2023, and by 2026, the e-commerce market is expected to total over $8.1 trillion, according to Forbes.

While the death of brick-and-mortar was already underway, the virus accelerated the universal adoption of online shopping. And with more consumers purchasing online than ever, retail media is also experiencing the same acceleration in its growth.

At the most fundamental level, retail media is advertising within a retailer’s sites and apps. Typically, it is orchestrated by brands that directly sell products with retailers, though retail media advertising can involve non-endemic brands in verticals such as financial services or travel. These industries are interested in a retailer’s audience but have no specific products to sell on their sites and apps.

Referred to as the third wave of digital advertising (in succession to search and social), retail media became prominent with retailers due to a need for secure, brand-safe advertising environments. As online shopping grows in popularity, brands are leveraging retail media as a new way to reach customers while retailers rely on its revenue to offset e-commerce operational costs.

Retail media allows brands to promote themselves on a “digital shelf” through native and display ads, similar to an endcap or special in-aisle feature within a brick-and-mortar. The best part: ads can be displayed on a retailer’s home page, category page, search page, or product detail page—allowing a brand to reach consumers at any part of their online shopping experience.

The Benefits of Retail Media

Retail media is gaining traction amongst C-Suite executives for reasons that promote sales and revenues, drive brand visibility, and create consumer loyalty through personalized content:

- Retail Media Drives E-Commerce Growth: More and more consumers are switching their shopping habits from brick-and-mortar purchases to online orders. To survive economic downturn, brands have to learn and prioritize the spaces their consumers are spending. For brands, retail media reaches high-intent shoppers at the point of sale on their retail partner’s sites and apps.

- Personalized Advertising with Consumer Consent: While concerns around data privacy and consumer cookie mining have recently led to major litigation for retailers and brands, personalized advertising isn’t going away. In the future, advertising will rely more on data being gathered in a first-party environment. Retailers are well-positioned to target consumers by leveraging first-party data and creating an environment with actual sales-based measurement because sales are occurring on the retailer’s site as well.

- Tying Retail Media Spending to Sales: For brands looking to link their advertisement budget directly to sales, the attribution capabilities of retail media are incredibly effective. Retailers have a surplus of sales data and can provide sales-based insights, enabling brands to link their spending to e-commerce sales down to the individual SKU level. Some retailers are even providing offline sales data, for a more complete view of the customer journey.

Leaders of Retail Media

GroupM, a leading media investment company, reported in its 2023 Global Mid-Year Forecast that retail media is the third fastest-growing advertising channel in 2023, behind digital out-of-home (OOH) screens and connected TV (CTV). However, the two later channels are just a small fraction of the size of retail media—that’s mostly because major companies are wielding retail media to their advantage.

From Amazon, Walmart, and Target to grocers like Carrefour Ahold Delhaize, Tesco, and Sainsbury’s—these mammoth corporations are aggressively working to attract big advertisers to their websites. During a 2022 survey, Amazon Advertising and Walmart Connect were the most used retail media networks in the United States, both named by 82% of respondents. Target Roundel and Kroger Precision Network followed in the ranking, both mentioned by over 60% of responding marketers.

While retail media activity is running rampant in the US, European companies are also raking in profits from the digital marketing strategy. Dutch grocer Ahold Delhaize has hit “roughly half” its goal to grow revenue from businesses beyond grocery stores to 1 billion euros by 2025, an effort focused on selling ads on its supermarkets’ websites and monetizing insights on consumer data.

Likewise, Sainsbury’s—Britain’s second biggest supermarket group—has created Nectar360, which combines its loyalty scheme with marketing services. Already working with 700 brands, it expects more than 90 million pounds ($113 million) of additional profit from the business by 2026.

“Growing Nectar participation creates richer data, further fuelling the growth of our Nectar360 business. This allows us to offer over 700 brands more relevant content and activations across a range of marketing channels. Nectar360 is on track to deliver at least £90 million of incremental profit contribution by March 2026.”

– ARS | J.Sainsbury PLC

Obstacles to Overcome in the Retail Media Space

The retail media industry is poised for significant growth in the coming years, with projections from Bain & Company indicating an annual market growth of 12%, reaching an approximate $140 billion valuation by 2026. This growth is anticipated to be particularly robust in the US, with retail media spending expected to increase by 16% between 2022 to 2026.

“Between now and 2030, retailers will see only modest profit growth from traditional trade (meaning retail activities centered on the simple sale of goods procured from suppliers). Instead, the lion’s share of profit growth is likely to come from activity that reaches beyond trade, with retail media being one of the most promising ways to branch out,” Bain & Company writes.

Yet, for all of the enthusiasm and potential revenue gains surrounding retail media, advertisers often feel their needs are not being met when they buy into it—positioning the industry for failure if these concerns are not addressed.

Four key challenges that retail media networks face emerge:

- A rapidly changing, increasingly complex market: Products are quickly moving beyond sponsored search to offsite formats (third-party display, social media, etc.) and other innovations, which makes long-term planning for tech investment even harder.

- Developing a new go-to-market playbook: The task of selling advertising solutions differs inherently from operating a retail business, involving a distinct set of customers and stakeholders, such as agencies and brand managers.

Traditionally, retailers have primarily managed relationships with CPG companies through their merchandising or trading organizations. However, for retail media to realize its full potential, it cannot solely rely on existing points of interface. To effectively engage with and sell to advertisers, retail media networks need to acquire new capabilities and make substantial investments in talent. Smaller networks must also navigate the transition from relying on third-party retail media specialists to developing their own in-house capabilities, determining the optimal timing and approach for this shift. - Effective design choices: Retailers encounter challenging decisions related to design, encompassing both organizational structure and day-to-day processes. Questions arise, such as how to effectively incorporate retail media into core marketing and merchandising functions. Determining the optimal approach to designing processes, decision rights, and incentives across stakeholder groups becomes pivotal. Identifying the appropriate trade-offs to facilitate change while minimizing friction is a crucial consideration. Moreover, determining the right tools to orchestrate these processes seamlessly between teams adds another layer to the decision-making process.

- Performance and Measurement: Not all networks can swiftly make adjustments to ad campaigns while they are in progress, leading to a compromise in effectiveness. Additionally, there is a lack of comprehensive shopper data that can link purchases to advertising, especially in the case of in-store transactions.

The difficulty in achieving closed-loop attribution is further exacerbated when a retailer’s loyalty program is underpowered, when the retailer has not sufficiently invested in its first-party data infrastructure, or when a retailer relies on third parties to enter the realm of retail media.

Lastly, there exists a mindset issue in certain networks where CPGs are still perceived solely as suppliers rather than customers who require detailed performance data to feel confident about increasing their spending.

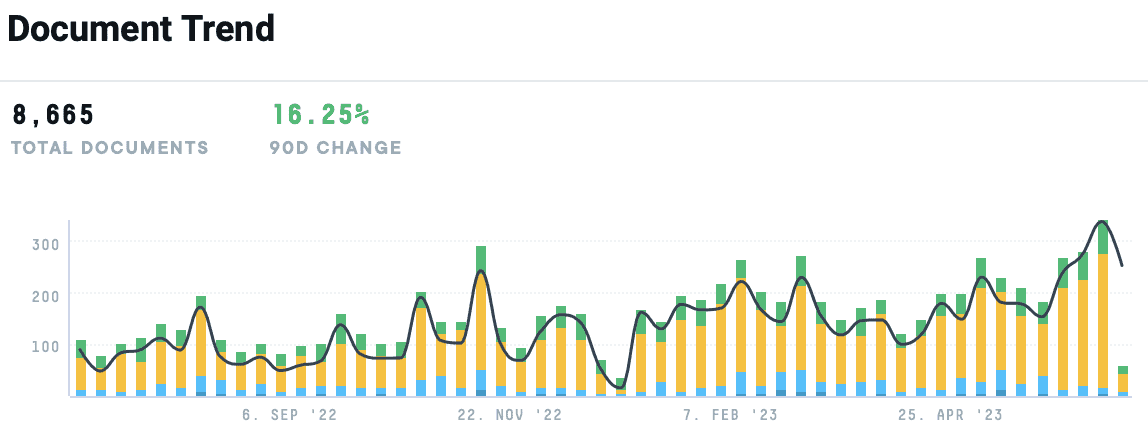

Staying On Top of Retail Media

Finding valuable information on your industry, competitor, or market requires a tool that separates the noise from the insights you need. With AlphaSense, there’s no need to meticulously search through multiple expert network libraries or spend hours manually reviewing documents to find crucial insights. The last thing you need is to be left in the dark on lucrative market movements or business strategies that could significantly impact your company.

Our AI search technology surfaces the precise insights you need to inform strategy and help you make business decisions that compete. Our vast content universe spans company documents, analyst reports, expert interviews, and news outlets—giving you a full-picture view of the ever-evolving market landscape. Get the competitive edge now with AlphaSense.