It’s no surprise that Silicon Valley Bank (SVB) catered to a specific type of startups, venture capitalists, and tech firms. For 40 years, SVB has provided banking services to nearly half of the country’s venture capital-backed tech and life-science companies. But in a matter of days, SVB ceased to exist—a collapse that has sent shock waves through Wall Street and Washington.

A large portion of SVB’s business focused on venture capital and private equity—a sector that has consistently performed well over the past decade. High concentration and exposure to one industry creates high risk, so when things got bad for their non-diversified portfolio of clients, things went south for the bank. This was further exacerbated when the crypto-focused bank, Silvergate, said it was winding down last week.

When it comes to the economy, history tends to repeat itself. Similar to the subprime crisis, the beginnings of the Silvergate and SVB downfall were set in a period of monetary abundance. Still, it’s hard to ignore how quickly one of the largest banks in the US failed. Two days is far from what anyone would call a slow fall from grace.

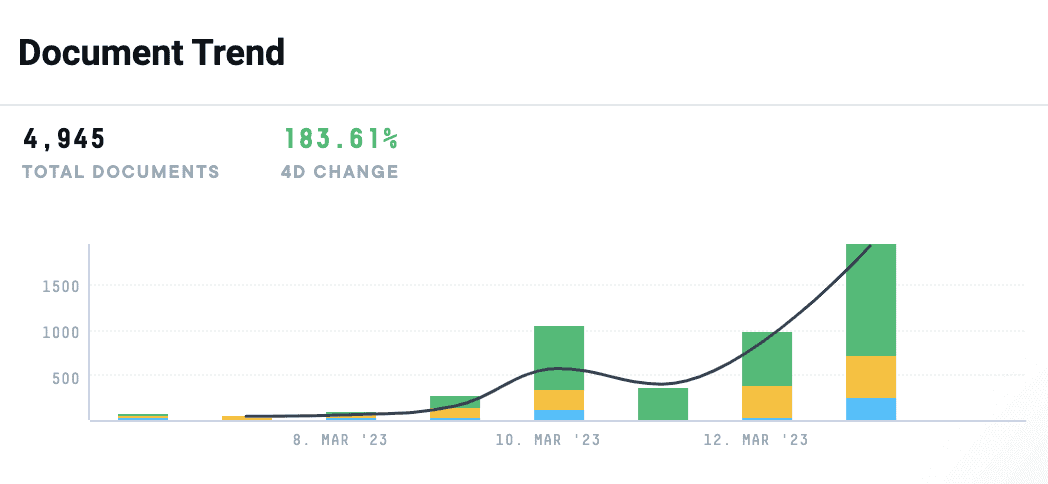

The sudden Silicon Valley Bank collapse has led regulators in the US and the United Kingdom to prepare emergency plans and has raised fear among small businesses, venture capitalists, and other depositors with funds stuck at the tech bank. Document mentions of SVB in the AlphaSense platform alone are up 183.61% over the last seven days with no indication of a slowdown in market chatter.

So, what exactly happened and what should we expect in the coming weeks? We dug into our vast content universe to give you insights from broker research reports and expert call transcripts on the current state of this collapse and the future outlook.

What Happened to SVB and How Did It Happen So Fast?

In what is now the largest U.S. banking failure since the 2008 financial crisis and the second-largest ever, bank regulators shuttered SVB on Friday, March 10. SVB met its demise as the result of a bank run spurred by red flags that began to emerge last week.

SVB invests deposits from clients into classically safe securities, like bonds. As the Federal Reserve has increased interest rates, these bonds have deteriorated in value. Ordinarily, this would not be an issue as SVB could just wait for the bonds to mature. But due to an overall slowdown in venture capital, and tech more broadly, deposit inflow activity has slowed, too, leading clients to withdraw their money at a rapid clip.

On Wednesday, March 8, SVB Financial Group, SVB’s parent company, announced it was going to undertake a $2.25 billion share sale after selling $21 billion of securities from its portfolio at a nearly $2 billion loss. This move had a clear objective: shore up the balance sheet. Instead, it created panic in clients and the market. The share price of SVB Financial plummeted the next day and by Friday morning, trading of the stock was halted. Big-name venture capitalists reportedly started to advise companies to pull their money out of the bank.

In a recent episode of our podcast, Signals, Nick Mazing, Director of Research goes over a framework for how financial institutions fail with Marc Rubinstein, a former financials analyst and portfolio manager, currently writing Net Interest. Subscribe and take a listen now.

Potentially Negative Signals in Former SVB Expert Interview

Expert call transcripts are a great form of primary research to use in proactively anticipating risk in the banking and finance industry.

In February 2023 (mere weeks before the implosion of SVB) AlphaSense conducted a Stream expert call with a Former Silicon Valley Bank – Western US Market Manager, Private Bank, Wealth Advisory, Wine (Prior), to gain a deeper understanding of the short-term outlook for SVB given the market downturn. Though the expert took a bearish approach on SVB’s short-term outlook, there were two potentially negative signals found in between the lines.

The first is that given the market downturn, the expert felt that SVB’s commercial bank would face some pressures in the venture debt space as valuations decrease and debt service is squeezed.

“When everything got grounded, what’s interesting is that we saw an increase in funding, an increase in activity. What I think happened is this, everybody went back to work and market crashed, and there was a bunch of factors that really reduced capital. SVB, in particular, I think is, tended to be on the front end of more aggressive funding. We tend to look at Fund I’s where other companies won’t even look at lending the Fund I or working with venture capital or private equity, who are establishing their first funds, will consider it.

SVB has been in start-up end of things and in seed rounds, where other companies won’t touch that. SVB is willing to take risks where other companies are not. When the market has pulled back and we’re seeing less capital in technology in particular, SVB is at a new precipice in how do they deal with what’s going on. If you remember back in 2008 with everything shifted previously, SVB actually used to work with wine and churches and other organizations that they pulled out of, and really focused on technology and of course, wine, which is part of private bank. They really moved away from doing certain types of business in 2008.

It’s interesting to see what’s going to happen in the future in regard to what SVB is continuing to work with, and who they’re choosing to work with in this new season of difficulty that they found themselves in with the stock price and CEO having to get up and talk about what’s happening at the bank.”

– Former Market Manager Is Bearish on SIVB’s Short-Term Outlook Given the Market Downturn, Expects a Return to Strong Performance in ~2 Years | Expert Call

The second was on the culture shift that took place with the acquisition of Boston Private. According to the expert, Boston Private has a completely different culture, focus, and way of operating, and even mentioned that some would have noted that this acquisition was “maybe not the best decision.”

“With the Boston Private acquisition and prior to that, Leerink, those were two very expensive acquisitions in some ways. Leerink is healthcare-focused. Boston Private was a company that has had a completely different culture, focus, and way of operating. Leerink was a bolt-on. Boston Private was a full acquisition.

While Leerink has been able to keep a lot of its culture, and in a lot of ways, it is almost like a sidecar, Boston Private infiltrated the private bank in a pretty significant way, culture shifted, and the way that they do business significantly shifted. Some would like to venture to say that maybe was not the best decision. It was a very expensive decision and there was a lot of risk that was taken, and we’ve yet to see how that shakes out.

Boston Private focused on manufacturing, lawyers, kind of professions that SVB has never focused on. To be a part of the private bank at SVB, you had to be in the innovation sector, and we, as private bank employees, had to actually verify that. SVB was mostly interested in working with innovation sector who are on a trajectory of having a $10 million net worth or more within three years… Part of the secret sauce of SVB is that we would get in at seed start-up, Series A, Series B with founders or investors and be there when the significant exit happened. We would invest the assets because we were the trusted source before any of the wealth had been really made real for people.

With Boston Private, they’re essentially just a blue-blooded northeast, broad-focused investment advisory firm that was very traditional. There was almost no technology clients at Boston Private. There was a steep learning curve. Some advisors were interested in learning, others had no interest. That was particularly challenging because that was really the focus of our client book.”

– Former Market Manager Is Bearish on SIVB’s Short-Term Outlook Given the Market Downturn, Expects a Return to Strong Performance in ~2 Years | Expert Call

Bank runs are largely narratively driven. What story should SIVB tell to be allowed to reopen? What would a potential rescuing acquirer want to hear? Read the answers and more to these questions in the latest blog from Stream, Deal Note: What Story Should SIVB Tell?

Analyst Perspective on the Current State of Banking and Future Outlook

In February, the Federal Deposit Insurance Corp. reported that unrealized losses on available-for-sale and held-to-maturity securities for US banks totaled $620 billion–up a whopping $8 billion from a year prior to when the Fed’s rate push started. This is partially due to the post-Covid deposit boom, leaving many drowning in cash. According to FDIC data, domestic deposits at federally insured banks rose 38% from Q4 2019 to Q4 2021. Total loans were similarly on the rise, leaving many institutions with an influx of cash to put into securities as interest rates sat at a record low.

Most unrealized investment losses in the banking industry are with the largest lenders. In its annual report, Bank of America shared that the fair-market value of its held-to-maturity debt securities was valued at $524 billion as of Dec. 31, 2022—approximately $109 billion less than the total value that appeared on their balance sheet. Unlike SVB, Bank of America draws its funding from a wider set of sources, including more long-term borrowing. At the end of 2022, 89% of SVB’s liabilities were deposits. Big banks tend to have more leeway since they hold a range of assets across the economy. In regards to risk, big banks tend to minimize the potential threat of an industry experiencing a downturn through diversification.

Without AlphaSense, keeping tabs on the deluge of information around SVB is challenging, especially when it comes to the analyst perspective. Staying on top of the latest broker research can mean hours spent sorting through or even trying to locate valuable yet dense documents. By the time you feel you have a grasp of what’s happening within a market, you’re back at square one as an influx of information continues to flow in. It can feel virtually impossible to get an accurate reading of what’s happening with the banking industry without the help of an AI-backed research tool aggregating all of the critical documents you need into one place.

In a matter of seconds, we combed through the broker documents in our platform and found three critical insights on the banking industry currently:

- Banks continue to have access to liquidity: While banks primary source of funding is deposits, they have several other ways to generate liquidity if need be. A few options might be: they can pledge collateral to the Federal Home Loan Bank, enter into repurchase agreements with their securities, securitize their loans and access government funding facilities such as the discount window in a highly stressed scenario. Banks also now have access to the just-announced Bank Term Funding Program.

- Regulatory capital across the industry remains solid: Many banks are well in excess of their regulatory minimums. G-SIBs are required to run the impacts of AOCI through their regulatory capital ratios while regional banks are allowed to opt-out of doing so. Thus, all of the negative marks from higher rates that banks took through their capital last year on their available for sale portfolios has already flowed through G-SIBs’ CET1.

- Margin pressure is likely the main issue from here on out: Back in 2022, bank net interest margins expanded. Given the higher for longer environment, deposit betas are expected to be under pressure, potentially reaching the high 40s with incremental betas north of 65%. Additionally, deposits are down and it is expected that banks will experience two things: 1.) they will continue to see mix shift in their portfolios from non-interest bearing deposits to interest-bearing and 2.) they will rely on securities paydowns and wholesale borrowings to fund their balance sheets.

One thing remains clear from analysts: the banking crisis is beyond SVB now and we should continue seeing major shifts and shakeups affecting the industry.

AlphaSense Was Built for Market Volatility

Regardless of the market environment, our first priority will always be to support our customers, with the help of AlphaSense. Our mission—to help businesses make decisions with confidence and speed—remains unchanged and is more critical now than ever before.

We’ve put together a number of resources for our customers to ensure you easily stay on top of crucial market updates during this time:

-

- Set up alerts on Broker Research with keywords “SIVB or SVB”

- Want to know how brokers will be analyzing and writing about the market this week? Interested in the global repercussions from this bank fallout? Set up an email alert for the Weekly Macro Headlines.

- Keep a pulse on all negative titles across the banking industry and negative SVB tickers in transcripts.

- Go even deeper on the state of SVB’s debt agreements, exposure in filings, negative sentiment, and PE/VS investment commentary:

Watch our exclusive webcast where we talk with Marc Rubinstein, former financial sector analyst and author at Net Interest, about the most pressing issues of the evolving banking crisis.

If you are a customer, please do not hesitate to reach out to your Account Manager for questions or best practices; we will continue to update you on any developments. If you are currently not a customer but are looking to stay ahead of any and all developments affecting SVB and the banking industry at large, sign up for a free trial of AlphaSense today.