As the first country affected by Coronavirus, the world has placed its attention on China as a leading indicator of how quickly other economies might expect to recuperate. Throughout Q1 earnings calls, executives across all industries have been asked about the virus’ impact on their bottom line. Which industries and companies are showing signals of recovery in the first market hit by the pandemic?

To understand which companies have been commenting on signals of recovery in China, take a look at the commentary we’ve compiled below.

Takeaways:

- Honeywell, McDonalds, Airbus, and 3M say that they remain cautiously optimistic that recovery in China will continue slowly but surely.

- Starbucks says that, barring any new disruptions, their business in China is on a path to a substantial recovery by the end of this fiscal year.

- PPG says that their factories in China are running at 70% to 80% capacity utilization, moving closer to their 2019 levels.

- LVMH noted an acceleration in online sales in March, signaling early signs of recovery in Mainland China, Taiwan, and Korea despite closures earlier in the quarter.

- Exxon Mobil says that April sales are back in line and slightly above the same period last quarter in three of their key businesses.

- QSR says that more than 80% of their restaurants are open, which reflects a strong recovery in China after peak crisis in February.

- PVH says down 30% in China, expecting April to be down 20% and May to down 10-15%

- Lamb Weston says traffic in China has rebounded to 70% of normalized levels

- Link Real Estate Investment Trust says footfall dropped significantly in February, it is now showing early signs of returning and more than 80% of tenants have resumed operations. However, most entertainment tenants, such as cinemas and gyms are still closed

AlphaSense can track management commentary in real-time across the entire market, by industry, or watchlist. We expect this to be an interesting theme to follow throughout earnings season. Start your free trial of AlphaSense now or login to your account.

Fiat Chrysler Automobiles – Earnings Call Transcript – 5/5

Answer – Michael M. Manley: Obviously, the only example that we are seeing today is the recovery of China. And I think the China market came back relatively quicker than people had expected. I saw a number of comments from players that are much bigger than us in China, who were very pleased with the speed that it came back. I think you’ll probably see different speed now in the U.S., Europe and in LATAM. And part of that will be how deep the drop is. And I think it will be — and it clearly has been deeper in different markets. So far, the drop in the U.S. has not been as deep as people expected. I think what you will see is intervention in the U.S. not aimed specifically at our industry, but I think you will see intervention in the U.S. in terms of getting the economy restarted again because as U.S. entered this crisis, obviously, the underlying economy was very, very strong. And I’m sure the administration is looking to get it back to that level.

I think in Europe, it may well be different speeds depending on the market. If you take Italy, for example, I think Italy was hit very, very hard. And now, as we know, progressively reopening, I think the recovery of the Italian market, again, I believe will surprise us.

Phillips 66 – Earnings Call Transcript – 5/1

We’re seeing that 80%, 90% back up, so strong recovery in China.

Exxon Mobil Corp – Earnings Call Transcript – 5/1

We’ve adjusted our plans to a low price and margin environment through year-end. Our price projections tend to be at the low end of third-party estimates. Once again, I hope we’re surprised with a quick recovery, which we have not ruled out, particularly given our ongoing experience in China.

While it’s still early days, there are some reasons to be cautiously optimistic as signs of demand and economic activity are beginning to pick up in China, with April sales in 3 of our key businesses back in line with and slightly above the same period last year. It’s too early to tell if this initial rebound will be sustained or if it reflects the broader economy or if it is even relevant to other economies around the world given the range of government responses and policies.

Estee Lauder – Earnings Call Transcript – 5/1

We are also focusing on the areas of most immediate opportunity in Asia/Pacific, with Mainland China as of March and Korea as of April moving from containment to recovery. We told you on our last earnings call that we stood ready to facilitate recovery as soon as the market supported it and we are doing just that.

In Mainland China, we successfully piloted emerging business model for online and department stores to adapt to the change in landscape. For La Mer, personalized service across channels with curated and targeted communication drove both online sales and department store sales significantly higher in the month of March. The strength of the La Mer repeat business model has been a key factor for its strong recovery and contributed to the brand’s outstanding prestige beauty share gains in Mainland China in the quarter.

As countries in Asia/Pacific move into recovery, we are mindful of the consumer in these markets who traditionally purchase our products in travel retail but not able to do so with air travel largely curtailed.

Abbvie Inc – Earnings Call Transcript – 5/1

However, after carefully analyzing the esthetics business performance during the 2008, 2009 recession, which experienced a rapid V-shape recovery, the recent trends we are observing in China, as clinics have reopened locally and procedures have started to ramp significantly and taking into account the household income and employment status of the esthetics patient base, we remain confident that the expected near-term impact, while likely substantial, will be transient with the esthetics business quickly ramping back to normalized trends following the relaxation of quarantine restrictions in the U.S. and major European markets.

Honeywell – Earnings Call Transcript – 5/1

Question – Sheila Karin Kahyaoglu: And then I guess my second question, maybe can you talk about what sort of recovery you’re starting to see in Asia and China by segment? How quickly are some of these businesses coming back?

Answer – Darius E. Adamczyk: Yes. I think it’s a little bit of a mixed story, and maybe I’ll use China as an example. So as you can imagine, in China, January and February were extraordinarily slow, that the business was — there wasn’t really much of anything happening. March was better. March, we saw a bounce back, which was encouraging. But April has been, no, not horrible, but soft. I mean think about negative, single-digit kind of business. So I think the assumption that China is back to normal, at least based only on the April data point, may not be correct. Aviation is just starting to pick up in China.

Restaurant Brands International Inc – Earnings Call Transcript – 5/1

As we sit here today, more than 95% of our U.S. restaurants are open. In Canada, around 85% of our Tim Hortons restaurants remain open, with most of the temporary closures in places like universities or malls that are currently closed. In APAC, more than 80% of our restaurants are open, which reflects a strong recovery in China after a majority of the restaurants were closed during the peak of the crisis there in February. And in EMEA and LAC, around 40% and 50% of our restaurants are open, respectively.

Fortive Corp – Earnings Call Transcript – 4/30

Answer – Andrew Alec Kaplowitz: That’s helpful. And then, Jim, I’m just trying to ask Steve’s question maybe a different way. Some of your multi-industry peers have talked about a V-shaped recovery in China specifically and some strength, at least not weakness, in semiconductor and some types of electronics. Seems like you’re really seeing more of a U in China. So maybe you can give us a little more color on that? And could you comment on your electronics-focused businesses?

Answer – James A. Lico: Yes. Sure. So I would say, I think it’s — we’ve got all these letters for recovery. I think at the end of the day, this is not a snapback recovery in China. If we look at our 4 largest businesses there, Tektronix has got electronics focus. That’s been pretty slow. We have a little bit of Huawei impact in the first quarter, but that’s been relatively slow still and haven’t seen that come back much. Fluke has seen nice demand in things like imaging. So they’ve seen some strong demand there, but the remaining part of it still remains slow. I haven’t seen much recovery there. I think with Gilbarco, we’ve been mostly waiting to put stuff in the ground given there’s still a lot of restrictions there. I mentioned that in North America, but we’re seeing that in other places around the world. So that’s probably been more slow than the other 2.

And of course, ASP, I mentioned elective surgeries at their peak were down 85% in China. So they’ve come back considerably, but not come back to normal yet.

Apple – Earnings Call Transcript – 4/30

Answer – Timothy D. Cook: Yes. What we saw in China for the full quarter, and I’ll speak about Mainland China because I think that’s the source of your question, we saw strong results in iPad and in Wearables and in Services. And if you look up underneath the full quarter, we saw a strong January and then a significantly reduced demand in February as the shelter-in-place orders and the lockdowns went into effect in China and the stores closed. And then in March, as stores reopened, we — the recovery began, and then we’ve seen further recovery in April. Where that goes, we will see, but that’s kind of what we’ve seen so far there.

To your question about store traffic, store traffic is obviously up from where it was in February, but it is not back to where it was pre the lockdown. There has been, however, more move to online. And as I’d mentioned earlier in my remarks, the — it’s pretty phenomenal actually. Retail had a quarterly record for us during the quarter, and that’s despite stores being closed for the 3-week period around the world ex China and then China was closed prior to that 3 weeks. And that’s partly because the online store had such a phenomenal quarter, and that included in China but it was also other regions as well. So there is definitely a move. And whether that’s a permanent shift, I would hesitate to go that far as I think people like to be out and about. They just know that now is not the time to do that.

Stryker Corp – Earnings Call Transcript – 4/30

By geography, Japan, Canada, and smaller countries in Europe and emerging markets performed well, while China was clearly the weakest.

In Q2, we expect a recovery in China, but most other geographies will get worse, given the spread of the virus. For the month of April, our company sales will decline by 35% to 40% versus 2019. Looking at the remainder of the quarter, we are encouraged by the planned gradual resumption of elective surgeries in the U.S. and abroad.

McDonald’s – Earnings Call Transcript – 4/30

Question – Jeffrey Andrew Bernstein: But China seems like some good intelligence. I’m just trying to assess the pace of recovery through the crisis. It seems like you mentioned it was down more than 20% from a comp perspective in the January, February time frame. Wondering if maybe you can give some sort of a monthly trend as that market, I think you said, is now down mid-teens. So it seems like it’s a 5-point-plus improvement but over multiple months. So it seems like maybe it’s slower than some had hoped. I was just wondering maybe if you can list out the primary factors. It looks like you said the U.S. is much more quickly improving, I think you said it started April, down 25%. And just within the month, it’s now only down 15%. So anything you can compare and contrast between China and the U.S. in terms of how we think about the recoveries around the world would be great.

Answer – Christopher J. Kempczinski: Sure. So I think there’s — as you mentioned, there’s a number of things that we’re learning from China. A lot of it was around operational elements that I described earlier in the call. We’ve certainly also been watching and learning as China has been able to approach the digital side of the business. I think they are further ahead than most of our markets in terms of how they use digital. So a lot of good — but as you mentioned, as we’ve referenced as well, the pace of recovery in China has been slow. We’re not seeing a V-shaped recovery in China. The business trends are improving, but they’re still running negative to where we were a year ago.

DOW Inc – Earnings Call Transcript – 4/29

The progression of containment and recovery that we saw in China is now playing out in Europe, and we expect similar patterns to evolve in the U.S. and other countries. So our corridor of potential outcomes assumes that the second quarter will show the largest global economic and chemical industry impacts from COVID-19 and the collapse in energy prices.

Using China as a reference, our modeling guidance assumes recovery for Dow begins as economies reopen. Reports suggest that overall activity in China did improve quickly year-over-year in February to March, but improvements have been uneven across industries.

Facebook – Earnings Call Transcript – 4/29

I think probably the market that would be most destructive would be a market like China. But I think for us, China is a bit different because we don’t have users in China. So the business there is China-based advertisers reaching people outside of China. So it’s hard to extrapolate too much from that. We did see a pullback of revenue in China earlier in the quarter. And we have seen a recovery there and a recovery — but one thing that’s hard to know is part of that is really kind of mixed up in the verticals as well. China tends to, for us, index pretty highly with gaming and e-commerce. And those segments that are driven towards online outcomes where we’re seeing relative strength. So it’s hard to really read too much into the experience.

Align Technology Inc – Earnings Call Transcript – 4/29

At the same time, while EMEA, North America and other parts of APAC fell off in mid-March, we began to see improvements in China as the country started to open up again. While it’s still early in the recovery process and the situation is different in every city and for every practice, we’re working closely with our doctors to support their current needs and ensure they have a game plan to resume operations in a very different environment for the foreseeable future. More on that in a few minutes.

Qualcomm – Earnings Call Transcript – 4/28

In the June quarter, we estimate the overall handset market to be down approximately 30%, driven by the impact of shutdowns in the rest of the world, while benefiting from the rebound we are seeing in China. Total demand will depend on the speed of the economic recovery. However, we see no change in our calendar year 2020 5G smartphone forecast.

Given the continued uncertainty around the timing and the pace of the resolution of COVID-19, our third fiscal quarter forecast is based on a planning assumption of approximately 30% reduction in handset shipments relative to our prior expectations. This planning assumption is based on 2 drivers: First, China sales for the quarter gradually improves from the exit rate of the March quarter; and second, other regions see a recovery starting in June, which is modeled based on the trends we are seeing in China. Our forecast for the first half of 2020 implies a reduction of approximately 10% to the calendar 2020 total device forecast. However, total devices in the second half of 2020 will depend on the speed of the economic recovery.

Answer – Akash Palkhiwala: Yes. Chris, it’s Akash. So the way we looked at the third fiscal quarter for us is we kind of focused on the — what we saw in the second fiscal quarter, which was we saw weakness in China earlier in the quarter, really starting from late January all the way through February, but a strong recovery exiting the quarter. And then outside China, we saw weakness exiting the quarter. And so we use that as the starting point. And our framework for how to model the June quarter was to use the exit rates and apply the China recovery model to the rest of the world. So as you think about the June quarter, the 30% decline that we’re expecting in handsets, it’s a combination of China being not as weak given that they’ve already gone through a substantial recovery, and then the rest of the world seeing more weakness.

Sherwin-Williams Co – Earnings Call Transcript – 4/29

Performance Coatings and was our strongest performer prior to the pandemic. We would expect that to be true going forward. We have started to see some recovery in China, but at a slower pace than anticipated.

Yum Brands – Earnings Call Transcript – 4/29

In the U.S., the stimulus impact on the consumers is obviously helping our business and helping build momentum there as well. But I think you heard last night from Yum China that what they’ve learned as they’ve gone through the recovery is that it’s been a little bit uneven, makes it very difficult to forecast where bottoms are and exact trends, but certainly look forward to sharing more details on sales when we get to the Q2 results.

3M – Earnings Call Transcript – 4/29

In China, there are more and more signs for recovery because the chances are good that in early, some of the automotive market could reach the previous year’s level on a monthly basis. All the 2,000 dealerships of the Volkswagen brand have reopened. Audi and Skoda have opened more than 95% of the dealerships, and the number of customers coming to the dealerships in the last weekend of March has reached a level that’s comparable to previous year. 32 of a total of 33 car and component factories have restarted production activities.

Again, this recovery, of course, hinges on the following conditions: coronavirus in China must not resurge, and the global economy must not slow down the recovery of the Chinese business world.

Airbus – Earnings Call Transcript – 4/28

Looking into our commercial aircraft environment in more detail. We start to see some signs of recovery in China, albeit at a very slow pace. Passenger capacity declined by minus 85% at the peak of the crisis in China in mid-February compared to pre-COVID-19 situation and recovered to a minus 60% in April. That’s the latest data available I have.

Starbucks – Earnings Call Transcript – 4/28

Today, continued recovery in China strengthens our belief that these impacts are temporary and that we will emerge from this global pandemic with new insights and capabilities that will make our business even stronger and more relevant.

For the month of April, comparable store sales in China were down approximately 35%, marking strong improvement from a weekly low of minus 90% in mid-February. Importantly, even though new store development activities were suspended for most of the quarter, we opened 59 net new locations in China during Q2 and another 7 locations added thus far in April. We are expecting to open at least 500 net new stores in fiscal 2020, with as many as 100 new stores originally planned for this year deferred to fiscal 2021. This represents a rapid reacceleration of our new store development and speaks to the amazing spirit and enormous capability of our team in China. Given this progress, we believe our recovery plan is working, and we remain optimistic about our ability to capitalize on the long-term growth potential of the premium coffee market in China.

We believe, barring any new disruptions, that our business in China is on a path to substantial recovery by the end of this fiscal year.

Unsurprisingly, business disruption attributable to the COVID-19 pandemic has materially impacted our financial results. Our belief is that these impacts are temporary as evidenced by our continued recovery in China, as Kevin outlined, so I will highlight the financial impacts to provide investors with perspective on our normalized performance for the second quarter as well as insight into how future quarters’ results may be affected by these conditions.

Costar Group – Earnings Call Transcript – 4/28

The entire industry is watching the recovery in China to hopefully shed light on what a recovery in their part of the world will look like. We have been reporting on China weekly and have now added a video series focused on China’s recovery that we’re producing both in English and Chinese. As of last week, 90% of the hotels in China are open, and we have a couple of markets that are inching towards 50% occupancy. Overall, though, occupancy in China is at 35%, and that’s certainly nowhere near the normal 70% to 75% of the occupancy we expect, but it’s well up from the low of 10% occupancy a few months ago. Slow but measured recovery in a matter of months.

United Parcel Service – Earnings Call Transcript – 4/28

One of the bright spots in the quarter occurred in mid-March, as China began its recovery. March export volume from Asia was up around 15% on a local day basis. We quickly added capacity to support pent-up demand out of Asia from a variety of sectors, including healthcare, high-tech and e-commerce. International generated $558 million in operating profit.

International air freight tonnage rebounded in March and was up more than 15% primarily on Asia outbound lanes as the China recovery took hold.

Transunion – Earnings Call Transcript – 4/28

Christopher A. Cartwright: Just 2 quick comments. I mean, I guess, in summary, the difference in the product mix that we have or the weighting of the product mix in Hong Kong lends itself to stability. And that business has held up pretty well over the past year or 18 months. I mean, initially, we had the protests and political instability, which caused some curtailment; and then we had the unfortunate fraud situation in our direct-to-consumer business, which took that off-line; and now, of course, the pandemic.

All that said, though, it’s still a strong business. And it’s also just given us insight as to how this pandemic and then also the recovery may develop. Our employees have been going back to the office in Hong Kong but in a measured and limited way.

3M – Earnings Call Transcript – 4/28

Andrew Alec Kaplowitz: I wanted to follow up on the comments on electronics. I mean you mentioned the recovery in China. It’s obviously more of a China-based business for you guys, but is that business being a little more resilient this cycle than expected? Can you give us some more color on what your — to the extent you can, on expectations moving forward between SEMICON? Obviously, you’ve got mobile devices in there. What are you seeing in that business?

Answer – Michael F. Roman: Yes. And Andy, even as we came into the year, we were starting to feel better about electronics, and it was really semiconductor manufacturing demand increasing. And that has held up. We’re seeing that and that’s part of that broader growth and return to growth in China.

PPG Industries – Earnings Call Transcript – 4/28

Since early March, in China, we have seen a measured recovery in demand patterns. Our factories in China have been running at 70% to 80% of capacity utilization for several weeks, moving closer to our 2019 levels and mirroring the needs of our customers’ demand. We’ve also learned a lot from the restart in China, which we will be able to leverage and optimize as other countries are beginning to restart their economies over the coming weeks.

In addition, we have included some details what we are currently experiencing during the early stages of the China pandemic recovery in our presentation materials. Regionally, demand continue to improve in China and is expected to return to growth in the second half of 2020. Consistent with the timing from the Great Recession, year-over-year auto builds in China are expected to be comparable in the second quarter. And retail auto sales have been increasing on a sequential basis now for a number of weeks and approaching levels close to 2019. Other end-use markets in China are in different stages of recovery, but all are directionally improving. Also, data shows that traffic congestion in China is nearing 2019 levels, which should aid demand for auto refinish.

Waters Corporation – Earnings Call Transcript – 4/28

Looking at the various geographies, we believe that the U.S., India, Japan and parts of Europe are currently in the containment phase, and we expect these geographies to move into recovery in the second half of the year. We believe that China, many parts of Asia and some parts of Europe are currently in the recovery phase. And while there is a possibility for a second wave of the virus, we see them on an improving trajectory.

Derik De Bruin: So can you talk a little bit more about some of the recovery in your emerging markets? Just basically just questioning — you mentioned you saw some pickup in China and some pickup in some of the European geographies. Can you talk a little bit more about that and specifically what you’re seeing?

Answer – Christopher James O’Connell: Sure. Yes. Thanks, Derik, and I hope you’re well. We have established a really robust framework for how to think about recovery. And as you might imagine, it’s not a one-size-fits-all approach. Every geography is really undergoing a different dynamic as it relates to 2 primary dimensions of recovery. One is the overall spread of the virus and what the local public health response is. And the other dimension being the knock-on effects of that approach to the local economic conditions.

And there’s obviously a wide range of programs around the world. China, which went through this first, I would characterize as seeing a steady recovery that continues to gain traction at this point in time.

HSBC Holdings – Earnings Call Transcript – 4/28

We’re already seeing the start of a decent recovery, particularly in Mainland China, and to a lesser extent, Hong Kong. We expect the second quarter to be tough in Western Europe, U.K., U.S. and other places, and therefore, understanding the path of that recovery into the second half of this year, I think. So therefore, when we stand up at Q2 results, I think we’ll know a lot more. We’ll be able to provide you with a lot more color at that point on what we’re seeing.

Adidas – Earnings Call Transcript – 4/27

Basically, we had the following priorities: more aggressively push e-com and reallocate resources to e-com; secondly, doubling down on recovery in China and Korea and where opportunities come; and number three, of course, intensify collections wherever possible…

… Greater China, down 58% and particularly around the Chinese New Year and into February, where we were heavily impacted. We’re seeing a recovery starting to materialize in March, which we’ll speak about later in this presentation…

…When we look upon China, and trying to take the first learnings out of China and understand how can we apply these learnings to the road to the recovery for other markets, we’re looking upon and saying — seeing the retail business are recovering since stores are opening at the beginning of March. But traffic and conversion trends are normalizing over time, but they are below normal rates. So even when traffic goes up, conversion still remains lower.

… However, there are still many uncertainties as we manage through 2020: the speed of recovery in China plus the risk of setbacks; the duration of store closures and openings in the rest of the world; the economy and consumer sentiment and excess inventories across all markets. That’s why in the context of this, we do not believe it’s possible to provide the outlook for 2020 that includes the impact of the coronavirus, but we’ll give you a quarterly outlook as we speak.

Domino’s Pizza Inc – Earnings Call Transcript – 4/23

In other markets, we’ve seen strong recovery and steady gains in same-store sales over the recent weeks. China was our first market to be significantly impacted by COVID-19, and we are pleased to see our sales there recover and accelerate in the last few weeks of the first quarter and to remain strong early in Q2.

Unilever – Sales Revenue Transcript – 4/23

On the other hand, as to competitiveness and growth versus market, actually, all signs are the green. Our brand penetration market shares were improving through February, actually a 3-year record high. And in China where we’re starting to see a significant recovery, there’s pretty strong data that shows we are weathering. In fact, we’ve come out of the situation in China competitively advantaged.

Kering – Earnings Call Transcript – 4/21

In Mainland China, we observed a gradual and steady recovery since late February, early March, as the rates of decline narrowed week after week. In the past few days, some of our brands have gotten back to growth and others are nearly there…

… E-commerce, was a bright spot for most of the quarter, but that stopped with the closure of most of our European logistics operations in late March. Gucci is ideally positioned to take advantage of the recovery of the Chinese market and actively fostering sale wherever its stores are reopened, reallocating inventory across regions.

Emerson Electric Co – Earnings Call Transcript – 4/21

Let me turn to Asia. The good news is China’s recovery is better than expected. We will beat order — the orders plan in April, significantly driven by semiconductor and medical. The near-term demand in China is relatively strong as the economic stimulation takes hold. And I’ll show you the specific details on a monthly basis on China.

Coca Cola – Earnings Call Transcript – 4/21

We’re seeing encouraging signs of increased consumption as outlets reopen, resulting in sequential improvement in China. However, the consumption is still lower than prior year, and we expect the full recovery to take time especially as there are still limits on crowd sizes.

As we anticipate a recovery in China, we’re planning key actions with bottlers to regain momentum, including our pre summer sales promotion and increased cooler placement. We will follow the strategy that has proved successful before the pandemic, adjusted with greater focus on channels and packages that will have traction as the new normal unfolds.

L’Oreal – Earnings Call Transcript – 4/16

There were progressive signs of recovery in March in Mainland China where L’Oréal achieved growth both in March and in the first quarter…

…we have seen, obviously, a weakness in makeup. And after confinement, we see that all categories are gaining traction. And consumption, as I said, is bouncing back to be positive with still progressive recovery for makeup, especially, obviously, in China where everyone is wearing mask. It is not, of course, a great incentive to wear lipstick or makeup in general.

Intuitive Surgical Inc – Earnings Call Transcript – 4/16

And so my first question is really on the chart on China. We’re showing a pretty nice recovery from trough to where you are right now. I was wondering if you could just walk through your views on how good a proxy China might be for a U.S. recovery. Like, why or why not? How could that be different? Just your general thoughts on that would be great.

Answer – Gary S. Guthart: Thanks, Bob. Yes, you see in that chart China. You see other countries as well, Japan and so on. And what you can really see is that country policy changes the shape. I think we’re encouraged by a couple of things. One is people’s interest — our customers’ interest in using da Vinci is durable. That’s been great.

You had asked a specific question of how predictive is China. And I think the answer there is too soon to tell for the rest of the regions. I’m encouraged by it. I think it indicates the durability of demand. Having said that, I think policy matters, and I think how people allocate their health care resources are going to change, too.

LVMH – Conference Call Transcript – 4/16

Louis Vuitton and Christian Dior couture continued their creative momentum despite stores being closed in Europe and the U.S. beginning in March as well as limited international travel.

There was an acceleration in online sales during the period, and we are starting to see early signs of recovery in Mainland China, in Taiwan and Korea after the closures early in the year — earlier in the quarter, sorry.

Abbott Laboratories – Earnings Call Transcript – 4/16

And as we shared, we’re starting to see an improving trend here in China. It’s not to the level that we saw in our normal levels, pre-COVID, say, December, January kind of rates. But they’re definitely not as low as where they were in February. And we’re starting to kind of see them every week, get better and better and getting closer to those levels that we saw pre-COVID.

We’ve seen other markets around the world, whether that’s Asia or some of the other European smaller markets there, where we’ve seen the beginning of the same kind of recovery trend that we saw in China. So starting to see some of the beginning of that recovery. And then in other markets, we’re seeing kind of just this flattening and a stabilization here that’s suggesting here that the speed of the virus is a little bit more controlled.

Daimler AG – Conference Transcript – 4/8

We see early signs of a recovery in China. Group sales in March returned close to 60,000 units, almost on the same level as last year’s sales. All of the dealers are in operation in China, and we are recognizing growing customer traffic.

As of the end of March, our operations in China is already fully normalized, including the complete supply chain.

Deutsche Post AG – Earnings Call Transcript – 4/8

So you have heard from us that we were in good shape or better shape than ever before than we started the year and entered the crisis. Of course, that’s still the case that we are in good shape. That’s the reason why we have clear priorities. We want to protect our people at the best way. We want to keep our customer service up and running. And of course, we are focusing very much on the liquidity and the balance sheet strength.

We have unfortunately, as Melanie said, a little bit limited visibility on what might happen in the next weeks even if I’m personally optimistic that the first signs of recovery, at least on the infection rate, is happening in some markets, and that should then lead, like we have seen in other markets, in particular in China, to a recovery of the economy. But it’s too early to say that and it’s too early to judge how long governments really keep the lockdown in place.

Smiths Group – Interim Report – 4/6

Group trading to the end of March was affected to some extent by early COVID-19 disruption, which is now accelerating. In HY2020 only the Chinese operations of John Crane and Interconnect were disrupted. All our sites in China have now reopened and are operating at close to normal levels

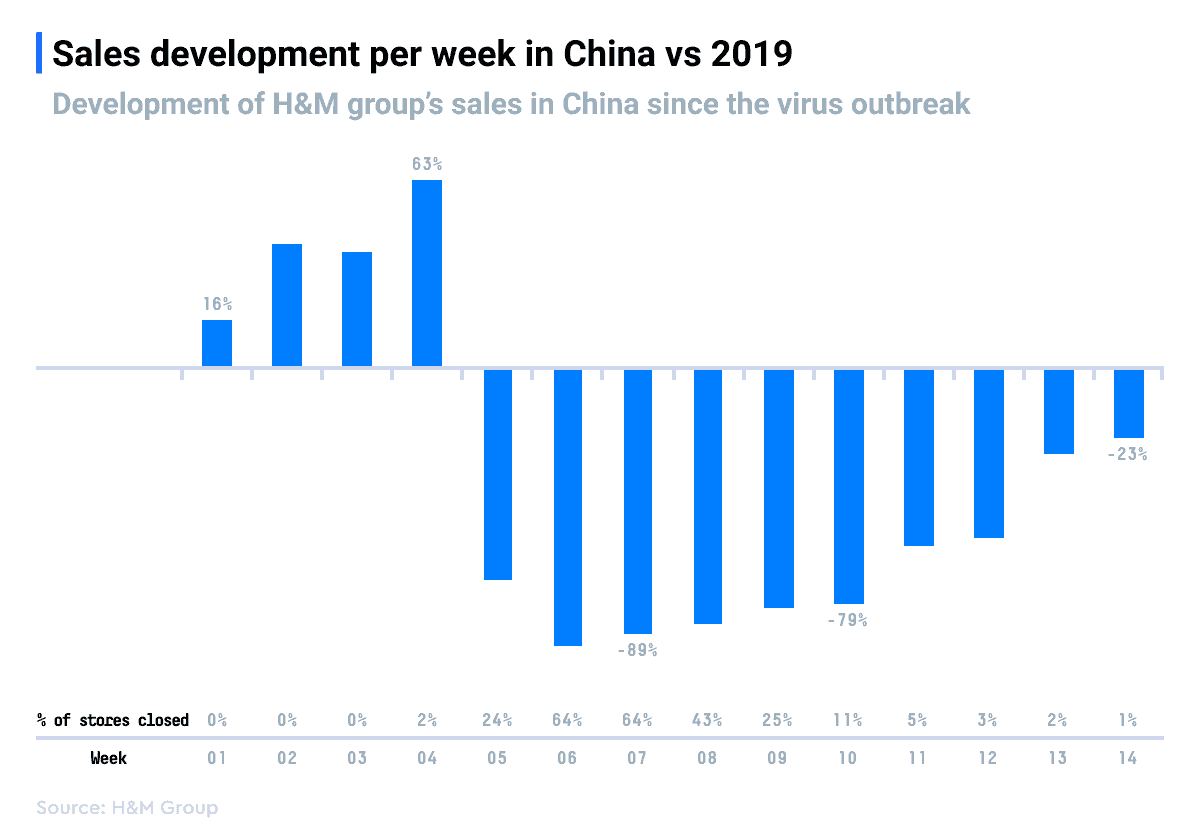

H&M – Earnings Call – 4/3

Answer – Rosie Shepard: You said that online sales in China didn’t change as much as in other markets, but there — and so China’s recovery could indicate the same recovery pattern as the other countries. For other markets, do you predict a change in online versus in-store and where the demand will be?

Answer – Adam Karlsson: I think what we tried to say was that the shape of the recovery is different in the online channel than the store channel in China. We don’t see the same pattern here. So it’s been a more even pattern in the online channel than in-store channel. So that was the intended answer.

Answer – Rosie Shepard: In other markets predicting the recovery, though, do you see any change in demand online versus in stores?

Answer – Adam Karlsson: We can say that in some markets, we’ve had a transfer of customers that’s previously been store customers that are now also starting to buy through the online channel. So we don’t have a good proxy for how this will evolve, but we see a flow of customers that used to be store only now into also becoming omni, so to say, multichannel customers.

PVH Corp – Earnings Call – 4/2

Beginning end of February, business opened. And for the month of March, overall, our business in China is back to about 65%. In the last week, it’s probably close to being back to 70% of the business. Digital continues to be very strong. What we’re seeing is in the major cities like Beijing and Hong Kong — Beijing and Shanghai, we’re seeing in those cities that are driven by, in some respect, international tourism. And we have the controls and store hours where the controls are tighter on movement and where the tourism has been a big impact on that business in those key cities. There is no tourism going on. Those 2 cities are feeling it much more than the rest of China at large. So it just gives you a sense of where we are.

We’re expecting that as we get into the month of April, that minus 30% will move to minus 20%. And then we get into May, minus 20% will move to minus 15% or 10%. And we are assuming when we get into the second half of the year, we will start to — assuming that the pandemic goes the way we hope it does, that business will start to get back to a more normal level as we get into the second half of the year. That’s how we’re planning it.

I think that’s a prudent way for us to plan the way North America will come back as well. I don’t think when stores open that the first thing consumers are going to do are going to run out to buy apparel and accessories and get online and go into stores immediately. I think it’s going to be a ramp-up as that happens, as people get more and more comfortable with the situation. And I think that’s how we’re planning it. I hope that was helping.

HELLA GmbH & Co KgaA Earnings Call – 4/2

Answer – Gabriel M. Adler: It’s Gabriel from Citigroup. I wanted to touch quickly on your suppliers and what risks you currently see from cash pressures and potential bankruptcies at the Tier 2 and 3 suppliers? Any color there would be very useful.

And then my second question would be on China, when you said that you’re seeing green shoots in recovery and demand is starting to come back. It’d be great to have some more examples here because, clearly, plants are reopening, but wholesale demand in China is still down, I think, around 50% last time I checked. So it’d be interesting to hear your views on whether you think the recovery in consumer demand in China could really start come through this month, that would be very helpful.

Answer – Rolf Breidenbach: Yes. With regard to our suppliers, of course, we are in close contact with many of them because the financial situation on — of our partners here and there is difficult. And therefore, we also have started a program to allow them to get cash in the necessary amount. Of course, we only can help where it’s absolutely necessary, but we have a focus on that. Overall, of course, we also try to use our contacts to the politicians in Germany, and to the industry, of course, also in Germany and in Europe to make sure — to again and again point out that the programs which are — have currently launched have to be accelerated and have to create bottom line impact as soon as possible. I think for the smaller companies, this is so far quite good installed in Germany, in the other countries, here and there also. But for example, when I look at Germany, for the midsized companies, we have to accelerate because we need — HELLA cannot help everywhere. We only can do this in a very selective way. We need these stabilization programs in the supply chain because especially the midsized suppliers are currently suffering a lot and we have to be very careful not to more destabilize the supply chain.

In China, as I said, our operations is — our plants are currently running at around 60%. We see that the plants of our customers are more and more opening. They — the whole attitude in China is very positive. It looks as if not only the Chinese government, but the whole Chinese nation now has a target to recover. And therefore, we see, in general, especially by the huge, let’s say, joint ventures between global OEMs and Chinese state-owned companies, a clear tendency to step-by-step go beyond the current level of 50%, 60%. And we are very optimistic that this also will be the case. The situation at the local Chinese customer is a little bit different. Some have already started their production, others are a little bit behind. But this depends on the market success of their products.

But the good news, in general, is that the demand for cars, for pass cars in China, is step-by-step improving, which, of course, is the most important prerequisites that the industry will recover and continue the development to — step-by-step, come to a, I don’t know, 80%, 90% utilization.

Lamb Weston Holdings – Earnings Call- 4/1

Question – Rebecca Scheuneman: So it can be difficult to get a read for exactly what is happening in China, but there have been some reports of — that new cases of the COVID-19 virus are spiking up again as people are getting back to work and back out in the general population. Are you seeing anything in your demand data to indicate that, that is happening?

Answer – Thomas P. Werner: This is Tom. I know that the news that’s coming out is mixed. That’s what I know. Factually, what I know in our business in China is what I stated earlier. When all this happened in January, February, the last 2, 3 weeks, our business fell off about 50%. The team worked through it. They did a terrific job, the China team continuing to operate, provide food for people. And now we’re seeing traffic patterns for our business about 70% of normalized levels.

And with the recent news that you alluded to, it’s new news to all of us. So I can’t speculate on what our business is going to do. But as I stated earlier, this is a — we’re managing this every day. So we’re looking at the data. It’s very fluid. We haven’t seen any indications based on what you alluded to, the new news and new cases. And so it’s really a day-to-day thing that we’re going to continue to monitor. But right now, we haven’t seen any change based on the last 24 hours. And so that’s — but again, we’re watching this every single day based on what we know.

China Southern Airlines – 6k – 4/1

China is in the crucial period of transforming development mode, optimizing economic structure and transforming growth momentum. Structural, institutional and periodic issues are intertwined. The “three period superimposed” effect continues to deepen and downward pressure on the economy increases. At the same time, the COVID-19 epidemic has also had some impact on China’s economy. Currently, China’s prevention and control measures have achieved positive results, and the most difficult and arduous stage has passed. The resumption of work and production of enterprises has been advanced in an orderly manner, and the economy returned to normal at a faster pace. The impact of the epidemic is short-term and generally controllable. The basic trend for China’s economy to seek progress while maintaining stability with long-term good prospects has not changed.

Xiaomi – Earnings Call – 3/31

Answer – Xiang Wang: Yes. Maybe I’ll answer the question and then Shou and Richmond can add. So the first question is related to the impact, right, the COVID-19 impact in our business in India and Europe. So right now in India, I think the Indian government take a very, very big step to prevent the whole country into — to try to help the people to prevent the more infection. I think it’s the right decision. So the whole country right now is shutting down. So we see definitely it will impact our business.

But based on the — but still, although everything is shutting down, we still see a lot of our customers or fans still buying our smartphones from different channels. That’s a good indication that the consumer — consumers need smartphone even in the very difficult situation. So based on the experience we have in China, we see a strong bounce back of the market. We believe after the — we recover from the virus, actually, we will see a strong recovery.

So in China, China’s experience told us, right now, in March actually, the run rate of smartphone sales is about 90% of the January consumption. And so a very good signal. And it tells us the smartphone demand is a resilient demand.

In Europe, the same thing. Many countries, including Spain, Italy and France, they — their focus is fight against the virus, right? So we see a demand drop, but gradually — after a week, gradually stabilize. So maybe later, I would like Shou to give you a detail.

Answer – Shou Zi Chew: Yes. Sure. Okay. I’ll go. So this is Shou here. I would just sort of reiterate a few things that Xiang Wang mentioned just now. The first is, based on our experience in China, the smartphone demand rebounds quickly. And our own assessment of this based on going through a full cycle here in China is that smartphones is on the — closer to the spectrum of essentials than on the spectrum of sort of luxuries in this time. So the good thing about our Chinese demand was — there was deferred consumption in the month of February, in particular, when a lot of cities were shut. Of course, e-commerce did a little bit to mitigate this. And as all of you know, our e-commerce presence in China is significant compared to a lot of our peers. So this is the experience we had in China.

Now the situation outside of China is very dynamic. As of — we are operational in 90 countries. And as of now, almost every single country has imposed some sort of restrictions within their countries internally. Now there are only a handful that have imposed the highest form of restrictions, which is even the logistics and fulfillment doesn’t work. Only a handful of countries are in this category. The large majority of countries are in the category where there is a social distancing policy. Some off-line retail shops are shut. But in general, the country is not at a complete, complete standstill.

So what we are seeing based on our numbers, the — first of all, we understand the gravity of the situation. We see a fall, but we see it sort of stabilizing. In particular, in some countries, we actually see a slight recovery. It’s across 90 countries around the world. So different countries are in different stages of this.

The second is, what we have seen is — in China is the consumption gets deferred. So at least in China, in certain — in the second half of March, what we are seeing is a relatively robust recovery. So this is something that we take to heart.

WPP – 6K – 3/31

For the first two months of 2020, excluding Greater China, Group LFL revenue less pass-through costs was up 0.4%. In Greater China (approximately 7% of WPP by revenue less pass-through costs) the impact from COVID-19 led to a 16.1%1 fall in LFL revenue less pass-through costs over the two-month period. For WPP as a whole, LFL revenue less pass-through costs was down 0.6%, in line with our expectations and the guidance set in our preliminary results announcement on 27 February 2020. In the USA, we saw an improvement in the rate of decline from 2019 with revenue less pass-through costs down 0.9% in the first two months, compared to a decline in the second half of 2019 of 4.4%. Our overall new business performance was very strong, with a number of key wins including Intel, Hasbro and Discover, and retentions including BBVA.

In China, despite the significant slowdown in economic activity and the closure of our offices, our people have responded extraordinarily well to the unprecedented challenges and we have successfully continued to work on client projects. At the peak of the crisis in China, almost all of our colleagues were working remotely, but as health restrictions are now being lifted, 55% of our local workforce are back in our offices.

In March, we have begun to see a range of different responses from clients globally, depending on the client sector, country and agency services. In the short term, media spend has largely remained committed, or diverted to alternative channels, although we have seen an increasing volume of cancellations. Project and retained work has continued in most sectors, but activity has begun to decline. New business pitches continue where the process was already underway, albeit we have less certainty over our future pipeline. In some markets, we are seeing additional demand in our PR and specialist communications businesses.

As a result, we expect our performance in March in markets experiencing significant COVID-19 outbreaks to be weaker than in January and February, impacted by government restrictions on movement and the consequent reduction in economic activity.

As we enter the second quarter, it is clear that the impact of COVID-19 on the business will increase but it is not possible at this stage to quantify the depth or duration of the impact. As a result, we have decided to withdraw our guidance for the 2020 financial year. We will provide an update when appropriate.

Credit Suisse AG – Annual Report – 3/31

The rapid spread of COVID-19 inside China in February 2020 and across the world in March 2020 led to the introduction of tight government controls and travel bans, as well as the implementation of other measures which quickly closed down activity and increased economic disruption globally. Markets globally were negatively impacted, with the energy, travel and tourism and transportation sectors, as well as companies with close links to China’s economy, being the worst affected so far. COVID-19 is expected to have a significant impact on the global economy, at least in the First half of 2020, and is likely to affect the Group’s Financial performance, including credit loss estimates, trading revenues, net interest income and potential goodwill assessments. We are closely monitoring the spread of COVID-19 and the potential effects on our operations and business

McCormick & Co – Earnings Call – 3/31

The disruption in China resulted in a 3% reduction in total company first quarter sales and reduced our total consumer and flavor solutions segment sales 5% and 1%, respectively. As a reminder, in China, our consumer segment includes the branded foodservice component, because those foodservice products use the same packaging format and share a common distribution channel, particularly in traditional trade and in the smaller markets, as other consumer products in China. The lower operating income from China impacted the total company’s growth in both adjusted operating income and adjusted earnings per share by 10%.

Currently, during the early stages of recovery in China, we are seeing increased cooking at home and a surge in consumer retail demand, both in stores as well as through e-commerce and the start of a recovery in foodservice as most restaurants and caterers reopen and consumer confidence gradually builds. We expect China’s results to be significantly impacted in the second quarter as well as the market begins to recover gradually. The lockdown in Hubei continued through March, and as recently announced, is expected to be lifted in April. For the year, we expect lower China sales from the COVID-19 impact will reduce our total net sales growth by 1% to 2%. And as I already mentioned, we currently believe COVID-19 impact in China cannot be extrapolated to the overall COVID-19 impact for the rest of the company.

Turning to the current status of our major markets outside of China, our presence in China afforded us the insight of seeing how COVID-19 scenarios can unfold as well as to take early action. Our supply chain business continuity plans have been in effect since January. We have assessed and implemented continuity plans to provide customers with continued supply. To date, there has been no material impact on supply for most of our sourced materials and for those impacted, continuity plans have been activated. We are partnering with our customers to monitor and respond to changes in consumer demand. We’re seeing increased consumer consumption, both through our scanner data and e-commerce as well as through customer orders, including those from packaged food companies in our flavor solutions segment.

Wynn Macau – Annual Report – 3/31

Visitation to Macau has fallen precipitously since the outbreak of COVID-19, driven by the outbreak’s strong deterrent effect on travel and social activities, the Chinese government’s suspension of its visa and group tour schemes that allow mainland Chinese residents to travel to Macau, quarantine measures, travel and entry restrictions and conditions in Macau, Hong Kong and certain cities and regions in mainland China, the suspension of ferry services and other modes of transportation within Macau and regionally, and, most recently, the ban on entry or enhanced quarantine requirements, depending on the person’s residency and their recent travel history, for any Macau residents, PRC citizens, Hong Kong residents and Taiwan residents attempting to enter Macau. Persons who are not residents of Greater China are barred from entry to Macau at this time.

The COVID-19 outbreak has had and will have an adverse effect on our results of operations. Given the uncertainty around the extent and timing of the potential future spread or mitigation of the COVID-19 and around the imposition or relaxation of protective measures, we cannot reasonably estimate the impact to our future results of operations, cash flows, or financial condition

Agricultural Bank of China – Annual Report – 3/31

In 2020, though the COVID-19 had some impacts on China’s economy, such impacts are mainly expected to be short-term and China’s fundamentals of high-quality economic development with favourable long-term prospects will remain unchanged. Investments in traditional and new infrastructures will play an important role in stabilization of economic growth, with significantly accelerated construction of 5G network, data centre and other new infrastructures. While consumptions will remain overall stable, online consumption will develop at a faster pace. The decrease in global demands will affect China’s export, and trade barriers resulting from the COVID-19 outbreak are also likely to affect our industrial chain. With the continuous economic structure optimization, internal demand will continue to further drive economic growth, and new retail, online education, online office and other forms of digital economy will have new development opportunities. Comprehensively considering the impacts of COVID-19 and pork price, the consumer price index (CPI) is expected to be relatively high at the beginning and decrease as the year progresses.

Link Real Estate Investment Trust – Investor Briefing – 3/30

Thank you, George, and all of you for dialing in. Our Hong Kong retail portfolio has shown resilience and occupancy was high at 97.2% as at December 2019. We maintained the nondiscretionary nature with 63% of the portfolio in food-related trades. Slide 8. Link’s overall average tenant sales growth has slowed in light of softening markets and was flat at 0.4%, still outperforming the overall Hong Kong market in the first 3 quarters of this financial year.

While F&B tenants recorded a gentle growth of 1.4%. Supermarket and foodstuff have done exceptionally well with a 5% growth. We saw a bigger hit on our general retail tenants, the sales shrank by 2.8% during the period, which was relatively milder compared to the Hong Kong market in general. Rent-to-sales ratio of the overall portfolio was steady at 14.5% as at December 2019. However, the figures here have not yet reflected the impact of COVID-19, which started in late January. The virus has severely impacted our tenants, especially Chinese restaurants and education centers in the last 2 months.

Through our proposed schemes, we have been working with our tenants to ride out this challenging period. Occupancy at The Quayside. Our joint venture development in Kowloon East is gradually ramping up. This 20-story office building has almost 14 out of 17 floors filled. 2 new additions, including Manulife and an FMCG tenant have committed to take up 2 office floors in recent weeks, pushing occupancy to over 80% as of March 2020. Around 70% of the 3-story retail podium is filled and provides a variety of amenities, especially F&B, to satisfy nearby demand. We hope to create a lively community for office tenants and their staff, offering suitable work-life balance.

Moving to Page 10. In Mainland China, the overall occupancy of our retail portfolio stood at 98.6% as at December 2019. They performed well up until Chinese New Year, then the outbreak of COVID-19 impacted shopping centers’ businesses at the end of January onwards.

Footfall dropped significantly in February, it is now showing early signs of returning and more than 80% of our tenants have resumed operations. However, most entertainment tenants, such as cinemas and gyms are still closed.

On our Mainland China office, Link Square. Link Square, our office in Shanghai delivered stable returns with occupancy at 95.8%. Office tenants have now resumed normal operations after over a month’s suspension due to the virus.

Domino’s Pizza Inc – 8K – 3/30

Across our international business, the unique circumstances in a number of markets have necessitated the temporary closing of stores. We continue to stay in contact with the master franchise companies operating these affected stores and look forward to them reopening as soon as possible. China was our first market to be significantly impacted by COVID-19, and we were pleased to see our sales there recover and accelerate in the last few weeks of the first quarter.

Cosco Shipping Holdings Co Inc – Annual Report – 3/30

Looking forward to 2020, overall, the sluggish global economic growth is accompanied by increasing uncertainties, the long-term stability of the Chinese economy and the short-term superimposed pressures coexist, and the relief of the shipping capacity growth pressure and the increased risk go hand in hand.

On the one hand, it is expected by many authorities that the global economic growth in 2020 will be at a low level since the financial crisis, and international geopolitics and local social turmoil could bring uncertainties to the global economy. The sudden outbreak of COVID-19 will have a material impact on China’s economy in the short term and may pose a threat to global economic and trade growth if it spreads globally. However, on the other hand, there are also some positive factors that should be noted. China and the United States have reached the first phase economic and trade agreement, which proves that the cooperation is still the current mainstream of global economic development. The Chinese government has quickly and efficiently promoted the epidemic prevention and control, and has increased counter-cyclical policy adjustments against the impact of the epidemic, which will effectively alleviate downward pressure on the global economy. Coupled with China’s continuous economic transformation, expansion and upgrading of the domestic market demand, continuous improvement of the business environment and obvious advantages in the industrial chain, China’s economy will continue to maintain stable growth in the medium and long term, and will continue to be an important stabilizer for the global economic growth, thereby supporting the development of global shipping industry

Enn Energy Holdings – Annual Report – 3/30

The National Development and Reform Commission has also brought forward low-season non-residential city gate price to relieve the mounting pressure from C/I users. The Group believes that the impact of the epidemic on China’s economy is temporary. After the epidemic, it is expected that local governments will also introduce policies to stimulate consumption and support enterprises, so that the overall domestic economic growth will gradually return to normal levels.

Shandong Weigao Group Medical Polymer Company Limited – Annual Report – 3/30

Since the outbreak of coronavirus in China in January 2020, the prevention and control of the epidemic has continued throughout the country. The epidemic has thus far impacted certain provinces, cities and industries, especially companies operating in the Hubei Province. This epidemic has also impacted the overall economic environment of China, which in turn impacted the operations of the Group in certain parts of China. The degree and extent of such impact will depend on the duration of the epidemic and prevention and control activities taken by the government.

Our manufacturing sites in China have thus far demonstrated strong resilience, with no material impact on manufacturing output and capacity witnessed since early 2020. On the other hand, sales and distribution activities in China experienced a slow down due to the extended Lunar New Year Holiday and delay in operation resumptions in hospitals across multiple regions. Since the gradual resumption of normal business operations across multiple provinces in China from March 2020, our sales and distribution activities are gradually reverting to normal levels in line with the business operations of our customers

EVERGRANDE HEALTH INDUSTRY GROUP LIMITED – Annual Report – 3/30

Looking ahead in 2020, the COVID-19 Outbreak, which began around the Lunar New Year, will create a short-term impact on the Chinese economy. With the effective management and monitoring of the Chinese government, preliminary control of the pandemic has been achieved. The healthcare industry has been a strategic focus under the key development of China, also being an industry closely connected to the COVID-19 Outbreak. The government is expected to introduce more relaxed industry policies with the market demand for this industry growing significantly. As such, the Group will take a more proactive attitude to providing and improving its healthcare products and services and leverage on the crisis of the COVID-19 Outbreak as a growth opportunity for the Group and to safeguard healthy-living of the mass public.

Abb Ltd – 6k – 3/30

Guidance issued on February 5, 2020, did not include impacts due to the coronavirus, the effects of which were mainly limited to China at that time. We have subsequently experienced a decline in trading conditions due to the outbreak, further impacted by a weakening oil price.

The situation in China has stabilized following extensive government-led efforts in February and operations at ABB’s three main production hubs of Shanghai, Beijing and Xiamen have largely returned to normal. While weakened customer demand in China, our second largest market, will also impact the first quarter results, our China business has been improving recently. At the same time, COVID-19 has spread rapidly to the western hemisphere in March, resulting in governments and customers adopting containment measures that have material economic consequences across the globe.

Geely Automobile Holdings – Annual Report – 3/30

The prevailing political and economic uncertainties should continue to affect the passenger vehicle demand in China. The recent outbreak of novel coronavirus had caused serious disruption to our supply chain and thus our production levels, meaning additional pressure on our business volume and profitability in 2020. The current headwind is expected to persist in the near future, making 2020 probably amongst the most difficult year in the Group’s history. Despite this, the fierce market competition in China has showed no sign of subsiding and should continue to put pressure on the sales performance and profitability of Chinese vehicle manufacturers in 2020

China Construction Bank Corporation – Annual Report – 3/29

In 2020, impacted by geopolitics, economic and trade frictions and global spread of COVID-19, the world economy is facing great downward pressure. Looking ahead, the outbreak of COVID–19 will affect China’s economy to some extent, but the duration and scale of COVID-19 remain to be seen. China’s economic fundamentals remain favourable for the long term, and China is still in an important period with strategic opportunities

Huazhu Group Ltd – Earnings Call 3/27

Question – Hay Ling Ng: I have 2 questions. One is regarding your current occupancy rate of 62%, which is very encouraging. I just wonder. Can you break down the demand of that 62%? How much is related to quarantine demand? How much is business? And how much is — if there is still any leisure left, can you give us some color on that number? And then I have another question.

Answer – Yu Ida: (foreign language)

Answer – Qi Ji: (foreign language)

Answer – Xinxin Liu: (foreign language)

Answer – Yu Ida: [Interpreted] So just like Jin Hui mentioned, cumulative, there are — over 500 hotels have been taken over by the government for quarantine purpose.

Answer – Xinxin Liu: (foreign language)

Answer – Yu Ida: [Interpreted] So we find that so-called the safety room or quarantine room actually take [up around] 80% of the rooms sold.

Answer – Xinxin Liu: (foreign language)

Answer – Yu Ida: [Interpreted] And 50% of the demand is actually from local demand, local business, like the people returning to work.

Answer – Xinxin Liu: (foreign language)

Answer – Yu Ida: [Interpreted] So majority of business is actually for the returning worker for the corporate needs and also the quarantine room for the customers.

Answer – Xinxin Liu: (foreign language)

Answer – Yu Ida: [Interpreted] And in the mid of March, we start to find the demand from the real business travelers start to pick.

Question – Hay Ling Ng: Okay. And can I follow up on that? It’s — do you see the leisure travel picking up a bit during the May 1 Golden Week.

Answer – Yu Ida: May 1. Oh, you’re talking about May 1 Golden Week, okay.

Question – Hay Ling Ng: Yes. Will you — okay.

Answer – Yu Ida: (foreign language)

Answer – Xinxin Liu: (foreign language)

Answer – Yu Ida: Okay.

[Interpreted] So we expect the demand from the leisure will come up at the second half of April, and we’re preparing different sales package for that wave of demand.

Bank of China Ltd – Annual Report – 3/27

In 2020, the banking industry will face a complicated operating environment. The worldwide spread of COVID-19 has hit the global economy and financial markets. From an international perspective, the global economy remains in a period of undergoing profound adjustment following the financial crisis, and will face stronger downward pressure under the impact of the COVID-19 pandemic. Risks to the financial system will increase, and the pace of adjustment will be uneven within the international economic landscape, which will bring greater uncertainties and risks. From a domestic perspective, China’s economy is in a critical period of tackling key challenges with regard to transforming its mode of development, improving its economic structure and shifting the drivers of growth. Although COVID-19 will have a temporary economic impact, the outlook towards growth for the Chinese economy will remain unchanged. The banking industry will face a more severe and complicated environment, with challenges and opportunities coexisting

Goldman Sachs – Investor Transcript – 3/26

On Slide 5, you can see our first quarter expectations. And we expect a strong performance, especially in light of the environment, nicely in excess of expectations from The Street, and the top line, down about 5% organically. And that’s almost exclusively driven by Asia and the impact of coronavirus in China specifically. And on the EBITDA line, we expect more than $95 million. There’s an FX headwind year-over-year of about $3 million. And so we should show year-over-year EBITDA growth despite that impact on the top line, driven by margins from mix as you know, the assembly business is a lower-margin business and the cost savings that we’ve talked through. Again, exemplary of our ability to preserve profitability in the — on the context of a weaker or pressure on the top line.

Micron Technology Inc – Earnings Call – 3/25

Turning now to COVID-19’s effect on demand. COVID-19 is significantly impacting China’s economic growth in the calendar first quarter, reflected in the sharp decline of smartphone and automobile unit sales. Weaker sell-through of consumer electronics and our customers’ factory shutdowns in China were headwinds for us late in our fiscal second quarter. In China, lower consumer demand was offset by stronger data center demand due to increased gaming, e-commerce and remote work activity. Looking to the third quarter, as these trends also take shape worldwide, data center demand in all regions look strong and is leading to supply shortages. In addition, we are seeing a recent increase in demand for notebooks used in the commercial and educational segments to support work from home and virtual learning initiatives occurring in many parts of the world. We are also encouraged to see manufacturers in China increasingly returning to full production, and we have recently started to see China smartphone manufacturing volumes recover. Nevertheless, as the world deals with the outbreak of COVID-19, we expect that overall demand for smartphones, consumer electronics and automobiles will be below our prior expectations for the second half of our fiscal 2020.

Nike – 8K – 3/25

As discussed in our press release issued on February 4, 2020, operations in Greater China were materially impacted as a result of COVID-19. In the third quarter, on a currency-neutral basis, Greater China revenues were down 4 percent following 22 consecutive quarters of double-digit growth. However, during the first two months of the third quarter, Greater China’s revenue grew strong double digits, offset by the impacts of COVID-19 beginning in late January. At the peak in February, roughly 75 percent of NIKE-owned and partner doors in Greater China were closed with others operating on reduced hours. Currently, nearly 80 percent of doors are open in Greater China with an even higher rate in key cities. Beginning March 16th, all NIKE-owned stores, outside of Greater China, Japan and Korea were closed to help curb the spread of COVID-19.

WH Group – Earnings Call – 3/24

Question – Unidentified Analyst: [Interpreted] So the question concerns the impact on both China and the U.S. business caused by the coronavirus outbreak. I would like to know, particularly, what is the impact level on your packaged meat business? For example, what do you think about the volume for the full year in relation to this segment?

Answer – Luis Chein: [Interpreted] Well, Mr. Ma is offering his comments in relation to the question.

Answer – Xiangjie Ma: [Interpreted] After the spring break, in Mainland China, we have seen rather big impacts caused by the virus outbreak. And we have seen rather big impact on the packaged meat business as well.

So basically, we are looking at rather strong demand in the earlier stage after the outbreak at the supermarket channel, and there are 2 reasons behind this. First of all, normally, when people are being quarantined at home, they would have this tendency to hold certain products at home. And at the same time, other channels are not opened for business. So mainly, our consumers are gathering or purchasing the products at supermarkets.

And basically, the business we do is very closely related to people’s daily life. So after the outbreak of the coronavirus, the government has demanded us to continue with what we do and provide a stable level of supply.

And we do face 2 major issues, and those issues have been resolved in a satisfactory manner. The first issue we faced is that we have this insufficient level of attendance of our employees. And the second issue relates to logistics.

Indeed, at the very beginning of the coronavirus outbreak, we have faced some great challenges in terms of delivering our products to our consumers. But we have quickly resolved that problem at a later stage.

And also because most of the sellers in our network have accumulated a certain level of inventory. So while there was some impact on product delivery at the beginning of this outbreak, at the end, there were no serious impact on the terminal sales.

So while we saw a reduction in terms of products delivered from our factories, in fact, there’s some kind of supplementation at the terminal level. And very quickly, we have caught up with the volume of sales that we have lost in the very beginning of the outbreak.

So judging on the current market situation, we believe that for the whole year, the sales volume for packaged meat products will continue to maintain stable growth. Thank you.

Airbus SE – Conference Call – 3/23

Now when it comes to your question on customers, well, it’s very active at the moment. It’s very dynamic. It’s very case-by-case. Obviously, we see a different type of behaviors, depending on where the airlines are located and how they are impacted. I mentioned before that we see a recovery of the flights, of the passenger traffic, I should say, in China. At the very bottom, it was, as far as I know, close to 15% compared to normal, so minus 85%. Mid of last week, number of passengers was back to 30%, 3-0. So we see that this is picking up progressively.

In the rest of the world, the trend is the opposite, okay? So each and every airline is trying to assess its own situation, find for recovery, finding the measures and we see very different kind of situation, and we are addressing this one by one. It’s premature to give an indication of what it will look like. That’s why we’ve decided to withdraw the guidance to give us time to assess and to redefine the new plan.

CK Hutchinson Holdings Ltd – Earnings Call – 3/19

Of course, everyone will be interested, the impact of the COVID-19 on China, so I will give you a update. In fact, the virus definitely has a significant impact on the business operation, particularly in February, when it’s at its peak, 64% of the stores has closed, which represent over 2,500 stores. And then because of this closure and also the mall closure, the footfall traffic dropped 90% and sales consequently dropped 80%. So this is a peak in February. But when we enter into March, we see very strong recovery. Up until yesterday, we only have 4% of store closed, so with the remaining open and operating. So although the traffic is down, but it improved from 90% down to 50% down. And also, if you look at sales number, which I think is quite encouraging under the circumstances, in February, the sales was down 80% from normal level. And in March, it has recovered dramatically, now it’s 25% reduction only and improving on a daily basis.

Uber – Analyst Call – 3/19

In some parts of our business, we’re already seeing what we believe is the worst of the impact behind us and the beginnings of a recovery. Hong Kong, for example, saw trips decline 45% from their peak but have ticked upwards consistently, now down to 30% from their peaks. All of this has happened over the course of 2 months.

Our Eats business is an important resource right now, especially for restaurants that have been hurt by containment policies. Even in Seattle, a community that has been hit really hard, the Eats business is still growing. And in the U.S., our small — our SMB sales team is now closing 2.5x the number of new restaurants we normally do per day. And our restaurant self-service website has seen a 10x increase in sign-ups since last Thursday. Eats is becoming all the more important for its partners, and we expect to be there for them.

Now as you would expect of us, we’re also performing extensive stress testing with multiple scenarios that we’re running through. At an extreme edge case scenario, where our Rides business declines 80% for the rest of the year with no recovery, shows us ending the year with $4 billion of unrestricted cash, not including access to over $2 billion from our revolver. We absolutely don’t expect this kind of edge case to happen, but we feel responsible to model it. Even in that edge case, our balance sheet remained strong.

Bayerische Motoren Werke AG – Earnings Call – 3/19

Answer – Nicolas Peter: Tim, so what do you do as a company in such type of situation? You work in scenarios in order to quantify the impact of the coronavirus. So what did we do? We’ve developed — we used China, as Oliver said, as a blueprint. The situation in China started mid of December to slightly deteriorate. We had a very strong January in a declining market in China. February already, yes, down by between 80% and 90%. However, in March, we are back to 2/3 of our regular volume.

So — and this, using this as a blueprint, we’ve identified 3 different scenarios: one, what I would call an optimistic best possible scenario; one very pessimistic; and the middle one, as you can imagine, in what I would call a likely scenario. And this scenario all — of course, not only includes volume impact. It includes what could happen on the service side, parts business, what about used car prices, residual values and so on. And this was then developed for all 3 major regions: Asia, Europe and of course, the U.S.

If we look at our cash situation, as I said, we are around EUR 17.4 billion liquidity at the end of 2019. This has not specifically changed. It even slightly improved in 2019 despite EUR 2.3 billion dividend payout last, last, last year. And of course, as you can imagine, we’ve discussed what to do with the dividend payment, but we are confident that with our very strict liquidity management on the one hand side with the measures we have already implemented in all parts of the organization that we will be able to manage this situation without cutting or yes, paying no dividend in 2020.

Starbucks – Investor Call – 3/18

Answer – Kevin R. Johnson: Thanks, Pat. Another question, Pat, for you. The question is, given how much is still unknown around COVID-19, do you have additional insights you can share about the short- and long-term financial impact of the virus on your business? And is the balance sheet solid, Pat?