With the US Election quickly approaching and the possibility of another wave of COVID cases looming, there is an air of uncertainty surrounding the global economic output. One industry that may be most sensitive to the results of the election is the Defense industry. Last week we sat down with Morgan Stanley analyst Kristine Liwag to get her insights into what the future of US defense spending could look like.

The Great Power Competition

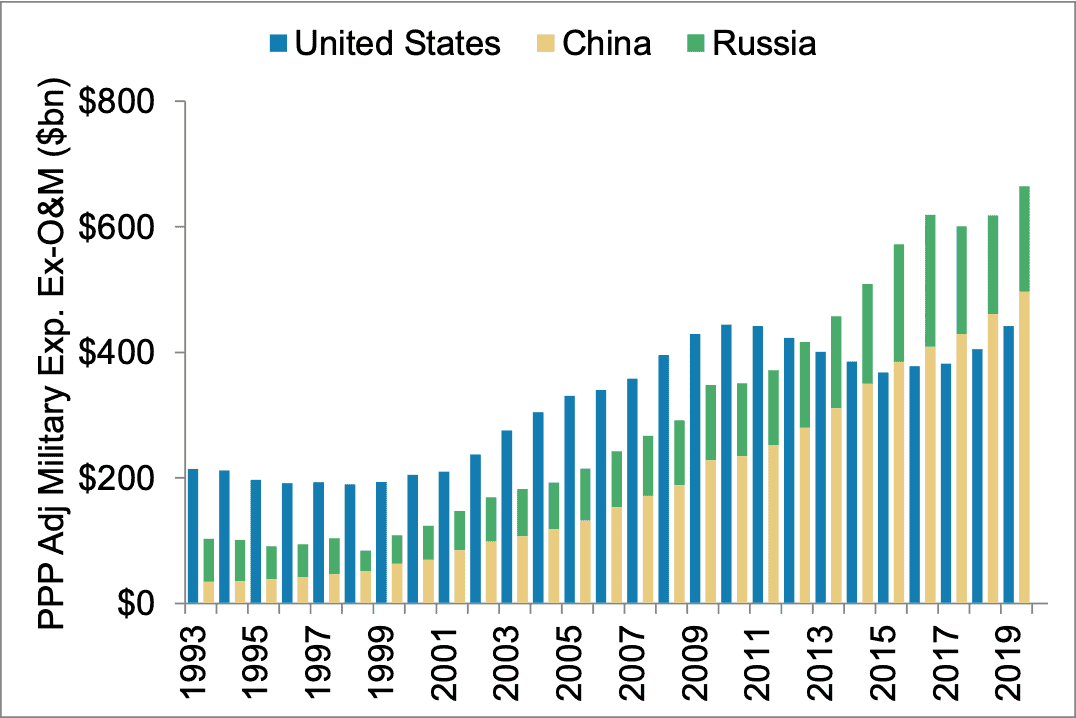

Liwag sees the current state of the defense industry as “The Great Power Competition” with the US, Russia, and China all jockeying for military dominance. While the general consensus is that the US outspends all of its competitors, Liwag points to an interesting fact which she says could influence future spending decisions: currently, after adjusting for troop deployments and purchasing power, the US spends less on defense than Russia and China combined. This imbalance is due to the US’s high levels of troop deployments in the Middle East, which have forced the US to spend more on operations and less on research and development, giving China and Russia an edge, especially in regards to hypersonic systems and space systems.

Source: Stockholm International Peace Research Institution (SIPRI), Morgan Stanley Research

Source: Stockholm International Peace Research Institution (SIPRI), Morgan Stanley Research

What Does This Mean for Future Spending?

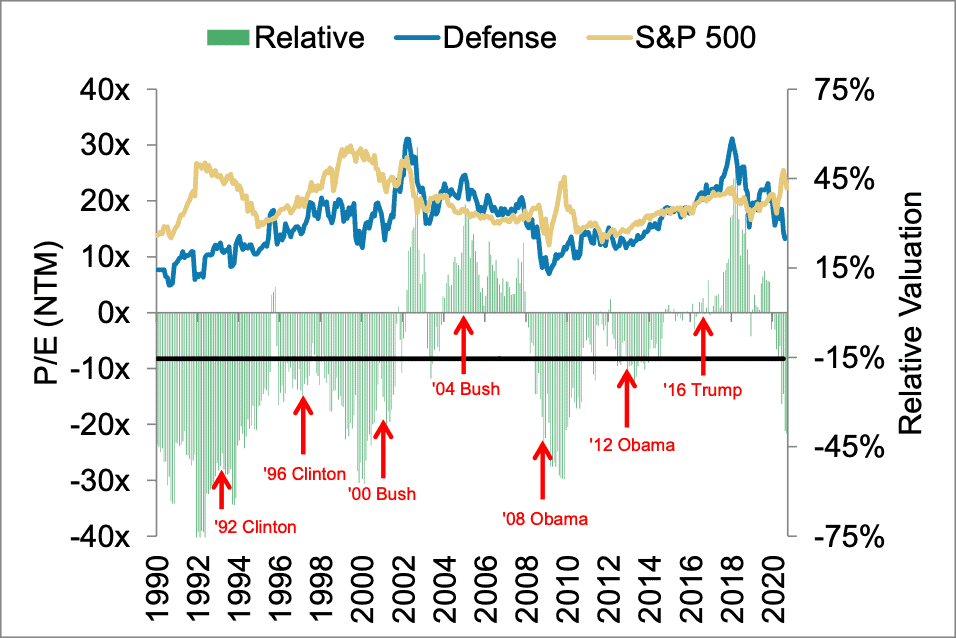

With all of this in mind, Liwag points to two factors as the biggest determinants of the future defense budget: Who wins the election in 2020, and what the perceived threat level is. Considering the fact that Russia and China now outspend the US on defense, Liwag assumes that there will be a high perceived threat level no matter who wins the election, and thus proposes two possible spending cases. In the case of a victory by Donald Trump, she forecasts a “Speak Loudly and Carry a Big Stick” bull case, in which spending on deployed troops remains high, while spending on procurement and RDT&E increases in the single digits to low double digits. On the other hand, if Joe Biden wins the election, Liwag sees a base case of “Keeping Up With the Neighbors” in which defense spending remains about constant due to the fact that even though defense may not be a priority for democrats, continued spending by China and Russia will force the US to also continue its spending. In this case spending on operations would likely decrease while spending on procurement and RDT&E increase, with the topline budget staying constant.

With the defense industry currently trading at a 40% discount to the S&P 500, questions abound about how investors will perceive the results of the election.

For more analysis, check out Kristine Liwag’s research within AlphaSense — log in or unlock free trial access now. To access the replay of the briefing, head to the Expert Briefing hub.