Last week, AlphaSense interviewed Katy Huberty, US IT Hardware Analyst, Keith Weiss, US Software Analyst, and Meta Marshall, US Networking/Telecom Equipment and Communications Software Analyst, from Morgan Stanley to discuss tech-enabled transformation post-COVID.

Technology is Eating the World

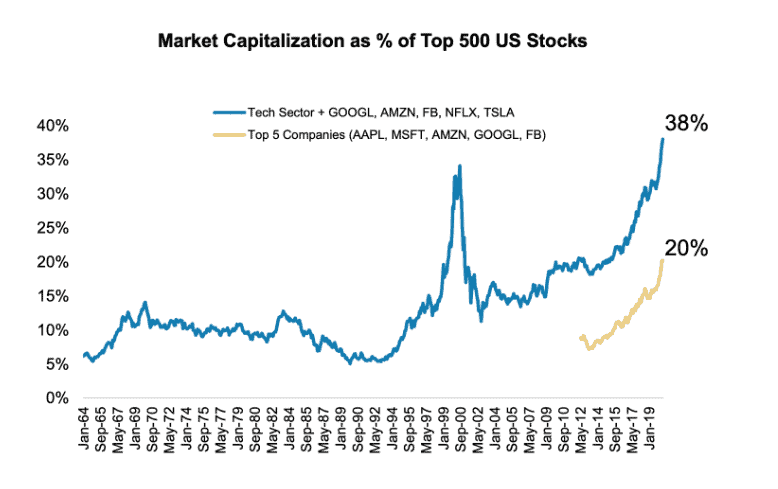

Today, the tech sector accounts for almost 40% of US market value, and five stocks account for 20% of the total US market. That’s three times the concentration of any other technology cycle. Liquidity and market momentum factors have allowed technology to outperform.

Source: Morgan Stanley – Top 500 US Stocks vs. Top 5 Companies

One high-level explanation for technology outperforming comes down to the fact that technology companies are out-investing almost every other sector in the market. The technology sector invests ~16% of revenue back into R&D and CAPEX. The rest of the market invests ~8% of revenue, which has been flat for the past decade (whereas technology investment has increased and essentially doubled over that period.)

The big five technology companies that make up 20% of the market invest even more–approximately 20% of their revenue back into R&D and CAPEX. While many market pundits today are talking about whether we are in some technology bubble, the reality is for most of the technology stocks, there are fundamentals and free cash flow that support their valuations. Morgan Stanley analysts believe that a more natural path to closing this valuation gap comes back to the relative levels of investment. They believe that other sectors need to invest in technology to create the same competitive advantage that you see at the big tech platforms today.

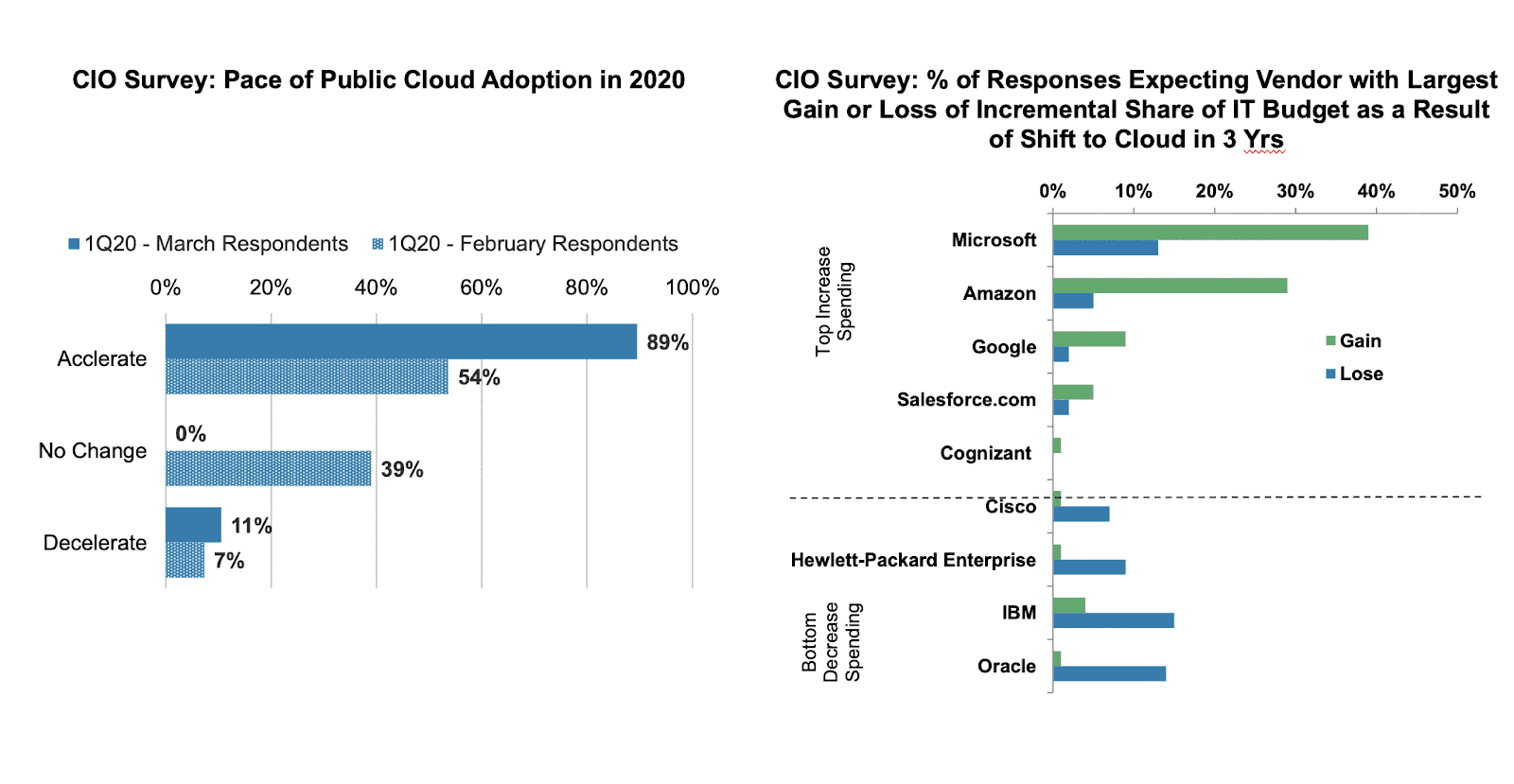

When Morgan Stanley analysts asked CIOs about their plans to increase technology spend, most said that they will spend more on technology (relative to the growth rate in their business) over the next three years. Also, CFOs and COOs, stated that their number one priority in the second half of 2020 is to maintain investments in technology, because companies that have invested in digital transformation have been most successful during the global pandemic. Technology is ranked ahead of investing in organic growth, in M&A, in cutting costs and maintaining liquidity.

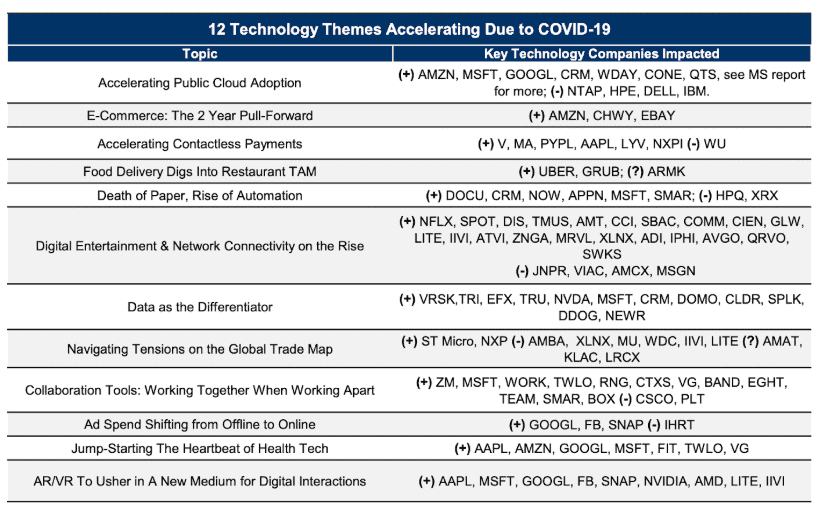

Morgan Stanley analysts recently highlighted 12 themes that are accelerating during and post-COVID, which are bucketed into three categories.

Source: Morgan Stanley Research, 12 Technology Themes Accelerating Due to COVID-19 Survey

Accelerating Public Cloud Adoption

The next ten years will be about businesses creating a competitive advantage, leveraging IoT, automation, AI, and even augmented reality and virtual reality as that develops. According to Morgan Stanley CIO surveys, AI, machine learning, digital transformation, and cloud computing are the top four spending priorities.

Source: Morgan Stanley Research CIO Survey for Cloud Adoption and IT Budgets

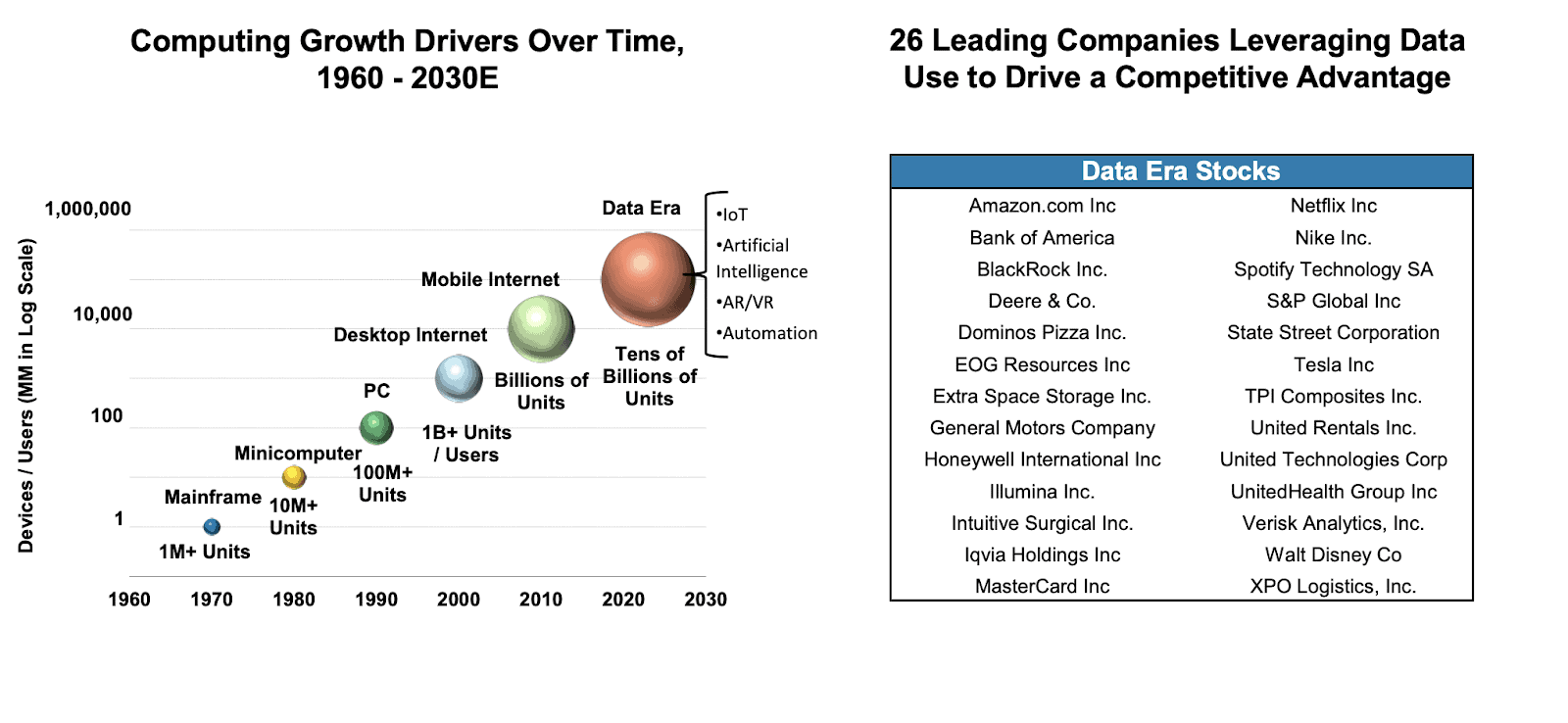

Data as the Differentiator

Morgan Stanley published a report “What’s Technology Worth?” where they surveyed all of their non-tech analysts, asking, “is there a company or two that you believe is creating competitive advantage through technology investment?” The team came up with 26 stocks; on average, they traded at 5-turn multiple premiums.

Source: Morgan Stanley Some of these on this list are obvious, Netflix and Amazon. For example, Nike acquired three AI companies and was able to leverage that to build a strong direct to consumer revenue stream; they also have a supply chain with 9-month lead times and better forecast demand and make adjustments in real-time addresses the cost structure.

Ultimately, Morgan Stanley is forecasting that over the next four years, the Data Era will continue to expand. The size of the AR market, for example, will increase tenfold from a $10 billion market size (which is rather insignificant for large technology companies) to $100 billion, which makes it more of a potential catalyst that investors pay attention to.

Cloud computing and technology is also evolving when it comes to COVID, particularly from testing and contact tracing standpoints. Apple and Google have come together, and, combined, can touch 99% of the world’s smartphone users to do contact tracing efficiently.

Collaboration Tools

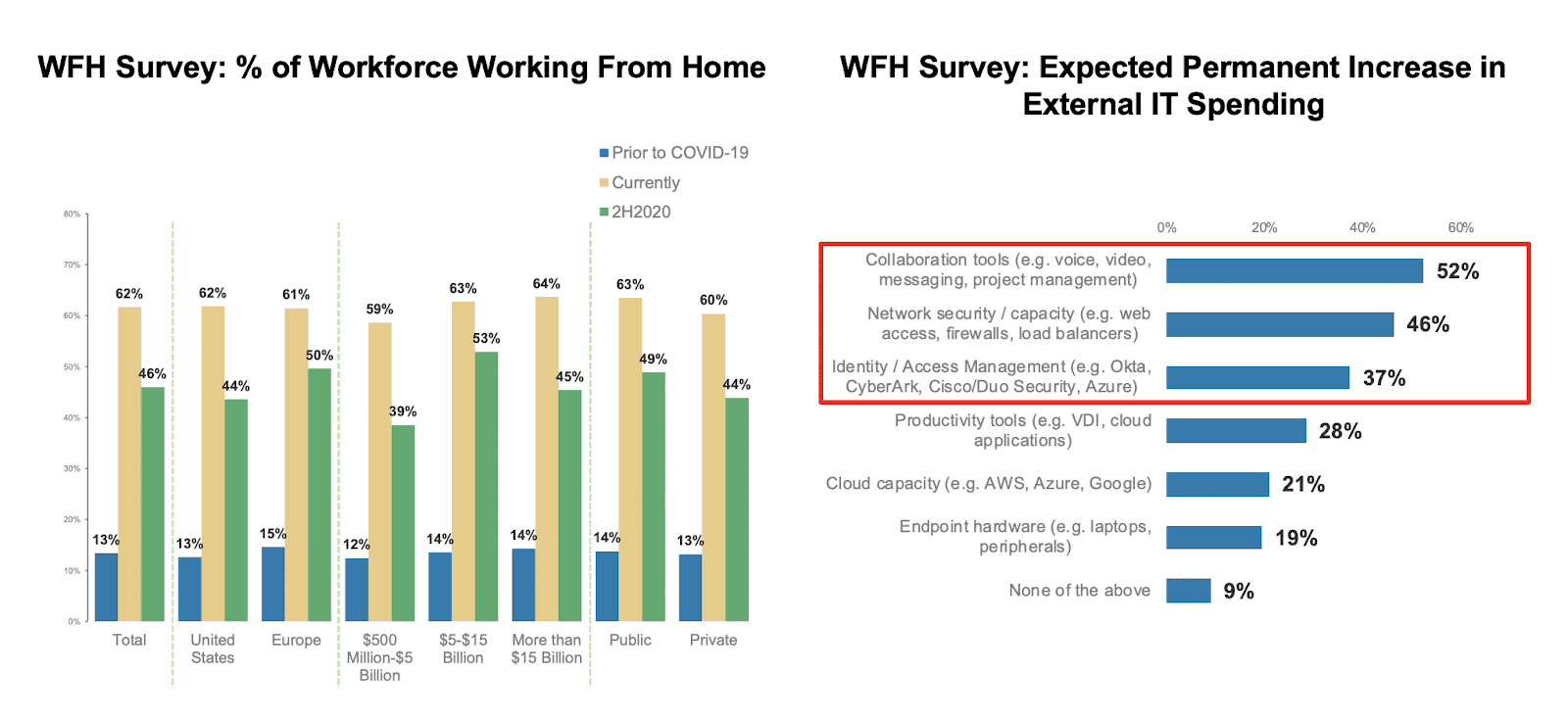

There has been a significant increase in remote work due to COVID. A recent Morgan Stanley survey showed that nearly 70% of employees are working from home at the height of COVID. Most organizations believe that upwards of 40% to 50% of their employees will work from home for the remainder of the year, if not longer.

Communication continuity has also become a priority, which means there will be a huge expansion in remote video capabilities. Video conferencing has historically been a niche market–it only served ~50 million pre-Covid. However, with vendors like Zoom and Microsoft creating more efficient technologies during COVID, video has become a much bigger tool, not just for corporations, but for education, for healthcare, for fitness, for recreation, etc.

Source: AlphaWise 2Q CIO Survey (n=100), AlphaWise CFO/COO survey (n=152), Morgan Stanley Research

With an increased need for connectivity, it’s become apparent that we need faster solutions and technologies. 5G allows for the bandwidth provided over a wireless line to come closer to matching wired speeds. Meaning, disadvantaged audiences either regionally or financially can have access to the same internet speeds as wealthier urban areas, a need that is clear now more than ever.

To read the full report (or to read more Morgan Stanley research) login to AlphaSense, or start a free trial. To access the full webcast, please explore our Expert Briefing Series.