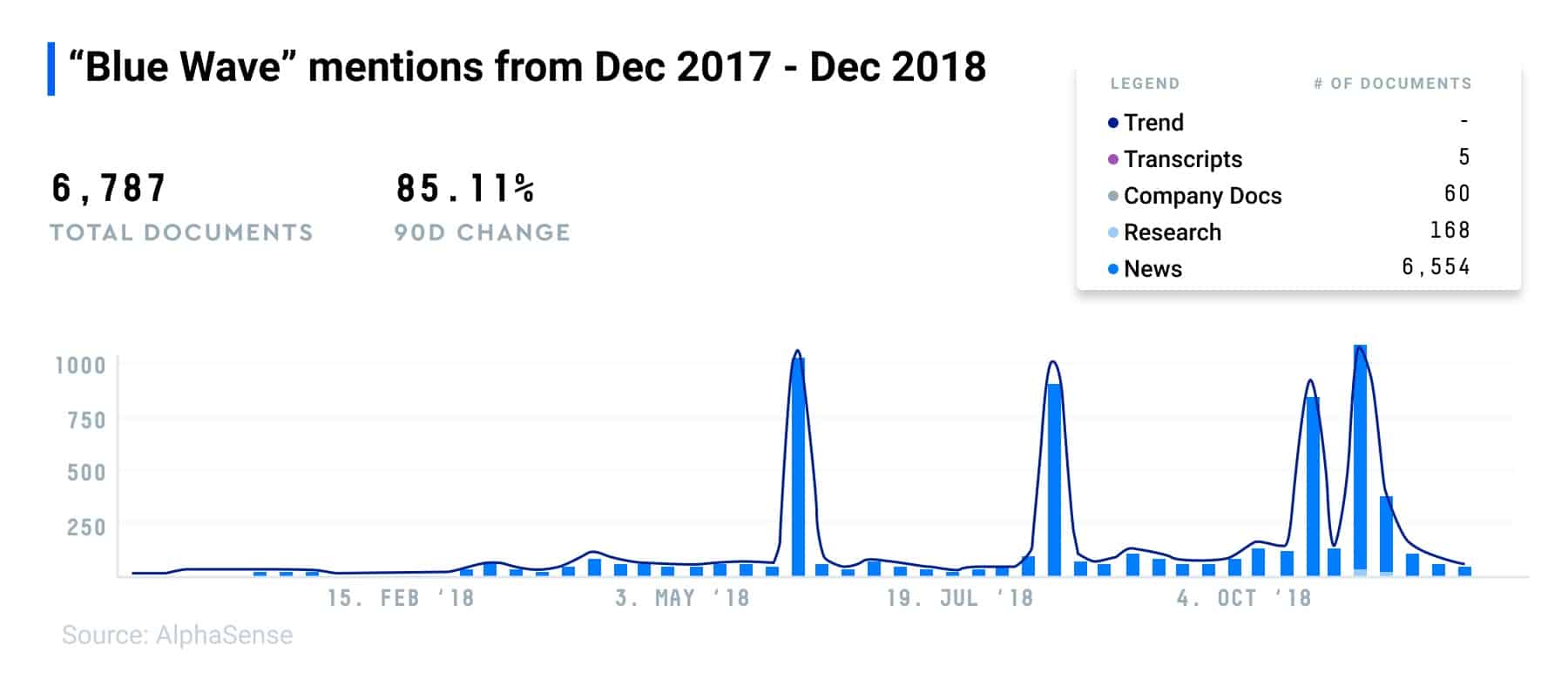

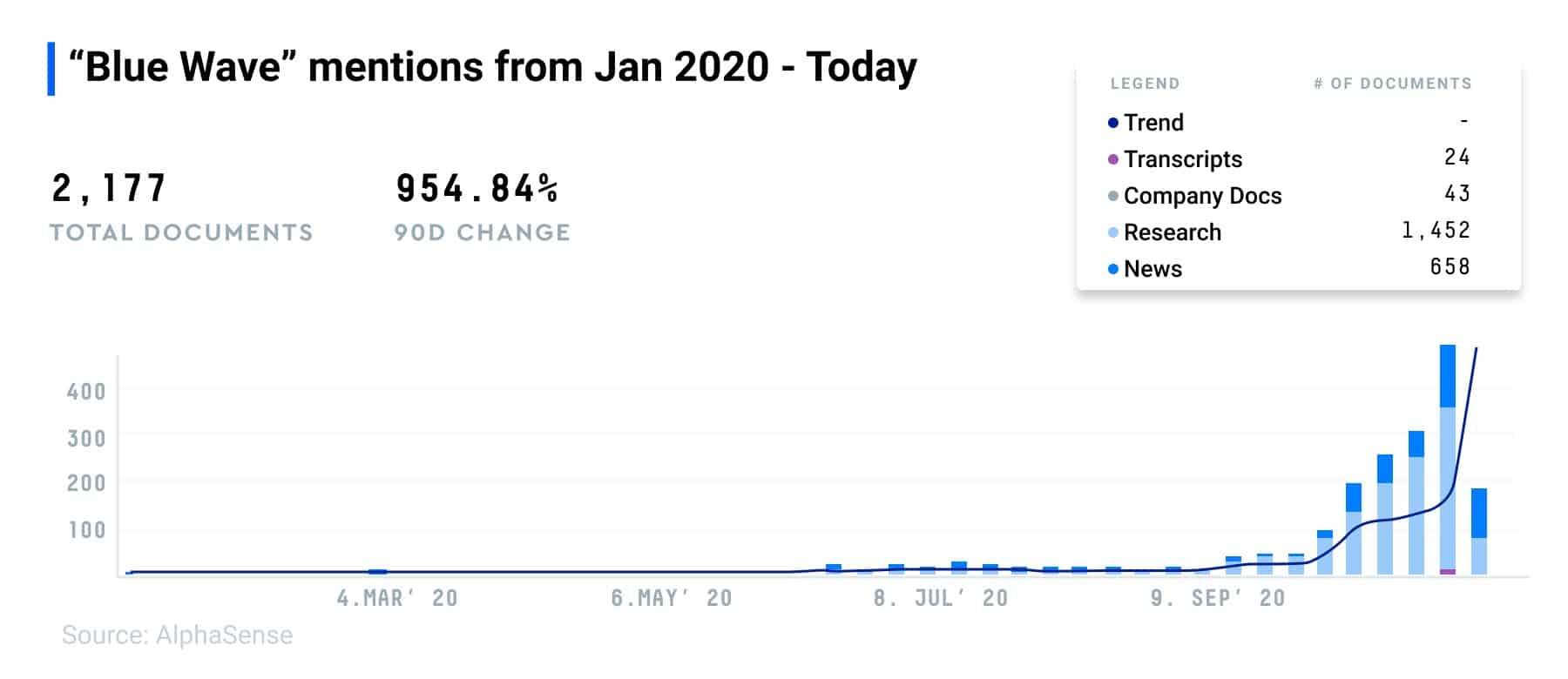

Democrats’ dreams of a ‘blue wave’ crashed this week as Republicans failed to flip House and Senate seats in the swing states including Texas, North Carolina, Iowa, Pennsylvania and Michigan. With its origins in the 2018 midterm elections, the term ‘blue wave’ became the buzzword of the moment within broker reports this election cycle as analysts attempted to understand and project the potential impacts of this election.

With the election now behind us and final vote counts still being tallied as of Friday morning, analysts and corporate leaders alike are both hanging in uncertainty. Unsurprisingly, analysts were interested in unpacking potential scenarios from Energy, Cannabis, and Real Estate leaders. Below, we’ve compiled executive commentary from earnings calls this week to highlight how corporate leaders are calculating the impacts of the election results.

This Week’s Election Chatter

Vitrolife – 11/6

Look, we got to respond from 1 customer that said, the clinic then that, we see a higher inflow from patients than ever. And there were 2 reasons behind it. One was that their patients now are working from home. So they had time to go into it and start the procedure. And also that there were some customers, who were afraid of more regulations in case of Biden would win, they were afraid that it could be more regulation. So therefore, they want to go into the clinic as soon as possible.

Cronos Group – 11/5

I think that one of the important things, and I’ve always maintained this, was getting past the election and allowing, from just a political process perspective, everyone to sit down and look at what’s the best way to put in regulations and put in policies, whether that’s a stimulus or building up industries that can help rebuild some of what the economy lost over the last year. And it’s very difficult to do that when you’re in an election year. So for us, it wasn’t — it’s something going to happen immediately after. I think that always sounds better than what the actual practice is. But getting past the election was a big catalyst regardless of who won blue wave split, and I think we’ll see that starting with stimulus. And I think the cannabis, you see with the ballot initiatives, whether it’s red or blue where the popular opinion is. You see the need for jobs. You need — we need tax revenue. We need social justice reform. And there is just a very simple and elegant solution, and that is advancing cannabis legislation.

TPI Composites -11/5

I think it’s a little bit difficult to answer at this point in time because there’s not a lot of detail behind the plan. So he’s got the made in America and an offshoring tax as well. So we’ve looked at what’s out there. And it’s a little bit early yet to describe what the impact might be, but, again, we have manufacturing capacity here in the U.S. And depending on what that means, it could mean additional capacity over time, depending on demand and what those provisions might ultimately be if they come into fruition. But it’s a little early to tell right now what the impact may or may not be.

Bright Horizons Family Solutions – 11/5

So certainly, we’ve reviewed the Biden proposal thoroughly and believe that government involvement in child care can be a positive, if done in the right way. The idea of universal Pre-K and other supports that Biden has suggested would be in his plan are things that broadly would support child care, and therefore, we would be supportive of.

We operate in environments like the U.K. and the Netherlands, where financial support of child care exists, and it’s a very important part of the overall model that we have in those countries.

I think for better or worse, we have a long history of evaluating political plans. And unfortunately, the fiscal reality tends to be where the plans fall apart and ultimately don’t get implemented. So while we like the idea of the U.S. having more financial support in the area of child care, we never count on that in our model.

Euronav – 11/5

The way we see it is if Biden was going to win the election and if you would have a majority in the Senate and in the chamber, I think that it will try to be a little bit more forceful on the path to decarbonization. I think that the blue wave that was predicted is not really the one that we are seeing. Even if he has a majority, it’s going to be a very, very thin majority. And given that fact, I think that we’re not going to have a revolution. I think we’re going to have an evolution. I think that we will be very mindful of not hitting the economy. That would be his first priority.

I mean, quite frankly, when you look around the world, this COVID crisis has impacted pretty much everyone, including the U.S. And so we are not expecting something radical in terms of a clean energy program. It’s certainly not something as big as what he announced when he was a candidate. I think the reality is going to hit if he is the one to become the new president. So we’re not too worried about it because if it’s evolutionary rather than revolutionary, I think that we are always in a good place to adapt to that.

The second aspect, which seems to be a little bit clearer if he wins is the Iranian situation and how soon will we want to reenter the deal because that may have an impact on obviously Iranian oil production. And to a certain extent, I would say a lesser extent, the Iranian fleet. But that’s not a fleet that is in very good condition. So we are not too mindful about it.

MGIC Investment Corp – 11/5

I mean, I think, obviously, there is speculation that if there was more of a blue wave, that there might be stronger stimulus. Ultimately, we have some expectations that there will be stimulus — some additional stimulus. Obviously, part of it has to do, I think, with what the path of the virus is, which is difficult to know. But I still think our view is that we would expect there’s going to be some amount of stimulus, although I think there’ll probably be a lot more discussion about it, again, where the election seems to be trending. But I guess I’d say ultimately, we think there will be some. In general, again, I view housing as being extremely resilient through all of this. So while the size can matter, I think it probably matters a little bit less from a housing standpoint.

Pioneer Natural Resources Company – 11/5

I think, first of all, based on the results of the Senate, I guess we’re going to be down to 2 key Georgia races, but I would expect Purdue to win. So that would be 51 Republican on the Senate, and then they’ll have the runoff in early January. And I would expect that person. So my guess the Senate will end up losing 1 seat. The Republicans will be 52, 48. In that regard, there should be no effect in regard to tactics going forward. I think what Biden will do — the big unknown for people that own federal acreage is that will he stop giving drilling permits. He’s already said he will ban, he will not ban fracking, but he can do other things like stop giving drilling permits which would affect New Mexico, Wyoming and the Gulf of Mexico and federal waters. And so nobody knows whether or not he’s going to do that, but that could have a major impact on U.S. production long-term if he stops giving drilling permits. Other things, he’ll roll back some of the — Trump’s movement, like on the emissions of 2016, which we were totally against Trump doing that, but Biden would obviously, with having the EPA under his control will probably roll back any of Trump’s emission. So those are the bigger issues that I see that will affect the industry.

Marathon Oil – 11/5

I think the current uncertainty around federal land is a good reminder of the benefits of our multi-basin model asset diversification and capital allocation flexibility. Certainly, we’re realistic that with a Biden win, doing business on BLM land will become more difficult. And those are his words, not mine.

Energy Transfer LP – 11/4

So I guess, kind of from our standpoint, as far as the election goes, I’m not sure we’re in the same boat that it’s already been decided. Certainly, that could happen. We think it’s probably still a toss-up for a whole number of reasons, but we certainly want to over the next 2 or 3 days. But just assuming your question that Biden were to win, we’ve said in the past, we — there’s some uncertainty about his positions over the years. At one point in time, he was kind of pro pipeline. He was kind of always pro fracking and he backed off on that. And now kind of supposedly going to ban some types of fracking, mainly around federal lands. But the positives are in a Democrat-controlled government is that the regulations will no doubt increase. So it will be much more difficult to build pipelines, to construct pipelines, to get pipelines permitted, be very time consuming.

Ternium SA – 11/4

Election in the U.S., what happens if Biden wins, to be honest, I don’t see a lot of changes regarding manufacturing if Biden wins. I mean I don’t think it’s going to change a lot of 232. Probably, he’s going to, I mean, negotiate or be a little bit more flexible with some countries, which should have been in the 232 probably in the first place. But I don’t — I mean the — think of this U.S. — this regional approach where a manufacturer has to come back to the region, to the U.S., to Mexico to Canada, this reshoring thing, it’s in the mind of Donald Trump really, the actual president. But it’s also on the mind of the Democrats. So I don’t think there’s going to be a lot of changes.

I think on the contrary, both candidates are going to try to make stronger manufacturing in the region. Biden — if you ask me, one of the things Biden is going to do a little bit more than the actual probably is in the environmental issues, which for us, for Ternium should be a very good thing regarding our footprint, our environmental footprint and how we are doing a lot of things. But that’s the only change that I see really.

Vornado Realty Trust and Alexander’s Inc – 11/4

There’s another group of folks down there who would like to continue to spend at the level that they have been spending and close the deficits by assistance from Washington. How this plays out is probably going to be some kind of a combination of both, but it will play out. The promise that the Democrat side made, which is that they will reverse the Trump tax plan and reverse the salt. I see that as being a very, very, very hard lift. So I don’t know where that will go.

Hamilton Lane Inc – 11/4

I think as of last week, we expected more realization activity because of a belief that taxes in the United States would increase since like people wanted to get deals done before year-end. If the election results, unclear whether there will be as big a push for higher taxes. So depending on how that shakes out, you will see whether activity increases solely for that reason. I suspect deals that are in process will continue that they have been caused by that. I think just in general, I think what you’re hearing from — from us is markets are strong and exit activity is good. And so certainly relative to earlier in the year, we’ve seen deal activity increasing across all geographies and across most sectors. So I don’t unless we tell me that markets are going to correct significantly, I would expect that the activity in equity.

Scotts Miracle-Gro Co – 11/4

The other great news for Hawthorne is what we expect from yesterday’s election. Look, people are still counting votes, so I don’t want to get too far ahead of myself. We expect New Jersey to approve recreational adult use of cannabis, and there’s a good chance that Arizona will do the same. Going into the election, there was also good polling from South Dakota, Montana and Mississippi. On top of that, the Governors in New York and Pennsylvania have said in recent weeks that they’ll look to legalization to help them make up some of the budget deficits that have been caused by COVID-related issues. Who knows what’s going to happen in D.C.

Chimera Investment Corp – 11/4

I think the best thing that happened — I mean, first of all, I mean, the housing market is screaming, and I think that’s great for our portfolio and for the credit of our portfolio. So that’s terrific. I don’t think that’s going to change with the election results. And I think regardless of what happens in the presidential election, it looks like the Senate is going to be very close, maybe stay Republican, which I think a divided government is probably not a bad thing for different markets.

Eaton Corporation PLC – 11/3

I can tell you despite the fact that the current administration perhaps has not been as focused on green, we continue to see increasing investments around the world in essentially energy transition and the greening of the economy.

So I think they’re the secular growth trends that we’re experiencing inside of the global economy that are essentially bigger than any administration in the U.S. and I think are going to be positive for us independent of who’s in the White House.

Williams Companies Inc – 11/3

If there was a Biden administration win would be the — a corporate tax raise. And actually, that works out to be a positive for us within our regulated assets because that would allow us to raise the rates back on Northwest pipeline that we had to lower when the corporate tax rate was lower.

Fox Corp – 11/3

And then to your second question, Michael, as far as the impact on FOX News of the presidential election, of course, it’s been a — to date, an incredible new cycle throughout the election, but also through the other incredible new stores and massive new stores out the year, obviously, COVID being the main one. We see as we — and by the way, that’s driven ratings. It’s driven revenue, I think FOX News revenue — advertising revenue is up 36%, which is a tremendous result.

Waste Management – 11/2

We will — regarding environmental regulation, it is interesting for us that — first off, all of our focus is not necessarily on the federal elections. We tend to focus on state elections, too, because the state has such an important place. That’s an important role for us, and that carries over to environmental regulation.

But as it relates to the federal elections tomorrow, we’ve said that regulation is actually, in a strange way, a good thing for WM because we hold ourselves to a very high regulatory standard, environmental standard. And so any additional regulation actually tends to work in our favor. So to the extent that, that comes out of tomorrow’s election, that could be a good thing for us.

Orix Group – 11/2

And also with the presidential election being scheduled tomorrow, and there seems to be no concerted effort being exercised by the countries of the world and also the second wave of COVID-19 is affecting Europe, so therefore we have to anticipate a certain impact, negative impact remaining for the time being.

Shell – 10/30

Yes. Thanks. First and foremost, we’ve operated a very successful business throughout a number of multiple administrations, right? And we found ways to deliver across that. So those come and go, certainly, they’ll have their challenges. As far as the Gulf of Mexico, in my comments earlier about being really bullish on the Gulf of Mexico, if you listen to Shell’s webcast and their earnings webcast, a couple of things to note. Ben highlighted the need for hydrocarbons for the next decades, and there’ll be a role for hydrocarbon in the next decades against the backdrop of energy transition, and we can certainly talk more about that. But there will be continued investment by Shell in the hydrocarbon chain. They’re going to take a very focused approach to that. And one of those areas specifically is the development of Gulf of Mexico.

CMS Energy Corp – 10/29

There’s a real problem with the ITC with solar that utilities can’t — because of normalization can’t take full advantage. I think if there were some fixes from a tax perspective on the ITC for solar, that could be interesting for utilities and could potentially make solar deployments more economic faster. And so I do think there will be some interesting developments with — if there is, in fact, a blue wave here in a couple of weeks.

Southern Co – 10/29

There’s a little bit of an assumption there about what happens with environmental and what happens with coal and gas prices, but I think you’re going to see something similar to this 2020 mix. Nuclear will go up a wee bit, maybe in the 2%, so maybe 19% would be nuclear, something like that. Gas would drop down. The marginal cost of nuclear is very cheap. Coal, it depends on what happens with environmental. And that really depends a lot, to a large extent, on the elections going forward. If you have a blue wave, it may be that we would see perhaps tighter regulation and coal waning importance, but we’ll see. The other big factor is you should see renewables increase in importance

Novatek Joint Stock Company – 10/29

We’re also in the midst of the U.S. presidential election next week, which could have profound changes to the oil and gas industry, depending on which party, whether Democrats or Republicans win, I think there’s quite a difference in terms of the platforms related to energy. So we just want everybody to just remain patient.