ESG/Sustainability is now a factor in both company competition and investor decision-making, as seen across IT companies by evidence of their press releases, annual reports, SEC filings and more. Here are key findings from my research using AlphaSense:

Findings

Press releases and Annual reports are the most frequently used communications vehicles for IT companies to discuss ESG / sustainability, outside of their sustainability report

Press releases are regularly used across the sector to announce newly published company sustainability reports, sustainability related rankings, certifications and awards, inclusion in the Dow Jones Sustainability Index (DJSI) e.g. MasterCard ($MA), Computer Sciences Corp ($CSC), Xerox ($XRX), new product launches, commercial partnerships, and often to reference the National Association for Environmental Management (NAEM) ratings report

Environmental sustainability and energy disclosure in annual reports across the entire IT sector included: companies’ general sustainability discussion, and references related to policy and programs, products and services, supplier and supply chain, energy efficiency and renewable energy, ISO 14001 Environmental Management System Certification, capital access through “green bonds” and specific performance references. Two companies provide robust examples of the disclosure breadth across the sector and its services sub-sectors, respectively: SAP ($SAP SE) and Infosys ($INFY)

- In addition, a quick scan of annual reports and SEC filings found several examples of companies describing either expectations for their board members’ commitment to ESG / Sustainability or sustainability leadership and oversight structure.

Do Investors Really Care?

- “In our analysis, we regularly see the top holders being #1 Vanguard, #2 American Funds/Capital Research and #3 Fidelity. While these well-known asset managers may not be directly asking [IR], they are adopting ESG approaches. Below the top 3 into the top 20 or 30 – yes, there are SRI players.” – Hank Boerner, Chairman and Chief Strategist of the Governance & Accountability Institute.

- “In contrast to Materials, Energy and Health Care, in the Information Technology sector there are a number of ESG issues that could potentially be material, although it’s estimated their financial impact would be less significant than in the other three sectors. Consequently, an overweight of the Information Technology sector would seem less risky from an ESG perspective than an overweight of the Materials, Energy or Health Care sectors.” – Michael Geraghty, Global Markets Strategist for Cornerstone Capital Group [2]

“ESG is still a relatively new strategy with hundreds of new funds launching around the world in the past few years…Since most ESG funds are also set up for long-term positions, firms that bet on a few big names built momentum and rose in the ranking.”

“Many of the large-cap focused indexes in the sectors had big bets on names in the technology and finance space, where fund managers said ESG disclosure is better and that they can tap into broad economic trends…”

IT defined

- Fidelity defines the Information Technology sector as comprised of companies that are engaged in the creation, storage and exchange of digital information

- AlphaSense defines the entire IT sector as including: Communications equipment, electronics equipment, instruments and distributors, Internet software & services; IT services, office electronics, semiconductors & semiconductor equipment, software, technology hardware and storage & peripheral

Approach

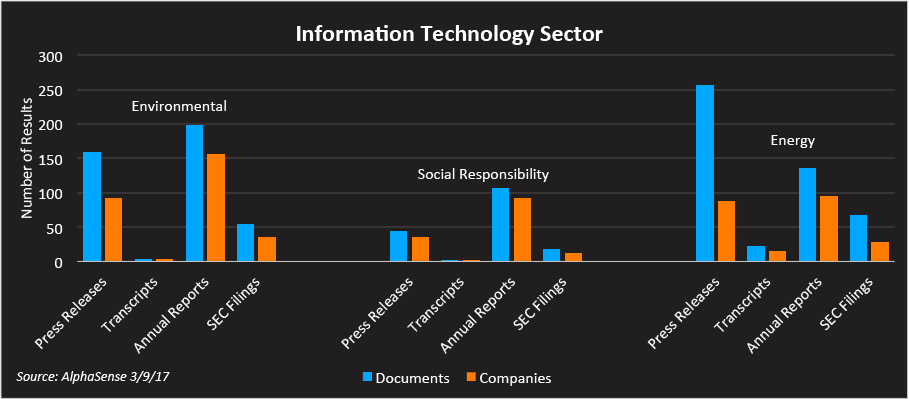

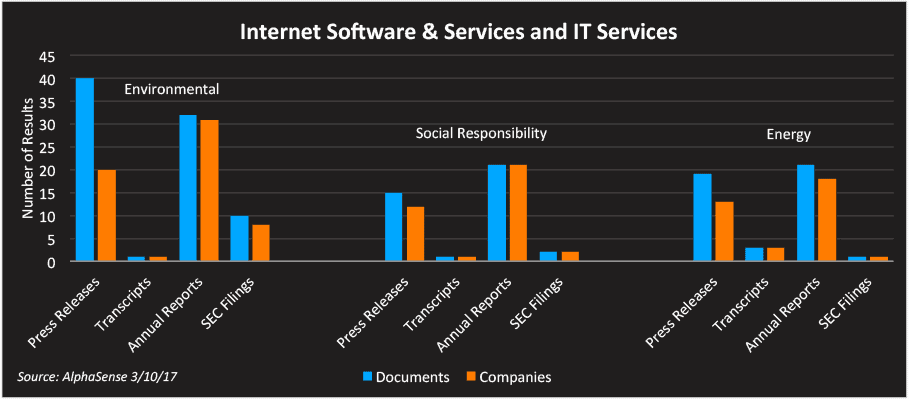

- I ran three queries: environmental sustainability, social responsibility sustainability and energy sustainability across four classic IR disclosure sources — SEC filings, annual reports, transcripts and press releases (related to earnings, M&A and miscellaneous subjects).

- I ran these queries twice — once for the entire sector and then for Internet software & services and IT services, in order to isolate the service only aspects of the sector.

Final note

As highlighted in several of my most recent AlphaSense blog posts, it is becoming noticeable that some utility and lodging & leisure sector leaders have been quietly bridging their company’s sustainability program successes into competitive IR communications strategy. From the results of my latest search, this appears to also hold true in the IT sector.

Pamela Styles is principal of Next Level Investor Relations LLC, an Investor Relations consultancy with dual IR and ESG/Sustainability specialties.