The Complete Guide to Conducting Competitive & Market Landscape Analyses

Get the guide

Some of the most valuable information contained within earnings documents is the data and financial information. This data can tell you a lot about a company, including overall performance and profitability, the success or failure behind new products or strategies, and even clues as to where the company thinks their future success will lie (a.k.a where the company plans to spend their R&D investments and how much).

The issue that most professionals face when working to uncover this type of information is the content itself. Oftentimes, the content toggles between structured and unstructured, meaning the data locked away inside can be difficult to efficiently find and extract. Fortunately, with AlphaSense, we’ve made the task of locating and utilizing data in all content formats super easy.

Here is how you can easily benchmark R&D investments or any other relevant data point:

Isolate R&D Investments for a Specific Company

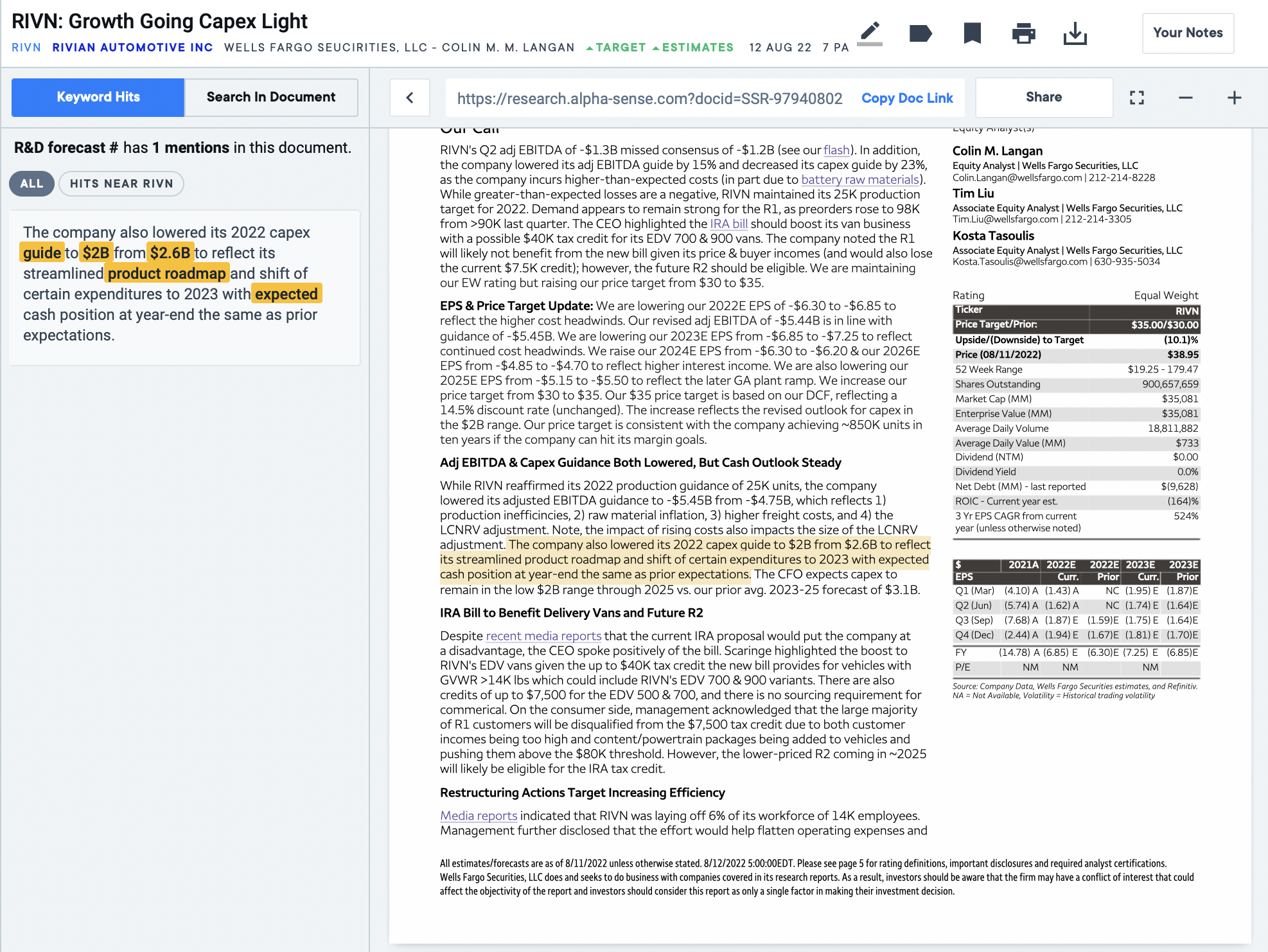

If you are focused on a specific company, you can go straight to the data by leveraging the keyword and ticker search boxes. Say I am trying to gauge how much investment Rivian (ticker: RIVN) is planning to spend on their product roadmap for the remainder of 2022, I would perform this search:

In this case, when searching for key metrics and data associated with a specific company, I want to include both the broker research and company document content types. There are two reasons for this: first, companies themselves will include details of their R&D investments, therefore I can include company documents and second, broker research includes coverage of companies and a comprehensive analysis of important things being reported by those companies.

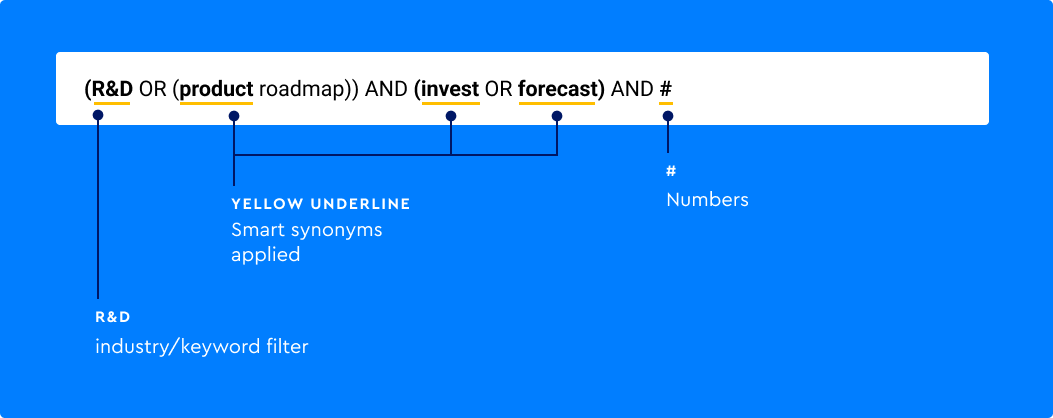

By including the “#” or “$” signs in my search string, AlphaSense knows to pull back exclusive mentions that include a number associated with them. And because AlphaSense’s AI-powered search engine is smart, it sources hits in structured (tables) or unstructured (text) formats – making sure nothing relevant gets past my eyes.

As a result, I am able to quickly understand that RIVN is planning to scale back its investment for the remainder of 2022:

Now I can easily highlight the text, make a comment, and add it to my RIVN note alongside the other intelligence I’m compiling around this topic.

Identify Key R&D Trends Across an Industry

Perhaps instead of a specific company of interest, you’re looking for the overall trends across an industry or group of companies. Let’s say I am researching R&D investments in the Aerospace industry, more specifically around commercial aircrafts, I would put these keywords into the search bar:

In this instance, I am using a keyword search and pairing it with the Aerospace & Defense industry filter. I’m able to see very specific results with the use of keywords such as “commercial aircraft”, ensuring any results populated are narrowed down further to this specific area. With a specific group of companies, I can use a watchlist filter to zero in on results around a specific group of companies.

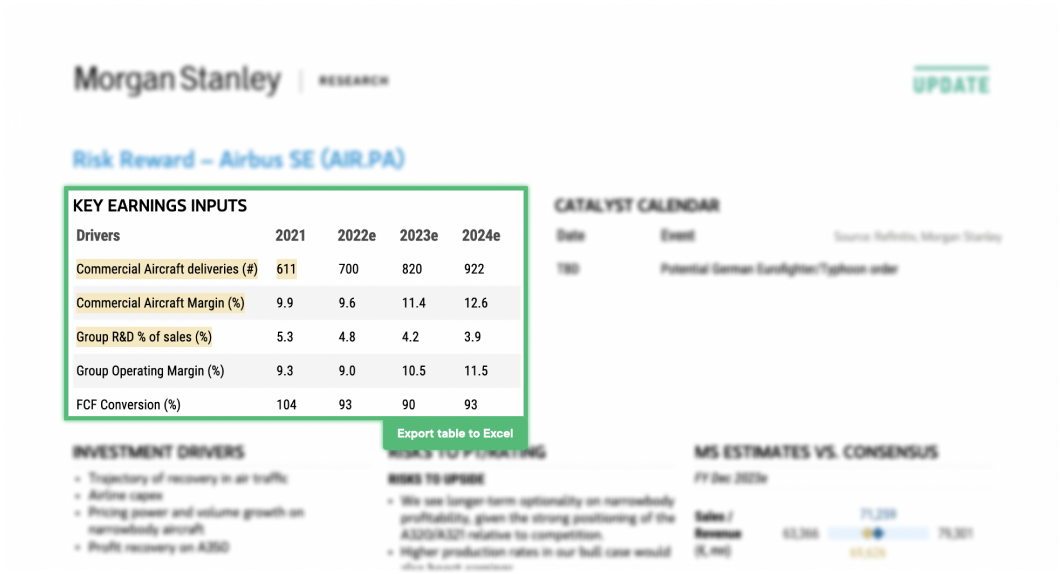

For this search across an entire industry with focus on broker research, I can take advantage of the data that researchers have already compiled (like the below screenshot showing R&D percentage of sales for Airbus), and also start to gather an idea of the key companies within the industry/ space that are talking about R&D. If I already had a watchlist of companies, I could also choose to include company documents as a content filter.

As seen above, through AlphaSense I am able to pull up useful data in a table. With this, I can not only highlight the table and export the data to an xlsx file but I can import it into my chosen spreadsheet tool for analysis.

Locate R&D News and Data Around a Specific Topic

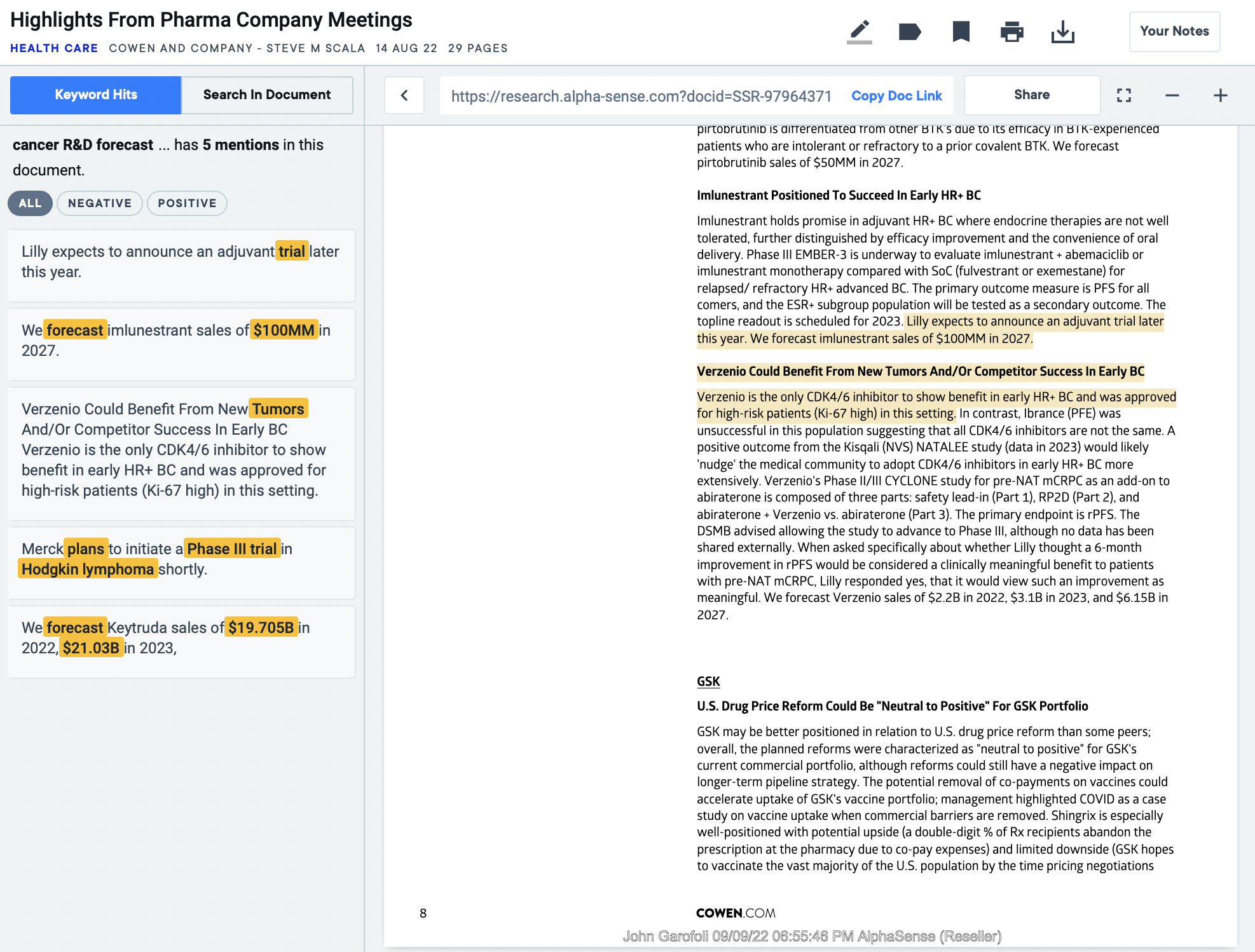

Similar to the industry search, in order to locate data around a specific topic, I can perform another targeted keyword search. For this example I am looking for R&D data on cancer. Instead of specifying any specific companies, I’m keeping it more broad. But if need be, I could narrow the search further to an individual company or a group of companies in a watchlist.

Since AlphaSense essentially tells me which documents are the most relevant, I can locate the right information quicker. Aside from the speed to insights, within each document AlphaSense shows me which hits are the most relevant. Normally I would need to read reports line by line but the relevancy element of the platform saves me from wasted time on potentially fruitless searching.

I decided to pick an interesting data point around a promising treatment that Lilly is developing. Since I am searching in broker research exclusively, I have immediate access to useful information around the forecasted sales revenues from the treatment.

It cannot be stated enough the importance of keeping a close eye on all the latest information and data happening around a specific topic of interest. Dashboards and alerts ensure not a single point of relevant data or information is missed. This ensures you always stay in the know and that you have a constant source of information to fuel recommendations or other important business decisions.

Ready to get started? Start designing your dashboards and alerts today, and make sure to download our mobile app.

Not yet an AlphaSense user? Request a trial.