Will Alphabet’s leadership transition serve as a catalyst to unlock shareholder value?

Is it the start of a new era or much ado about nothing? Alphabet’s legendary founders Larry Page and Sergey Brin announced they would step down this month. That elevated Sundar Pichai, formerly the head of subsidiary Google, to the top slot. The transition leaves Alphabet as the only FANG (Facebook, Amazon, Netflix, Google) stock without a founder-CEO. Investors are watching to see if Pichai can execute with the same intuitive acumen and vision as the sector’s many other celebrated leaders.

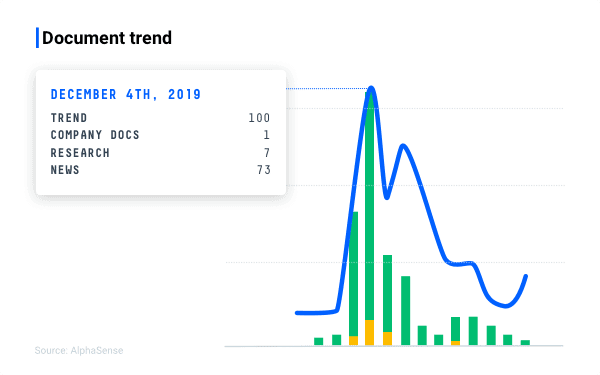

Document results for “Page OR Brin” on AlphaSense spiked to over 745 when the news hit on December 4.

Sell-side analysts are updating their sum-of-parts valuation, and Sentiment Analysis of the company’s last quarterly call highlights many non-core growth initiatives. While Alphabet’s core businesses continue to perform strongly, investors now want to see whether recent management changes lead to a more accommodative company.

We dug into the AlphaSense platform to gather key insights about what analysts are saying and how sentiment is changing in light of the recent news.

Above: As of 12/12, Alphabet received a sentiment score of 57, which represents a 7% increase over the previous quarter. For context, Facebook is scored -19 (down -12), Amazon -16 (down -25), and Netflix -10 (+3%).

From the Company

8K:

On December 3, 2019, Alphabet Inc. (“Alphabet”) announced that Larry Page and Sergey Brin have decided to transition from their roles as Alphabet’s Chief Executive Officer and President, respectively. Mr. Page and Mr. Brin will continue to remain active as co-founders, stockholders, and board members of Alphabet.

Key Analyst Insights

The key focus for the analyst community is whether Pichai’s more pragmatic leadership could unlock shareholder value by focusing efforts on profitable initiatives and possibly setting the stage for spinoffs.

Some analysts have seen the developments as potentially bullish.

MKM Partners, for instance, reads between the lines of Google’s latest blog post as potentially heralding more unlocking of shareholder value. The firm notes that Pichai has developed a “stellar” reputation with investors and that shares are up 100% since Oct 2015 versus the S&P 500’s 60% gain. MKM also points to the larger share buyback plan the company recently announced as a trend that could continue under Pichai.

Cowen, meanwhile, notes that the company continues to perform well and its focus on long-term results should remain intact. Key initiatives like digital and mobile advertising are thriving, driving an estimated 20 percent year-over-year net revenue growth in 2019 and 15% year-over-year growth in EBITDA. The analysts also note that Page and Brin have been taking a more hands-off approach since 2015, implying there is more continuity than the transition might imply.

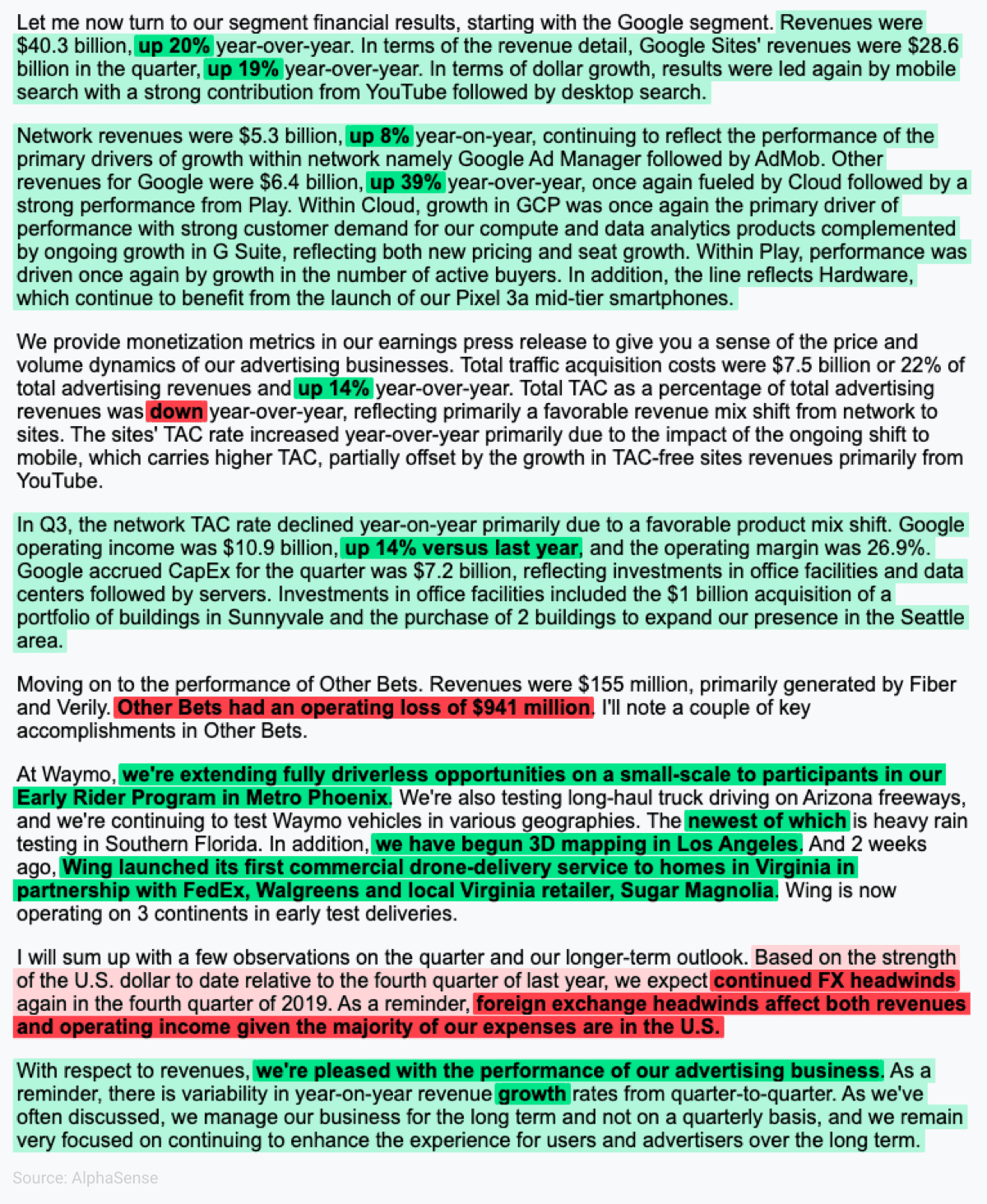

Sentiment Analysis of Alphabet’s Q3 2019 Earnings Call

Alphabet’s core business lines [mobile, search, YouTube, Cloud] continue to drive strong operating performance. But the company has many non-core initiatives as well, and expenses continue to be a challenge. AlphaSense Sentiment Analysis (below) highlights both positive and challenging developments for the quarter.

The key question for investors and analysts in the company’s next quarterly earnings call: will the company indicate a greater focus on its core business, and indicate that other areas could be in for retrenchment?

Sundar Pichai, CEO:

If you’re an AlphaSense user, log in to view the full analysis of Alphabet.

Don’t have access? Register for a free trial here.