The Coronavirus outbreak has been an economic catastrophe. This week alone, it wiped out $1.7 trillion in stock market value within two days. It has caused massive job losses and could cost the global economy $1.1 trillion in lost income, according to estimates by Oxford Economics.

At the same time, though, it has opened up pockets of opportunity for investment.

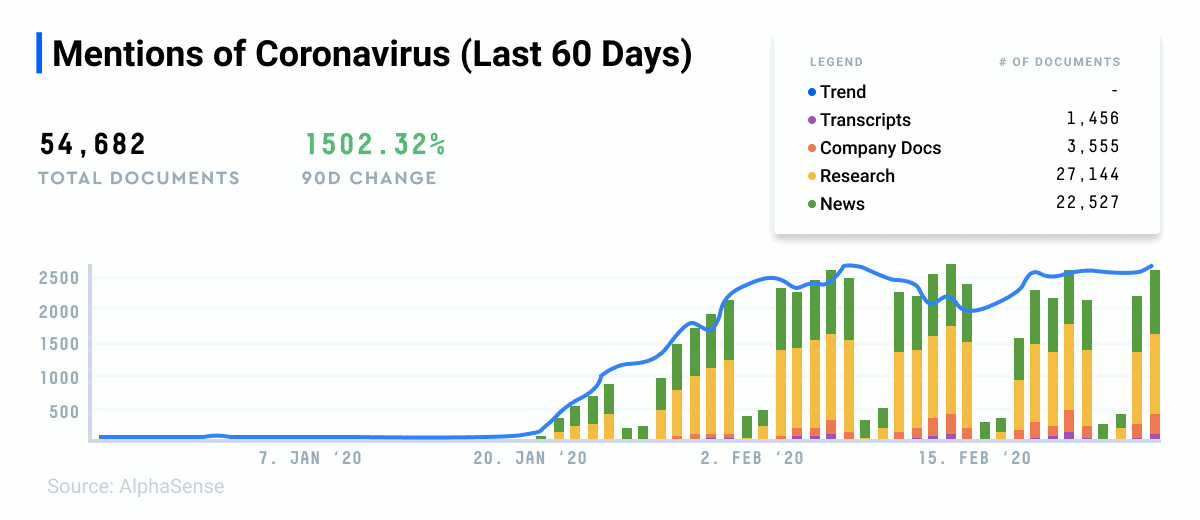

The Coronavirus outbreak became a driving force in the markets and economy at the beginning of the year, as reflected in the news, broker research, and company documents.

The Chinese online economy is booming as consumers flock online

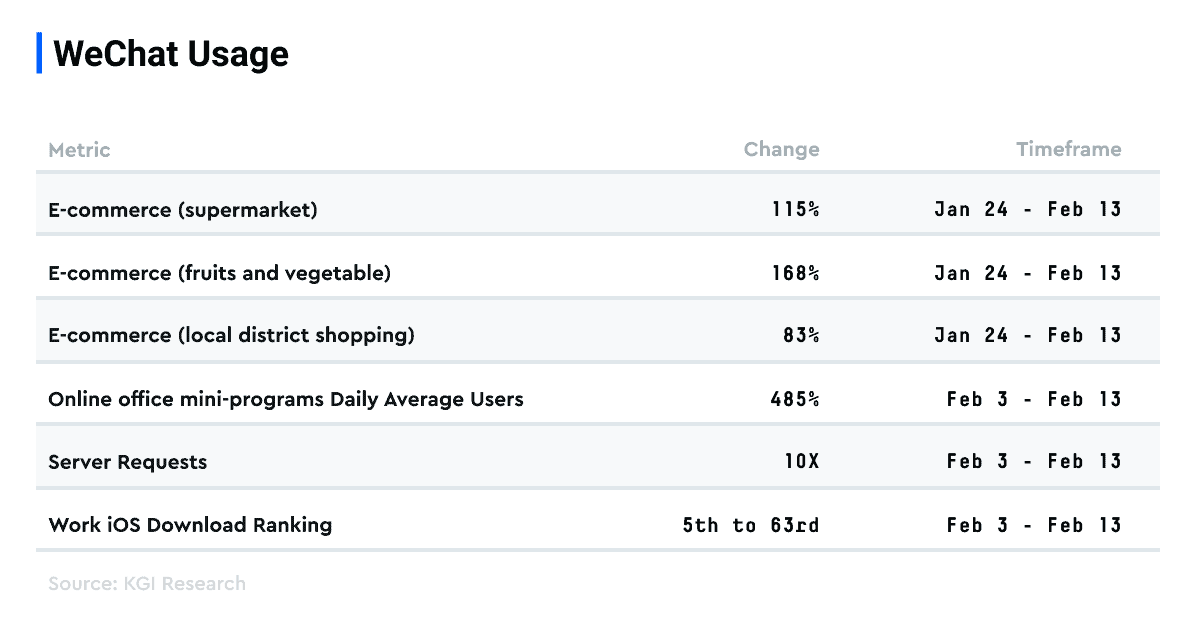

With many cities in China under partial lockdown to stop the spread of Coronavirus, the number of employees working from home has surged and schools are suspended. Not surprisingly, this is driving online traffic growth and engagement, analysts at KGI note.

WeChat (owned by Weimob Hong Kong: 2013) is one beneficiary of this trend. Many WeChat mini-programs — sub-applications in the WeChat ecosystem like e-commerce, payment services, and task management — have seen a sharp rise in usage.

Other online Chinese leaders like Tencent (Hong Kong: 700) and Youzan (Hong Kong: 8083) also stand to benefit from the growing online engagement, KGI analysts note.

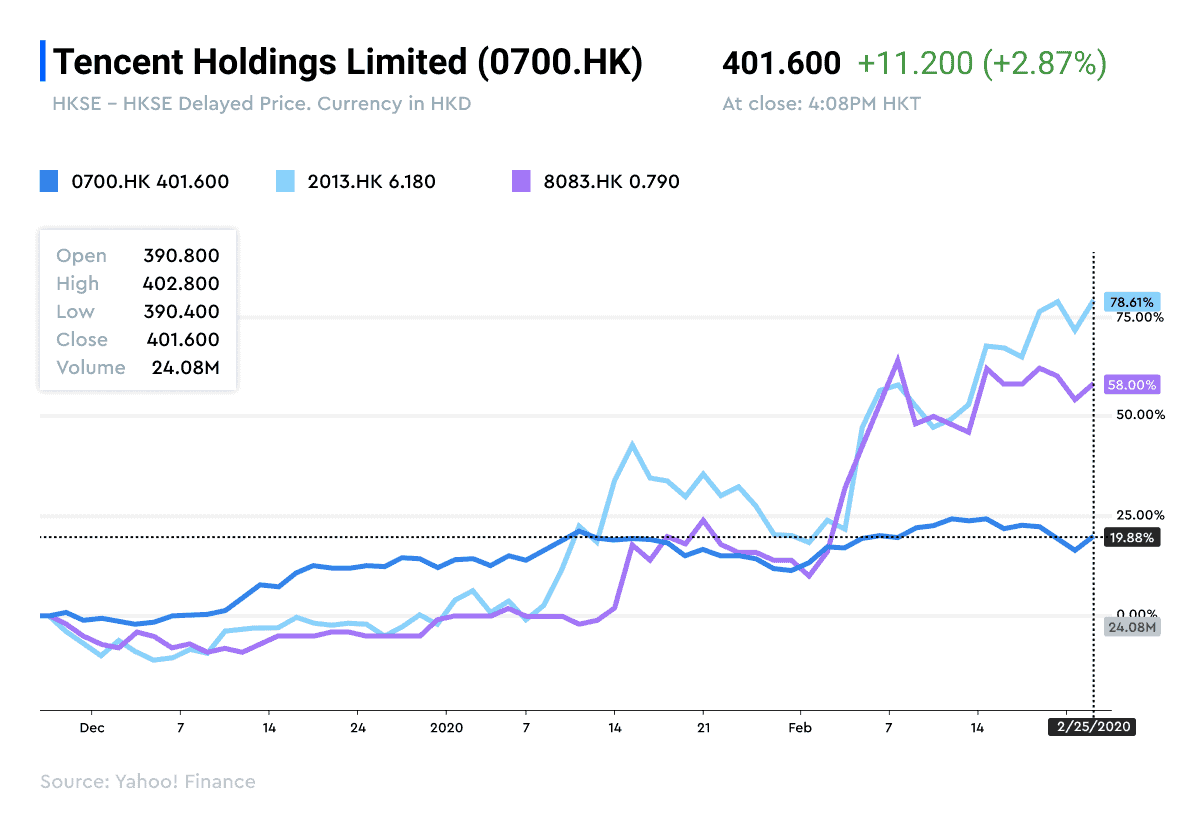

The growth in online engagement following the Coronavirus outbreak has been substantial enough to cause a major boost to Chinese Internet companies like Tencent (700.HK), Weimob (2013.HK), and Youzan (8083.HK).

E-commerce giant Alibaba (NYSE: BABA) also sees consumers flocking online to replace physical services. “Consumers, they change their way of living and for many offices — many workers, they change the way of how to work,” said Daniel Zhang, CEO of Alibaba, in the company’s most recent conference call. “So people now work remotely from home. People buy foods, buy fresh products, buy groceries, buy necessities from home.”

It remains to be seen, as Zhang referenced in the call, whether the shift to digital-first lifestyles will take hold for the long term.

Vaccine makers could see a big opportunity

The search is on to develop or apply existing drugs to Coronavirus.

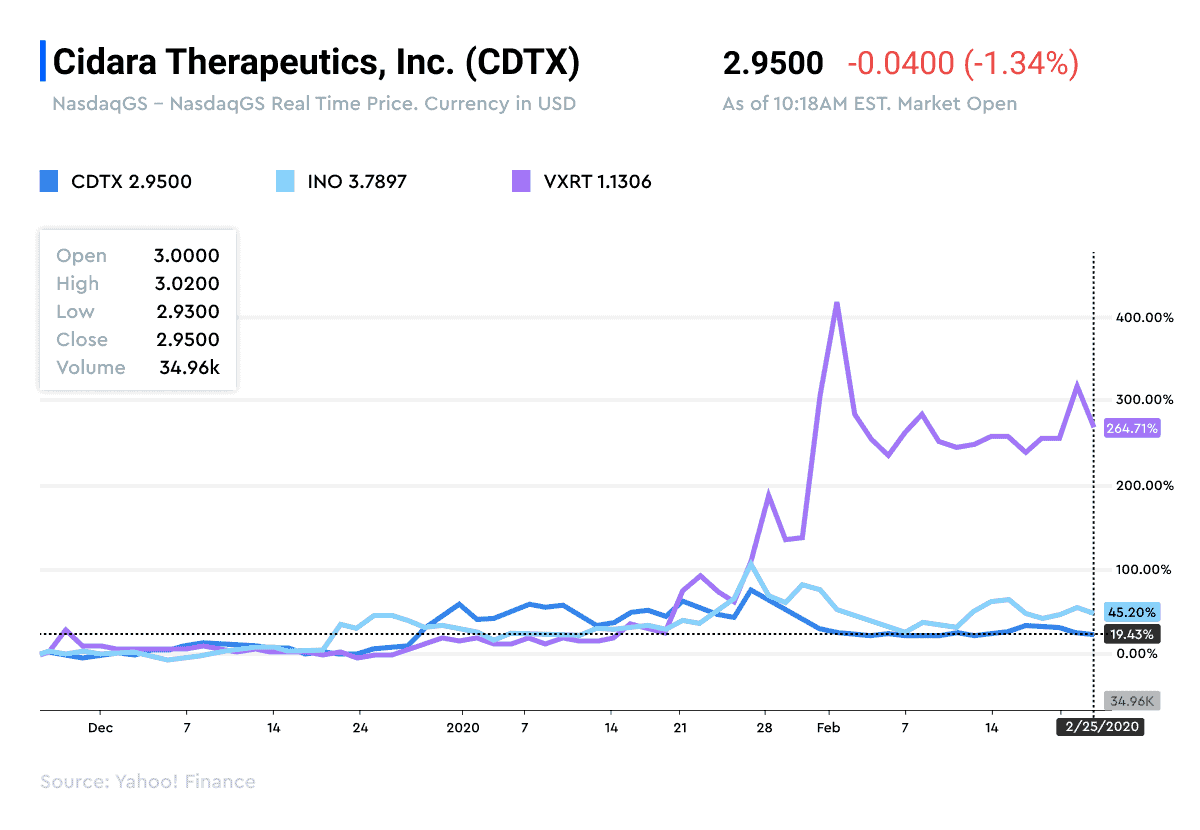

Analysts at Cantor Fitzgerald believe the Coronavirus could bring Cidara Therapeutics (Nasdaq: CDTX) Cloudbreak Antiviral Fc-Conjugates (AVC) into the spotlight. They note that the company is developing a universal flu vaccine and the data so far has been impressive.

Shares of biotech companies (Cidara, Inovio, Meridian Biosciences) with the potential to develop vaccines for Coronavirus rallied as investors analyzed their ability to deliver solutions and profits

Analysts at Needham note that Moderna (Nasdaq: MRNA) has established preclinical and clinical proof of concept trials for a Coronavirus vaccine platform, while competitor Curevac has also announced plans to develop a vaccine. Shares of Moderna surged more than 25% on Tuesday after the company announced that US government researchers were now testing its vaccine. And Inovio (Nasdaq: INO) recently announced a grant from CEPI to fund the development of its DNA vaccine.

Additional vaccine programs are also underway at Johnson & Johnson (NYSE: JNJ), Novavax (Nasdaq: NVAX), and Vaxart (Nasdaq: VXRT). Shares of Novavax gained 18% on Wednesday after the company announced that it plans to begin clinical testing for a Coronavirus vaccine by late spring.

Meridian Biosciences (Nasdaq: VIVO), meanwhile, sees opportunity in using their diagnostic platforms to help vaccine makers develop their products. “I think the more exciting thing in my mind is that [our diagnostic platform technology] is a key component that’s used in the development of all molecular tests and these customers that we can go with and help them with Coronavirus make other molecular tests,” CEO John Kenny said in the company’s most recent conference call. “So that creates an opportunity for us to sell [our diagnostic platform technology] into other molecular tests that they have down the road.’”

As the Coronavirus outbreak continues to take an economic toll, investors need to be attuned to the major trends caused by such a profound event. The migration of Chinese consumers online and incentives for drugmakers to innovate are two immediate consequences.

Interested in reading more AlphaSense content? Check out our Insights section, or learn more about AlphaSense through our whitepapers, webinars, and case studies.