The Complete Guide to Conducting Competitive & Market Landscape Analyses

Get the guide

Several years ago, the discussion around blockchain technology and cryptocurrencies like Bitcoin and Ethereum were whether these technological novelties were merely a fad or if they were here to stay. Now, with cryptocurrencies having reached a 2 trillion dollar market capitalization, the question isn’t whether these cryptocurrencies will have any longevity; it’s how much of an impact they will have on consumer banking and the financial industry as a whole.

New technical innovations, like NFTs, have emerged and are now raising similar questions as digital artists, the NBA, and hundreds of brands seek to take advantage of this new crypto-trend. But how will banking institutions use these new financial and technological innovations, and will they have the same mainstream adoption we see on the consumer side?

We used AlphaSense to learn how the finance industry is approaching cryptocurrencies.

Company discussion around cryptocurrency and infrastructure

While cryptocurrency is bound to be a widespread discussion among the financial industry, we wanted to be more specific and discover whether the industry thought it could impact banking and economic systems.

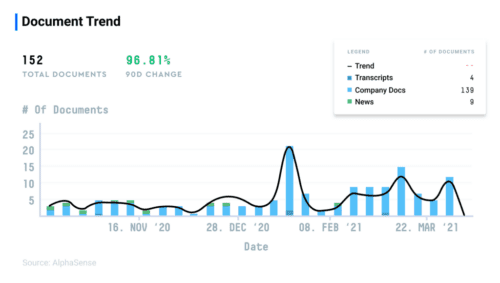

In six months leading up to April 5th, we found over 152 total company documents within the financial industry that mentioned “cryptocurrency” and “infrastructure,” a 96% increase over the last 90 days. (AlphaSense users, here’s a saved search link)

Drilling even more profound, we found a 184% increase in company docs over the last 90 Days across Banks, Insurance, and Consumer Finance companies that contained those terms.

Within those documents, and across documents that mentioned “blockchain” and “infrastructure,” we found some noteworthy events where major private and public institutions across the globe were making moves towards incorporating cryptocurrency or blockchain technology among their service offerings or leveraging them as a complement to what they were already providing as a service. Here are some examples.

- JSE Limited, one of South Africa’s largest financial institutions, entered into a commercial arrangement with Globacap Technology to “establish a blockchain-enabled private placements platform to enable the raising of infrastructure finance and to allow small-to-medium-sized issuers to raise capital in South Africa.”

- Silvergate Capital, an infrastructure and service provider for the digital currency industry, recently announced that Fidelity Digital Assets would serve as the custodian of SEN Leverage, Silvergate’s bitcoin-collateralized U.S. dollar loans, marking a significant partnership between a cryptocurrency infrastructure provider and a major U.S. financial institution.

- Sino Global Shipping American Ltd, a shipping and freight logistics provider, announced that they would acquire a 60% ownership of the blockchain infrastructure developer Super Node LLC in an all-stock transaction valued at $5 million, highlighting how blockchain technology isn’t just for the finance industry.

- TAAL, an enterprise blockchain infrastructure and service provider, recently went public in Canada, with an impressive $40M IPO debut.

- The European Commission published a digital finance package including a set of proposals that, according to EuroNext’s Universal Registration Document, “would create a bespoke regime for crypto-tokens that are not considered as financial instruments, create a pilot regime for market infrastructures that use distributed ledger technology, and amend existing legislation to frame crypto-tokens that act like financial instruments to be defined as such.”

Raiffeisen Bank’s Annual Reports Statement also points to this package and new business models and financial products as paving the way for further digitalization in the financial sector and new strategies for retail payment services.

Organizations across and beyond the banking and finance industry are leveraging cryptocurrency and blockchain technology in their ways. And the opportunity only seems to be growing. For example, Murray Stahl, Chairman, and CEO of FRMO Corp, an investment holding company, had the following in a Q2 2021 Earnings Call.

“…this was a quarter where everything was working in our favor. I expect that as the infrastructure builds out, for cryptocurrency, that it’s going to be a wonderful experience for many, many years….”

NFTs emerge as the new cryptocurrency kid on the block.

NFTs (non-fungible tokens), built on blockchain technology (most commonly, Ethereum’s blockchain tech), have exploded in popularity over the last few months. NFTs can be used to commodify everything from digital art, music, and even moments in sport. They represent a new form of ownership for anything that can live in the digital world, and there has been a lot of chatter within the AlphaSense platform.

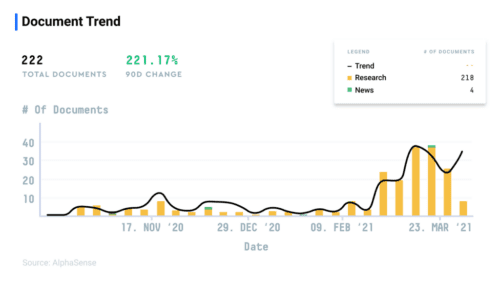

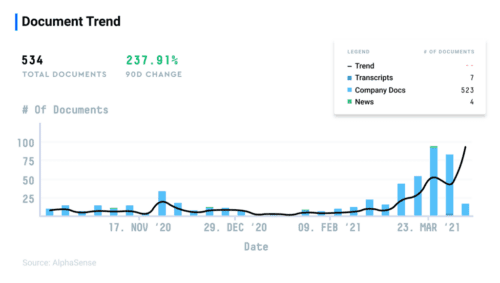

We saw a massive increase in the mentions of NFTs across Company Docs, Transcripts, and News and across research as well, with 90-day increases hitting over 220%.

Across these documents, companies were either announcing their NFT release, finding their foothold within the NFT space, or, as you’ll see with one example, looking for business opportunities given the potential of NFTs. Here are a few key transcripts.

Monex Group, Inc, Q3 2021 Earnings Call | AlphaSense Transcript

“…But in [the] non-fungible token [space]… no one won the #1 position in the world. And to create a platform for a non-fungible — a marketplace for a non-fungible token, the technologies, and the expertise are pretty much the same as running the crypto exchange. So Coincheck is…trying to take a prominent position in the world in the NFT marketplace. So this is quite interesting…”

Wizard Entertainment | Annual Report | AlphaSense Transcript

“We see an opportunity in the Non-Fungible Tokens (NFTs) industry…In recent months many companies have entered this space. However, Wizard Brands, Inc., because of its existing enterprises, is perhaps uniquely situated to enter the NFT marketplace on a scale at which no other new market entrant into this space can achieve. Although the NFT market is currently gaining considerable attention in the press and is achieving traction with consumers, it is impossible to know the ultimate size and significance of the NFT marketplace.“

Mudrick Capital Acquisition Corporation | 8K Filing | AlphaSense Document Link

Mudrick Capital is a SPAC and has recently announced that it is looking to take the famous collectibles company TOPPS public, citing, among other things, its potential in the NFT market. One of the critical reasons TOPPS is being considered is due to “Significant growth in its industry-leading e-commerce and digital (apps) platforms positions Topps to further expand with Blockchain/NFT (Non-Fungible Token) initiatives.“

Lastly, we recommend checking out Galaxy Digital’s Q4 2020 Earnings Call. In it, Mike Novogratz, Founder, CEO, & Chairman of Galaxy Digital, offers crucial insights and commentary around the current NFT craze and what he thinks the opportunity will look like moving forward.

How CBDC may displace cryptocurrency

There is another digital currency that may significantly impact the banking industry across the private and public sectors. Central Bank Digital Currency (or CBDC) is similar to other cryptocurrencies with one significant difference. Rather than traditional cryptocurrencies relying on decentralized technology, CBDC (also known as e-cash) is, by definition, centralized, which may foster adoption among more conventional financial institutions.

There’s even a potential that CBDC displaces cryptocurrency adoption among governments and influential banking organizations. To learn more about cryptocurrency, CBDC, e-cash, and what the near future looks like for these new financial innovations, check out our AIR Summit webcast. Howard Mason, a Financial Analyst at Renaissance Macro, will discuss the opportunities CBDC will provide to the private and public bank sector and the significant differences between CBDC and cryptocurrency.