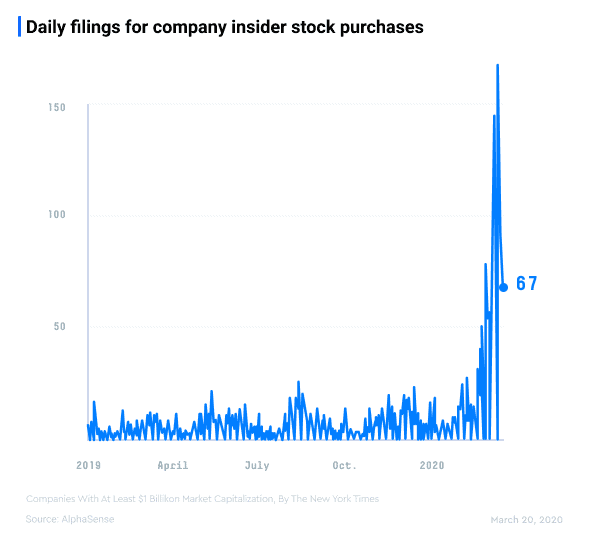

Despite the steep market decline brought about by the rapid spread of COVID-19, the number of executives buying their own stock has exploded. Today, the New York Times reported that insider purchasing is at an all-time high, according to data provided by AlphaSense.

At companies with >$1B market cap, insider purchase frequency has grown by more than 10x month over month — outpacing the prior all-time high of late 2008. March to date, there have been 1,305 filings for insider purchases so far this month, compared with 113 filings during the same period last year.

Management teams buying their own stock in the open market is a sign of confidence to investors. This likely signals that executives believe the nearly 30% drop in the market over the last month has gone too far.

Digging into the data

Overall, we’ve seen a good deal of buying in the companies hardest hit by Coronavirus shutdowns including Live Nation (4 purchases in the past week, including $1M purchase by CEO Michael Rapino), Planet Fitness, American Airlines, and Delta.

Looking at the past 7 days:

- Shari Redstone, Chairwoman of ViacomCBS, just bought $1M of ViacomCBS stock (as did 2 other Viacom executives in the last two days).

- The CEO of Simon Property Group bought $9M of stock yesterday.

- Wells Fargo CEO Charlie Scharf bought $5M on Friday 3/13.

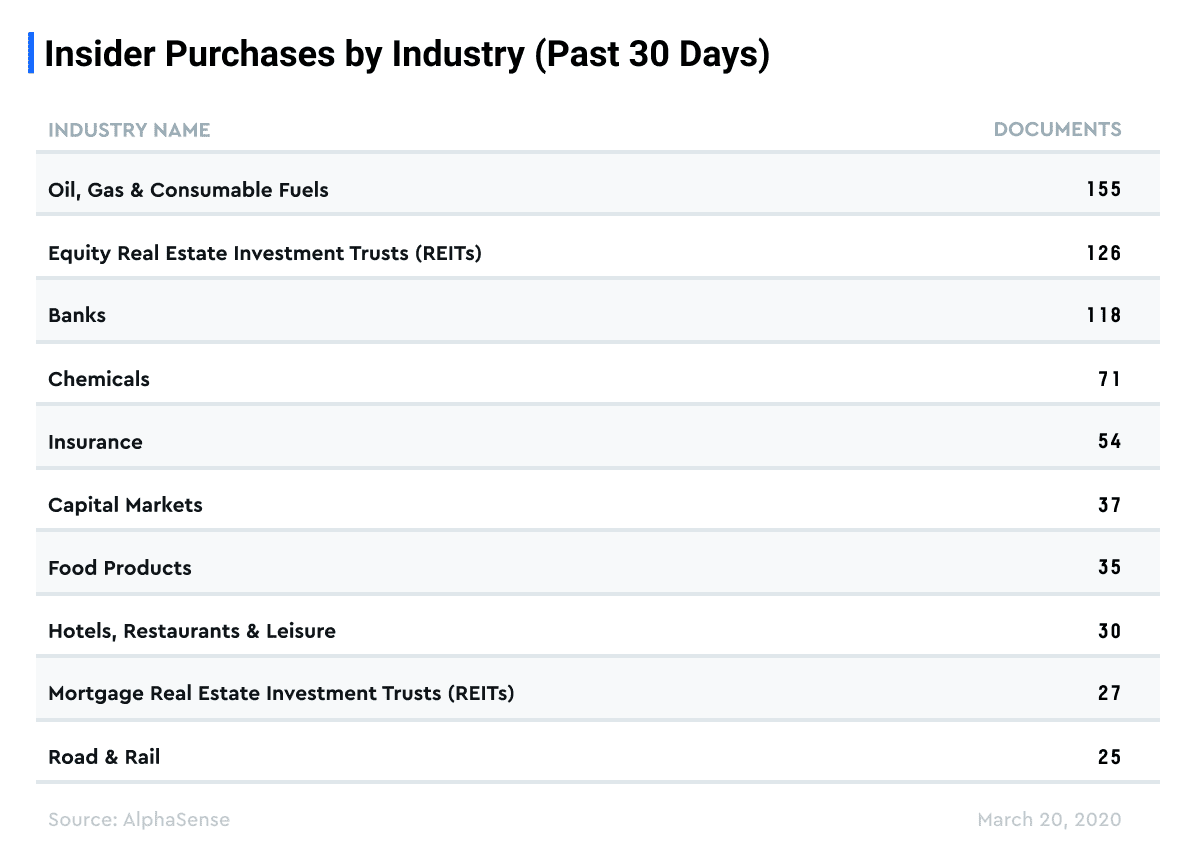

Zooming out to the last 30 days, we see the most concentration of buying in Oil & Gas, Banks, and REITs.

AlphaSense users: Login to view pre-set alerts to help you track insider buying across the market, your watchlist, or individual companies.

Don’t have a subscription? Unlock two weeks of free AlphaSense access to surface real-time insights on global themes.

Notes on methodology: AlphaSense can sort Form 4s (which executives and board members are required to file when they buy or sell their own stock) to find only the Purchases. We looked at companies with >$1B market cap and tracked filings from 2005 to date. Note that we are tracking the number of purchase filings; not the amount of the purchase.