The S&P 500 set a record this week, coming in at 0.1 percent higher than it was six months ago at the close of trading on Tuesday. That represents a 50 percent jump from its low in late March — a sharp contrast to the devastation of the pandemic. Now the question is how long it can last.

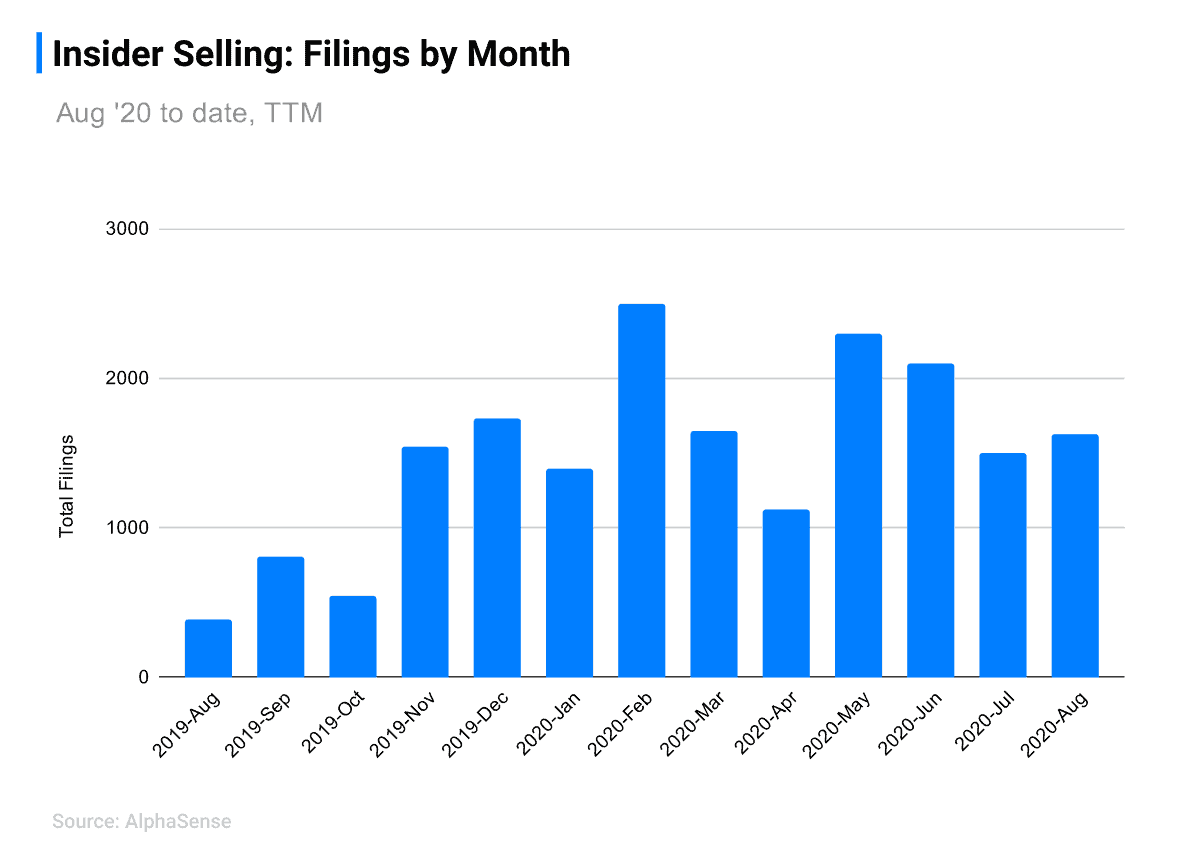

Insider selling is one indicator of market stability, says the New York Times in Wednesday’s DealBook. Citing AlphaSense data, they report that disclosures of executive stock sales so far this month have already surpassed last month’s total, and are on track to beat the previous high set in February of this year.

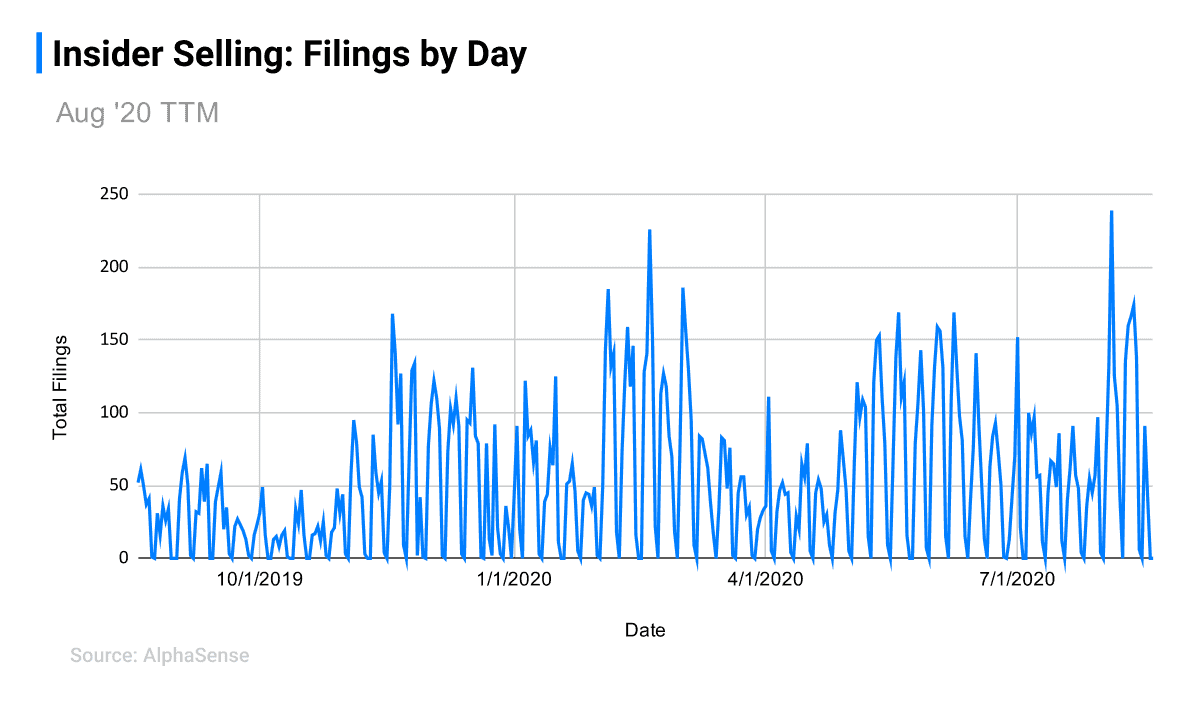

According to AlphaSense data, August 4th was a record high for insider selling, with 239 transactions recorded that day alone. The previous all-time high was February 19th of this year — just as the pandemic was beginning to impact markets — with 226 filings recorded.

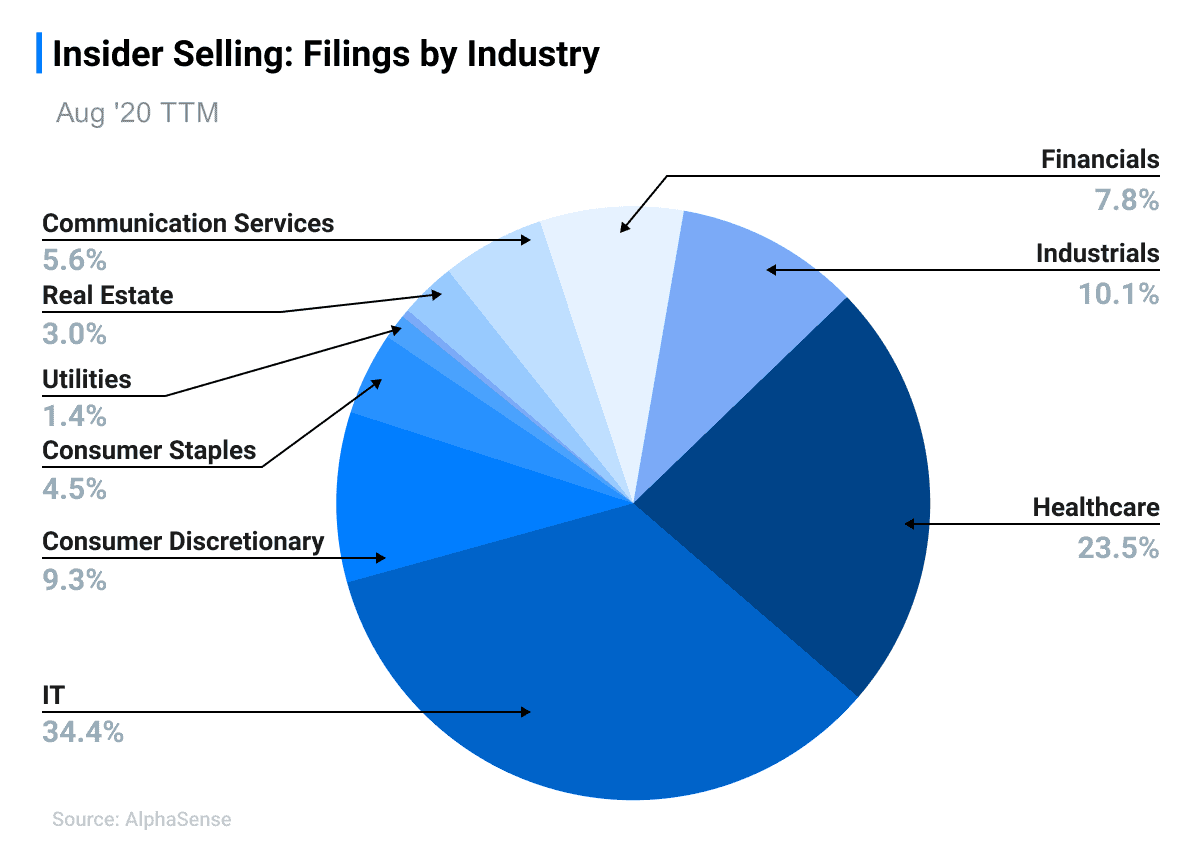

The IT industry accounts for just over a third of all sales, with Salesforce and Slack dominating the most frequent sellers list over the past six months. Healthcare executives account for just over 23% of the past year total, with 100 filings recorded from Moderna executives alone over the past six months.

AlphaSense can track insider selling in real-time by industry, watchlist, or across the entire market. Start your free trial of AlphaSense or login now to explore the data.