Last month, the stock market returned to record highs, largely on the strength of retail sales. Three sectors led the overall S&P 500: Consumer Discretionary, Internet, and Direct Marketing Retail industry. Now that September has wrapped up, we are looking forward to October, a month intrinsically tied to political outcomes.

As the election rages on, it’s apparent that America’s economic future is dependent on the outcome of November’s election. In response to this change in voters’ moods, the aisle between left and right will narrow a bit. A new stimulus package will be passed because it must. Otherwise, the economic rebound will fizzle and both candidates – and their parties – will have a lot of explaining to do.

Takeaways

- While no sectors significantly outpaced the over S&P 500 in September, Energy continued to underperform.

- The other sectors were all basically flat.

- Going forward, you have to pick individual companies rather than sectors or even industries at the moment.

First look at October

In a rare happenstance, most S&P 500 sectors traded in lockstep through September; that is, they didn’t move much one way or the other. The exception was Energy, which lost 20.2% of its value over the course of the month.

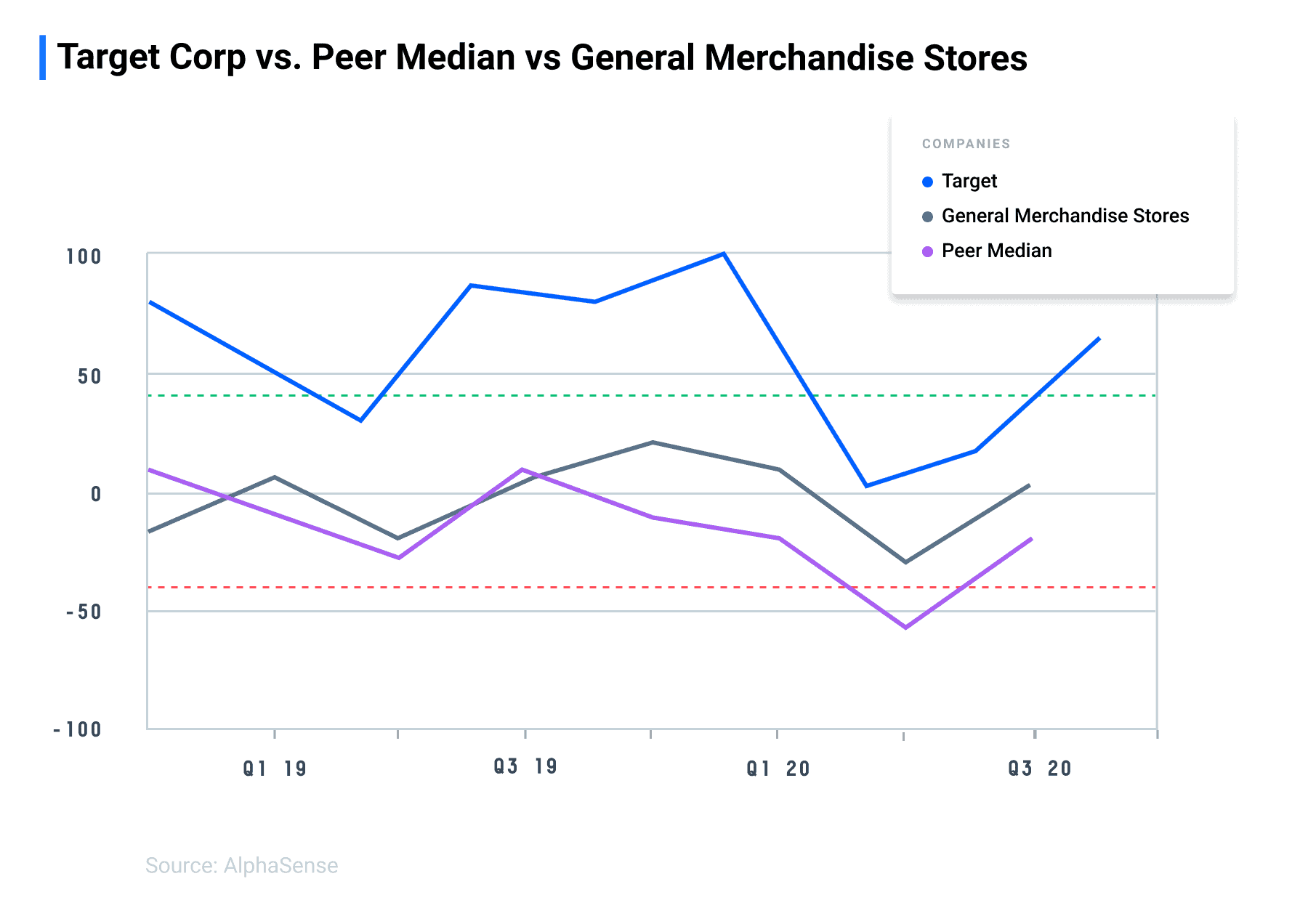

There are some bright spots, but you have to dig deeper than the sector level to find them. Within the Consumer Discretionary sector, the Internet & Direct Marketing Retail industry – which had been blazing all year – has tapped the breaks, but there might still be room for growth in Household Durables; for example, gamer gear purveyor Turtle Beach (HEAR: $19.12) is worth a look. And for those who thought Retail was dead, it’s not, as discounter Ollie’s Bargain Outlet (OLLI: $89.11) and midrange Target (TGT: $161.51) can attest.

There are green shoots in the Industrials sector. This a part of the economy that tends to perform dismally during recessions but comes on strong in the early stages of recoveries. At the moment, Atlas Air Worldwide (AAWW: $62.57) is ruling its Air Freight & Logistics industry, which is ruling the rest of the sector. Meanwhile, in Information Technology, the Software industry has the hot hand, and e-commerce facilitator Channeladvisor (ECOM: $15.18) has been showing particular strength.

Perhaps the biggest surprises, though, might come from the particularly unsexy world of Materials. The Metals & Mining industry isn’t very closely followed these days, but the ADR of Piedmont Lithium (PLL: $26.02) seems to be flying under everyone’s radar.

September wrap-up

Gross domestic product decreased at an annual rate of 31.4% in Q2. This final number is an improvement over the first and second reads due to an upward revision of personal consumption expenditures. While it’s still too early to get an authoritative read on third-quarter GDP, the Atlanta Fed’s GDPNow model estimates a 32% increase, suggesting that the hoped-for V-shaped recovery is real.

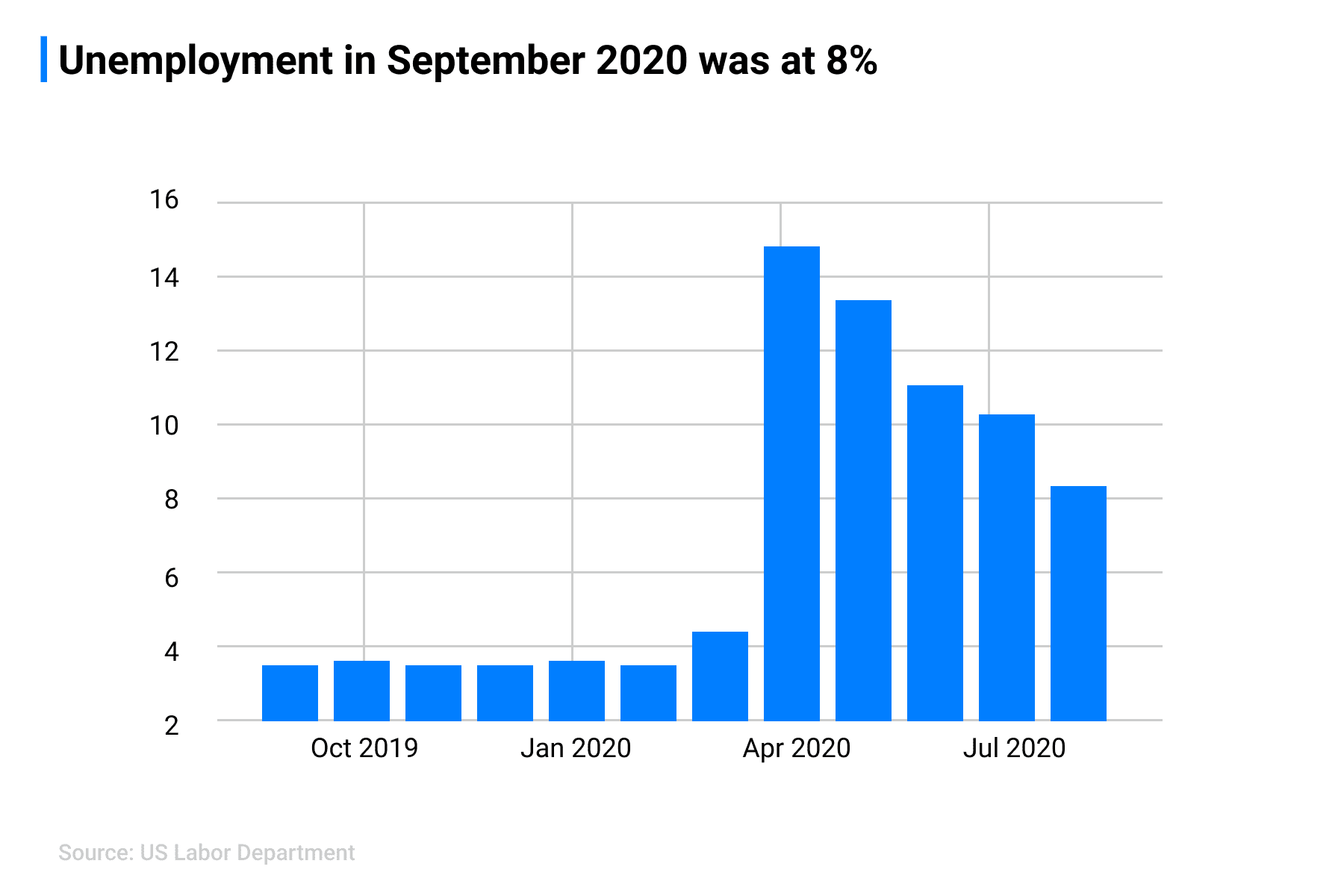

Initial jobless claims for the week ending September 26 totaled 837,000, a decrease of 36,000 week-over-week. The four-week moving average was 867,250, an 11,750 decline. While this is relatively good news, it’s also a stark reminder that economic recovery isn’t equally distributed.

The unemployment rate was 8.1% for the week ending September 19, a decrease of 0.6 percentage point over the previous week, or 1.8 percentage points over the previous month. While almost a million Americans either found work or otherwise dropped off the unemployment radar in that one week, 11.8 million remain in the job hunt.

The S&P 500 lost 5.8% on a total return basis for September, but still managed a 10.9% gain for the third quarter. Meanwhile the CBOE VIX market volatility index closed September at 27.77 suggesting stock prices were 4.4% more unsettled than they were at the start of the month.

The yield on the benchmark 10-year U.S. Treasury note, which stood at 0.716% at the start of September, sank to 0.654% by the end.

After four months of stability, the oil market returned to its struggles in September. West Texas Intermediate crude lost 5.6% of its market price, ending the month at $40.22 per barrel. Meantime, gold continued its slow decline by another 4.2%, closing at $1,896 per ounce.

The dollar gained against other major currencies in September, up 1.6%, 3.4% and 0.4% against the euro, pound, and yen respectively. Cryptocurrency was more subdued as Bitcoin gave back its month-earlier gains to end September at $10,709.

William Freedman, MBA, writes about finance and technology. He serves on the board of governors of the New York Financial Writers’ Association.

For more expert analysis, head to our resources page. To access company documents, including SEC filings, earnings call transcripts, and more, unlock free trial access to AlphaSense or log into your account.