Big banks will kick off Q3 earnings on October 13th. After two uncertain quarters of reporting, analysts are hoping for more clarity and direction for the remainder of 2020.

During the first half of 2020, major banks took major reserves and reported significantly lower earnings–an early look at how COVID-19 was impacting the economy across sectors. This quarter, the nation’s largest lenders are expected to report better earnings after delinquencies came in better than initially feared.

Even with an increase in borrowing, the remainder of 2020 is uncertain mostly due to Congress–will we see another stimulus package to help U.S. households and businesses?

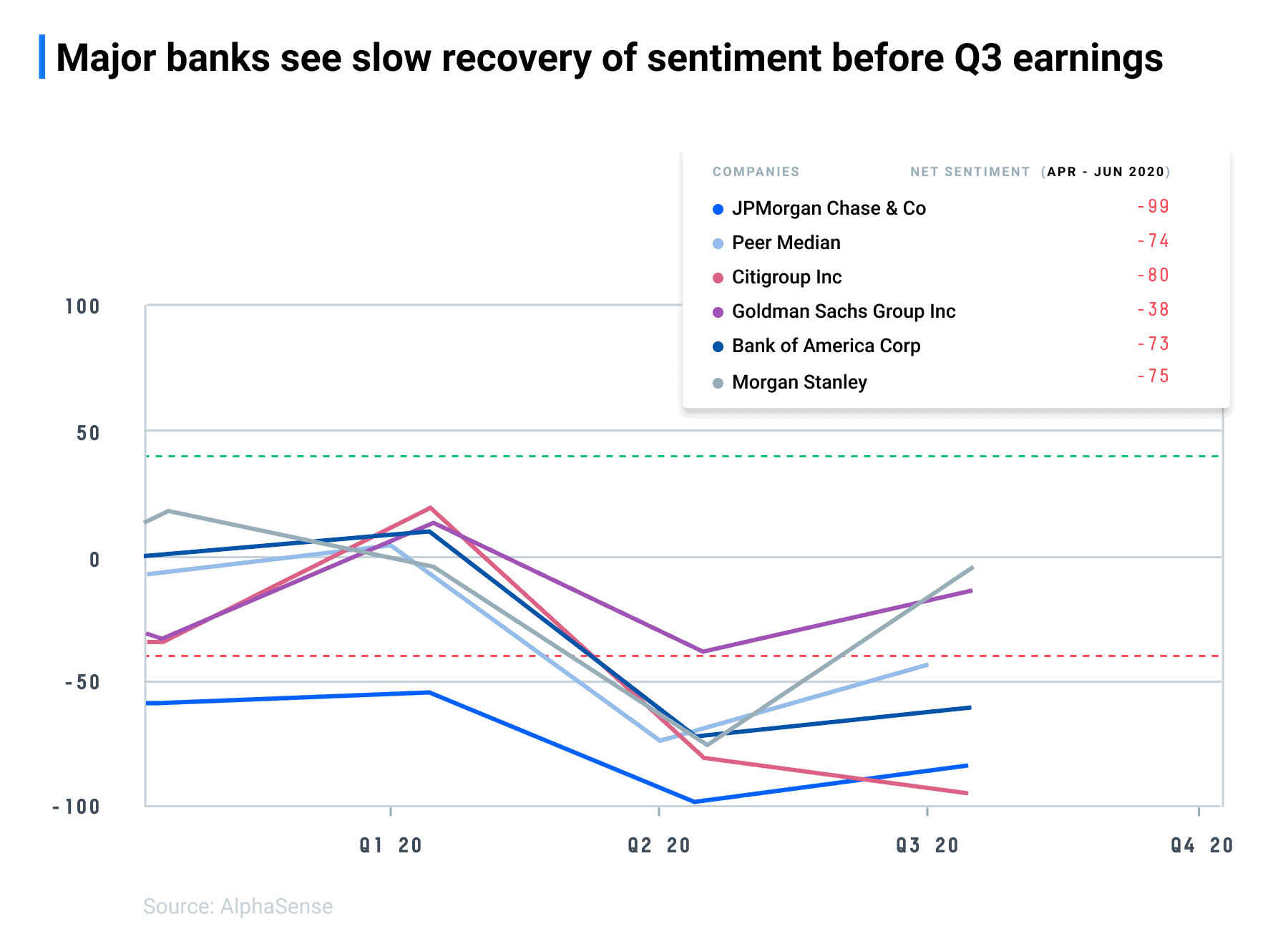

After Q2 earnings, most big banks saw a dropoff in positive sentiment,; they are slowly rebounding after financial conferences in September and anticipated Q3 earnings. This chart does not reflect Q3 earnings. | Sentiment analysis for JPMorgan Chase, Citigroup, Goldman Sachs, BoA, and Morgan Stanley vs. Peer Median

What were the major trends in executive commentary last quarter? And what assumptions can we make about their Q3 earnings? We’ve compiled highlights from last quarter’s earnings, including major themes, executive commentary, and ungated document links to help you prepare for this week’s big bank earnings.

Major Banks Earnings This Week:

- October 13th: JPMorgan Chase & Co (Before market open)

- October 13th: Citigroup Inc (Before market open)

- October 13th: Charles Schwab (Before market open)

- October 14th: Bank of America (Before market open)

- October 14th: Wells Fargo & Co (Before market open)

- October 14th: PNC Financial Services Group (Before market open)

- October 14th: Goldman Sachs Group Inc (Before market open)

- October 15th: Morgan Stanley (Before market open)

Takeaways:

- In September, financial service companies gathered at Barclays Global Financials conference. There, Bank of America CEO Brian Moynihan said he expects to see net interest income drop by $600 million or $700 million in the third quarter. Moynihan said the reserve build would be “very modest,” if anything at all.

- At the Barclays Global Financials conference, JPMorgan Chase CFO Jennifer Piepszak revised the bank’s net interest income down from $56 billion to $55 billion for the year. Piepszak said she expects to see “near zero” in terms of a reserve build for JPMorgan.

- JPMorgan Chase and Bank of America are expected to report $2.06 and $0.44 in earnings per share, topping the two banks’ quarterly profits from earlier this year.

AlphaSense can track management commentary in real-time across the entire market, by industry, or watchlist. Start your free trial of AlphaSense now or login to your account.

PNC Financial Services Group

Credit & credit extension

William Demchak (Chairman, President, & CEO): “If you looked at the base case we put forward in the second quarter for where the economy will go, it’s pretty similar to what other people are doing. I think what was different was our expectation on credit, and not because of what we have on our balance sheet. If you look at metrics on what we have exposed to COVID sectors or what we have in criticized classified or growth in criticized classified, I mean, everything is — we actually stand out to the good side on that versus peers and things have been behaving well. Having said all that, we look where we are today, data has been better than what we would have had in our economic forecast.” (Barclays Global Financials NY Conference – Virtual | September 15, 2020)

Loan Growth: William Demchak (Chairman, President, & CEO): On loan growth, H.8 has been weak, and we can talk about that a little bit. And it’s been weak, not just because of the bond market and people basically refinancing out at cheap rates in public markets, but also because utilizations are down as business activity is lower, and we’re impacted by that as well. But we benefit on an ongoing basis from kind of our specialty lending areas, which we have an outsized capacity, I think, versus our peers.”

Answer – William S. Demchak: Yes. So I think we said in the second quarter here that when we gave second quarter guidance that we’d see loan growth down kind of 1% or so, I think we’re going to see it closer down to 4% or 5%, correct me, Rob, if I go wrong here, but — and NII dropping as a result of that. Having said that, fee income has surprised us to the upside. So we had fee income dropping quarter-to-quarter. And in fact, we’ll see that grow. So it’s — call it a push, but fee income taking up some of the slack we’re seeing in loan growth expectations.

Answer – Robert Q. Reilly: Yes. Just to clarify that, Bill, so Jason, our guidance was loan growth down low single digits than it’s likely to be, as Bill mentioned, down mid-single digits. So a little bit less than what we thought. And then on net interest income, we had said down 1%, and we’ll probably be down a little bit more than that, in line with that lower loan growth.

(Barclays Global Financials NY Conference – Virtual | September 15, 2020)

JPMorgan Chase & Co

Stimulus & recovery:

Answer – Jennifer A. Piepszak: Sure. So Mike, as we close the books for the first quarter, just to give it context, we were looking at an economic outlook that had GDP down 25% in the second quarter and unemployment above 10%. It’s just important to note that, that kind of gives you a frame of how to think about it, but there’s a lot more that goes into our reserving, including management judgment of some like world-class risk management and finance people and also other analytics. And so that just kind of gives you a frame of reference.

But there, we did think about a number of other scenarios that we should contemplate in reserving. And we also thought about the impact, what’s our best estimate of the impact of these extraordinary government programs as well as our own payment relief programs.

Since then, as I noted in my prepared remarks, our economists have updated their outlook and now have GDP down 40% in the second quarter and unemployment at 20%. That’s obviously materially different. Both scenarios, though, do include a recovery in the back half of the year.

Wells Fargo & Co

Balance sheet, NII and net interest margins stabilizing

Question – Jason Michael Goldberg: Okay. And I guess more near term, I think one of the bigger questions we get is just around net interest income. You kind of talked to a $41 billion to $42 billion NII guide for this year. Maybe given where we are now in the quarter, are you still comfortable with that? And maybe just talk to where you see NII and net interest margin stabilizing. And just what are you doing with the balance sheet in case this — as it looks like this prolonged low interest rate environment is going to continue?

Answer – John Richard Shrewsberry: Yes. So it will likely be a little bit worse than that this year. I’d say loan growth has been a little weaker than previously imagined. And prepayment premium amortization and mortgage securities has been a little bit stronger as a result of this sustained rally. So call it, $40.5 billion, something like that, is probably a reasonable estimate for the year on net interest income.

The — so we’re awash in liquidity like everybody else. And in a relatively low loan demand environment, the opportunity to redeploy that in securities isn’t compelling. We’re doing it by reinvesting mostly in mortgage-related securities as coupons move lower and lower. It’s still a big pickup, and we think an appropriate pickup over treasuries or agencies. And those are the only markets that have the size that we operate in. (Wells Fargo & Co at Barclays Global Financials New York Conference | September 14th, 2020)

Loan growth

Question – Jason Michael Goldberg: You kind of cited loan growth being a touch worse than expected. Maybe just delve into that a bit. I think expectations were for obviously loan growth to be challenged in the back half of the year. It sounds like it will be a touch worse than you initially thought. Is that coming from more on the commercial side? The consumer side? And maybe just maybe talk a bit more into that.

Answer – John Richard Shrewsberry: Yes. For us, it’s more on the commercial side. There’s so much liquidity. Bond markets are wide open. The — our customers, large- and medium-sized customers, are using the bond market to finance themselves. So we’re seeing line utilization at a lower percentage level than it has been recently. The demand for new credit, at least at this point in the cycle, is not particularly robust. And then people are refinancing out into securities.

Credit

On the consumer side, it’s a great time for mortgage, but we’re getting lower and lower in coupon, but jumbo mortgage production is strong. Autos are — have picked up certainly from where they were at the beginning of Q2. But I think we’re all being cautious about the size of the credit spectrum that we’re attacking at this point in the cycle in auto, but it is delivering. And in credit card, lower — credit card spending is lower. So credit card receivable generation is now happening at the very high level. And those are mostly the big categories.

Citigroup Inc

On Uncertainty

We don’t know and — where this will go, but our gut or how we’re thinking about this is this recovery is going to be uneven. I would say that, as a team, we’ve pretty well discounted a uniform v-shaped recovery. The question is it U-shaped, is it W-shaped or parts of it L-shaped. And I think we want to retain a lot of flexibility and capacity to be able to step into the situations that count.

I mean, yes, what I said was that if you take the cards portfolio we have today, which is of a better quality than it was back in ’08, and you would destress it for the ’08 financial crisis that, yes, our pro forma loss rates would be 25% to 30% lower than what we experienced in the last crisis.

I think we’re expected to be there for our clients in a period like this. And you’ve seen our CET1 ratio drop to 11.2% this quarter. And as the needs of our clients evolve, we’re going to be there for them and if that means that our ratio takes more pressure, then we’ll manage through that. If we were to drop below the 10% you referenced, there’s still plenty of room between that and the use of the buffer that the regulators have authorized.

On Guidance

With that said, given the adverse impact of COVID-19, we no longer expect to deliver the RoTCE of 12% to 13% for the full year. Based on what we are seeing today, on the top line, we expect the revenue trend in the latter part of March and the beginning of April, characterized by COVID-related lower level of activity, particularly in banking and our consumer franchise, will continue through much of the second quarter. And in our Markets business, revenue should reflect the broader industry. The first quarter is typically the strongest quarter. And clearly, this year was particularly strong, so we would expect some normalization in activity levels here. And finally, we will see the more pronounced impact of the lower rate environment on the top line.

Looking ahead to the second quarter and the remainder of 2020, we do expect a higher level of losses given our current outlook. And as our outlook continues to evolve, it is also reasonable to expect additional increases in credit reserves if our outlook deteriorates further. However, given the credit quality of our portfolio, we remain confident in our ability to maintain our overall strength and stability as well as continue to support our customers and win new business. Undoubtedly, every company around the world will feel an economic impact from this unprecedented situation, but we are confident that Citi will emerge in a position of strength, having demonstrated that we lived up to our stated objective to be an indisputably strong and stable institution and having shown that we stood by our clients and supported our customers and employees ring this very difficult time.

Bank of America

On consumer spending

So when we weighted a scenario that produced clearly a recessionary outlook, which included a significant drop in GDP in the second quarter with negative GDP growth rates extending well into 2021, we also considered the impact of various groups of credits and stressed industries. And while small relative to the impact of scenario weighting, we incrementally factored that analysis into the sizing of our reserve build.

Obviously, there are many unknowns, including how government, fiscal and monetary actions will impact the outcome, but we can try to consider that as well. And we also had to consider how our own deferral programs will impact losses. But perhaps the biggest unknown is how long economic activities and conditions will be significantly impacted by the virus.

Morgan Stanley

On Q1 and Q2:

Now we didn’t have a full quarter of being in absolute crisis, we had a half quarter or 2/3 of a quarter being absolute crisis, but boy, it was an absolute crisis. And for this fund, we have come through that and generate $9.5 billion in revenue, and that’s net of the deferred compensation plans, which actually puts us a bit over $10 billion in revenue, effectively flat to a year ago. I thought was remarkable.

Now maybe it’s my job to think that’s remarkable. But I did think it was remarkable. I think the stability and breadth of the franchise, the diversification clearly showed that we have an underlying sort of backstop of our performance. I can’t tell you it’s 10% ROTCE. I know coming into the second quarter, we’ll have less market volume, we have lower interest rates, we have lower asset prices at the moment, although we reprice our assets every month, we’ll probably have lower non-comp expenses. I suspect, in the second quarter for a variety of reasons, there will be a lot of things going back and forth.

So is 10% a bottom? I don’t want to call that now because I just don’t know how deep this recession is going to be. But given what we went through to have produced that felt like a really resilient franchise.

AlphaSense can track management commentary in real-time across the entire market, by industry, or watchlist. Start your free trial of AlphaSense now or login to your account.