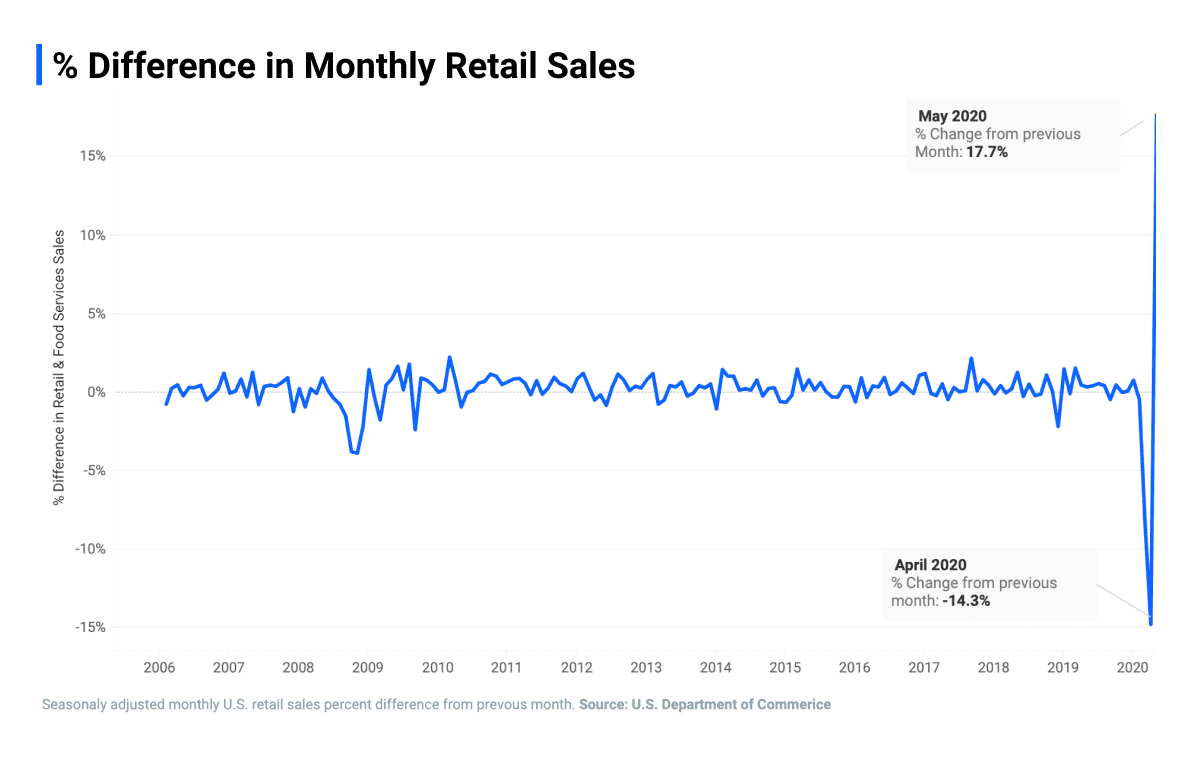

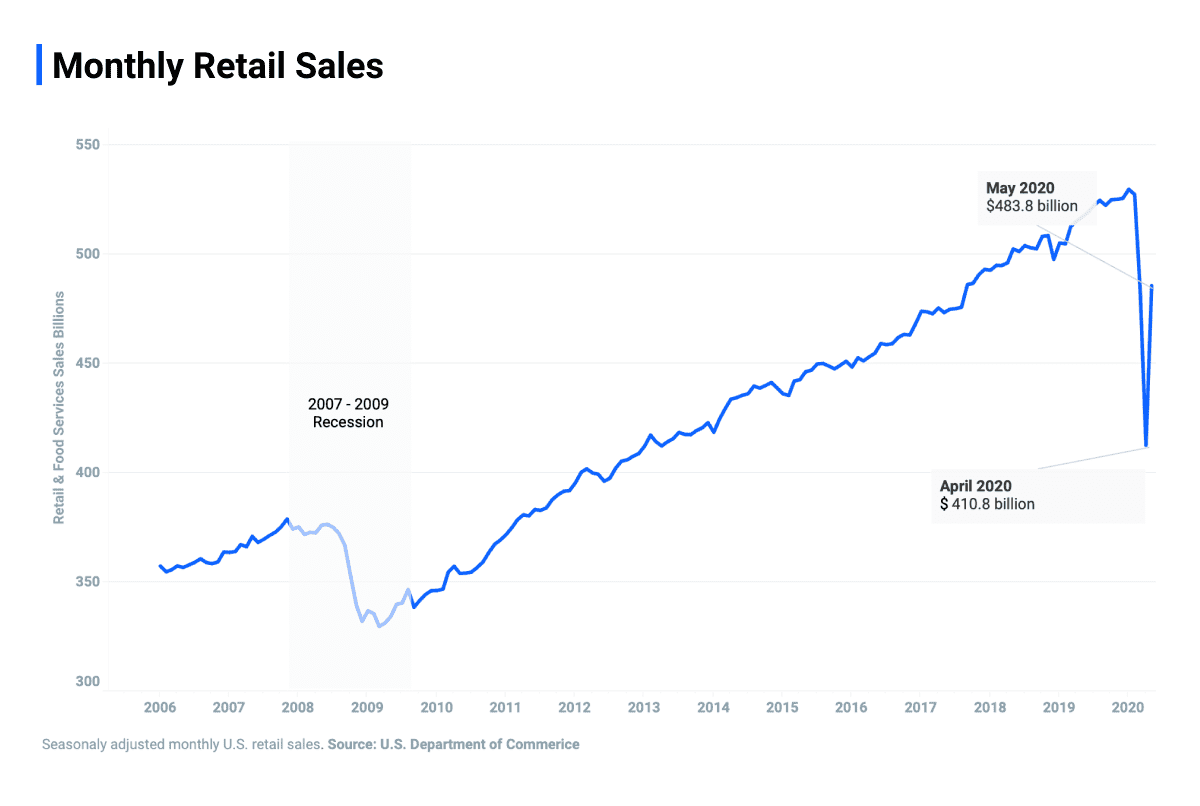

A trifecta of pent-up demand, warm weather, and stimulus money contributed to the record surge. In the span of weeks, retailers have had to readjust their strategy and operations to accommodate capacity restrictions and new modes of shopping like curbside pickup. While the increase is promising, companies preface these emerging trends with reminders that growth and sales have not returned to pre-COVID levels.

As stores reopen and sales pick-up, retailers outline the new roles of physical stores with an accelerated path towards driving digital adoption and using physical assets to improve the overall purchase experience. Bankruptcies filed by major retailers such as J.Crew, Neiman Marcus, and J.C. Penny cement this as an inflection point for retailers to evolve or die.

Takeaways:

- Retailers are accelerating digital strategy execution to help build better omni-channel experiences for consumers.

- New market share is up for grabs as small to major retailers file for bankruptcy across the U.S and consumers seek out new retailers to purchase goods from.

- 3-5 years of change has been condensed into a few months, and retailers who anticipated consumer preferences and habits are getting stronger, whereas those that waited are struggling to survive.

AlphaSense can track emerging trends in real-time across the entire market, by industry, or watchlist. We expect reopenings and retail sales to be an essential theme to follow as U.S. states reopen. Start your free trial of AlphaSense now or login to your account.

Ralph Lauren Corp, Evercore ISI Virtual Consumer & Retail Summit, 6/17

“I think that much like we’re going to see across the industry that you are going to see a weeding out of the weak and the strong. Now I think some of that will come retailer by retailer. We’ve seen, obviously, JCPenney’s new markets enter into Chapter 11. But I also think that department stores like Macy’s are going to focus on their stronger accounts. Their stronger doors tend to be our stronger doors. So it’s not — I don’t think that over time, it will be a bad thing. I think it will be healthy to put them in a better position from a door positioning standpoint. I think we feel like we got out ahead of, not all of it, but a majority of it when we cleaned up our own system in participation and cleaned up some points of sales 2 years ago. So a lot of that has been done in our system. Obviously, not all. We didn’t have a perfect crystal ball, but we feel pretty good from where we’re positioned now.”

Dollar General, Oppenheimer Consumer Growth & E-Commerce Conference, 6/17

Q: “Okay. And Todd, as you look at the retail landscape, so clearly, a lot of retail bankruptcies already is more likely coming. Any sense how the share opportunity could be different coming out of this crisis versus a financial crisis in 2008, 2009?”

A: “Yes. I think it will be different, right? It will be different on a couple of fronts. One is, you’re right, there are some unfortunate retail bankruptcies out there. There will be a lot of displaced customers looking for goods. We feel we’re well positioned in many cases. We’ve taken advantage of a lot of those to date. Think of Fred’s and some others that unfortunately went out of business over the last 12-or-so months. And we continue to watch that and continue to attract and hopefully retain those customers that are looking for a viable option. The one thing to keep in mind, though, that I think is really important is the consumer post-COVID is going to be looking for a place to shop that’s close to home that you don’t have to fight the crowds and has a great value convenience cross-section. And that’s almost in the definition, if you will, if not the definition of what Dollar General is.”

HanesBrands, Evercore ISI Virtual Consumer & Retail Summit, 6/15

“Yes. I think certainly, the door closures have been a headwind for us for several years from the standpoint of the transition, and we had certainly focused on building our online business from consumer direct and general, more stores in certain countries, particularly internationally and online in this country, including the brick-and-mortar dot-coms as well as the pure plays. It feels like — and you always say this, and you always wonder if this truly is the case, but it feels like this has been a good thing. It’s taken some of the questionable retailers and certainly, their stores, and it’s taken them out or adjusted them. So Sears was a couple of years ago, that one came off. And at a minimum, we’re going to see pennies come out of this thing with fewer doors and so forth. And as we look at the other department stores, my guess is that some of these doors are never reopened. But what we also see is that the dot-com sites of those brick-and-mortar department stores are increasingly representing a large portion of their total sales for our business. So I think our focus is insulated as heavily from the potential of future impact. So you never say never, but I would say that I think that I really do feel that the worst of it is behind us. And if there’s a good thing to come out of this pandemic is that it forced out some of the remaining bad doors and retailers that could have been a problem going forward.”

Childrens Place, Q1 2020 Earnings Call, 6/11

“Due to the pandemic, consumers all across America have been forced to shop online, many for the first time, with positive results. We anticipate that the lingering impact of COVID-19 will continue to accelerate the shift to digital, putting enormous pressure on the already stressed brick-and-mortar channel, resulting in accelerated store closures. Further exacerbating this issue are the forced bankruptcies of several weaker retailers that were unable to handle the demand shock to their balance sheets caused by the pandemic. Retail bankruptcies almost always come with outsized and accelerated store closures, or in many cases, full store liquidations. When you combine the accelerated shift to digital, which we believe will continue over the long term, with the large number of store closures anticipated to occur over the next few years, we believe that significant market share consolidation opportunities exist for retailers with stronger balance sheets, developed omni capabilities and recession-proof assortments.”

RH, Q1 Earnings Q&A Conference Call, 6/04

“But yes. I just think you’re going to see — the biggest fallout here is the — or the biggest change is the best brands and the best kind of retail businesses will be much stronger coming out of this. And the people that were weak, that were on the fringe, the people that don’t have a — I was talking to a very smart investor, one of the people — I think he’s one of the smartest people I know on the planet. And he said, look, people who don’t have a fully integrated multichannel business that’s frictionless for the customer are going to be gone by 2022, that this is going to accelerate that. It’s accelerating the weak retailers. Like Neiman Marcus was going to always go bankrupt. It’s just are they going to go bankrupt 2 years from now or 3 years from now or they just went bankrupt now, right? And the weaker businesses, it just accelerates. So it’s like a cleaning house. But history would tell you, every time there’s a cleaning house, there is like newness that comes. There’s new grass that grows. There’s new ideas that come to the market. There’s new things that evolve. And it’s different, but it’s usually just a lot better.”

Kirkland Inc, Q1 2020 Earnings Call, 6/04

“First, we took the opportunity to rightsize the company and make it nimbler than it’s ever been. That capability was on display very early on and in the pandemic when we were one of the first in the country to stand up contactless curbside pickup to great success. Second, we have less store-based competition. With the ongoing liquidation of Pier 1 and last week’s announcement of Tuesday Morning’s bankruptcy and the closing of 1/3 of their stores, we’re seeing a significant amount of our stores lose competition within their markets. Third, we entered the pandemic with strong trends in the stores and online, and those accelerated online while the stores were closed, and the trends have returned in both channels since the stores begun reopening. Fourth, our online business is being fueled by margin-friendly promotion and first-time shoppers. Collectively, these 4 factors have had a positive effect on our results to date in the second quarter.”

American Eagle Outfitters, Q1 2020 Earnings Call, 6/03

“Our third near-term priority is preparing for a new future. This event has clearly accelerated the disruption that has been underway in the retail industry. Bankruptcies and some store closures will continue, which we see as an opportunity to gain share. We’ll use this event as an inflection point to charter new and more profitable course for the company.”

Burlington Stores, Q1 2020 Earnings Call, 5/29

“There’s one other point to keep in mind when comparing our current situation with 2008, 2009, I think the pivotal moment in the financial crisis was really when Lehman Brothers declared bankruptcy in 2008, after that, the economy and retail sales began to fall apart. The third and fourth quarters of 2008, as I recall, were very difficult for all retailers, including off-price. And the spring of 2009 wasn’t great either. It wasn’t until the back half of 2009. So a whole year later that the off-price retailers really started to post very strong high single-digit, even low double-digit comp store sales growth numbers. And from that point onwards really began to take market share. Now if you apply that same timing for the current situation, it takes us to late spring or even summer of 2021. So yes, I actually agree. I think it’s about a comparison. I think this could turn into a big opportunity for off-price. But one of the lessons from 2008 that I think is important is it could take some time before the opportunity really materializes.”

AutoZone, Q3 Earnings Call 2020, 5/26

“Then at the beginning of the third 4-week period, federal stimulus checks began to arrive and flow through the U.S. economy. We experienced a significant change in trend, moving from negative double-digit comps to a significantly positive comp almost immediately. To put this in perspective, in 2 days, from a Monday to a Wednesday, our retail sales increased by roughly 50%, 5 0 percent in 2 days, and we continue to experience extremely robust sales performance through the end of the quarter. Throughout this crisis, our DIY business has been substantially stronger than DIFM. Retail began rebounding sooner and reacted stronger than commercial when the stimulus money arrived. At the end of the quarter, our commercial business turned positive again but had not yet returned to double-digit growth like before the crisis.”