Workers have gained something surprisingly positive amid the economy’s recovery from the pandemic: increased wages.

In just the past two months alone, wages grew at a 7.4% annual pace. That is three times the typical yearly average. So while America is far from a worker’s utopia, we are starting to see the needle move in a more favorable direction, giving low-wage workers leverage and perks that had previously been reserved for white-collar employees.

But even as American workers rejoice in the newfound benefits of the post-pandemic job landscape, businesses, both small and large, have higher labor costs on their minds. Not to mention, “inflation” remains the ever-present elephant in the room.

Offsetting higher labor costs onto consumers

The demand for the consumer discretionary sector has returned to pre-pandemic levels. However, employees have been hesitant to come back to work, whether a company has increased wages or not.

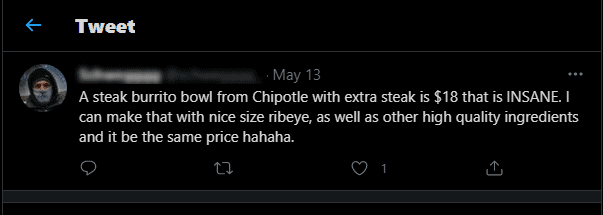

While the higher wages benefit workers, higher labor costs come with consequences for employers in the form of narrower profit margins and missed sales due to staffing shortages. In addition, a rise in wages tends to lead to higher costs put on the customer, contributing to the current surge of inflation. (We’ve seen the public lamentation over more expensive Chipotle burritos.)

We know that higher wages alone are not the cause of inflation. If workers are productive, companies can successfully increase pay without harming their bottom line or risking additional costs caused by rising inflation. At this point, it is far from clear if the workers being hired now will turn out to be more productive or not. However, the cost of labor is not like the cost of raw materials and other business supplies. Unlike commodity costs, wages rarely go down.

These factors may contribute to a potential pumping of the brakes on what is expected to be rapid economic growth in the second half of 2021.

Workers worry less as businesses worry more

Pandemic-fueled broadening of unemployment benefits has left a lot of workers feeling comfortable enough to be pickier about the jobs they are willing to accept. However, it’s no secret that recent decades have presented the American workforce with an exaggerated power imbalance between employers and employees.

And while wage workers are far from determining the price of labor via equal footing negotiations with employers, consumer discretionary companies feel the pressure to facilitate higher pay. Chipotle has been a company with the loudest presence in the media on this topic but are others joining in? We dove into the AlphaSense platform to get some answers.

We found several broker research documents pointing to two interesting points:

- The consensus is that the increase in wages and subsequent labor costs is a temporary trend, with no long-term margin dilution.

- There is a fear of increased labor costs corresponding to an increase in automation.

We also checked in on several companies across the consumer discretionary sector, most notably hotels, restaurants, leisure, and distributors, to see what they had to say.

Chipotle | RTT News

The restaurant chain said it plans to hike menu prices by about 4% to cover the cost of raising its workers’ wages.

Last month, Chipotle announced that it would increase worker pay to an average of $15 an hour by the end of June. Chipotle also introduced a $200 employee referral bonus for crew members and a $750 referral bonus for Apprentices or General Managers.

MasterCraft Boat Holdings, Inc. | Form 10-Q Quarterly Report

Gross profit increased $24.8 million, or 36.5 percent, to $92.7 million compared to $67.9 million for the prior-year period. The increase was primarily a result of lower dealer incentives, higher unit volume, higher prices, favorable options mix, and higher parts sales volume. These increases were partially offset by higher labor costs for each reportable segment and higher incentive compensation costs and costs associated with the transition of Aviara to our Merritt Island facility. In addition, we expect to realize higher labor costs for the full fiscal year due to changes implemented in the first quarter of fiscal 2021 to our production employee compensation packages.

Nathan’s Famous Inc. | Form 10-K Annual Report

The COVID-19 pandemic has caused additional changes as companies struggle to find and hire workers as states begin to ease restrictions. As demand for new hires increases, the competition for these employees could require the payment of higher wages that could result in higher labor costs.

The reduction in margin was primarily due to higher premium restaurant costs associated with new menu offerings and higher labor costs associated with higher minimum hourly rates of pay at two of our Company-owned restaurants.

The Container Store Group Inc. | Form 10-K Annual Report

Organized labor activities could cause labor relation issues and higher labor costs.

Voxx International Corp | Form 10-K Annual Report

Margins were negatively affected further during the year ended February 29, 2020, by tariff increases. The confidence of the Company’s products is manufactured in China, while production of certain other products was relocated to other countries with higher labor costs.

Hall of Fame Resort and Entertainment Company | Form 10-K/A Annual Report

Because labor costs are and will continue to be a significant component of our operating expenses, higher labor costs could reduce our profitability. Higher labor costs could result from, among other things, labor shortages that require us to raise labor rates to attract employees and increases in minimum wage rates. Higher employee health insurance costs could also adversely affect our profitability. Additionally, increased labor costs, labor shortages, or labor disruptions by employees of our third-party contractors and subcontractors could disrupt our operations, increase our costs and affect our profitability.

Lear Corp | Form 10-Q Quarterly Report

Although industry production has improved relative to 2020, production remains below recent historical levels. As a result, it is likely that, for some time, the global automotive industry will continue to be impacted by the COVID-19 pandemic, mainly through supply shortages, ongoing costs related to personal protective equipment, and higher labor costs reflecting an increase in absenteeism.

Coupang Inc. | Form 10-Q Quarterly Report

When we overstock products, we may be required to take significant inventory markdowns or write-offs and incur commitment costs, resulting in lower margins and higher labor costs as a percentage of sales, which would harm our financial performance.

Fat Brands Inc. | Series B Stock Prospectus

An increase in the costs of employee wages, benefits, and insurance (including workers’ compensation, general liability, property, and health) could result from government imposition of higher minimum wages or general economic or competitive conditions. In addition, competition for qualified employees could compel our franchisees to pay higher wages to attract or retain key crew members, resulting in higher labor costs and decreased profitability.

Track other trends are happening in real-time across the consumer discretionary sector. Request a free trial to AlphaSense and access data from over 10,000 content sources. Sign up here.