Trade topics are dominating headlines recently. While a certain number of these topics, such as the US relationship with China, might be too opaque for now, investors and analysts can gather interesting intel about the tariffs that are already in place, mainly steel tariffs.

The Trump administration initiated the first round of steel tariffs in early March. After this, a volatile discussion ensued about who can or should be exempt and how other countries will respond. Soon, it was clear that tariffs are going to impact many key global economies. For example:

- Canada, the EU, and China are not able to negotiate with the Trump administration.

- According to Reuters, South Korea or Australia could benefit because of exemptions.

To understand who will benefit or not from these policies, I use AlphaSense. It’s an efficient way to double-check a macro thesis or to check the micro-level impact on individual companies.

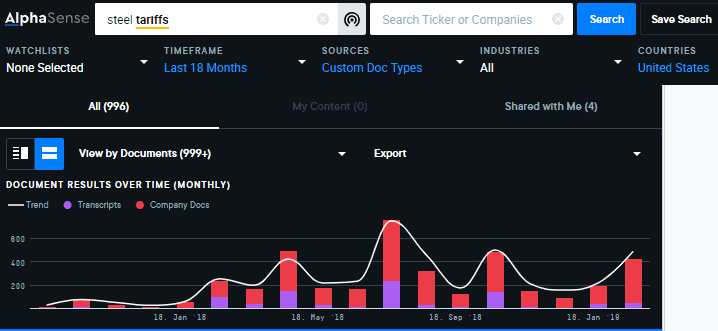

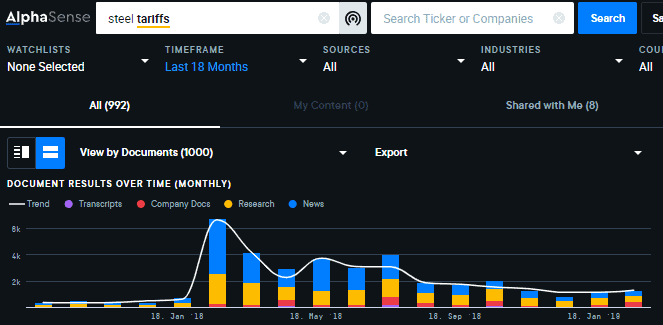

To see a high level trend chart of the number of mentions of “steel tariffs” across global company filings, company presentations, call transcripts, industry reports, etc. I first run a keyword search in AlphaSense for steel tariffs.

To refine my results, I’ll narrow by geography because I’m looking exclusively at U.S. based companies.

I’ll also refine by type of filing, since I am primarily interested in conference call transcripts and press releases, which provide a slightly more granular discussion than the regular 10Qs and 10Ks.

While it is clear that steel producers such as U.S. Steel or Timken are going to become beneficiaries (both have voiced positive comments about the tariffs), the rest of the players could face an uncertain future according to several mentions.

The most concerns were voiced by oil & gas companies that use steel in the construction of wells and pipelines. C&J Energy Services was one such example. According to Forbes, one quarter of steel pipe and tube purchased by U.S. companies was imported, meaning the effect could be pronounced.

American Railcar Industries, a large manufacturer of hopper and tank railcars, also mentioned its raw materials costs already went up, and the company is looking to adjust its supply chain. LCI Industries, an RV parts manufacturer, mentioned similar points and a concern about margin pressure.

Interestingly, there could be unforeseen negative impacts as well. A recent example is Brown-Forman, a liquor company (owner of Jack Daniel’s), which mentioned that it is likely to be impacted as Mexico has slapped retaliatory tariffs on American whiskey.

The Federal Reserve Districts also had their say on the tariffs. According to the New York Fed’s Liberty Street Economics blog, it is likely that the policy is going to destroy more jobs than it creates, citing historical examples. Chicago Fed surveyed the business owners of the area, who voiced similar opinions.

In the U.S., steel producers are likely to generate extra profits, however the steel tariffs will likely affect the oil & gas business, because they rely on imported steel. Other industries could also be impacted, because the countries affected by steel tariffs can retaliate. More generally, several companies and institutions have raised doubt about the overall positive effect of the tariffs on the U.S. economy.

Now, let’s dig into the reactions from companies outside the U.S.

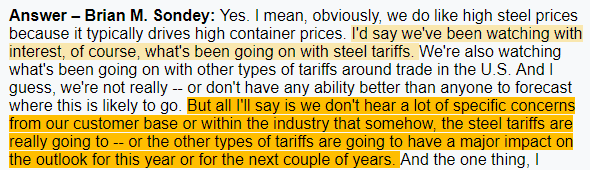

Using the AlphaSense PDF summary feature, I can quickly pinpoint several interesting comments, such as the following from Triton International, a global lessor of container ships.

Triton International was not alone in questioning how much of an impact the tariffs are going to have on the global economy. Seafarms, an Australian agri-company has also mentioned in their economic outlook that the impact on the global economy should not be outsized. They were joined by the ECB, which in one of its monetary policy updates, noted that the targeted products do not constitute a large part of the U.S. or world trade.

Other players noted that their impact should be limited due to domestically sourced products. This was the case with several companies, including Irish-based Johnson Controls International, a global manufacturer of automotive parts, electronic and HVAC equipment, as well as Sensata, a British electronic manufacturer or Honeywell Automation, which is listed in India.

Others like the Canadian Linamar Corp., the second-largest automobile parts manufacturer in the country, think they can pass the increased cost onto the customer.

Renold PLC, a British industrial manufacturer, could stand to benefit, because U.S. steel manufacturers could increase investment in their infrastructure. The same goes for Advanced Metallurgical Group, which notes that as the U.S. will increase its steel production, they will be able to increase its sales of vanadium, used in one of the steel alloys.

However, some companies could feel the pressure. ADF Group, a Canadian steel parts manufacturer, said it lost three new projects in the U.S. due to the recent developments.

Nippon Steel, a Japanese steel producer, ended their comments on a more relaxed note. In their recent investor presentation, they mentioned that the price volatility could weaken and demand remain firm, because Chinese President Xi maintained he will lower tariffs and push to open the Chinese economy more, which could help the Asian players balance the impact.

Overall, it seems that the global players do not see immediate challenges stemming from the policy.

Conclusion

Despite the significant amount of discussion that the Trump administration caused by the tariffs, the actual impact of the policy might be less severe for companies outside of the country due to various factors, such as supply chains or overall size of the U.S. steel trade.

Tariffs are a complex topic, but with AlphaSense, I reduced my initial research from hours to just minutes. By searching with just two keywords, I identified players that might have large exposure to the policy, and I’m able to stay on top of what’s happening through my AlphaSense saved search alerts.