Automation–the use of equipment to automate systems or production processes within manufacturing—kept the world’s top manufacturers producing at the height of the COVID-19 pandemic. In 2020, when our world had yet not conceived the Pfizer and Moderna vaccines, essential workers faced the possibility of contracting the virus while on the job. It left employers questioning how they could mitigate the risk of potentially infecting employees while safely fulfilling the demands of their role. The solution required robots—workers who did not need oxygen to complete their work and, therefore, could not spread COVID-19.

But as our understanding of how we can protect ourselves from COVID-19 has evolved, society has become increasingly comfortable with the idea of returning to physical workspaces. With the desire to return to in-person work continuing to grow, there’s speculation that automation has, and will continue, to fill the jobs that once required on-site employees.

While robotic implementation is skyrocketing, with more than half of manufacturers reporting that they now have ten or more robots in operation, workers can rest assured that their jobs are safe for the time being.

Global Automation Flourishes Across Multiple Sectors

In a Veobot report that surveyed 500 manufacturers in the US, UK, and Japan, 57% of those surveyed said that their use of robots is “not [to] replace human workers in their facilities but rather working alongside humans to supplement their work.” Implementing robots to perform the mundane, repetitive tasks of the manufacturing process allows human workers to focus on more thoughtful work, ranging from interfacing with customers to managing robots.

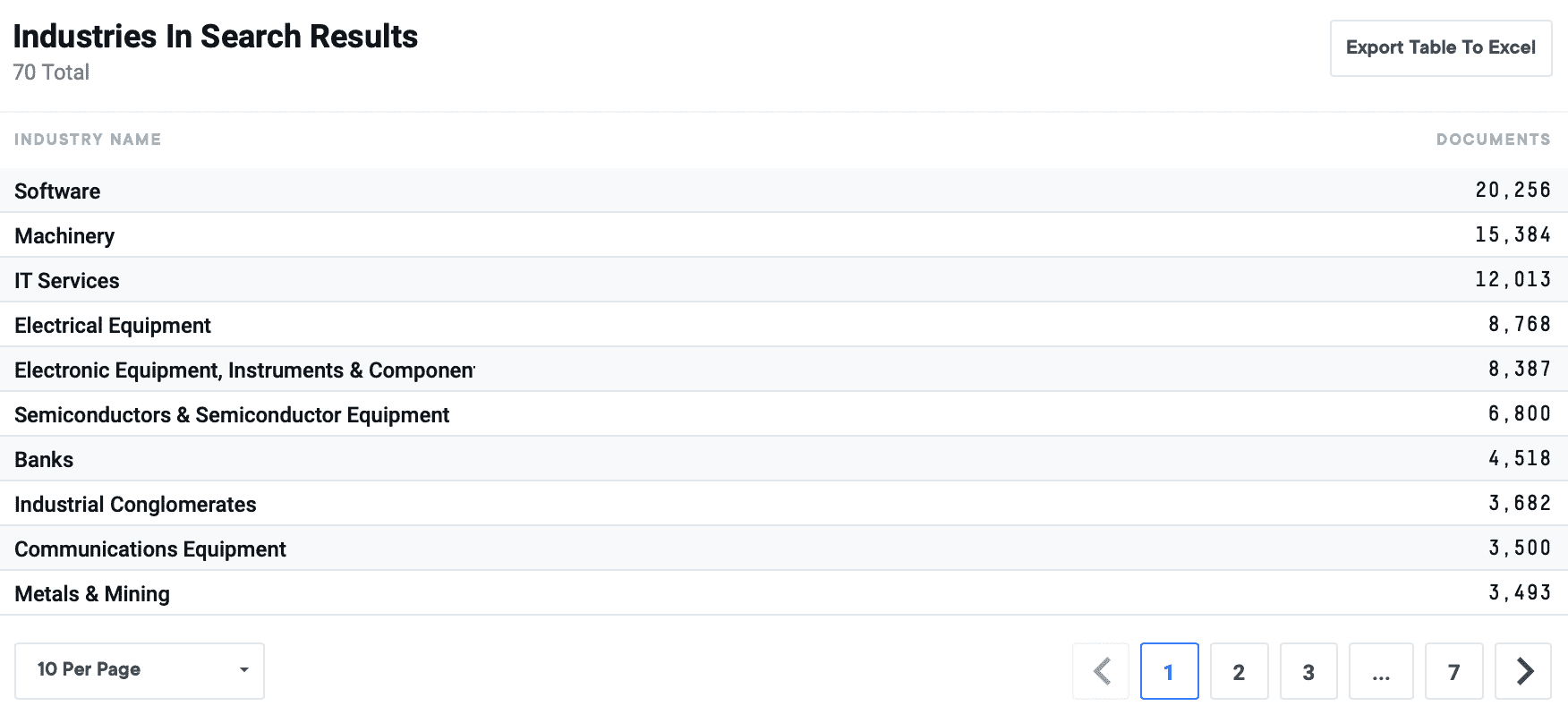

Moreso, automation has also allowed manufacturers to keep up with increasing consumer demands, as 58% of businesses have seen an increase in fulfillment volume within the past year. A larger percentage of businesses (73%) have struggled to attract and retain employees, leaving 75% of light industrial companies feeling unprepared for the upcoming months. To combat labor and demand issues, the software, machinery, semiconductor, metals and mining, and electronic-engineering industries have broadly adopted automation processes and greatly benefited from their investments.

An inside look at the AlphaSense platform shows a growing number of sectors are producing documents mentioning automation and even further, are examining growth opportunities of their own.

Within AlphaSense, we noticed that these sectors are joining the growing conversation about automation. Below, we share why some of these sectors are investing in automation, how the adoption of automation has led to their corresponding market growth, and projections as to where this growth could go.

Software

Already, the software industry has seen substantial financial growth in its respective automation market – reaching a $33.54 billion evaluation in the first year of the pandemic. A few factors can be attributed to this activity:

- Increasing investment in digital transformation across all industries

- The adoption of new technologies like Industrial Internet of Things (IIoT) and Supervisory Control and Data Acquisition (SCADA)

- Demands from global businesses

Small- and medium-sized companies have grown a need for cloud-based services to easily oversee automation processes, which has driven new opportunities for automation software providers and consequently boosted revenue growth.

Based on broker documents within AlphaSense, software automation will continue to drive strong revenue growth across the sector, however, one of the biggest challenges for software automation is dealing with unstructured data. With the software sector projected to grow quicker than IT spending (9% vs 2.7% CAGR), competitors will find growth opportunities in conquering this data challenge.

Machinery

Fueled by the rebounding global economy, agricultural and construction equipment demand is growing fast. However, post-pandemic labor shortages have forced machinery manufacturers to invest in automation. With Industry 4.0 technology like additive manufacturing, artificial intelligence, augmented reality, automated guided vehicles (AGVs), collaborative robots, and digital twins, manufacturers have improved the output and quality of their products and increased the safety of their practices.

Market growth from 2021 left manufacturers optimistic about the future, leaving 80% of the Association of Equipment Manufacturer members to anticipate rising demand for agricultural and construction equipment over the next year. More than half of the members (65%) believe that the need for agricultural machinery will exceed normal demands, while 44% have similar beliefs about construction equipment.

Metals and Mining

The coronavirus pandemic severely impacted the mining industry, so automation players saw an opportunity to provide a solution to the declining sales businesses were experiencing. In 2021, the mining automation market size was valued at $4.6 million, and today, it is projected to expand at a compound annual growth rate (CAGR) of 7.3% from 2022 to 2030.

AI technology and tools like Internet of Things (IoT), which provides miners with the opportunity to manage developments with real-time analytics via visualization tools, has propelled the use of mining automation systems, effectively decreasing operating costs for mining companies and dramatically increasing production. Mining techniques will also play a large part in the growth of the mining automation market. While the underground mining segment generated most of the mining automation market revenue in 2021, surface mining will witness a significant growth rate in the coming years.

Semiconductor

Semiconductor manufacturing is considered one of the most complex processes due to variable demand, high levels of automation, and the need for sophisticated equipment. Despite these challenges, semiconductors are a vital industry in the global economy.

The Asian-Pacific automation market is projected to grow by 10.7% annually, with a market cap reaching $14.6 million over the next eleven years, driven mainly by the strong demands from the semiconductor industry., For semiconductor manufacturers, implementing automation tools allows suppliers to streamline material handling, storage and processes outside their clean rooms to maximize operations around the clock.

Electronic-Engineering

The implementation of electrical automation is developing into a global trend that has converged with numerous sectors, ranging from the software to the semiconductor sectors. With Europe in the forefront of technological advancement, the foreign market developed a need for electrical automation, accounting for 36.19% of the global demand in 2018.

Virtual retailers, like Amazon, are restructuring their warehouses to adapt electrical automation for more efficient logistics operations so as to remove potential human-errors made in production and eliminate revenue loss due to defective products.

Investing Further in Technology: Industrial Sensors

For the past ten years, companies have faced increasing levels of disruption due to quickly changing customer preferences and uncertainty around demand, rendering planning systems useless. That’s why manufacturers have prioritized investing in technology that ensures quick production lines that output quality products.

Industrial sensors are wireless technology that allows maintenance employees to monitor production lines and develop quality-assurance processes to decrease rework in defective products. In addition, they play an essential part in automation, ensuring that mechanical components are in their correct positioning and providing intel based on their findings. The capabilities of industrial sensors are extensive and can be applied to various sectors, like oil and gas, manufacturing, power generation, healthcare, etc. Forecasters project that the global industrial sensors market will experience a CAGR growth of 9.1% in the next five years.

Interested in analyzing transportation, defense, and CapEx trends one year into a new presidency and ongoing COVID recovery? Explore our three-part expert briefing webcast series with Morgan Stanley, The New Normal: Planes, Supply Chains, and Industrial Innovations.