Powered by machine learning, Chinese innovators are finding new applications in fast-growing markets.

Most investors in the West have some benign, familiar images when it comes to central technologies like Artificial Intelligence (AI) and machine learning. Self-driving cars by Uber and Google make the evening news, and Facebook seems to have an ever-growing list of friends and article recommendations.

But some of the biggest gains and fastest-growing markets for machine learning and AI are thriving across the world – and largely under the radar. Driven by domestic security needs, Chinese video surveillance companies are heavily relying on and innovating in the AI and machine learning space. These AI-cameras are deployed to survey, photograph, and catalog both booming urban areas and dissident populations. And these advances are less-talked about for a reason: China is not eager to advertise the growing power and accuracy of its rapidly expanding surveillance state.

A booming market

The market for surveillance is expanding rapidly, and the demand is global. Research firm CLSA forecasts the global video surveillance market size to grow from $27 billion in 2018 to $53 billion by 2023 (a Cumulative Average Growth Rate of 14%). AI-powered cameras, meanwhile, will rise from 2% of the market to 19% in that time as cheaper, more powerful technology becomes available. Processor prices are expected to fall from $900 to $230 in that timeframe.

China is leading the pack, with a 45% market share for surveillance and the single largest market globally, according to analysts at Macquarie. They note the country’s innovation is leading the way in the AI era.

The AI prowess has been met with questionable applications. China’s ability and willingness to surveil dissident minorities, for example, has come under harsh criticism. The controversial ethical use and the growing power of Chinese surveillance technology prompted the US to create a blacklist in 2019. While it limited the number of components that US companies could export to Chinese companies, it did little to halt Chinese advances.

Now, investors see the global growth and Chinese technological edge as creating potential investment opportunities.

The key players and valuations

The leaders in the China AI surveillance industry include some publicly-traded (listed on the Shanghai stock exchange) companies and some multi-billion Unicorns with some very high-profile investors.

- Hikvision ($48 billion market cap): China’s largest surveillance company with a market share of 28%.

- Dahua: ($20 billion market cap): China’s second-largest company with a market share of 20%.

- SenseTime: ($7.5 billion market cap): Raised more than $3 billion from investors including Temasek Holdings, Alibaba, SoftBank Vision Fund, and Silver Lake Partners

- Megvi: ($4 billion market cap): Raised more than $1.3 billion including from e-commerce giant Alibaba, GGV Ventures, and sovereign wealth funds of Abu Dhabi and Kuwait

Investment Opportunities

The most accessible investment opportunities for the vast majority of investors are the two public companies: Hikvision (002415.SZ) and Dahua (002236.CN).

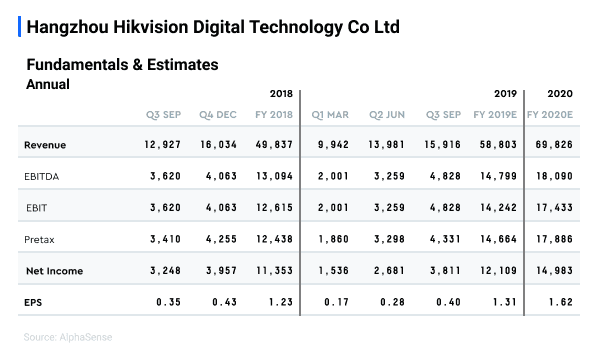

Hikvision is firing on all cylinders, with shares having rallied over 6% year to date. Shares are also not cheap. The company currently trades at 20 times 2020 analyst estimates.

Investor bullishness on the company’s AI-based business units and innovation are driving factors, analysts at UBS note. In 2019, the company’s AI and surveillance solutions were the fastest-growing of its portfolio and were expected to be the main driver of growth into 2020. AI-innovation and vertical expansion – finding new industries and applications for its AI-camera solutions – are crucial for the company’s prospects. Here, the company has a track record of demonstrating new solutions. For example, Hikvision is embedding AI algorithms with its AI- video, and thermometer solutions to prevent fires. The technology can identify early warning fire signals to detect fires before they occur, whereas traditional smoke sensors only offer an alert after fires start.

The investment in new technology and products, however, can take a toll on capital expenditures and earnings if it’s not managed aggressively, and investors keep a close eye on this dynamic. Trade wars and tariffs have also boosted input costs in the past. Shares are also subject to the volatility of the Chinese markets.

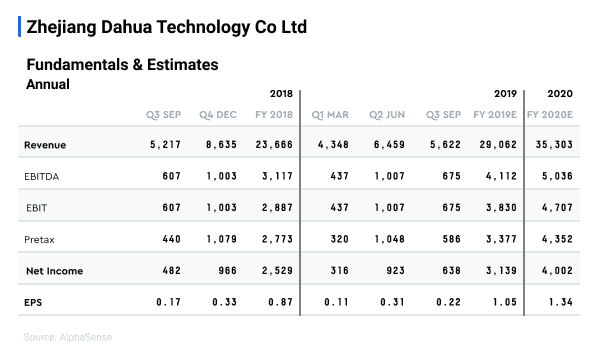

Dahua is amid retrenchment as management attempts to focus on new, higher-growth industries, analysts at UBS note. Shares reflect the uncertainty. The stock has traded off 7% year to date and currently trades at just 14 times 2020 analyst estimates.

Over 2019, Dahua decided to downgrade its exposure to the small enterprises because of the low margins and bad cash collection practices of the sector. Instead, the company is becoming increasingly aggressive in higher-growth verticals like Energy, Financials, and Transportation.

Management also wants to focus on overseas markets, which currently make up 35% of the company’s business. However, regulatory hurdles in developed markets have made growth challenging. The company’s end-demand stayed flat at 25% in the US and Western Europe through 2019. The company instead wants to focus on emerging markets such as Asia and Latin America.

AI product and application growth is also a central push for Dahua, analysts at Macquarie note. The company increased headcount by 500 in its AI-related business in 2019, focusing on facial and car plate recognition.

The increasing dominance of Hikvison in domestic markets – particularly with government entities – and its increasing scale is a mounting risk for investors in Dahua. The company also faces potential margin pressures from trade wars, and shares are subject to the volatility of Chinese markets.

Technology and Components

Faster and more powerful semiconductors are major drivers in advancing the utility of surveillance cameras and enabling enhanced AI-functionality.

The industry has traditionally used Graphics Processing Units (GPUs) from market leaders like Nvidia (NVDA) to power its applications, analysts at CLSA note. However, as the size of the markets expands, smaller, more agile upstarts like Hisilicon and Ambarella have started to design custom processors known as Systems-on-a-Chip (SoC) to tackle applications customized for video surveillance.

The use of Software-Defined-Cameras (SDCs) is also growing, as software updates allow for new uses and configurations of existing cameras without physical interaction. SDCs still face a variety of hurdles, however, as costs are high and communications network issues can lead to low reliability.

Analysts at Macquarie note that the technology trajectory of the surveillance industry makes it particularly ripe for disruption based on AI-based solutions at this juncture. And Chinese companies are leading the globe when it comes to implementing forward-thinking AI applications.

They note that the industry started based on analog technology and being dominated by international players such as Axis, Honeywell, Sony, and Panasonic. As digital technology took hold in all corners around 2010, surveillance products too upgraded from analog to digital. This allowed for greater standardization and made components more generic. This opened the door for local fast-followers like Hikvision and Dahua, with the Chinese government moving aggressively to court local players. As the surveillance sector boomed in China, local players used their clout to dominate supply chains.

This industry evolution has set the stage for what Macquarie analysts see as a fourth wave of evolution for the industry, where AI functionality comes to eclipse traditional surveillance demands like cost and reliability. And with end-to-end solutions now in their grasp, Chinese players are focusing heavily on new recognition applications.

These include cutting-edge features like emotional recognition, where AI-technology is touted to be powerful enough to predict a person’s mental state via facial recognition. Chinese authorities have said that deployment will reduce crime by being able to identify individuals in mental states for potentially criminal behavior. For example, current deployments at customs could identify signs of aggressiveness, nervousness, stress levels and a person’s potential to attack others.

The edge that Chinese surveillance technology companies have is so powerful that it is also shaping standards at the UN. This sets the stage for China to influence emerging countries that are increasingly reliant on surveillance tech as they grapple with domestic unrest, urban growth, and cost-efficiency considerations.

The Upshot

China has created a thriving technology ecosystem based on AI-powered surveillance. The landscape includes large, fast-growing and publicly-traded incumbents along with innovative startups that fetch meg-Unicorn valuations.

For investors in the West, the AI sector can be unsavory. Many of the applications of AI and Machine Learning technology have raised major ethical concerns.

But the technology edge of Chinese companies is very real – and so is the global market demand. The vast data that Chinese companies have amassed on facial recognition alone is key to powering machine learning algorithms and creates a self-reinforcing advantage. While China leads the world in surveillance, other fast-growing emerging economies are sources of booming global demand and are emulating many of Beijing’s creative applications.

As semiconductors and software grow even more powerful, investors should recognize the opportunity these companies represent in the years ahead.

Ethical considerations, though, also need to be evaluated as business risks.

The invasiveness of the surveillance capabilities is already causing a backlash – the European Union put a temporary ban on facial recognition in January, for example – and one that could grow.

The rapid rise of Environmental, Social and Governance (ESG) investing presents another major potential challenge. The assets controlled by investment vehicles attuned to both social and financial considerations are exploding. If ethical concerns mount, surveillance technology companies could find many investors turning away – even if they continue to deliver on the bottom line.

Interested in reading more AlphaSense content? Check out our Insights section, or learn more about AlphaSense through our whitepapers, webinars, and case studies.