After two volatile and unpredictable years for global markets, investors and economists were hopeful that 2022 would prove to be the year of recovery. All eyes have been on Asia, especially, as we look to China and other Asian countries who play a significant role in manufacturing and distribution around the world.

Like the rest of the world, Asia has experienced its fair share of ups and downs so far in 2022. And while it hasn’t been smooth sailing, there are indicators that Asia is on a positive economic trajectory.

Let’s dive further into the current state of Asian economies so far in 2022, what’s next on the horizon, and what investors should be paying attention to in the coming months and years.

Quick Takeaways

- Late surges and slower recoveries from the COVID-19 Omicron variant left many Asian economies lagging at the start of 2022.

- Supply chain issues continue to persist in Asia, particularly in China, where their radical zero-COVID policy has been a source of disruption.

- Consumer demand for nondurable products, largely manufactured in Asia, is expected to drop in 2022.

- China’s aging population and their increased demand for certain premium products should be a point of interest for investors.

- Asia’s (and China’s, specifically) focus on self-reliance and energy independence indicates that companies related to renewables will grow in the coming years.

- India is a top export market for the U.S., but distribution is difficult. Investors could find opportunities with companies that have strong distribution infrastructure in the area.

The Year of the Tiger: What’s Happened so Far in 2022

Omicron Gives Asia a Weak Start

A slower rebound from the COVID-19 Omicron variant in early 2022 set Asia behind on jumpstarting domestic economies and continuing their recovery from previous pandemic surges. While the US saw its Omicron peak in late January, countries like China, Vietnam, and South Korea all saw a continued rise in cases well into March and April.

With lockdowns and other safety measures in place throughout Asia, both domestic demand and production for international trade lagged.

Supply Chain Issues Persist

While Asian countries are now seeing cases fall and beginning a return to normalcy, supply chain issues persist. China in particular is hindered by their radical zero-COVID policy, denounced as irresponsible by the WHO. This policy continues to disrupt supply chains already stretched thin from increased global product demand during the pandemic.

Other Asian countries are taking note. Most recently, Japan has encouraged their companies to move production and distribution back home to avoid further disruptions and delays.

Global Product Demand Begins to Fall

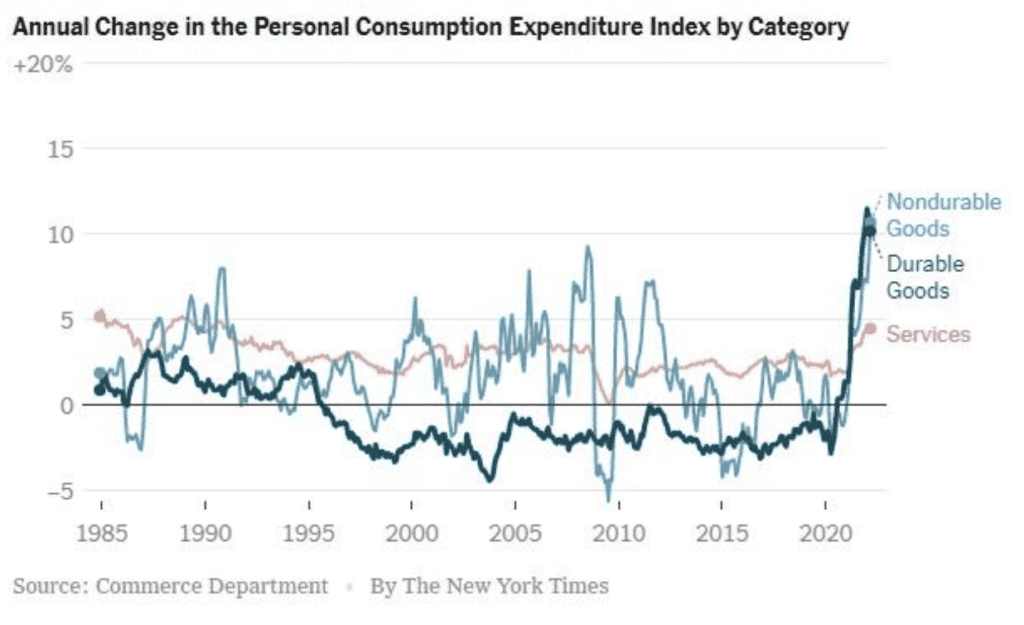

China may see some supply chain relief as product demand falls amidst the seeming tail end of the pandemic. As you can see below, American demand for nondurable goods (which are largely manufactured in Asia) jumped sharply in 2020 after the onset of the pandemic.

However, this peak is not sustainable. The general consensus is that we can expect to see a drop in demand for nondurable goods as people no longer stay at home and shift their demand back to services.

Image Source

A Look to the Future: Investment Trends to Note

Considering the economic outlook for Asia in 2022, what can investors expect in the coming years? How should they strategize? In a recent webinar co-hosted by AlphaSense, HSBC’s Head of Equity Strategy for Asia Pacific, Herald van der Linde, outlined three trends to watch.

China’s Aging Population

China’s decades-long policy of one child per household has resulted in an interesting demographic and economic situation heading into 2022. In short: China’s population is aging. As children born under this policy age and move out on their own, their parents are becoming empty nesters with extra income to spare.

This trend will continue for some time, and investors would be smart to pay attention to the types of businesses to which this aging population gives their demand. Herald van der Linde mentioned keeping an eye on home upgrades/construction, alcohol, and other premium, and high-margin products.

Asian Focus on Self Reliance

Driven largely by an increasingly antagonistic relationship between the U.S. and China, Asian countries are working to be as self-reliant as possible moving toward the future.

This is especially true as it relates to energy independence and renewables in particular. Solar is one area where China is gaining momentum. They’re also a leader in photovoltaic glass production. For investors looking to expand their portfolios in Asia, solar and renewables are two places to focus.

India’s Rural Consumers

India is one of the top trading partners for the U.S. (their 12th-largest export market in 2021) and demand for American goods there remains high. The challenge in India, however, is not demand. It’s distribution. As van der Linde outlined, most of the population is rural (72%).

Getting products to these consumers can be complex and is compounded by the country’s underdeveloped postal system. Investors, then, would be savvy to focus on companies with distribution infrastructure and a history of success.

For a deeper dive on The Year of the Tiger: The Economic Outlook for Asia in 2022, check out our recent webinar hosted in partnership with HSBC.