Once again, India is proving to be a rising “superpower” country in the global market, and is quickly gaining the potential to supersede China in the chain of command. But what’s causing this major shift in economic authority?

One reason is the rising diplomatic tension with the US, regulatory risks, economic uncertainty, and a long-standing battle to contain COVID-19 outbreaks in China.

But a major part of India’s ascension has to do with a series of events that have taken place over the past few years. India is a major player in the global IT and BPO services industry and a powerful manufacturing leader. Between 2021 and 2022, the country generated $157 billion in revenue with $106 billion coming from IT services alone. This staggering growth can be attributed to India’s population, which swelled so rapidly in recent years that India has surpassed China as the world’s most populous nation—reaching a population of 1.429 billion people last year.

And now, as investors pivot away from investing in China due to the aforementioned reasons, India’s private equity (PE) and venture capital (VC) markets are experiencing rapid growth—more than $60 billion in deal value has been unlocked each consecutive year since 2020. Now, experts are questioning what this means for India in the coming quarters of 2024.

Below, we dive into the events that led to this transfer of power between China and India, reveal the growth India’s PE and VC markets are experiencing, and tune into the conversations surrounding these series of events.

Semiconductor-Manufacturing Tension Brews

Over the past three years, China has experienced major headwinds that have compromised its ability to meet manufacturing needs, secure financial backing, and maintain diplomatic relationships with various nations. Tension most notably arose between the US and China in 2019 when the supply of TMSC’s semiconductors became subject to compromise due to Xi Jinping’s intent to reunify Taiwan with China. TSMC, located in a municipality of Taiwan, uses some of the most advanced technology today to yield roughly 90% of the microchips found in everything from mobile phones to the medical devices central to fighting the COVID-19 pandemic. Xi Jinping’s potential seizure of TSMC’s fabs would dismantle a global supply chain—namely the US military’s access to warfare firearms, but more importantly, impact global technological leadership.

This debacle led President Biden to devise a plan to get ahead of China in the semiconductor manufacturing race—a plan that’s caused a multi-hundred billion dollar conundrum. In July of 2022, Congress passed the China Competition Bill or “CHIPS-plus” package, which aimed to allocate $52 billion in funding to US companies producing computer chips and offered a tax credit for investment in chip manufacturing.

To further secure the US’s place in the race for semiconductor dominance, Biden signed an executive order this past August that narrowly prohibited certain US investments in sensitive Chinese technology and required government notification of funding in other tech sectors, including semiconductors and microelectronics. However, the consequences of these restrictions are extensive, as China is responsible for roughly 80% of global electronics manufacturing and constitutes a substantial market for semiconductor consumption.

India Emerges as Competitor

In the midst of the US-China-Taiwan debacle, India has greatly developed their manufacturing footprint, and more specifically, its domestic production of semiconductors. Having experienced a surge in infrastructure investment, India’s manufacturing market is poised to reach $1 trillion within the next two years, according to a report from Colliers.

The main driver of this financial expansion? India’s Foreign Direct Investment (FDI) accrued $17.51 billion between 2020 and 2021—a testament to increased confidence and interest from global investors. The credit for this financial achievement largely goes to the government’s “Make in India” campaign, aimed at bolstering domestic manufacturing, along with initiatives like the production-linked incentive (PLI) scheme. Likewise, the Bharatmala Pariyojana Project, the anticipated DESH Bill, and the National Logistics Policy have also fostered interest for India’s industrial market.

With the manufacturing sector currently contributing approximately 17% to the GDP, Collier projects this value to escalate to 21% within the next 6-7 years, underscoring India’s potential to fortify its standing in global supply chains and capture market share from China.

India’s Fast-Developing TMT and PE Markets

Who is the global leader of the technology market? According to the Australian Strategic Policy Institute, China is, as the communist country led 37 of 44 technology sectors tracked in a year-long project by the think tank. But a new contender for the position is emerging: India.

It’s already clear that India is a major player in the global IT and BPO services industry. Between 2021 and 2022, the country generated $157 billion in revenue with $106 billion coming from IT services alone. Experts project revenue for India’s IT Services market to reach $22.41bn by the end of 2023 and experience an annual growth rate (CAGR 2023-2028) of 13.97%, resulting in a market volume of $43.09 billion by 2028.

What sets up India apart from other countries and up for success is its legislative commitment to investing in national technology development. India’s government has launched several schemes to promote digital literacy, such as the Pradhan Mantri Gramin Digital Saksharta Abhiyan (PMGDISHA), which aims to make one person in every rural household digitally literate—an essential skill needed to thrive in an increasingly interconnected world. By fostering a robust digital infrastructure, these programs not only enhance accessibility but also promote transparency and efficiency in governance.

What makes India’s startup ecosystem also particularly remarkable is its ability to nurture and encourage innovation. This has been made possible, in part, by the government’s proactive approach. The Startup India program, for instance, has emerged as a cornerstone of this support system. Through this initiative, the government provides crucial resources such as funding, mentorship, and a conducive regulatory environment to fuel the growth of startups. In doing so, it has fostered an environment where entrepreneurialism flourishes and provides opportunity for home-grown talent.

A Burgeoning Private Equity and Venture Capital Market

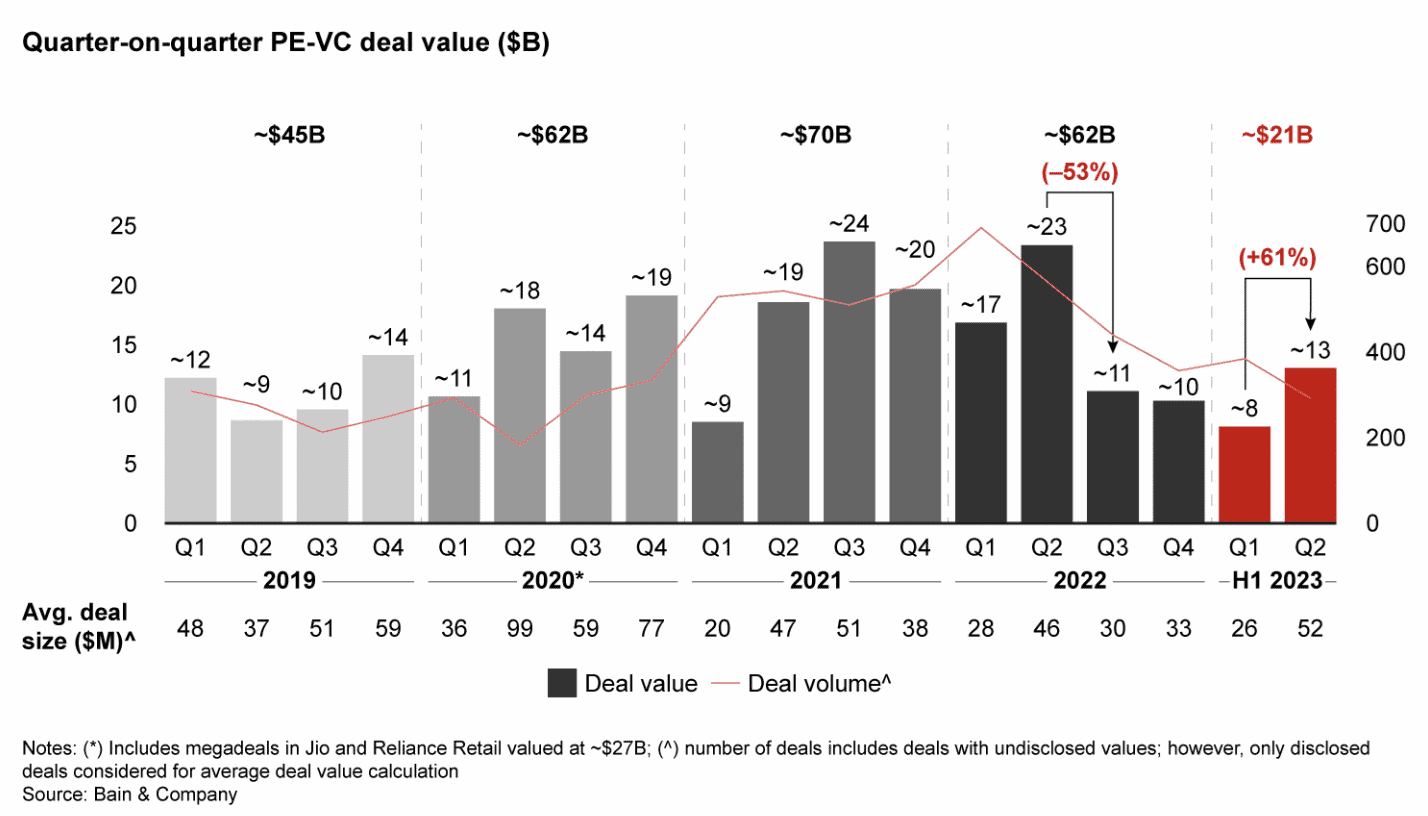

After enjoying a robust three-year period, India is witnessing a moderation in the enthusiastic activity of private equity-venture capital—reflecting a subdued sentiment prevailing across global markets. While India, in particular, experienced a notable decline in PE-VC investments, with $21 billion recorded in the first six months of 2023, compared to the $40 billion dealmaking witnessed during the same period the previous year, the past three years marked a remarkable ascent for India’s PE and VC ecosystem, according to Bain & Company.

It ushered in over $60 billion in deal value annually since 2020 and in 2021, buoyed by ample dry powder, low interest rates, and a fervent VC environment, allowing India to reach nearly $70 billion in PE-VC investments. However, the momentum faltered in 2022, with approximately $62 billion invested amidst geopolitical uncertainties, tighter monetary policies, and supply chain disruptions. But with Q1 2023 matching the levels seen in Q1 2019 at $21 billion, there’s a clear indication of a significant “reset” in the PE-VC landscape, signaling a return to pre-boom levels after the bumper run.

The bottom line: India’s private equity (PE) landscape remains robust, with PE activity expanding by approximately 10% compared to the second half of 2022, reaching $16.5 billion. This growth, representing around 80% of total investments, marks a gradual recovery of market share lost to venture capital (VC) and growth equity in 2021. However, VC and growth equity segments experienced a decline of approximately 25% in deal value during the first half of 2023 compared to the latter half of 2022, totaling approximately $5 billion. This contraction in VC deal volumes reflects ongoing portfolio assessments within the VC ecosystem, prompting a recalibration of investment strategies.

Conversations from industry leaders and experts:

“So the real story for us in Asia has been India. Our team there has really delivered, particularly in private equity, Amit Dixit and the team have delivered amongst our highest returns globally in India. And it’s represented, frankly in real estate and private equity, about half of our Asia activities.”

– Blackstone Inc. | Earnings Call Q2 2023

“There’s a lot of capital in India and outside India looking and is like the #1 emerging market for, I guess, public and private equity these days because China is gone off the M&G in terms of risk appetite. But there is a lot of money looking at India across the spectrum.”

– VEF AB | Earnings Call Q1 2023

“For that part, I believe Biden government’s new policy will slow down China export of high-technology products to speed the pace.”

– Competitor of Caterprillar Inc. | Expert Insights

“One thing to keep in mind, China has invested heavily in terms of R&D when it comes to the electronic industry and semiconductor industry. Of lately, I do see there a lot of research papers which proposes really good analog solutions. As far as the industry is concerned, I think it is still not there where, let’s say, any Chinese company is making a very high-performance analog. Also, that trust is actually lacking when it comes to the China market because of their past history, I believe.”

– Former Manager of Texas Instruments | Expert Insights

“As you know, private equity is a great opportunity in India, but it’s also a very competitive space. There are a lot of private equity funds.”

– Edelweiss Financial Services Limited | Q2 2023 Earnings Call

“There was continued softness in semiconductor and automotive markets and ongoing weakness in China. We continue to launch orders as a key indicator and still expect to turn in the second half on easier comps.”

– Emerson Electric Co | Q1 2024 Earnings Call

“You have a number of factories going in in Europe, are ramping up in Europe, and more probably to come, because European Union is probably going to try to invest in STMicro, probably in particular since it’s a local European company to try to get more control of its semiconductor supply chain and reduce the risk of the China, Taiwan supply chain situation.”

– Former Senior Director of ON Semiconductor Grp. | Expert Insights

Looking Ahead to the Future

Staying on top of industry news, diplomatic relations, and international power plays can be a full-time job—one that is crucial to remaining in the know and ahead of the competition. With AlphaSense, you can significantly cut your lead-time to find the answers you need and make faster, more informed decisions in anticipation of macro- and microeconomic events shaping your industry.

AlphaSense helps you cut through the noise and deliver meaningful insights from over 10,000 content sources including company reports, broker research, news sources, and expert interviews—effectively eliminating research blindspots.