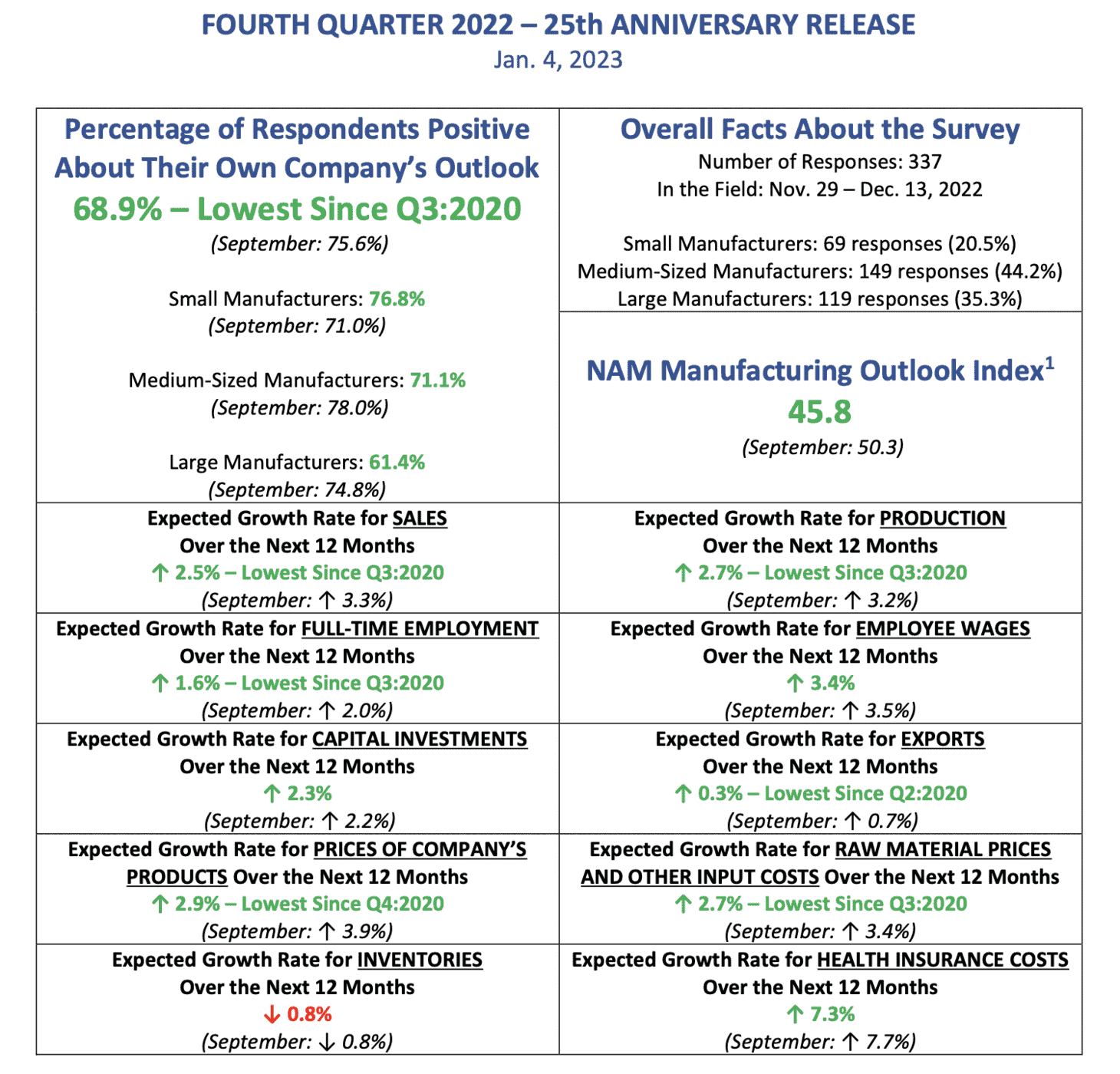

This past December, the National Association of Manufacturers released its 2022 Fourth Quarter Manufacturers’ Outlook Survey—a key report in fleshing out the challenges national manufacturers expect to face in future QoQs. Findings from NAM’s report were precarious: the percentage of respondents who had a positive outlook on their own company is at its lowest since Q3 of 2020 (68.9%, the combined average of small-, medium-, and large-manufacturers).

In fact, most of the data revealed a downward trend compared to percentages reported at the beginning of the COVID-19 pandemic. So what’s caused this loss of optimism amongst American manufacturers?

Caption: A statistical overview of NAM’s Outlook Survey Fourth Quarter 2022 – 25th Anniversary Release

According to NAM, “the sector ended 2022 with weaker conditions, both in the U.S. and globally. Manufacturers continue to report concerns about workforce shortages, inflationary pressures, and lingering supply chain bottlenecks, even with the latter showing improvement. This is on top of other economic and geopolitical uncertainties.” More importantly, 62.4% of manufacturing leaders believed the U.S. economy would officially fall into a recession in 2023.

As national manufacturers, investors, and supply chains reflect on the economic turbulence of last year, many are questioning what they can expect from 2023 and, more importantly, how they can overcome any anticipated and unexpected market challenges.

Using the AlphaSense platform, we dug into our extensive universe of content to learn more about the current and future obstacles manufacturers have to overcome, as well as their potential resolutions.

The Cost of Compliance

Since 1981, the federal government has issued at least one manufacturing-related regulation each week. Consequently, the industrial sector faces a staggering 297,696 federal regulations—compliance being contingent on a business’s ability to save (time, money, resources, etc.) wherever and whenever possible.

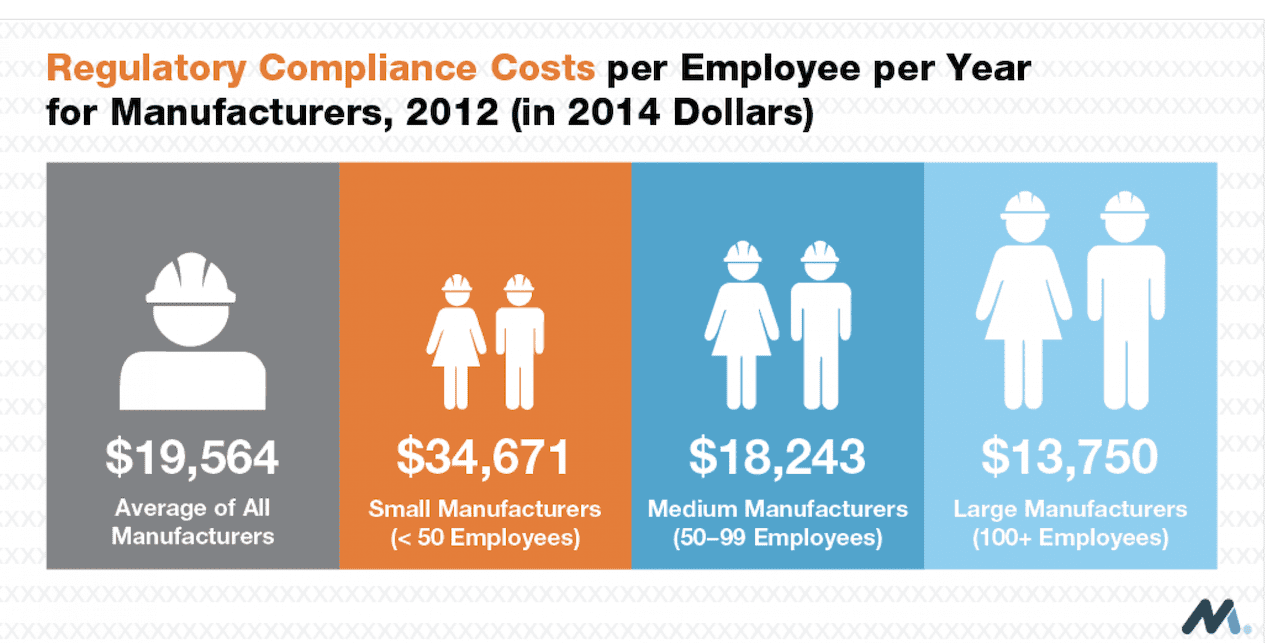

NAM issued a revealing report in 2014 about the fiscal and operational tolls federal regulations impose on manufacturers. More specifically, it divulges how small businesses and manufacturers bear a disproportionate share of the regulatory burden due to their compliance costs being unaffected by economies of scale.

Caption: Graphic sourced from the National Association of Manufacturers

Further, NAM found that U.S. companies pay $9,991 per employee annually to comply with federal regulations. The average manufacturer in the United States spends nearly double that amount—$19,564 per employee per year. Small manufacturers, or those with fewer than 50 employees, incur regulatory costs of $34,671 per employee per year—more than three times the cost borne by the average U.S. company. These numbers have only grown exponentially over the past decade.

Complying with federal regulations costs Americans $2.028 trillion in lost economic growth annually, or roughly 12% of the total gross domestic product that could be invested back into U.S. businesses, according to NAM. Consequently, these regulations are forcing manufacturers to spend more to produce.

“Government regulations related to the minimum energy efficiency standards have forced most of our competition to reengineer their equipment, causing them to use higher quality, higher priced components in their designs. As a result, the cost of manufacturing across our industry has gone up significantly more compared to our costs. This has resulted in substantially larger price increases of our competition compared to the price increases that we have initiated.”

– AAON, Inc. | Q4 2022 Earnings Call

According to NAM, the total regulatory costs ($138.6 billion) spent by manufacturers and small businesses was split between staff devoted to compliance ($94.8 million), capital equipment ($18.6 million), outside advisors ($12.1 million), operations and maintenance ($10.7 million) and federal compliance penalties ($2.4 million).

Macroeconomic Pain Points

Diminishing Workforces

Labor shortages have put pressure on manufacturers to fill jobs commonly done by humans. But globally, the market for workers with the needed or necessary skills is limited. NAM’s Q4 2022 report showed that survey participants expect the growth rate for full-time employment to rise 1.6% over the next 12 months—the lowest percentage of growth since Q3 of 2022.

According to Gartner, roughly half of the CEOs they surveyed agree that it is “very difficult to find and hire the right kind of people for our business,” leading to a potential skill gap that could result in more than two million unfilled US manufacturing jobs by 2030 reports the Manufacturing Institute.

Additionally, the European Union (EU) has relayed “shortages of high magnitude” for software and IT positions. The US Bureau of Labor Statistics also estimates that there will be more than 125,000 software engineering openings on average annually through 2030. The cost of those missing jobs could potentially total $1 trillion in 2030 alone.

“While a wide variety of industrial products are required in order to respond to diversifying customer demands and objectives, the labor shortage in the manufacturing industry has become serious, and it has become difficult to respond with conventional production methods dependent on individual employees.”

– Okuma Corp. | ARS

Lean labor markets have led manufacturing leaders to adopt automation—the use of equipment to automate systems or production processes within manufacturing. Automation kept the world’s top manufacturers producing at the height of the COVID-19 pandemic and will likely become more popular within the industry (last July, more than half of manufacturers reported they had ten or more operating robots).

Automation has also allowed manufacturers to keep up with increasing consumer demands, as 58% of businesses using automation have seen an increase in fulfillment volume within the past year (Veo Robotics). A larger percentage of businesses (73%) have struggled to attract and retain employees, leaving 75% of light industrial companies feeling unprepared for the upcoming months.

Supply Chain Issues

While supply chain disruptions have largely resolved in the early months of 2023, challenges remain. Twenty years ago, most manufacturers outsourced parts and electronics manufacturing, where small parts could be made more cheaply. However, quality control issues and rising wages overseas, as well as increased shipping times, have muddied the waters for manufacturers to plan accurate production schedules.

Manufacturers are left searching for supply-chain alternatives as the energy shortage across the EU becomes increasingly severe and ongoing COVID-19 outbreaks continue to plague China. These macroeconomic events have led The Harvard Business Review to proclaim that “far-flung global supply chains are probably over,” meaning manufacturers will begin to rely on local or regional sourcing and production models.

“We have faced down headwind from the COVID pandemic, a significant downturn in global production, a shortage of materials, and supply chain disruption. Our efficient and well-managed global sourcing and regional supply chain enable our team to deal with those challenges.”

– H.B. Fuller Company | Analyst/Investor Day

Establishing domestic supply chains starts with reshoring—a strategy that brings production and manufacturing “back home,” i.e. returning it to the country in which the company was first established. According to Deloitte, American manufacturers will reshore nearly 350,000 jobs in 2022—a 25% increase compared to the previous year.

Materials and Inflation

Manufacturing pain points like supply chain disruptions lead to materials shortages for many small- to medium-sized manufacturers. Although the severe shortages that plagued the early QoQs of the COVID-19 pandemic have begun to ease, shortages are still an issue for many industrial companies. And with material shortages or scarcity, manufacturers will have to pay premium prices.

Business leaders and economists unequivocally agree that inflation will continue to be an issue in 2023, but projections differ vastly regarding the duration and impact of higher prices for goods and services. To tackle unreliable material resources and inflated prices, leading manufacturing companies are adopting a design-to-cost (DTC) methodology.

DTC “addresses cost throughout the new product development process,” aPrior says. A recent report found that successfully implementing DTC can save 15%-40% in product development time and material costs.

“With design-to-cost, having a kind of inflation markup in our pricing and at the same time, as soon as the contract is signed, securing prices of long-term contracts, we see ourselves in a position to manage this kind of inflation to safeguard our profitability.”

– OC Oerlikon Corporation AG | Analyst/Investor Day

An Aging Workforce

The North American, European, and Japanese populations are among the most elderly, posing a significant hurdle for manufacturers in their search for ripe talent.

A recent study conducted by the Manufacturers Association revealed that 82% of recent retirees from the manufacturing sector cited age or health-related concerns as their primary reasons for departing the workforce.

For manufacturers, the current objective revolves around maintaining the appeal of working in the eyes of skilled workers, especially amidst a substantial exodus from the industry. However, to compensate, the adoption of digital transformation technologies, exoskeletons, augmented reality (AR)-based employee training, and collaborative robots will play a pivotal role in enhancing production output.

An aging workforce presents a combination of demographic and talent availability issues. Operational decision-makers at heavy equipment manufacturers are most negatively impacted by talent shortages. In terms of demographics, executives for automakers seem to be the most impacted.

The Future of Manufacturing

Navigating the obstacles manufacturers face this coming year and beyond requires a premium market intelligence platform. You need access to insights on how competitors are overcoming industry challenges, as well as research that forecasts market trends and movements. It’s the only way to take the lead in your respective sector. The key to navigating industry challenges amidst volatile markets is ensuring you mitigate the risk of blindspots in your research.

Learn how the four key perspectives can help prevent research blindspots and provide the confidence you need to take the lead. Download our infosheet, The Four Key Perspectives of Market Intelligence, to learn how to get a 360 degree view of any topic, industry, or market. .

AlphaSense’s AI-based smart search functionality, customizable alerts, intuitive user interface, and extensive library of content is an all-in-one market intelligence solution that can help your business succeed.

Sign up for your free trial of AlphaSense today.