Get ready folks. The metaverse is coming.

Virtual reality (VR) has long been a fixture in science fiction films and novels, a tool that blends both real and digital worlds. VR technology and computing power have grown leaps and bounds since its inception, creating demand not just for this space but for metaverse stocks.

The metaverse is ripe with the potential to be as big as the internet – or at least that’s the goal. Thus, metaverse stocks have cemented themselves on the radar of many investors over the past year. After all, the idea is for the metaverse to become an integral part of our lives in the coming years. At its core, it is meant to be a virtual reality that would function like the internet we’re used to, but one in which we could move through and participate with avatars.

According to JP Morgan, the metaverse represents a $1 trillion market. Though nobody can predict how much it will shake things up, many companies are already preparing for the metaverse era.

What is the Metaverse?

We’ve heard tech CEOs, like Mark Zuckerberg, talk about the metaverse as the future of the internet. But what exactly do they mean by that vague sentiment, and is it that simple?

In a report published in early February, Credit Suisse defined the metaverse as “a more spatially immersive, compelling and frictionless internet which comprises five essential components: infrastructure, hardware, content, platforms or communities and payment mechanisms.”

Still sounding a bit vague?

That’s because the term doesn’t refer to a specific type of technology but more about the ways in which we interact with technology. The technologies that make up the metaverse include VR and augmented reality (AR). However, the metaverse is not exclusive to VR or AR. Virtual worlds can also be metaversal, and they are accessed through traditional means, such as game consoles and PCs.

The metaverse also relates to a digital economy, one where users can engage in creating, buying, and selling goods. In its most ideal state, the metaverse is interoperable, allowing users to take virtual goods from one platform to another.

What About Metaverse Crypto and NFTs?

The metaverse, even in its early stages of development, presents a huge opportunity for both blockchain technology and NFTs. The metaverse has the ability to change the ways in which people socialize, interact with brands, and trade digital assets. Non-fungible tokens are a great way to represent ownership of virtual assets. In this NFT-powered world, you have the ability to own digital land, avatars, apparel, and more, with the power to migrate them across platforms via a crypto wallet.

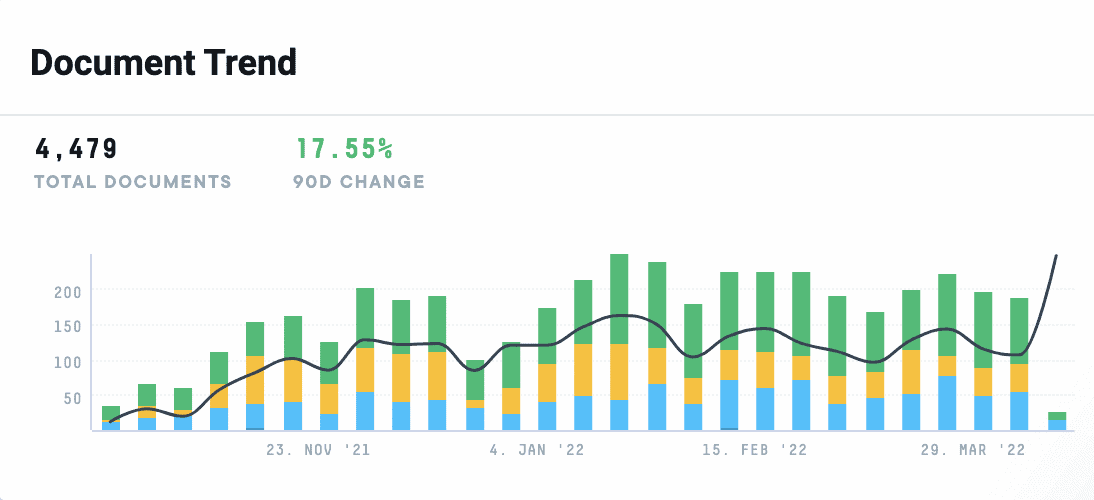

Metaverse crypto is becoming more mainstream in terms of utility and adoption as it becomes the primary medium of exchange. In the AlphaSense platform, there has been a 17% increase in documents uploaded for Metaverse and Crypto over the past 6 months alone.

Furthermore, advocates of the metaverse believe that it will promote new economic opportunities for users and creators alike, whether that be through play-to-earn games, the creation of content and items that can be purchased as NFTs, or even designing games and places that users can explore for a fee.

Luxury fashion giants like Louis Vuitton, Gucci, Burberry, Adidas, and Nike are spearheading this digital transformation, pushing towards a world where digital fashion will be just as important as physical fashion. Although a democratized digital world and fashion exclusivity might seem like opposing concepts, the metaverse as a technological advancement melds the two.

Tech has always been a way to perpetuate the consumption of luxury. In an interview with Forbes, Vincent Quan, Associate Professor at the Fashion Institute of Technology, discusses the intermix of the luxury fashion business and the ever-evolving Metaverse, “Luxury branding strategy has always been driven by the consumer’s desire to own something which many do not have. Scarcity creates demand. As such, luxury fashion houses can meet this demand by continuing to offer exclusive apparel and accessories with limited availability. By complementing the physical with digital, these brands will perpetuate their brand identities while simultaneously capitalizing on their digital assets in a new market, the Metaverse.”

But it doesn’t just stop at high-end fashion.

Popular NFTs like the Bored Ape Yacht Club could be transformed into 3D avatars that owners can bring into metaverse worlds. These virtual assets can also be traded, customized and even monetized. In October of last year, a CryptoPunks NFT sold for $532 million, signaling that a metaverse would only create more opportunities for profit.

Metaverse Investment as a Long-Term Play

While technology stocks have fallen since the start of the year, investing in the metaverse is a long-term play. On a macro level, Grand View Research estimates that the industry will grow at a compound annual growth rate of 39.4% through 2030 and attain a market size of $678 billion. Investors can approach this secular trend from many different directions.

In our market landscape report on “The Future of the Metaverse: An Analysis of the Leaders, Opportunities, and Threats,” we consider the following list of potential layers to the metaverse and more:

- Immersive hardware: Metaverse hardware is essentially limited to VR headsets. Popular consumer products currently only incorporate sight and sound, but the metaverse could also present opportunities for touch via haptic devices.

- 3D creation software: Whether it’s building the virtual world’s scenery or creating items that can be bought and sold, software solutions will be critical in world-building.

- Interactive platforms: In the same way people visit websites, there will need to be a need for users to be able to interact with and within these virtual worlds.

- Connectivity: Connections will need to be lightning-fast in order to accommodate users in real-time, and computers will need to be powerful enough to render 3D smoothly.

- Semiconductors: As mentioned above, the computing power requirements of the metaverse will be massive, thus requiring major advancements in semiconductor technology. The metaverse also will generate a large amount of data that will need to be stored.

- Security: With so much data collection, the identities and finances of users will need protection. This means that cybersecurity will become increasingly indispensable.

Related Reading: 10 Best Stock & Investment Research Tools

The Top 16 Metaverse Stocks to Watch

With so many aspects to choose from, there’s likely a metaverse stock to fit any investor’s style and risk tolerance. With that long-term growth in mind, here are the best metaverse stocks to keep an eye on:

1. Roblox

Roblox is a technology company that plans to build a human co-experience platform that would allow for shared experiences among users. Roblox Platform users have identities in the form of avatars that allow them to interact and be whoever or whatever they want. Roblox could be the closest technology platform to what people envision the metaverse to be.

Autodesk Inc. makes software products for the engineering and construction industry, with programs like AutoCAD and Revit, which are used for building information modeling. Aside from construction, Autodesk’s media and entertainment segments offer 3D software tools to animators, modelers, and visual effects artists. Once building for the metaverse is fully underway, companies that work in information modeling and 3D tools will become crucial.

This may be an obvious one but given the fact that Meta is responsible for bringing the metaverse trend to the forefront of investors’ minds, it should remain on everyone’s radars. The Oculus VR headsets have some more units than any other on the market, cementing them as a top immersive metaverse hardware stock. The company is also investing billions of dollars into creating software and content for AR and VR applications.

Unity Software is, without a doubt, the industry leader in the 3D software space. Half of all 3D content today is made with their software technology. As more metaverse content is created, it is reasonable to assume a large portion of that content will involve Unity in some way. Another interesting angle to this company is their two products – Unity Personal and Unity Student – which are offered to content creators who are just starting out for free. As these people continue to create, they will likely become paying Unity customers.

5. Fastly Inc.

Cloud computing and decentralization faces a big problem: data lag. Users experience this all the time, clicking a link on their internet browser and waiting for the next page to download or process to happen. The metaverse will want to tackle these problems ahead of time. Fastly operates an edge computing infrastructure-as-a-service (IaaS) platform that brings servers and other equipment to the source of data creation. Without edge computing and companies like Fastly, a virtual world that operates in real-time simply can’t function.

6. NVIDIA Corp.

Nvidia’s chipsets are already being used in a variety of servers and other centralized computers that run complex calculations, including Fastly. They are also in the midst of a buying out ARM Holdings from SoftBank Group. With this buyout, Nvidia will be able to build out an end-to-end ecosystem and replace their graphics processing unit and advanced chips directly into more systems. The metaverse will need this level of computing power in order to run smoothly.

7. Matterport

Matterport, a spatial data company, operates a 3D data platform that could help understand digital space better. Their platform also works with a range of 3D cameras, 360 cameras, and even iPhones, meaning customers could realize the full potential of a space from every single angle. They just announced their revolutionary motorized mount, Matterport Axis™, that works with smartphones. Users can now supercharge 3D capture using just their phone at any given moment.

Shopify, the largest e-commerce platform behind Amazon.com Inc., offers a suite of software to online retailers that aids in streamlining payments, analytics, and fulfillment. As an established leader already, they have a massive opportunity to shape buyer-vendor relations in the metaverse. Shopify already allows online retailers to upload 3D and AR versions of their products and recently announced they would open a NFT marketplace for selling and trading.

Popular dating apps such as Tinder and Hinge are under the Match Group Inc. umbrella. In July of 2020, the company broke away from parent IAC/ InteractiveCorp and became stand-alone with a market capitalization of $30 billion. They recently acquired video tech company Hyperconnect and announced plans to leverage these technologies to create a live virtual world where singles can meet and interact with one another.

10. Microsoft

Microsoft, a cloud computing giant, has positioned Teams and its 365 software suite into the go-to work-from-home productivity platform. Satya Nadella, CEO of Microsoft, just recently revealed a new suite of metaverse and virtual products created to integrated seamlessly into their current suite of tools. Microsoft Dynamics 365 Connected Spaces will allow companies to create virtual spaces, allowing workers to visit their factory floors or retail stores during virtual meetings to enhance collaboration, troubleshoot issues, and interact with product spaces.

11. Cloudflare

Cloudflare, a content delivery network, claims its network can deliver content in 50 milliseconds or less to 95% of the worlds population. As the metaverse scales, this speed will be instrumental. Cloudflare also offers cybersecurity solutions and data-storage products, two things the metaverse will also need.

Electronic Arts (EA) is a video game company headquartered in Redwood City, California. Since video game companies already have established infrastructures and user bases, they can prove to be very fruitful stocks to keep an eye on. EA was one of the first to alter their business model and shift focus away from game launches to recurring revenue streams driven by in-game purchases, making them a perfect fit for the metaverse.

13. McDonald’s

Fast food giant, McDonald’s, is the latest to file for a trademark application for virtual goods, services, and virtual restaurants and cafes. They claim that their goal is to operate a virtual restaurant online that features home delivery. As the metaverse builds out, expect more food companies to jump on this bandwagon and offer users digital dining experiences.

CrowdStrike Holdings is a cloud-based security software company. They offer endpoint security to protect against potential data breaches. Data security implementation is paramount to the metaverse long-term, which makes CrowdStrike Holdings and any security company a solid stock to watch.

15. Adobe Inc.

Adobe Inc. is an obvious choice for metaverse tech stocks and rightfully so. They are focused heavily on collaboration with the metaverse, specifically on enhancing growth efficiently. They are working to expand their range of products to incorporate emerging technologies like 3D.

16. Vuzix Corp.

Vuzix Corp. is one of the leading suppliers of smart glasses and AR technology products. Their smart optics technology could prove to be especially useful to the metaverse with AR and VR smart glasses. As the metaverse expands, wearable products that provide fully immersive experiences will become a necessity to users.

When it comes to the metaverse, it’s difficult to understand what is real and what is hype. Will the metaverse actually become our new reality in the next decade? How far off are we, and what does that mean for all the industries that will be impacted? Answer all of your questions and more in our latest report, The Future of the Metaverse: An Analysis of the Leaders, Opportunities, and Threats.